R and R Printing

Executive Summary

R & R Printing is a new print brokerage firm, formed as a sole proprietorship. The owner has extensive experience in the printing industry as a sales manager.

We will offer printing services for a wide range of print media, including business cards, letterhead, envelopes, brochures, booklets, business forms, posters, catalogues and labels. Our goal is to serve all the printing needs for each company we work with, to be a one-stop-shop. While our services, product quality, and prices will be excellent, our marketing strategy focuses on building long-term relationships with our customers.

By focusing on its commitment to helping businesses obtain the printing products and services they need, R & R Printing will increase its sales to more than $1.5 million in three years, while improving the gross margin. R & R Printing will distinguish themselves by reinforcing reliability and expertise with competitive pricing.

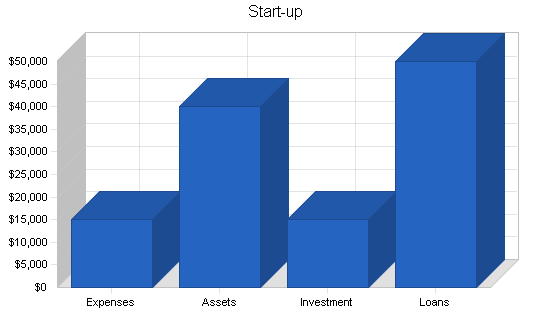

To finance the start-up of the business, the owner will invest $15,000, and is seeking a five-year loan of $50,000.

1.1 Objectives

- Sell $750,000 in the first year.

- Increase sales to more than $1.5 million by the third year.

- Bring gross margin up above 30%, and maintain that level.

- Retain client base from previous relationships, and obtain 20 new clients by the end of the first year.

1.2 Mission

R & R Printing is dedicated to helping businesses obtain the printing products and services they need. R & R Printing offers a high level of practical experience, know-how, and a network of industry contacts, so clients save money and time by allowing a printing professional to handle their printing needs. Very few print shops posess all the equipment and products that most businesses require for all of their printing They rely on the knowledge of a professional that can provide one-stop shopping for all services, paper, bindery, and graphics at a reasonable cost, while overseeing the printing process to ensure the highest quality possible.

R & R Printing is such a vendor. We make it our number one goal that our clients receive the quality of printing they need, with maximum efficiency and reliability. By providing fast response, expertise, and high-quality solutions, R & R Printing generates satisfied repeat customers. This provides a stable retainer base that creates consistent profits.

1.3 Keys to Success

The keys to the success in this business are:

- Consistent, timely, and accurate expertise and information to fulfill the client’s printing needs.

- Offer one-stop-shopping with competitive pricing for the quality of products and services offered.

- Build long-term relations with clients to develop a loyal repeat customer base.

Company Summary

R & R Printing is a new print brokerage firm.

2.1 Company Ownership

R & R Printing is a sole-proprietorship owned by Robert M. Scott, operated by Robert M. Scott and his wife Ronda E. Scott. The owner has extensive prior experience as a sales manager in the printing industry. Incorporation will be explored as a later option.

2.2 Start-up Summary

Our initial start-up costs will amount to approximately $65,000, of which $15,000 will be used to purchase office equipment and up-front manufacturing costs until credit is established with vendors. Additionally, we project the need for a financial commitment of another $50,000 to finance receivables and payroll expenses for the first 12 months of operation.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $200 |

| Meet & Greet | $600 |

| Business Plan | $200 |

| Logo Design | $1,500 |

| Stationery | $900 |

| Insurance | $4,000 |

| Business Cards | $500 |

| Establish Credit | $2,000 |

| Initial Mailing | $100 |

| Process Funding | $500 |

| Office Equipment | $4,500 |

| Total Start-up Expenses | $15,000 |

| Start-up Assets | |

| Cash Required | $40,000 |

| Other Current Assets | $0 |

| Long-term Assets | $0 |

| Total Assets | $40,000 |

| Total Requirements | $55,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $15,000 |

| Start-up Assets to Fund | $40,000 |

| Total Funding Required | $55,000 |

| Assets | |

| Non-cash Assets from Start-up | $0 |

| Cash Requirements from Start-up | $40,000 |

| Additional Cash Raised | $10,000 |

| Cash Balance on Starting Date | $50,000 |

| Total Assets | $50,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $50,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $50,000 |

| Capital | |

| Planned Investment | |

| Owner | $15,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $15,000 |

| Loss at Start-up (Start-up Expenses) | ($15,000) |

| Total Capital | $0 |

| Total Capital and Liabilities | $50,000 |

| Total Funding | $65,000 |

2.3 Company Locations and Facilities

This is a home office venture, located in a studio in the owner’s home.

Products and Services

R & R Printing provides print media and related services. We are especially focused on providing the broadest possible types of print media, in addition to our knowledge and expertise of the print industry.

3.1 Product and Service Description

R & R Printing is a full service agency that sells printing and related services. Products such as business cards, letterhead, envelopes, brochures, booklets, business forms, posters, catalogues and labels are manufactured and delivered on a timely and cost effective basis. The added value of R & R Printing is its knowledge and expertise. Printing needs are evaluated and assessed; ideas and solutions are offered for each client to meet their individual needs. Most companies require a number of varied print media in order operate, market, and communicate efficiently on a daily basis.

3.2 Competitive Comparison

The print industry is competitive. The way we differ is to define the vision of the company to be a reliable and informative ally to our clients. Most printing companies can only afford a small variety of printing equipment, therefore can only offer a limited type of print media. We maintain close contact with several print manufacturers, paper distributors, and graphic specialists in order to offer most any type of printing on any type of paper at a competitive price. We know where to turn for all types of printing, this saves our clients money and time that would be wasted searching this broad field for each precise need.

3.3 Sales Literature

The business will begin with an introductory letter to all former and prospective clients sharing our exciting news of the creation of our business. We will include our business cards with each letter to ensure easy access to our business number, mobile numbers, fax number, email address and physical address. This letter will be developed as part of the start-up expenses.

3.4 Fulfillment

R & R Printing has established relationships with several trade-only print companies and paper distribution companies. Two of the trade-only print companies and three of the paper distribution companies have been selected as our primary vendors. We have been able to identify opportunities to capture margins of up to 45% for certain parties. Sourcing opportunities will be continually evaluated.

3.5 Technology

We use QuickBooks Pro™ software for accounting, purchasing, taxes, estimating, and invoicing. Act 2000™ is a sales based software that enables us to keep track and effectively manage client accounts. Talkworks Pro™ is a communication software that acts as voice mail, fax machine, and message notification, so that we can keep in close contact with our clients and vendors. These three previously mentioned software programs integrate with each other so to minimize redundancy.

Our business plan will be generated on an annual basis using Business Plan Pro™ software, and will be evaluated quarterly.

Most printing customers provide artwork on electronic digital files. We will maintain contacts with vendors who use the most current versions of graphics, printing, and publishing software from such companies as Adobe®, Corel®, Broderbund®, among others. This allows for the artwork to be recreated exactly to the clients specifications.

3.6 Future Products and Services

Within the next year we will implement a website for R & R Printing to process quote request and repeat orders.

Market Analysis Summary

R & R Printing focuses on local large businesses that utilize a variety of printed materials.

4.1 Market Segmentation

Our market segmentation scheme allows room for estimates and non-specific definitions. We focus on large companies, and it is hard to find information to make exact classifications. Our target companies are large enough to utilize a great deal of print products, but small enough that they do not have in-house printing equipment. We say that our target market company has at least 50 people.

4.2 Target Market Segment Strategy

Our target markets are larger companies that utilize diverse printed materials. We chose this group because the marketing and purchasing departments are generally too busy to research and follow a printed product from beginning to end. They usually rely on the expertise and knowledge of a print vendor they can trust. The focal point of our marketing strategy will be direct face-to-face contact with those individuals that make the print vendor choice.

4.2.1 Market Growth

According to the December 1999 issue of Fortune Magazine, Dallas was ranked number one in their “Best Cities for Business” article. They noted that the Dallas economy is growing at 4.8% annually, significantly above the national average. According to the publication Greater Dallas Chamber, for the year 2000 there are more than 140,000 businesses in the Dallas area, and more that 5,000 corporate headquarters. Eleven of the nation’s largest private firms are located in Dallas and 19 Fortune 500 public headquarters. There are 43 colleges and universities. All of these businesses use printed products. As these businesses grow so does their need for printed material.

Printing is one of the largest manufacturing industries in the United States. According to Ron Davis, Ph.D in his report in the PIA 2000 Print Market Atlas, “print markets should remain healthy, providing printers with many opportunities for success.” He states that print sales should rise five to six percent, adjusted for inflation and the increase is at three to four percent. The five to 10 year outlook looks quite similar.

4.2.2 Market Needs

The most important market needs are knowledge, reliability, pricing, timely completion and high quality. One of the key points of our strategy is to focus on those decision making individuals that know and understand these needs.

4.3 Service Business Analysis

The following is a description of market segmentation, strategies, and industry analysis.

4.3.1 Distributing a Service

The primary distribution pattern in the printing business is from supplier to agent to consumer. The agent can be an in-house sales person or independent broker.

4.3.2 Competition and Buying Patterns

Printing is generally considered a commodity bought at the lowest price on a bid basis for every job. Service, quality, reputation, and timely production are also factors that effect the final decision to whom the project is awarded.

4.3.3 Main Competitors

Other Print Brokers:

There are numerous print brokers already established. Some of which have been highly successful due to their number of years in the business and established client base. These brokers already have more work than they can handle.

Commercial Printing Companies:

This field is dominated by individually owned print shops that can turn around the work quickly when sold in-house. However, high turnover in employees, especially sales people, makes it hard for them to retain long-term clients.

4.3.4 Business Participants

The printing industry is similar to many others. There are;

- Large national franchises, such as Minute Man, Sir Speedy and Kinkos.

- Large local commercial printing companies that do large projects, such as the J. C. Penney Catalogue.

- Medium sized commercial printing companies that produce large quantity of full color work, such as 50,000 full color brochures or flyers.

- Small quick print shops, that are individually owned, that do work such as copy, stationery, business cards, newsletters, etc.

- Print brokers provide all the above as one-stop-shopping.

The Printing Industries of America, Inc. (PIA) gives some indication of the number of local participants in its PIA 2000 Print Market Atlas. Dallas ranked eighth in the United States with 804 print facilities, 18,009 employees, and producing 2.4 billion pieces of print media per year. According to Printing Manager Online Experts, the printing field is dominated by relatively small, privately owned businesses.

Strategy and Implementation Summary

In order to reach its goal of becoming a successful printing company, R & R Printing will adopt the following strategy:

- Emphasize expertise, professionalism, and reliability.

- Build a long-term relationship-oriented business.

- Provide solutions, service, and quality printing to our clients.

5.1 Strategy Pyramid

R & R Printing’s marketing efforts depend on recognition for expertise, professionalism, and reliability. It starts with our known contacts, recommendations from satisfied clients, and continues with long-term fulfillment of our promises.

We have already developed a database of contacts from previous sales positions. We utilize our database to make regular contact and updates; most of our contact is face-to-face. This keeps our name and reputation in view of the customer as much as possible, so when a print need approaches these consumers choose R & R Printing for their printing needs.

5.2 Sales Strategy

Sales strategy for R & R Printing is simple and straightforward: customer satisfaction. Happy customers will be repeat customers, and they will provide referrals to new customers.

Sales forecast figures are based on Rob Scott’s last five years of performance in this field while employed by another printing company.

Sales projections are detailed in the Sales by Year chart.

5.2.1 Sales Forecast

The important elements of the sales forecast are shown in the Sales Monthly chart and table. We expect a steady fast paced growth during the first year. Sales growth is estimated to grow at an estimated 50% annually through the first three years of operation.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Rob Scott’s Sales | $750,000 | $1,250,000 | $1,500,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $750,000 | $1,250,000 | $1,500,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Rob Scott’s Sales | $559,600 | $875,000 | $1,050,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $559,600 | $875,000 | $1,050,000 |

5.3 Value Proposition

Our value proposition has to be different from the standard printing vendor. We offer our clients a vendor who is an ally, who is going to work for them and with them to obtain the product and service they want. Our confidence and ability translates into confidence for the consumer and a starting point towards developing long-term relationships and trust.

5.4 Competitive Edge

Our most important competitive edge is our relationship with our clients as a strategic ally. By building a business based on long-standing relationships with satisfied clients we simultaneously build defenses against competition. The longer the relationship stands, the more we help our clients understand what we offer and why they need it.

5.5 Marketing Strategy

R & R Printing adheres to the theory that the goal of business is to create and keep customers. The marketing strategy will reflect this goal as R & R builds its reputation. Our focus will be:

- Reliability, expertise, and quality.

- Building long-term personal relationships with those that make the printing decisions for a company.

- Establishing face-to-face contact with the client as much as possible.

5.5.1 Distribution Strategy

R & R Printing’s distributing strategy will focus on the the target market in the Dallas area to whom it will sell directly.

5.5.2 Marketing Programs

The most important marketing program for R & R Printing is to get the word out, through a combination of the following:

- Sending a letter of announcement with enclosed business cards to all existing contacts. Ronda Scott will be responsible with a budget of $1,500 and a milestone date of September 5, 2000. This program is intended to inform them of our services, excite the potential clients about our new endeavor, and create interest in R & R Printing. Achievement should be measured by the number of requests for printing quotes by these individuals.

- Making personal contact by calling and paying a personal visit to existing contacts. Rob Scott will be responsible with a budget of $600 and a milestone of October 10, 2000. This program is intended to establish personal relationships, and inform the contacts of our services. Achievement should be measured by the number of requests for printing quotes by these individuals.

5.5.3 Positioning Statement

For business professionals who want their printing accurate, on time, with the utmost reliability, R & R Printing is a vendor and ally who ensures high quality printing, fair pricing, and personal service. Unlike other printing vendors, R & R Printing establishes personal long-term relationships, goes to the customer to offer proactive ideas, solutions, services and quality printing.

5.5.4 Pricing Strategy

Much of our pricing is determined by market standards. R & R Printing will attempt to maintain margins of 30% to 35%. We will make every effort to maintain a competitive pricing policy.

5.5.5 Promotion Strategy

During our first few weeks of operation, we plan to mail a personal letter to all of our previous contacts, expressing our excitement of our new company, and offer quality printing and service. We will enclose our business cards in each letter so all contact information is easily accessible. We will also call and go directly to previous contacts in order to emphasize our personal service. We will depend on word of mouth by our satisfied clients, which will always be our most important means of promotion.

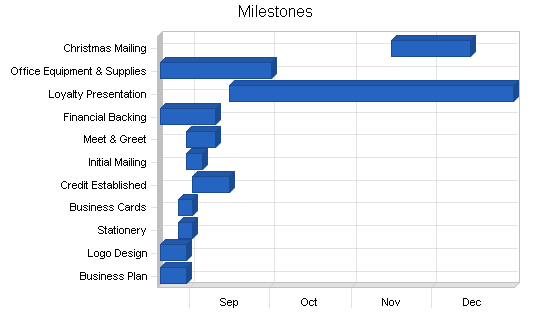

5.6 Milestones

The accompanying table lists important program milestones, with dates, responsible parties, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

What the table does not show is the commitment behind it. We will hold follow-up meetings every month to discuss accomplishments, variances and course corrections.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 8/20/2000 | 8/30/2000 | $200 | Ronda | Department |

| Logo Design | 8/20/2000 | 8/30/2000 | $1,500 | Rob | Department |

| Stationery | 8/27/2000 | 9/1/2000 | $900 | Rob & Ronda | Department |

| Business Cards | 8/27/2000 | 9/1/2000 | $500 | Rob & Ronda | Department |

| Credit Established | 9/1/2000 | 9/15/2000 | $2,000 | Rob & Ronda | Department |

| Initial Mailing | 8/30/2000 | 9/5/2000 | $100 | Ronda | Department |

| Meet & Greet | 8/30/2000 | 9/10/2000 | $600 | Rob | Department |

| Financial Backing | 8/20/2000 | 9/10/2000 | $500 | Rob & Ronda | Department |

| Loyalty Presentation | 9/15/2000 | 12/31/2000 | $1,500 | Rob & Ronda | Department |

| Office Equipment & Supplies | 8/20/2000 | 10/1/2000 | $4,500 | Rob & Ronda | Department |

| Christmas Mailing | 11/15/2000 | 12/15/2000 | $250 | Ronda | Department |

| Totals | $12,550 | ||||

Management Summary

The initial management team depends on the founders themselves. Our management philosophy is based on responsibility and mutual respect. Our team includes Rob Scott and Ronda Scott. Rob will handle sales responsibilities, and Ronda will handle all administrative tasks.

6.1 Management Team

Rob Scott, owner: 36 years old, B.A. Geology with Business minor, Southwest Texas State. Rob has 10 years experience in direct selling, including five years as sales manager at Montgomery Press. As a printing sales person at Montgomery Press he increased his sales on an average of 45% per year for five consecutive years, this yielded a 640% increase in his overall sales.

Ronda Scott, president: 36 years old, B.S. Biology, Texas Woman’s University. Ronda has seven years experience in sales and service industries.

Donna Elston, accounting consultant. Retired comptroller for Rodger Meier Cadillac. Over 25 years experience in business accounting. Donna will act as consultant and advisor for R & R Printing accounting and administrative needs.

6.2 Personnel Plan

The founder is the sole paid employee.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Rob Scott | $20,004 | $20,500 | $20,500 |

| Other | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 |

| Total Payroll | $20,004 | $20,500 | $20,500 |

Financial Plan

R & R Printing’s financial plan is detailed in following sections. Preliminary estimates suggest that we will experience a steady growth in the first year of operation. Income estimates are based, in part, on anticipated revenues from accounts that were secured by Rob Scott in his prior sales position. R & R Printing also anticipates an increase in gross margin and sales volume. Thus, the overall financial plan presents a conservative but realistic depiction of R & R Printing’s financial position.

7.1 Important Assumptions

R & R Printing assumes the following:

- Market growth projections for the printing industry are accurate.

- National economic conditions, which are favorable to the printing industry, will not experience significant decline in the next three years.

- Conditions will remain favorable for service providers and R & R Printing will be able to maintain those relationships.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Key Financial Indicators

The following chart indicates R & R Printing’s key financial indicators for the first three years of business. R & R Printing anticipates growth in sales with relatively stable operating expenses. Favorable economic conditions and forecasts of continued growth in the printing market support R & R Printing planned financial success.

7.3 Break-even Analysis

The following table details R & R Printing’s break-even analysis.

Break-even calculations assume a 25% to 30% gross margin. This is a conservative estimate, and it will be improved as strategic relationships develop and the benefits of R & R Printing offerings are realized by customers.

| Break-even Analysis | |

| Monthly Revenue Break-even | $10,112 |

| Assumptions: | |

| Average Percent Variable Cost | 75% |

| Estimated Monthly Fixed Cost | $2,567 |

7.4 Projected Profit and Loss

R & R Printing’s profit picture improves as operations progress into the second quarter of operation. R & R Printing anticipates improving its gross margin from 25% in year one to 30% in year two. Annual estimates of profit and loss are detailed in the following table.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $750,000 | $1,250,000 | $1,500,000 |

| Direct Cost of Sales | $559,600 | $875,000 | $1,050,000 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $559,600 | $875,000 | $1,050,000 |

| Gross Margin | $190,400 | $375,000 | $450,000 |

| Gross Margin % | 25.39% | 30.00% | 30.00% |

| Expenses | |||

| Payroll | $20,004 | $20,500 | $20,500 |

| Marketing/Promotion | $6,000 | $6,000 | $6,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Insurance | $4,800 | $4,800 | $4,800 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $30,804 | $31,300 | $31,300 |

| Profit Before Interest and Taxes | $159,596 | $343,700 | $418,700 |

| EBITDA | $159,596 | $343,700 | $418,700 |

| Interest Expense | $4,533 | $3,470 | $2,450 |

| Taxes Incurred | $46,519 | $102,069 | $124,875 |

| Net Profit | $108,544 | $238,161 | $291,375 |

| Net Profit/Sales | 14.47% | 19.05% | 19.43% |

7.5 Projected Cash Flow

Monthly cash flow is shown in the following illustration. Annual cash flow figures are estimated based on collection days included in the table. Annual cash flow for the first year of operation becomes positive in the second quarter of operation.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $594,600 | $1,146,400 | $1,448,200 |

| Subtotal Cash from Operations | $594,600 | $1,146,400 | $1,448,200 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $37,000 | $0 | $0 |

| Subtotal Cash Received | $631,600 | $1,146,400 | $1,448,200 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $20,004 | $20,500 | $20,500 |

| Bill Payments | $560,008 | $971,302 | $1,171,951 |

| Subtotal Spent on Operations | $580,012 | $991,802 | $1,192,451 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $10,200 | $10,200 | $10,200 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $590,212 | $1,002,002 | $1,202,651 |

| Net Cash Flow | $41,388 | $144,398 | $245,549 |

| Cash Balance | $91,388 | $235,785 | $481,335 |

7.6 Projected Balance Sheet

The Projected Balance Sheet is quite solid. We do not project any trouble meeting our debt obligations — as long as we can achieve our specific objectives.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $91,388 | $235,785 | $481,335 |

| Accounts Receivable | $155,400 | $259,000 | $310,800 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $246,788 | $494,785 | $792,135 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $246,788 | $494,785 | $792,135 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $61,443 | $81,480 | $97,654 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $61,443 | $81,480 | $97,654 |

| Long-term Liabilities | $39,800 | $29,600 | $19,400 |

| Total Liabilities | $101,243 | $111,080 | $117,054 |

| Paid-in Capital | $52,000 | $52,000 | $52,000 |

| Retained Earnings | ($15,000) | $93,544 | $331,705 |

| Earnings | $108,544 | $238,161 | $291,375 |

| Total Capital | $145,544 | $383,705 | $675,080 |

| Total Liabilities and Capital | $246,788 | $494,785 | $792,135 |

| Net Worth | $145,544 | $383,705 | $675,080 |

7.7 Business Ratios

The following table details our primary business ratios. Initial analysis indicates that R & R Printing ratios for profitability, risk, and return are financially favorable and will improve greatly in year two of operation. Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 2752, Commercial Printing, Lithographic, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 66.67% | 20.00% | 1.00% |

| Percent of Total Assets | ||||

| Accounts Receivable | 62.97% | 52.35% | 39.24% | 25.80% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 24.00% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 57.90% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 42.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 24.90% | 16.47% | 12.33% | 32.20% |

| Long-term Liabilities | 16.13% | 5.98% | 2.45% | 25.40% |

| Total Liabilities | 41.02% | 22.45% | 14.78% | 57.60% |

| Net Worth | 58.98% | 77.55% | 85.22% | 42.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 25.39% | 30.00% | 30.00% | 30.00% |

| Selling, General & Administrative Expenses | 9.05% | 9.80% | 9.62% | 15.60% |

| Advertising Expenses | 0.48% | 0.29% | 0.24% | 0.50% |

| Profit Before Interest and Taxes | 21.28% | 27.50% | 27.91% | 2.30% |

| Main Ratios | ||||

| Current | 4.02 | 6.07 | 8.11 | 1.61 |

| Quick | 4.02 | 6.07 | 8.11 | 1.19 |

| Total Debt to Total Assets | 41.02% | 22.45% | 14.78% | 57.60% |

| Pre-tax Return on Net Worth | 106.54% | 88.67% | 61.66% | 4.20% |

| Pre-tax Return on Assets | 62.83% | 68.76% | 52.55% | 10.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 14.47% | 19.05% | 19.43% | n.a |

| Return on Equity | 74.58% | 62.07% | 43.16% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.83 | 4.83 | 4.83 | n.a |

| Collection Days | 57 | 61 | 69 | n.a |

| Accounts Payable Turnover | 10.11 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 26 | 28 | n.a |

| Total Asset Turnover | 3.04 | 2.53 | 1.89 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.70 | 0.29 | 0.17 | n.a |

| Current Liab. to Liab. | 0.61 | 0.73 | 0.83 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $185,344 | $413,305 | $694,480 | n.a |

| Interest Coverage | 35.21 | 99.05 | 170.90 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.33 | 0.40 | 0.53 | n.a |

| Current Debt/Total Assets | 25% | 16% | 12% | n.a |

| Acid Test | 1.49 | 2.89 | 4.93 | n.a |

| Sales/Net Worth | 5.15 | 3.26 | 2.22 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Rob Scott’s Sales | 0% | $30,000 | $40,000 | $50,000 | $55,000 | $60,000 | $65,000 | $70,000 | $72,000 | $75,000 | $75,000 | $78,000 | $80,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $30,000 | $40,000 | $50,000 | $55,000 | $60,000 | $65,000 | $70,000 | $72,000 | $75,000 | $75,000 | $78,000 | $80,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Rob Scott’s Sales | $24,000 | $32,000 | $40,000 | $44,000 | $45,000 | $48,750 | $52,500 | $54,000 | $56,250 | $52,500 | $54,600 | $56,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $24,000 | $32,000 | $40,000 | $44,000 | $45,000 | $48,750 | $52,500 | $54,000 | $56,250 | $52,500 | $54,600 | $56,000 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Rob Scott | 0% | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Total Payroll | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $30,000 | $40,000 | $50,000 | $55,000 | $60,000 | $65,000 | $70,000 | $72,000 | $75,000 | $75,000 | $78,000 | $80,000 | |

| Direct Cost of Sales | $24,000 | $32,000 | $40,000 | $44,000 | $45,000 | $48,750 | $52,500 | $54,000 | $56,250 | $52,500 | $54,600 | $56,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $24,000 | $32,000 | $40,000 | $44,000 | $45,000 | $48,750 | $52,500 | $54,000 | $56,250 | $52,500 | $54,600 | $56,000 | |

| Gross Margin | $6,000 | $8,000 | $10,000 | $11,000 | $15,000 | $16,250 | $17,500 | $18,000 | $18,750 | $22,500 | $23,400 | $24,000 | |

| Gross Margin % | 20.00% | 20.00% | 20.00% | 20.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 30.00% | 30.00% | 30.00% | |

| Expenses | |||||||||||||

| Payroll | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | |

| Marketing/Promotion | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Insurance | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | $2,567 | |

| Profit Before Interest and Taxes | $3,433 | $5,433 | $7,433 | $8,433 | $12,433 | $13,683 | $14,933 | $15,433 | $16,183 | $19,933 | $20,833 | $21,433 | |

| EBITDA | $3,433 | $5,433 | $7,433 | $8,433 | $12,433 | $13,683 | $14,933 | $15,433 | $16,183 | $19,933 | $20,833 | $21,433 | |

| Interest Expense | $417 | $417 | $408 | $400 | $391 | $383 | $374 | $366 | $357 | $349 | $340 | $332 | |

| Taxes Incurred | $905 | $1,505 | $2,107 | $2,410 | $3,613 | $3,990 | $4,368 | $4,520 | $4,748 | $5,875 | $6,148 | $6,330 | |

| Net Profit | $2,111 | $3,511 | $4,917 | $5,623 | $8,429 | $9,310 | $10,191 | $10,547 | $11,078 | $13,709 | $14,345 | $14,771 | |

| Net Profit/Sales | 7.04% | 8.78% | 9.83% | 10.22% | 14.05% | 14.32% | 14.56% | 14.65% | 14.77% | 18.28% | 18.39% | 18.46% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Cash from Receivables | $0 | $1,000 | $30,333 | $40,333 | $50,167 | $55,167 | $60,167 | $65,167 | $70,067 | $72,100 | $75,000 | $75,100 | |

| Subtotal Cash from Operations | $0 | $1,000 | $30,333 | $40,333 | $50,167 | $55,167 | $60,167 | $65,167 | $70,067 | $72,100 | $75,000 | $75,100 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $37,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $38,000 | $30,333 | $40,333 | $50,167 | $55,167 | $60,167 | $65,167 | $70,067 | $72,100 | $75,000 | $75,100 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | |

| Bill Payments | $874 | $26,508 | $35,108 | $43,559 | $47,783 | $50,041 | $54,160 | $58,197 | $59,868 | $62,167 | $59,703 | $62,040 | |

| Subtotal Spent on Operations | $2,541 | $28,175 | $36,775 | $45,226 | $49,450 | $51,708 | $55,827 | $59,864 | $61,535 | $63,834 | $61,370 | $63,707 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | $1,020 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,541 | $28,175 | $37,795 | $46,246 | $50,470 | $52,728 | $56,847 | $60,884 | $62,555 | $64,854 | $62,390 | $64,727 | |

| Net Cash Flow | ($2,541) | $9,825 | ($7,462) | ($5,912) | ($303) | $2,439 | $3,320 | $4,283 | $7,511 | $7,246 | $12,610 | $10,373 | |

| Cash Balance | $47,459 | $57,284 | $49,822 | $43,910 | $43,606 | $46,045 | $49,365 | $53,648 | $61,159 | $68,405 | $81,015 | $91,388 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $50,000 | $47,459 | $57,284 | $49,822 | $43,910 | $43,606 | $46,045 | $49,365 | $53,648 | $61,159 | $68,405 | $81,015 | $91,388 |

| Accounts Receivable | $0 | $30,000 | $69,000 | $88,667 | $103,333 | $113,167 | $123,000 | $132,833 | $139,667 | $144,600 | $147,500 | $150,500 | $155,400 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $50,000 | $77,459 | $126,284 | $138,489 | $147,243 | $156,773 | $169,045 | $182,198 | $193,314 | $205,759 | $215,905 | $231,515 | $246,788 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $50,000 | $77,459 | $126,284 | $138,489 | $147,243 | $156,773 | $169,045 | $182,198 | $193,314 | $205,759 | $215,905 | $231,515 | $246,788 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $25,348 | $33,661 | $41,968 | $46,119 | $48,240 | $52,222 | $56,204 | $57,793 | $60,180 | $57,637 | $59,922 | $61,443 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $25,348 | $33,661 | $41,968 | $46,119 | $48,240 | $52,222 | $56,204 | $57,793 | $60,180 | $57,637 | $59,922 | $61,443 |

| Long-term Liabilities | $50,000 | $50,000 | $50,000 | $48,980 | $47,960 | $46,940 | $45,920 | $44,900 | $43,880 | $42,860 | $41,840 | $40,820 | $39,800 |

| Total Liabilities | $50,000 | $75,348 | $83,661 | $90,948 | $94,079 | $95,180 | $98,142 | $101,104 | $101,673 | $103,040 | $99,477 | $100,742 | $101,243 |

| Paid-in Capital | $15,000 | $15,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 |

| Retained Earnings | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) | ($15,000) |

| Earnings | $0 | $2,111 | $5,623 | $10,540 | $16,164 | $24,593 | $33,903 | $44,094 | $54,641 | $65,720 | $79,429 | $93,774 | $108,544 |

| Total Capital | $0 | $2,111 | $42,623 | $47,540 | $53,164 | $61,593 | $70,903 | $81,094 | $91,641 | $102,720 | $116,429 | $130,774 | $145,544 |

| Total Liabilities and Capital | $50,000 | $77,459 | $126,284 | $138,489 | $147,243 | $156,773 | $169,045 | $182,198 | $193,314 | $205,759 | $215,905 | $231,515 | $246,788 |

| Net Worth | $0 | $2,111 | $42,623 | $47,540 | $53,164 | $61,593 | $70,903 | $81,094 | $91,641 | $102,720 | $116,429 | $130,774 | $145,544 |