Barnum Painters

Executive Summary

Barnum Painters will provide top-quality interior and exterior residential and commercial painting services. The principal officers of Barnum Painters believe that most companies in this industry suffer two major problems. These are poor scheduling of job projects and poor retention of quality employees. Both lead to lower customer satisfaction, lack of repeat business and a low word-of-mouth referral rate. Barnum Painters believes that by implementing this contractor business plan, it can improve upon and exploit these weaknesses to gain local market share.

The objectives for Barnum Painters over the next three years are:

- To achieve sales revenues of approximately $620,000 by year three.

- To achieve a customer mix of 30% commercial/60% residential building contracts per year.

- To expand operations to include all the Greater Seattle area including Kirkland, Renton and the Kitsap Peninsula.

The company will seek to provide its painting services in the most timely manner and with an ongoing comprehensive quality-control program to provide 100% customer satisfaction. The company’s principal officers see each contract as an agreement not between a business and its customers, but between partners that wish to create a close and mutually-beneficial long-term relationship. This will help to provide greater long-term profits through referrals and repeat business.

Barnum Painters will institute the following key procedures to reach its goals:

- Create a position of inventory coordinator, and have at least one expediter assigned to each project.

- Have a dedicated project manager for each project who can handle quality-control issues.

- Institute a program of profit sharing among all employees.

Barnum Painters is a start-up limited liability company consisting of three principal officers with combined industry experience of 40 years. Barnum Painters will be a partnership between Mr. William Barnum, Mr. Anthony Barnum and Mr. Michael Kruger. The principals will be investing significant amounts of their own capital into the company and will also be seeking a loan of $7,000 to cover start-up costs and future growth. Finally, the company has procured a $10,000 line of credit (not shown on financial statements) that will be used if necessary to cover unforeseen expenses or opportunities.

Barnum Painters will be located in a rented suite in the Rucker Industrial Park on 710 Snoquamie Route, Suite 250 in Edmonds, WA. The facilities will include a reception area, offices for the principals, storage area for inventory, and employee lounge. Barnum Painters offers a wide variety of services primarily focused on interior and exterior residential and commercial painting. The firm also provides such services as drywall plastering, acoustical ceilings, pressure washing, and others. The idea is to provide clients with a broad range of related services that will minimize their need to employ a variety of contractors. Barnum Painters will engage in a low-cost leadership strategy while maintaining a suitable level of quality.

Initially the company will focus on residential and commercial customers in the Everett, Washington area. However, by the end of the three-year projections, the company expects to be serving the entire Puget Sound area. The company has rigorously examined its financial projections and concluded that they are both conservative in profits and generous in expenditures. This was done deliberately to provide for unforeseeable events. The company’s principals believe that cash flow projections are realistic.

Keys to Success

The principal officers of Barnum Painters have had many years of experience in the contracting business. They believe that most companies in this industry, which includes painting contractors, suffer from two major problems that Barnum Painters can improve upon and exploit.

The first problem comes from scheduling of jobs. Many painting contractors find it difficult to maintain established schedules with their customers that lead to a decrease in customer satisfaction and retention. This is caused by poor management, less than reliable employees, and delays in inventory procurement and distribution. The second problem is in retaining reliable and motivated personnel. Many painting companies rely on temporary or transient employees that lead to high turnover rates and decreased service quality.

Barnum Painters will institute the following key procedures:

- Creation of a position of inventory coordinator and have at least one expediter assigned to each project.

- Have a dedicated project manager for each project who can handle quality control issues.

- Institute a program of profit sharing among all employees.

Mission

The mission of Barnum Painters is to provide top-quality interior and exterior residential and commercial painting services. The company will seek to provide these services in the most timely manner and with an ongoing comprehensive quality control program to provide 100% customer satisfaction. The company’s principal officers see each contract as an agreement not between a business and its customers, but between partners that wish to create a close and mutually beneficial long-term relationship. This will help to provide greater long-term profits through referrals and repeat business.

Objectives

The objectives for Barnum Painters over the next three years is to:

- Achieve sales revenues of approximately $450,000 by year three.

- Achieve a customer mix of 30% commercial/60% residential building contracts per year.

- Expand operations to include all the Greater Seattle area including Kirkland, Renton and the Kitsap Peninsula.

Company Summary

Barnum Painters is a start-up limited liability company consisting of three principle officers with combined industry experience of 40 years. The company was formed to take advantage of the perceived weakness and inadequacies of other regional companies in terms of quality and customer satisfaction. Barnum Painters will be a partnership between Mr. William Barnum, Mr. Anthony Barnum and Mr. Michael Kruger. The principles in the company will be investing significant amounts of their own capital into the company and will also be seeking a loan to cover start-up costs and future growth.

Barnum Painters will be located in a rented suite in the Rucker Industrial Park on 710 Snoquamie Route, Suite 250 in Edmonds, WA. The facilities will include a reception area, offices for the principals, storage area for inventory, and employee lounge.

The company plans to use its existing contacts and the combined customer base of Mr.’s Barnum and Kruger to generate short-term residential contracts. Its long-term profitability will rely on focusing on commercial contracts that will be obtained through strategic alliances and a comprehensive marketing program.

Company Ownership

Barnum Painters is a privately owned limited liability partnership with each of the principal officers holding an equal share in the company.

Start-up Summary

The following table and chart show the start-up costs for Barnum Painters.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $400 |

| Stationery etc. | $300 |

| Brochures | $500 |

| Consultants | $750 |

| Insurance | $600 |

| Rent | $4,000 |

| Expensed equipment | $0 |

| Expensed Equipment | $0 |

| Other | $0 |

| Total Start-up Expenses | $6,550 |

| Start-up Assets | |

| Cash Required | $40,150 |

| Start-up Inventory | $850 |

| Other Current Assets | $0 |

| Long-term Assets | $4,000 |

| Total Assets | $45,000 |

| Total Requirements | $51,550 |

| Start-up Funding | |

| Start-up Expenses to Fund | $6,550 |

| Start-up Assets to Fund | $45,000 |

| Total Funding Required | $51,550 |

| Assets | |

| Non-cash Assets from Start-up | $4,850 |

| Cash Requirements from Start-up | $40,150 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $40,150 |

| Total Assets | $45,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $7,000 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $7,000 |

| Capital | |

| Planned Investment | |

| William Barnum | $15,000 |

| Anthony Barnum | $18,550 |

| Michael Kruger | $11,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $44,550 |

| Loss at Start-up (Start-up Expenses) | ($6,550) |

| Total Capital | $38,000 |

| Total Capital and Liabilities | $45,000 |

| Total Funding | $51,550 |

Company Locations and Facilities

Barnum Painters will be located in a rented suite in the Rucker Industrial Park on 710 Snoquamie Route, Suite 250 in Edmonds, WA. The facilities will include a reception area, offices for the principals, storage area for inventory, a painting booth, tool area and employee lounge.

Services

Barnum Painters offers comprehensive interior and exterior painting services for both the residential and commercial markets.

Service Description

Barnum Painters services include:

- Full prep work.

- Dry wall contouring.

- Fine detailing.

- Small carpentry work.

- Specialty wall coatings.

- Refinishings.

- Acoustical ceilings.

- Pressure washing/roof cleaning.

Each project is customized to the wants and needs of the client. Prices are determined by the scope of the project, materials needed, wear and tear on equipment and required profit margin.

Competitive Comparison

The contracting and painting market is very competitive. The barriers to entry and exit in this market are very low making this an industry with a large number of rival firms with high turnover rates. Buyers have a significant amount of power since they have a large number of companies to choose from. Moreover, services are undifferentiated, which means that customer loyalty is usually low. Painting companies must compete on quality and timeliness of service, customer relations, and price.

Barnum Painters believes that it can improve on the quality and timeliness of services in this industry by instituting procedures that will avoid many of the mistakes that other firms make. This includes delayed schedules and high employee turnover which leads to lower service quality. The company will be equally competitive in price and will maintain close ties with its clients throughout the entire project since each project is a customized job. Through these steps, Barnum Painters will be able to build up a reputation of better quality service at competitive prices than its competitors.

Market Analysis Summary

Barnum Painters will focus on two markets within the industry, the residential segment (including apartment buildings) and the commercial segment (including buildings used for professional purposes).

The commercial market requires the shortest amount of time to completion of projects and usually the least amount of customization. Since our projects impinge upon a business’ profitability, it is absolutely crucial for our project foremen to maintain schedule and keep the stakeholders apprised of the project’s progress.

Although the above is also true for the residental owner, time is not as critical, quality and meeting the needs/wants of the client come first in the residential segment. The client is often willing to wait a little longer to have the project done to his/her specifications. The project foremen must be willing to be more flexible and willing to listen to the client.

Over the past decade a number of new trends have been observed in this industry. This includes the tremendous growth of the economy, the high technology boom, and the growth of substitute services such as Home Depot.

Market Segmentation

Barnum Painters will focus on two markets within the industry, the residential segment (including apartment buildings) and the commercial segment which includes buildings used for professional purposes. The company can handle any size building that needs its services. It is the goal of the company to eventually have approximately one-third of all business coming from the commercial segment, since this generates the greatest cash flow. Furthermore, this segment has the lowest percentage of variable costs. The residential segment is considered to be the company’s cash cow. Even during the slow winter months, the company can expect to have a small number of residential contracts.

Initially the company will focus on the two segments in just the Everett, Washington area. However, by the end of the three year projections, the company expects to be serving the entire Puget Sound area.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Commercial Buildings | 4% | 300,000 | 310,500 | 321,368 | 332,616 | 344,258 | 3.50% |

| Residential Buildings | 3% | 1,375,000 | 1,409,375 | 1,444,609 | 1,480,724 | 1,517,742 | 2.50% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 2.68% | 1,675,000 | 1,719,875 | 1,765,977 | 1,813,340 | 1,862,000 | 2.68% |

Target Market Segment Strategy

Each of the two market segments has differing needs and trends. The following sections go into detail about how the company will fact them.

Market Trends

Over the past decade a number of new trends have been observed in this industry. The tremendous growth of the economy has fueled the painting contractors industry as well, as people have progressively spent more and saved less. The high technology boom has created great opportunities in the Pacific Northwest which the industry has also benefited from. However, the growth of firms such as Home Depot, which encourages do-it-yourself painting and construction, has lead to a serious decline in sales for the residential segment. The growth of this trend poses a significant threat to the industry. Barnum Painters plans to increasingly focus on the commercial segment as the company grows in order to promote greater revenue and income.

Service Business Analysis

Most of the industry analysis is contained in the Competitive Comparison section to give the reader the idea of the competitive nature of the industry, its opportunities and threats, and the company’s flexibility in pricing. Barnum Painters exists in a purely competitive market that faces virtually unlimited competition and high demand. The ability of the company to differentiate its services or enter into a niche market is limited. The company will engage in a low-cost leadership strategy while maintaining a suitable level of quality.

In the painting contracting industry, there are a limited number of large firms that compete for the largest projects, and a vast number of smaller companies that fight for all the rest. Within the largest company section, market consolidation is always a threat.

Competition and Buying Patterns

This industry is highly seasonal. The busiest times are during the summer months where it is easy for a company to become so engaged that it must turn down contracts. During the winter months businesses must focus on marketing to get any contracts at all.

Main Competitors

The main competitors for Barnum Painters include Kolby and Wilson, DMB Enterprises, Sun Painting, and Milbrant Commercial Painters.

Each of these competitors is able to achieve a high degree of profitability through marketing, volume or high-end contracts. They pose a significant threat to Barnum Painters because of their deep pockets and their desire to acquire other painting competitors. Barnum Painters will compete with these rivals through the use of greater marketing and better service.

Strategy and Implementation Summary

As stated before, the company will focus on greater service through better scheduling, project management, and greater alignment of personnel by providing profit sharing. The company is seeking to use the most up-to-date communications and scheduling technology between the project manager, foreman, suppliers, and operations personnel to insure that deadlines are met. Furthermore, the company will seek to create a reliable pool of individual painters to draw upon and eventually hire all the painters full time with salary and other compensation.

The company also plans to carry out an agressive marketing plan starting in year three. This includes literature, TV, radio, billboards and strategic alliances with other large contractors that do not have their own painting services. These companies include Marble Construction, Talbot Construction and Burns & Associates.

Marketing Strategy

The following sections detail the marketing strategy for Barnum Painters.

Promotion Strategy

The company will be engaging in an agressive marketing program that will include mailers, phone solicitation, TV, radio, billboards and other platforms to generate service awareness, and value proposition. However, as stated elsewhere, the company’s immediate goal will be to generate enough profit to pay for such expenses. The marketing plan will go into effect starting in year three. Prior to this the company will use more modest marketing tools such as mailer, promotion of word-of-mouth marketing, and ads such as in the Yellow Pages.

Pricing Strategy

The company will price each project based on time, material, and a flat 5-10% profit margin, depending on the segment. In the first year or two, depending on sales, the company will focus more on getting the contracts than on maintaining its pricing structure. Therefore, profit margin may be a little low for the first year or two.

Sales Strategy

Sales forecast is based on the existing client base of the three principal officers of the company and their ability to generate new sales based on their contacts. By bringing together Mr. Kruger’s commercial painting experience and Mr. Barnum’s residential experience, the company will be able to generate sales in both areas. Furthermore, the company’s growing marketing program will generate the growth the company needs to survive.

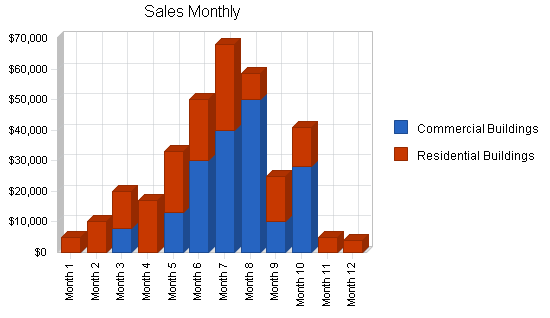

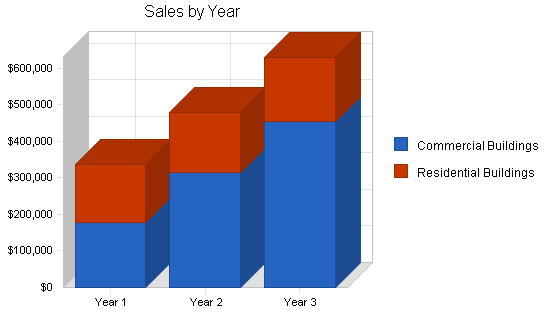

Sales Forecast

See Sales Strategy.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Commercial Buildings | $179,000 | $315,130 | $455,404 |

| Residential Buildings | $157,500 | $165,375 | $173,644 |

| Total Sales | $336,500 | $480,505 | $629,048 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Commercial Buildings | $40,480 | $78,783 | $100,189 |

| Residential Buildings | $47,250 | $52,920 | $55,566 |

| Subtotal Direct Cost of Sales | $87,730 | $131,703 | $155,755 |

Strategic Alliances

The company is currently in negotiations to form a strategic alliance with an undisclosed large contractor company. The agreement will be that Barnum Painters will provide all the painting needs that the contractor’s clients require and vice versa. The company will seek further alliances as situations develop. The company will seek only those contractors that have high standards of customer service and retention.

Management Summary

Management consists of three individuals who have extensive experience in the painting contractors industry. These are William Barnum, Anthony Barnum, and Michael Kruger. Each individual brings a unique outlook and skill set that will help drive sales and profits.

The president and head of operations of Barnum Painters will be Mr. William Barnum, the head of inventory, expediter and Q&A will be Mr. Kruger and the person in charge of sales and contracting will be Mr. Anthony Barnum.

Organizational Structure

The company will follow a hierarchical structure with Mr. William Barnum at the top as president and Mr. Anthony Barnum and Mr. Michael Kruger as department heads. The sales and contracting department along with inventory, expediters, and Q&A will consist of only those individuals until such time as growth of the company will require more people. This is anticipated to occur in year three to five.

Management Team

Mr. William Barnum has been in the painting industry working with residential owners for 15 years. He initially started off with B&B contractors as a carpenter and painter and worked with various companies for the next ten years. Desiring to own his own company, Mr. Barnum attended Puget Sound University where he got his B.S. in business. He then worked for Star Painters as a project manager and financial analyst.

Mr. Anthony Barnum started out working with painting and contracting companies while attending college. He has a B.S. in communications from Washington State University. He has eight years experience in sales.

Mr. Michael Kruger has worked in the painting industry for 20 years as a contractor, project manager and owner of Kruger Enterprises. He has extensive experience in bidding and completing commercial painting projects.

Personnel Plan

The following table is the personnel plan for Barnum Painters.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Production Personnel | |||

| Project Forman #1 | $22,800 | $30,000 | $30,000 |

| Project Foreman #2 | $0 | $0 | $30,000 |

| Residential Painter | $12,900 | $13,500 | $14,000 |

| Residential Painter | $12,900 | $13,500 | $14,000 |

| Residential Painter | $12,900 | $13,500 | $14,000 |

| Commercial Painter | $7,525 | $13,500 | $14,000 |

| Commercial Painter | $7,525 | $13,500 | $14,000 |

| Commercial Painter | $7,525 | $13,500 | $14,000 |

| Commercial Painter | $0 | $0 | $14,000 |

| Commercial Painter | $0 | $0 | $14,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $84,075 | $111,000 | $172,000 |

| Sales and Marketing Personnel | |||

| Mr. Anthony Barnum, Contracting and Sales | $30,000 | $30,000 | $30,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $30,000 | $30,000 | $30,000 |

| General and Administrative Personnel | |||

| Mr. William Barnum. Operations | $30,000 | $30,000 | $30,000 |

| Mr. Michael Kruger, Expeditor and Q&A | $30,000 | $30,000 | $30,000 |

| Expeditor | $0 | $18,000 | $18,000 |

| Expeditor | $0 | $0 | $18,000 |

| Subtotal | $60,000 | $78,000 | $96,000 |

| Other Personnel | |||

| Name or Title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 7 | 11 | 14 |

| Total Payroll | $174,075 | $219,000 | $298,000 |

Financial Plan

The following sections will outline the Financial Plan of Barnum Painters.

Important Assumptions

The following table shows the General Assumptions for Barnum Painters.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

Key Financial Indicators

The chart below shows the Benchmarks for Barnum Painters.

Break-even Analysis

The Break-even Analysis gives the reader an idea of how many projects Barnum Painters must bid for, prep, paint and complete each month to cover costs. Because Barnum Painters is providing a customized service with many projects having unique requirements, the estimates of revenue and cost are somewhat arbitrary. Furthermore, the company experiences a high degree of seasonality in its contracts which may result in a number of unprofitable months during the late fall, winter and early spring periods.

Fixed costs are based on running costs estimated by the officers of the company and include payroll for all employees. Variable costs are based on a 26% estimate of the average sales per unit. The average revenue estimate is based on the consensus of the principal officers who have had many years of experience in the industry and on the realistic assumption of the types of contracts the company will get in the beginning and the requirements needed to complete such projects.

| Break-even Analysis | |

| Monthly Revenue Break-even | $17,755 |

| Assumptions: | |

| Average Percent Variable Cost | 26% |

| Estimated Monthly Fixed Cost | $13,126 |

Projected Profit and Loss

The following table and chart shows the projected Profit and Loss for Barnum Painters.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $336,500 | $480,505 | $629,048 |

| Direct Cost of Sales | $87,730 | $131,703 | $155,755 |

| Production Payroll | $84,075 | $111,000 | $172,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $171,805 | $242,703 | $327,755 |

| Gross Margin | $164,695 | $237,803 | $301,293 |

| Gross Margin % | 48.94% | 49.49% | 47.90% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $30,000 | $30,000 | $30,000 |

| Advertising/Promotion | $3,600 | $5,000 | $10,000 |

| Travel | $2,400 | $3,500 | $4,000 |

| Miscellaneous | $2,400 | $3,000 | $3,000 |

| Total Sales and Marketing Expenses | $38,400 | $41,500 | $47,000 |

| Sales and Marketing % | 11.41% | 8.64% | 7.47% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $60,000 | $78,000 | $96,000 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $1,200 | $1,200 | $1,200 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,800 | $1,800 | $1,800 |

| Insurance | $3,600 | $3,600 | $3,600 |

| Rent | $24,000 | $24,000 | $24,000 |

| Payroll Taxes | $26,111 | $32,850 | $44,700 |

| Other General and Administrative Expenses | $0 | $0 | $0 |

| Total General and Administrative Expenses | $116,711 | $141,450 | $171,300 |

| General and Administrative % | 34.68% | 29.44% | 27.23% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 |

| Bookkeeper and acountant | $2,400 | $2,500 | $2,750 |

| Total Other Expenses | $2,400 | $2,500 | $2,750 |

| Other % | 0.71% | 0.52% | 0.44% |

| Total Operating Expenses | $157,511 | $185,450 | $221,050 |

| Profit Before Interest and Taxes | $7,184 | $52,353 | $80,243 |

| EBITDA | $8,384 | $53,553 | $81,443 |

| Interest Expense | $574 | $350 | $117 |

| Taxes Incurred | $1,983 | $15,601 | $24,038 |

| Net Profit | $4,627 | $36,402 | $56,088 |

| Net Profit/Sales | 1.38% | 7.58% | 8.92% |

Projected Cash Flow

The following table and chart is the Cash Flow for Barnum Painters.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $168,250 | $240,253 | $314,524 |

| Cash from Receivables | $163,833 | $238,362 | $312,574 |

| Subtotal Cash from Operations | $332,083 | $478,615 | $627,098 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $3,000 | $0 | $0 |

| Subtotal Cash Received | $335,083 | $478,615 | $627,098 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $174,075 | $219,000 | $298,000 |

| Bill Payments | $164,958 | $217,088 | $269,271 |

| Subtotal Spent on Operations | $339,033 | $436,088 | $567,271 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $2,334 | $2,333 | $2,333 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $341,367 | $438,421 | $569,604 |

| Net Cash Flow | ($6,283) | $40,194 | $57,494 |

| Cash Balance | $33,867 | $74,061 | $131,555 |

Projected Balance Sheet

The following table presents the Balance Sheet for Barnum Painters.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $33,867 | $74,061 | $131,555 |

| Accounts Receivable | $4,417 | $6,307 | $8,256 |

| Inventory | $9,906 | $21,772 | $20,284 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $48,189 | $102,140 | $160,096 |

| Long-term Assets | |||

| Long-term Assets | $4,000 | $4,000 | $4,000 |

| Accumulated Depreciation | $1,200 | $2,400 | $3,600 |

| Total Long-term Assets | $2,800 | $1,600 | $400 |

| Total Assets | $50,989 | $103,740 | $160,496 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $696 | $19,378 | $22,378 |

| Current Borrowing | $4,666 | $2,333 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $5,362 | $21,711 | $22,378 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $5,362 | $21,711 | $22,378 |

| Paid-in Capital | $47,550 | $47,550 | $47,550 |

| Retained Earnings | ($6,550) | ($1,923) | $34,479 |

| Earnings | $4,627 | $36,402 | $56,088 |

| Total Capital | $45,627 | $82,029 | $138,117 |

| Total Liabilities and Capital | $50,989 | $103,740 | $160,496 |

| Net Worth | $45,627 | $82,029 | $138,117 |

Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 1721, Painting and Paper Hanging, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 42.79% | 30.91% | 5.90% |

| Percent of Total Assets | ||||

| Accounts Receivable | 8.66% | 6.08% | 5.14% | 34.60% |

| Inventory | 19.43% | 20.99% | 12.64% | 5.40% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 29.80% |

| Total Current Assets | 94.51% | 98.46% | 99.75% | 69.80% |

| Long-term Assets | 5.49% | 1.54% | 0.25% | 30.20% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 10.52% | 20.93% | 13.94% | 43.40% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 12.40% |

| Total Liabilities | 10.52% | 20.93% | 13.94% | 55.80% |

| Net Worth | 89.48% | 79.07% | 86.06% | 44.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 48.94% | 49.49% | 47.90% | 27.20% |

| Selling, General & Administrative Expenses | 47.59% | 41.97% | 39.05% | 15.40% |

| Advertising Expenses | 1.07% | 1.04% | 1.59% | 0.40% |

| Profit Before Interest and Taxes | 2.13% | 10.90% | 12.76% | 2.50% |

| Main Ratios | ||||

| Current | 8.99 | 4.70 | 7.15 | 1.60 |

| Quick | 7.14 | 3.70 | 6.25 | 1.27 |

| Total Debt to Total Assets | 10.52% | 20.93% | 13.94% | 55.80% |

| Pre-tax Return on Net Worth | 14.49% | 63.40% | 58.01% | 5.60% |

| Pre-tax Return on Assets | 12.96% | 50.13% | 49.92% | 12.60% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 1.38% | 7.58% | 8.92% | n.a |

| Return on Equity | 10.14% | 44.38% | 40.61% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 38.09 | 38.09 | 38.09 | n.a |

| Collection Days | 59 | 8 | 8 | n.a |

| Inventory Turnover | 9.08 | 8.31 | 7.41 | n.a |

| Accounts Payable Turnover | 237.90 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 16 | 28 | n.a |

| Total Asset Turnover | 6.60 | 4.63 | 3.92 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.12 | 0.26 | 0.16 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $42,827 | $80,429 | $137,717 | n.a |

| Interest Coverage | 12.52 | 149.60 | 687.89 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.15 | 0.22 | 0.26 | n.a |

| Current Debt/Total Assets | 11% | 21% | 14% | n.a |

| Acid Test | 6.32 | 3.41 | 5.88 | n.a |

| Sales/Net Worth | 7.38 | 5.86 | 4.55 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Commercial Buildings | 0% | $0 | $0 | $8,000 | $0 | $13,000 | $30,000 | $40,000 | $50,000 | $10,000 | $28,000 | $0 | $0 |

| Residential Buildings | 0% | $5,000 | $10,000 | $12,000 | $17,000 | $20,000 | $20,000 | $28,000 | $8,500 | $15,000 | $13,000 | $5,000 | $4,000 |

| Total Sales | $5,000 | $10,000 | $20,000 | $17,000 | $33,000 | $50,000 | $68,000 | $58,500 | $25,000 | $41,000 | $5,000 | $4,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Commercial Buildings | $0 | $0 | $1,760 | $0 | $2,860 | $6,600 | $8,000 | $11,500 | $2,200 | $7,560 | $0 | $0 | |

| Residential Buildings | $1,500 | $3,000 | $3,600 | $5,100 | $6,000 | $6,000 | $8,400 | $2,550 | $4,500 | $3,900 | $1,500 | $1,200 | |

| Subtotal Direct Cost of Sales | $1,500 | $3,000 | $5,360 | $5,100 | $8,860 | $12,600 | $16,400 | $14,050 | $6,700 | $11,460 | $1,500 | $1,200 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Production Personnel | |||||||||||||

| Project Forman #1 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | |

| Project Foreman #2 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Residential Painter | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | |

| Residential Painter | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | |

| Residential Painter | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | |

| Commercial Painter | $0 | $0 | $1,075 | $0 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $0 | $0 | |

| Commercial Painter | $0 | $0 | $1,075 | $0 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $0 | $0 | |

| Commercial Painter | $0 | $0 | $1,075 | $0 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $1,075 | $0 | $0 | |

| Commercial Painter | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Commercial Painter | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | $5,125 | $5,125 | $8,350 | $5,125 | $8,350 | $8,350 | $8,350 | $8,350 | $8,350 | $8,350 | $5,125 | $5,125 | |

| Sales and Marketing Personnel | |||||||||||||

| Mr. Anthony Barnum, Contracting and Sales | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| General and Administrative Personnel | |||||||||||||

| Mr. William Barnum. Operations | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Mr. Michael Kruger, Expeditor and Q&A | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Expeditor | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Expeditor | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Other Personnel | |||||||||||||

| Name or Title | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total People | 7 | 7 | 10 | 7 | 10 | 10 | 10 | 10 | 10 | 10 | 7 | 7 | |

| Total Payroll | $12,625 | $12,625 | $15,850 | $12,625 | $15,850 | $15,850 | $15,850 | $15,850 | $15,850 | $15,850 | $12,625 | $12,625 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $5,000 | $10,000 | $20,000 | $17,000 | $33,000 | $50,000 | $68,000 | $58,500 | $25,000 | $41,000 | $5,000 | $4,000 | |

| Direct Cost of Sales | $1,500 | $3,000 | $5,360 | $5,100 | $8,860 | $12,600 | $16,400 | $14,050 | $6,700 | $11,460 | $1,500 | $1,200 | |

| Production Payroll | $5,125 | $5,125 | $8,350 | $5,125 | $8,350 | $8,350 | $8,350 | $8,350 | $8,350 | $8,350 | $5,125 | $5,125 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $6,625 | $8,125 | $13,710 | $10,225 | $17,210 | $20,950 | $24,750 | $22,400 | $15,050 | $19,810 | $6,625 | $6,325 | |

| Gross Margin | ($1,625) | $1,875 | $6,290 | $6,775 | $15,790 | $29,050 | $43,250 | $36,100 | $9,950 | $21,190 | ($1,625) | ($2,325) | |

| Gross Margin % | -32.50% | 18.75% | 31.45% | 39.85% | 47.85% | 58.10% | 63.60% | 61.71% | 39.80% | 51.68% | -32.50% | -58.13% | |

| Operating Expenses | |||||||||||||

| Sales and Marketing Expenses | |||||||||||||

| Sales and Marketing Payroll | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Advertising/Promotion | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Travel | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Miscellaneous | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Total Sales and Marketing Expenses | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | |

| Sales and Marketing % | 64.00% | 32.00% | 16.00% | 18.82% | 9.70% | 6.40% | 4.71% | 5.47% | 12.80% | 7.80% | 64.00% | 80.00% | |

| General and Administrative Expenses | |||||||||||||

| General and Administrative Payroll | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Insurance | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Payroll Taxes | 15% | $1,894 | $1,894 | $2,378 | $1,894 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $1,894 | $1,894 |

| Other General and Administrative Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total General and Administrative Expenses | $9,444 | $9,444 | $9,928 | $9,444 | $9,928 | $9,928 | $9,928 | $9,928 | $9,928 | $9,928 | $9,444 | $9,444 | |

| General and Administrative % | 188.88% | 94.44% | 49.64% | 55.55% | 30.08% | 19.86% | 14.60% | 16.97% | 39.71% | 24.21% | 188.88% | 236.09% | |

| Other Expenses: | |||||||||||||

| Other Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Consultants | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Bookkeeper and acountant | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Total Other Expenses | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Other % | 4.00% | 2.00% | 1.00% | 1.18% | 0.61% | 0.40% | 0.29% | 0.34% | 0.80% | 0.49% | 4.00% | 5.00% | |

| Total Operating Expenses | $12,844 | $12,844 | $13,328 | $12,844 | $13,328 | $13,328 | $13,328 | $13,328 | $13,328 | $13,328 | $12,844 | $12,844 | |

| Profit Before Interest and Taxes | ($14,469) | ($10,969) | ($7,038) | ($6,069) | $2,463 | $15,723 | $29,923 | $22,773 | ($3,378) | $7,863 | ($14,469) | ($15,169) | |

| EBITDA | ($14,369) | ($10,869) | ($6,938) | ($5,969) | $2,563 | $15,823 | $30,023 | $22,873 | ($3,278) | $7,963 | ($14,369) | ($15,069) | |

| Interest Expense | $57 | $55 | $53 | $52 | $50 | $49 | $47 | $45 | $44 | $42 | $41 | $39 | |

| Taxes Incurred | ($4,358) | ($3,307) | ($2,127) | ($1,836) | $724 | $4,702 | $8,963 | $6,818 | ($1,026) | $2,346 | ($4,353) | ($4,562) | |

| Net Profit | ($10,168) | ($7,717) | ($4,964) | ($4,284) | $1,689 | $10,972 | $20,913 | $15,909 | ($2,395) | $5,474 | ($10,157) | ($10,645) | |

| Net Profit/Sales | -203.36% | -77.17% | -24.82% | -25.20% | 5.12% | 21.94% | 30.75% | 27.19% | -9.58% | 13.35% | -203.13% | -266.13% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,500 | $5,000 | $10,000 | $8,500 | $16,500 | $25,000 | $34,000 | $29,250 | $12,500 | $20,500 | $2,500 | $2,000 | |

| Cash from Receivables | $0 | $83 | $2,583 | $5,167 | $9,950 | $8,767 | $16,783 | $25,300 | $33,842 | $28,692 | $12,767 | $19,900 | |

| Subtotal Cash from Operations | $2,500 | $5,083 | $12,583 | $13,667 | $26,450 | $33,767 | $50,783 | $54,550 | $46,342 | $49,192 | $15,267 | $21,900 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $3,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $2,500 | $5,083 | $12,583 | $16,667 | $26,450 | $33,767 | $50,783 | $54,550 | $46,342 | $49,192 | $15,267 | $21,900 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $12,625 | $12,625 | $15,850 | $12,625 | $15,850 | $15,850 | $15,850 | $15,850 | $15,850 | $15,850 | $12,625 | $12,625 | |

| Bill Payments | $108 | $3,356 | $6,807 | $11,498 | $8,648 | $19,754 | $27,463 | $34,942 | $23,412 | $5,368 | $22,677 | $924 | |

| Subtotal Spent on Operations | $12,733 | $15,981 | $22,657 | $24,123 | $24,498 | $35,604 | $43,313 | $50,792 | $39,262 | $21,218 | $35,302 | $13,549 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $194 | $200 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $12,927 | $16,175 | $22,851 | $24,317 | $24,692 | $35,798 | $43,507 | $50,986 | $39,456 | $21,412 | $35,496 | $13,749 | |

| Net Cash Flow | ($10,427) | ($11,092) | ($10,268) | ($7,651) | $1,758 | ($2,031) | $7,276 | $3,564 | $6,885 | $27,780 | ($20,229) | $8,151 | |

| Cash Balance | $29,723 | $18,631 | $8,363 | $712 | $2,471 | $440 | $7,716 | $11,280 | $18,165 | $45,945 | $25,716 | $33,867 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $40,150 | $29,723 | $18,631 | $8,363 | $712 | $2,471 | $440 | $7,716 | $11,280 | $18,165 | $45,945 | $25,716 | $33,867 |

| Accounts Receivable | $0 | $2,500 | $7,417 | $14,833 | $18,167 | $24,717 | $40,950 | $58,167 | $62,117 | $40,775 | $32,583 | $22,317 | $4,417 |

| Inventory | $850 | $1,650 | $3,300 | $5,896 | $5,610 | $9,746 | $13,860 | $18,040 | $15,455 | $8,755 | $12,606 | $11,106 | $9,906 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $41,000 | $33,873 | $29,348 | $29,092 | $24,489 | $36,933 | $55,250 | $83,922 | $88,852 | $67,695 | $91,135 | $59,139 | $48,189 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Accumulated Depreciation | $0 | $100 | $200 | $300 | $400 | $500 | $600 | $700 | $800 | $900 | $1,000 | $1,100 | $1,200 |

| Total Long-term Assets | $4,000 | $3,900 | $3,800 | $3,700 | $3,600 | $3,500 | $3,400 | $3,300 | $3,200 | $3,100 | $3,000 | $2,900 | $2,800 |

| Total Assets | $45,000 | $37,773 | $33,148 | $32,792 | $28,089 | $40,433 | $58,650 | $87,222 | $92,052 | $70,795 | $94,135 | $62,039 | $50,989 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $3,135 | $6,420 | $11,223 | $7,998 | $18,848 | $26,286 | $34,140 | $23,254 | $4,587 | $22,646 | $900 | $696 |

| Current Borrowing | $7,000 | $6,806 | $6,612 | $6,418 | $6,224 | $6,030 | $5,836 | $5,642 | $5,448 | $5,254 | $5,060 | $4,866 | $4,666 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $7,000 | $9,941 | $13,032 | $17,641 | $14,222 | $24,878 | $32,122 | $39,782 | $28,702 | $9,841 | $27,706 | $5,766 | $5,362 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $7,000 | $9,941 | $13,032 | $17,641 | $14,222 | $24,878 | $32,122 | $39,782 | $28,702 | $9,841 | $27,706 | $5,766 | $5,362 |

| Paid-in Capital | $44,550 | $44,550 | $44,550 | $44,550 | $47,550 | $47,550 | $47,550 | $47,550 | $47,550 | $47,550 | $47,550 | $47,550 | $47,550 |

| Retained Earnings | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) | ($6,550) |

| Earnings | $0 | ($10,168) | ($17,885) | ($22,848) | ($27,133) | ($25,444) | ($14,472) | $6,440 | $22,349 | $19,955 | $25,429 | $15,272 | $4,627 |

| Total Capital | $38,000 | $27,832 | $20,115 | $15,152 | $13,867 | $15,556 | $26,528 | $47,440 | $63,349 | $60,955 | $66,429 | $56,272 | $45,627 |

| Total Liabilities and Capital | $45,000 | $37,773 | $33,148 | $32,792 | $28,089 | $40,433 | $58,650 | $87,222 | $92,052 | $70,795 | $94,135 | $62,039 | $50,989 |

| Net Worth | $38,000 | $27,832 | $20,115 | $15,152 | $13,867 | $15,556 | $26,528 | $47,440 | $63,349 | $60,955 | $66,429 | $56,272 | $45,627 |