Claremont Funding

Executive Summary

Claremont Funding is an outstanding mortgage brokerage firm serving the lending needs of real estate professionals, builders and individual home buyers. We have access to a full range of mortgage sources and are dedicated to finding the right loan–with the best rates, terms and costs–to meet our clients’ unique needs.

This firm is capitalized by two principal investors, Joan Billings and Maureen Shoe. Both are licensed brokers with a combined experience of over 30 years in the industry.

1.1 Objectives

Claremont Funding aims to offer comprehensive mortgage broker services. Claremont Funding will focus on providing personal and specialized services to meet each client’s specific needs. The primary objectives of our firm are:

-

Become profitable serving the real estate investment opportunities becoming available in the rapidly growing old town section of the city.

-

Develop a solid, corporate identity in our specified target market area.

-

Become one of the top brokerage firms in the area by our third year of operation, or before.

-

Realize a positive return on investment within the first 12 months.

1.2 Mission

Claremont Funding offers high-quality mortgage brokerage services to residential and business customers. Our aim is to provide our customers with fair mortgage rates at reasonable prices, while keeping our clients informed and educated throughout the process. We will become friends and mentors to our customers as well as quality service providers. Claremont is an excellent place to work, a professional environment that is challenging, rewarding, creative, and respectful of ideas and individuals. Claremont ultimately provides excellent value to its customers and fair reward to its owners and employees.

Company Summary

Claremont Funding is a new company that provides a high level of expertise. We will provide superior personal service to buyers. We take pride in knowing that 70% of our business comes from repeat clients and their referrals.

Our responsibility as mortgage professionals is to determine what a customer’s financial goals are, not just quote a rate. We have access to hundreds of loan programs, allowing us to arrange the most beneficial solution… whatever the buyer’s needs may be.

2.1 Company Ownership

The owners and brokers of Claremont Funding are Joan Billings and Maureen Shoe.

2.2 Start-up Summary

Our start-up costs are outlined in the following table. Start-up costs derive from website design, office equipment, main computer station complete with all mortgage information for broker usage, stationery, legal costs, furnishings, office advertising and services, and expenses associated with opening our office. The start-up costs are to be financed by direct owner investment and credit. Lease office space averages $1.10 – 1.60 per square foot to an approximate of $1,500 per month, plus utilities, for efficient leased office space. Commercial lease will be for a three to five year agreement with the first month and a security deposit equal to the monthly lease rate payable at the time of lease start date.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $900 |

| Stationery etc. | $2,000 |

| Brochures | $1,000 |

| Advertising | $2,500 |

| Insurance | $200 |

| Rent | $3,000 |

| Answering Service | $200 |

| Utilities Start Up | $250 |

| Office Furnishings | $4,000 |

| Expensed Equipment | $3,000 |

| Business Software | $2,000 |

| Office Supplies | $1,000 |

| Total Start-up Expenses | $20,050 |

| Start-up Assets | |

| Cash Required | $39,950 |

| Other Current Assets | $20,000 |

| Long-term Assets | $0 |

| Total Assets | $59,950 |

| Total Requirements | $80,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $20,050 |

| Start-up Assets to Fund | $59,950 |

| Total Funding Required | $80,000 |

| Assets | |

| Non-cash Assets from Start-up | $20,000 |

| Cash Requirements from Start-up | $39,950 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $39,950 |

| Total Assets | $59,950 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $30,000 |

| Accounts Payable (Outstanding Bills) | $10,000 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $40,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $20,000 |

| Investor 2 | $20,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $40,000 |

| Loss at Start-up (Start-up Expenses) | ($20,050) |

| Total Capital | $19,950 |

| Total Capital and Liabilities | $59,950 |

| Total Funding | $80,000 |

Services

Our personal goal is to break through the barriers that impede homeownership for those who wish to realize the American Dream. We provide potential and current homeowners the opportunity to find the best mortgage loan for their needs.

We match buyers to loan programs. We have an extensive questionnaire for our buyers to list their wants and needs. We then take this questionnaire and put the supplied information to match buyers to the loan packages matching their criteria.

Market Analysis Summary

Due to the strengthening of the area’s economy and lower interest rates, more home buyers today are looking to purchase homes. These changes in attitudes of home buyers are a tremendous boost to real estate firms. Residential construction is booming in the city’s Old Town section. We are poised to take advantage of these changes, and expect to become a recognized name and profitable entity in the city’s real estate market. We chose to locate our office in the area of most revenue potential and where we have close connection to dominant real estate firms. Our targeted market area, the Old Town area, shows stability and growth. We have a beautiful office, centered in the Old Town area.

The first quarter home values were up 12.5 percent from the same period in 2001, the Office of Federal Housing Enterprise Oversight reported. The gain reflects an increase from the previous quarter, when residential real estate values saw growth of 12.1 percent.

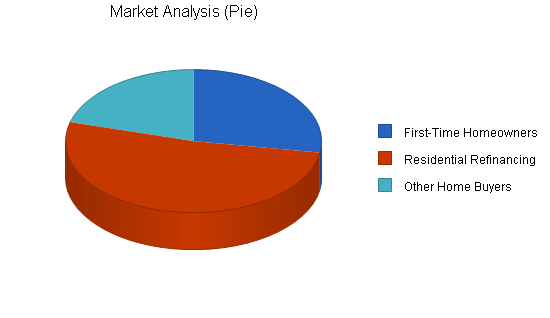

4.1 Market Segmentation

The home buyers that Claremont Funding will be serving can be divided into two groups:

-

First-time homeowners: A bulk of the new construction in the Old Town section of the city is directed toward first-time homeowners.

-

Residential refinancing: Whether it is for purchasing, construction, remodeling, debt consolidation, investment properties or refinancing–we have programs available to service those with good and bad credit.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| First-Time Homeowners | 15% | 80,000 | 92,000 | 105,800 | 121,670 | 139,921 | 15.00% |

| Residential Refinancing | 10% | 150,000 | 165,000 | 181,500 | 199,650 | 219,615 | 10.00% |

| Other Home Buyers | 7% | 60,000 | 64,200 | 68,694 | 73,503 | 78,648 | 7.00% |

| Total | 10.87% | 290,000 | 321,200 | 355,994 | 394,823 | 438,184 | 10.87% |

4.2 Target Market Segment Strategy

We cannot survive waiting for the customer to come to us. Instead, we must get better at focusing on the specific market segments whose needs match our offerings. Focusing on targeted segments is the key to our future. Therefore, we need to focus our marketing message and our services offered. We need to develop our message, communicate it, and make good on it.

Strategy and Implementation Summary

Claremont Funding will focus on the mortgage broker needs in the Old Town section of the city and the surrounding areas. Our target customer will be first-time home buyers and existing homeowners who are interested in refinancing.

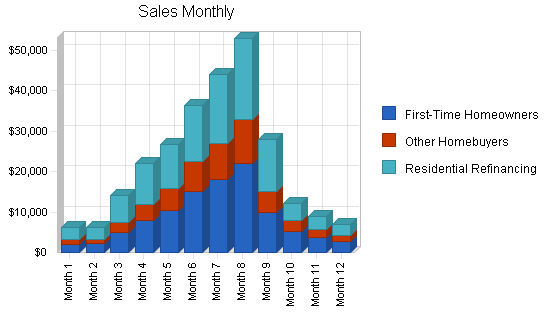

5.1 Sales Forecast

The following table and chart give a run-down on forecasted sales. We expect sales to build between January through March with the most growth during the months of March through August. We expect sales to drop off from September till the end of the year.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| First-Time Homeowners | $104,672 | $150,000 | $180,000 |

| Other Homebuyers | $52,336 | $75,000 | $90,000 |

| Residential Refinancing | $107,839 | $140,000 | $175,000 |

| Total Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| First-Time Homeowners | $0 | $0 | $0 |

| Other Homebuyers | $0 | $0 | $0 |

| Residential Refinancing | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

5.2 Milestones

The accompanying table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Lease Office Space | 12/15/2001 | 12/28/2001 | $3,000 | Maureen | Marketing |

| Purchase Office Equipment/Computer, etc. | 12/1/2001 | 12/15/2001 | $3,000 | Maureen | Marketing |

| Office Utilities | 12/20/2001 | 12/21/2001 | $250 | Joan | Web |

| Answering Service | 12/13/2001 | 12/23/2001 | $200 | Joan | Web |

| Stationary | 12/1/2001 | 12/10/2001 | $2,000 | Joan | Admin |

| Business Software | 12/15/2001 | 12/28/2001 | $2,000 | Joan | Admin |

| Advertising | 12/1/2001 | 12/30/2001 | $2,500 | Maureen | Marketing |

| Totals | $12,950 | ||||

5.3 Competitive Edge

Claremont Funding’s competitive edge is that both Joan and Maureen are the most visible lecturers to new home owners in the city. Joan has a weekly column in the city’s daily newspaper and Maureen lectures weekly to the city’s numerous neighborhood councils and civic groups. Together, they represent the most recognizable faces in the city on the subject of home ownership and refinancing a home.

Between them, they have a base of 6,000 satisfied customers who continue to make referrals to the brokers.

The city has been growing by 15% annually for the past 10 years. With the population now at 1.3 million, the new construction in the Old Town section of the city is valued at two billion dollars in home sales next year alone. Claremont Funding is positioned well to grab a large share of the mortgage services demanded by the city’s growth in Old Town.

Management Summary

Claremont Funding is a two member mortgage brokerage firm. Both brokers are equal partners in the firm.

6.1 Personnel Plan

The following table shows the personnel plan for Claremont Funding.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Joan Billings | $60,000 | $80,000 | $90,000 |

| Maureen Shoe | $60,000 | $80,000 | $90,000 |

| Admin Assistants | $46,000 | $60,000 | $80,000 |

| Total People | 3 | 4 | 4 |

| Total Payroll | $166,000 | $220,000 | $260,000 |

Financial Plan

-

We want to finance growth mainly through cash flow.

-

The most important factor for Claremont Funding is the closing sales days. These dates will be determined ultimately by the Seller and the Buyer and a move out/move in schedule will be complied with.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. The monthly assumptions are included in the appendix. From the beginning, we recognize that collection days are critical, but not a factor we can influence easily. At least we are planning on the problem, and dealing with it. Interest rates, tax rates, and personnel burden are based on conservative assumptions. Some of the more important underlying assumptions are:

-

We assume a strong economy, without major recession.

-

We assume, of course, that there are no unforeseen changes in the economy that would change our estimations.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The following table and chart will summarize our break-even analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | $19,975 |

| Assumptions: | |

| Average Percent Variable Cost | 0% |

| Estimated Monthly Fixed Cost | $19,975 |

7.3 Projected Profit and Loss

Our projected profit and loss is shown on the following table.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $264,847 | $365,000 | $445,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $264,847 | $365,000 | $445,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $166,000 | $220,000 | $260,000 |

| Sales and Marketing and Other Expenses | $7,800 | $13,000 | $19,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $200 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Rent | $36,000 | $36,000 | $36,000 |

| Payroll Taxes | $24,900 | $33,000 | $39,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $239,700 | $306,800 | $358,800 |

| Profit Before Interest and Taxes | $25,147 | $58,200 | $86,200 |

| EBITDA | $25,147 | $58,200 | $86,200 |

| Interest Expense | $2,950 | $2,550 | $2,250 |

| Taxes Incurred | $6,659 | $16,695 | $25,185 |

| Net Profit | $15,538 | $38,955 | $58,765 |

| Net Profit/Sales | 5.87% | 10.67% | 13.21% |

7.4 Projected Cash Flow

Cash flow projections are critical to our success. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $66,212 | $91,250 | $111,250 |

| Cash from Receivables | $187,004 | $269,352 | $330,237 |

| Subtotal Cash from Operations | $253,216 | $360,602 | $441,487 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $4,500 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $12,000 | $0 | $0 |

| Subtotal Cash Received | $269,716 | $360,602 | $441,487 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $166,000 | $220,000 | $260,000 |

| Bill Payments | $90,879 | $99,759 | $124,576 |

| Subtotal Spent on Operations | $256,879 | $319,759 | $384,576 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,500 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $3,000 | $3,000 | $3,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $264,379 | $322,759 | $387,576 |

| Net Cash Flow | $5,337 | $37,842 | $53,911 |

| Cash Balance | $45,287 | $83,129 | $137,040 |

7.5 Projected Balance Sheet

The balance sheet in the following table shows managed but sufficient growth of net worth, and a sufficiently healthy financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $45,287 | $83,129 | $137,040 |

| Accounts Receivable | $11,631 | $16,030 | $19,543 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $76,918 | $119,159 | $176,583 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $76,918 | $119,159 | $176,583 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $2,430 | $8,716 | $10,375 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,430 | $8,716 | $10,375 |

| Long-term Liabilities | $27,000 | $24,000 | $21,000 |

| Total Liabilities | $29,430 | $32,716 | $31,375 |

| Paid-in Capital | $52,000 | $52,000 | $52,000 |

| Retained Earnings | ($20,050) | ($4,512) | $34,443 |

| Earnings | $15,538 | $38,955 | $58,765 |

| Total Capital | $47,488 | $86,443 | $145,208 |

| Total Liabilities and Capital | $76,918 | $119,159 | $176,583 |

| Net Worth | $47,488 | $86,443 | $145,208 |

7.6 Business Ratios

The following table provides important ratios for the industry, as determined by the Standard Industry Classification (SIC) Index, 7389, Business Services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 37.82% | 21.92% | 8.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 15.12% | 13.45% | 11.07% | 20.90% |

| Other Current Assets | 26.00% | 16.78% | 11.33% | 55.70% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 81.60% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 18.40% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 3.16% | 7.31% | 5.88% | 48.20% |

| Long-term Liabilities | 35.10% | 20.14% | 11.89% | 15.50% |

| Total Liabilities | 38.26% | 27.46% | 17.77% | 63.70% |

| Net Worth | 61.74% | 72.54% | 82.23% | 36.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 94.18% | 89.41% | 86.91% | 82.60% |

| Advertising Expenses | 2.27% | 2.74% | 3.37% | 0.60% |

| Profit Before Interest and Taxes | 9.49% | 15.95% | 19.37% | 1.50% |

| Main Ratios | ||||

| Current | 31.65 | 13.67 | 17.02 | 1.57 |

| Quick | 31.65 | 13.67 | 17.02 | 1.13 |

| Total Debt to Total Assets | 38.26% | 27.46% | 17.77% | 63.70% |

| Pre-tax Return on Net Worth | 46.74% | 64.38% | 57.81% | 1.90% |

| Pre-tax Return on Assets | 28.86% | 46.70% | 47.54% | 5.20% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 5.87% | 10.67% | 13.21% | n.a |

| Return on Equity | 32.72% | 45.06% | 40.47% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 17.08 | 17.08 | 17.08 | n.a |

| Collection Days | 59 | 18 | 19 | n.a |

| Accounts Payable Turnover | 34.28 | 12.17 | 12.17 | n.a |

| Payment Days | 31 | 19 | 28 | n.a |

| Total Asset Turnover | 3.44 | 3.06 | 2.52 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.62 | 0.38 | 0.22 | n.a |

| Current Liab. to Liab. | 0.08 | 0.27 | 0.33 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $74,488 | $110,443 | $166,208 | n.a |

| Interest Coverage | 8.52 | 22.82 | 38.31 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.29 | 0.33 | 0.40 | n.a |

| Current Debt/Total Assets | 3% | 7% | 6% | n.a |

| Acid Test | 26.86 | 11.83 | 15.14 | n.a |

| Sales/Net Worth | 5.58 | 4.22 | 3.06 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| First-Time Homeowners | 0% | $2,100 | $2,200 | $5,020 | $8,000 | $10,500 | $15,000 | $18,000 | $22,000 | $10,022 | $5,210 | $3,820 | $2,800 |

| Other Homebuyers | 0% | $1,050 | $1,100 | $2,510 | $4,000 | $5,250 | $7,500 | $9,000 | $11,000 | $5,011 | $2,605 | $1,910 | $1,400 |

| Residential Refinancing | 0% | $3,000 | $3,000 | $6,640 | $10,000 | $11,000 | $14,000 | $17,000 | $20,000 | $13,000 | $4,322 | $3,222 | $2,655 |

| Total Sales | $6,150 | $6,300 | $14,170 | $22,000 | $26,750 | $36,500 | $44,000 | $53,000 | $28,033 | $12,137 | $8,952 | $6,855 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| First-Time Homeowners | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Homebuyers | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Residential Refinancing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Joan Billings | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Maureen Shoe | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Admin Assistants | 0% | $3,000 | $3,000 | $3,000 | $3,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $3,000 | $3,000 | $3,000 |

| Total People | 3 | 3 | 3 | 3 | 4 | 4 | 4 | 4 | 4 | 3 | 3 | 3 | |

| Total Payroll | $13,000 | $13,000 | $13,000 | $13,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $13,000 | $13,000 | $13,000 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $6,150 | $6,300 | $14,170 | $22,000 | $26,750 | $36,500 | $44,000 | $53,000 | $28,033 | $12,137 | $8,952 | $6,855 | |

| Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Gross Margin | $6,150 | $6,300 | $14,170 | $22,000 | $26,750 | $36,500 | $44,000 | $53,000 | $28,033 | $12,137 | $8,952 | $6,855 | |

| Gross Margin % | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | |

| Expenses | |||||||||||||

| Payroll | $13,000 | $13,000 | $13,000 | $13,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $13,000 | $13,000 | $13,000 | |

| Sales and Marketing and Other Expenses | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $200 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Insurance | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Rent | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Payroll Taxes | 15% | $1,950 | $1,950 | $1,950 | $1,950 | $2,250 | $2,250 | $2,250 | $2,250 | $2,250 | $1,950 | $1,950 | $1,950 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $19,200 | $19,000 | $19,000 | $19,000 | $21,300 | $21,300 | $21,300 | $21,300 | $21,300 | $19,000 | $19,000 | $19,000 | |

| Profit Before Interest and Taxes | ($13,050) | ($12,700) | ($4,830) | $3,000 | $5,450 | $15,200 | $22,700 | $31,700 | $6,733 | ($6,863) | ($10,048) | ($12,145) | |

| EBITDA | ($13,050) | ($12,700) | ($4,830) | $3,000 | $5,450 | $15,200 | $22,700 | $31,700 | $6,733 | ($6,863) | ($10,048) | ($12,145) | |

| Interest Expense | $248 | $246 | $244 | $279 | $277 | $275 | $235 | $233 | $231 | $229 | $227 | $225 | |

| Taxes Incurred | ($3,989) | ($3,884) | ($1,522) | $816 | $1,552 | $4,478 | $6,739 | $9,440 | $1,951 | ($2,128) | ($3,083) | ($3,711) | |

| Net Profit | ($9,309) | ($9,062) | ($3,552) | $1,905 | $3,621 | $10,448 | $15,725 | $22,027 | $4,551 | ($4,965) | ($7,193) | ($8,659) | |

| Net Profit/Sales | -151.36% | -143.84% | -25.06% | 8.66% | 13.54% | 28.62% | 35.74% | 41.56% | 16.24% | -40.90% | -80.35% | -126.32% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $1,538 | $1,575 | $3,543 | $5,500 | $6,688 | $9,125 | $11,000 | $13,250 | $7,008 | $3,034 | $2,238 | $1,714 | |

| Cash from Receivables | $0 | $154 | $4,616 | $4,922 | $10,823 | $16,619 | $20,306 | $27,563 | $33,225 | $39,126 | $20,627 | $9,023 | |

| Subtotal Cash from Operations | $1,538 | $1,729 | $8,159 | $10,422 | $17,511 | $25,744 | $31,306 | $40,813 | $40,233 | $42,160 | $22,865 | $10,737 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $4,500 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $12,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $1,538 | $1,729 | $20,159 | $14,922 | $17,511 | $25,744 | $31,306 | $40,813 | $40,233 | $42,160 | $22,865 | $10,737 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $13,000 | $13,000 | $13,000 | $13,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $13,000 | $13,000 | $13,000 | |

| Bill Payments | $10,082 | $2,455 | $2,441 | $4,801 | $7,130 | $8,226 | $11,127 | $13,365 | $15,724 | $8,336 | $4,070 | $3,124 | |

| Subtotal Spent on Operations | $23,082 | $15,455 | $15,441 | $17,801 | $22,130 | $23,226 | $26,127 | $28,365 | $30,724 | $21,336 | $17,070 | $16,124 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $4,500 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $23,332 | $15,705 | $15,691 | $18,051 | $22,380 | $23,476 | $30,877 | $28,615 | $30,974 | $21,586 | $17,320 | $16,374 | |

| Net Cash Flow | ($21,794) | ($13,977) | $4,468 | ($3,129) | ($4,869) | $2,267 | $430 | $12,198 | $9,260 | $20,574 | $5,546 | ($5,637) | |

| Cash Balance | $18,156 | $4,179 | $8,647 | $5,518 | $649 | $2,916 | $3,346 | $15,544 | $24,803 | $45,378 | $50,923 | $45,287 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $39,950 | $18,156 | $4,179 | $8,647 | $5,518 | $649 | $2,916 | $3,346 | $15,544 | $24,803 | $45,378 | $50,923 | $45,287 |

| Accounts Receivable | $0 | $4,613 | $9,184 | $15,195 | $26,773 | $36,013 | $46,769 | $59,463 | $71,650 | $59,450 | $29,427 | $15,513 | $11,631 |

| Other Current Assets | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $59,950 | $42,768 | $33,363 | $43,842 | $52,291 | $56,661 | $69,685 | $82,808 | $107,194 | $104,253 | $94,804 | $86,437 | $76,918 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $59,950 | $42,768 | $33,363 | $43,842 | $52,291 | $56,661 | $69,685 | $82,808 | $107,194 | $104,253 | $94,804 | $86,437 | $76,918 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $10,000 | $2,377 | $2,283 | $4,564 | $6,859 | $7,858 | $10,684 | $12,832 | $15,441 | $8,199 | $3,965 | $3,040 | $2,430 |

| Current Borrowing | $0 | $0 | $0 | $0 | $4,500 | $4,500 | $4,500 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $10,000 | $2,377 | $2,283 | $4,564 | $11,359 | $12,358 | $15,184 | $12,832 | $15,441 | $8,199 | $3,965 | $3,040 | $2,430 |

| Long-term Liabilities | $30,000 | $29,750 | $29,500 | $29,250 | $29,000 | $28,750 | $28,500 | $28,250 | $28,000 | $27,750 | $27,500 | $27,250 | $27,000 |

| Total Liabilities | $40,000 | $32,127 | $31,783 | $33,814 | $40,359 | $41,108 | $43,684 | $41,082 | $43,441 | $35,949 | $31,465 | $30,290 | $29,430 |

| Paid-in Capital | $40,000 | $40,000 | $40,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 | $52,000 |

| Retained Earnings | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) | ($20,050) |

| Earnings | $0 | ($9,309) | ($18,371) | ($21,922) | ($20,018) | ($16,397) | ($5,949) | $9,776 | $31,803 | $36,354 | $31,389 | $24,197 | $15,538 |

| Total Capital | $19,950 | $10,641 | $1,579 | $10,028 | $11,932 | $15,553 | $26,001 | $41,726 | $63,753 | $68,304 | $63,339 | $56,147 | $47,488 |

| Total Liabilities and Capital | $59,950 | $42,768 | $33,363 | $43,842 | $52,291 | $56,661 | $69,685 | $82,808 | $107,194 | $104,253 | $94,804 | $86,437 | $76,918 |

| Net Worth | $19,950 | $10,641 | $1,579 | $10,028 | $11,932 | $15,553 | $26,001 | $41,726 | $63,753 | $68,304 | $63,339 | $56,147 | $47,488 |