clair de lune

Executive Summary

clair de lune (moonlight in French), is a new, European influenced lingerie boutique that will provide high quality lingerie in a wide array of sizes and styles with exceptional customer service. The 1,300 square foot store will be located in a proven retail center called Hawthorne Plaza in Southern Johnson County, Kansas where the demographics are suitably upscale, traffic counts are high, and compatible retailers offer qualified traffic and potential referral business.

Competition:

The outlets for intimate apparel purchases in Kansas City are much more limited than markets of similar size. There are mass merchandisers and discount stores that offer mass produced and lesser quality brands; department stores that offer better brands, but in limited sizes and with varying degrees of customer service; and 10 Victoria’s Secret stores which cater to the 18-34 age group with product of inconsistent quality and untrained store personnel. There are no lingerie boutiques serving the upper income, south Johnson County, Kansas and south Kansas City, Missouri area.

Market Potential:

Three key target groups are identified in Sections 4.1 and 4.2 of this business plan, based on lingerie spending patterns. The three target groups are:

- Women 25-59 with a household income of $75K+

- Women 18-24

- Brides

A common psychographic component that clair de lune is targeting amongst all three groups is the Intimate Apparel Enthusiast (IAE). An IAE is a woman who cares enough about her lingerie to want to shop at a specialty store, and is not purchasing her lingerie at Wal-Mart.

There are large numbers of potential customers who fit these target descriptions within a five mile radius of our store location, which captures Hawthorne Plaza shoppers for impulse purchases, and within a fifteen mile radius for destination traffic. (See section 4.1).

Unique Selling Proposition:

A recent “Dear Abby” column quoted a desperate bra shopper complaining, “Why is it that if a woman wears a 32-A and really doesn’t need to wear a bra at all, she has her choice of white, black, beige, navy, shocking pink and turquoise, as well as plaids, polka dots and leopard prints? But if a woman is a 42-D (or more) and requires a bra every waking moment, she has a choice of – white.”

clair de lune will solve this woman’s dilemma by offering a wide range of styles and sizes that she will not find elsewhere in Kansas City. The moderate to more expensive lines of lingerie offered by clair de lune are known for quality silks, hand finished laces and superior craftsmanship. We will be able to up-sell the Victoria’s Secret shopper to a higher quality product that they may have seen in a fashion magazine, by educating her on the better durability, construction and fit, at a slightly higher price. A full description of clair de lune’s product offerings can be found in Sections 3.1 and 5.1.

clair de lune’s highly trained personnel will get to know each customer’s individual needs, and will offer personal bra fitting and other special services, as described in more detail in Section 5.1.

Leadership and Vision:

The sole owner, Terry Levine, brings over 20 years of marketing and advertising experience which will be a tremendous asset in analyzing the customer and market potential, as well as in implementing a strong marketing plan, as outlined in Section 5.2. As a seasoned media strategist, she has a great grasp of numbers, and will utilize her negotiating and relationship building skills with vendors and clients. She has extensive experience controlling costs for other businesses, with a natural penchant for watching the bottom line.

Terry will be guided in her inventory management decisions by one of the most successful independent intimate apparel retailers in the U.S. Susan Nethero, owner of Intimacy in Atlanta, an award winning lingerie store with over $5 million in sales, will serve as a consultant for start-up inventory, inventory management and other operational issues. She is widely recognized by vendors and customers alike as an icon in her field.

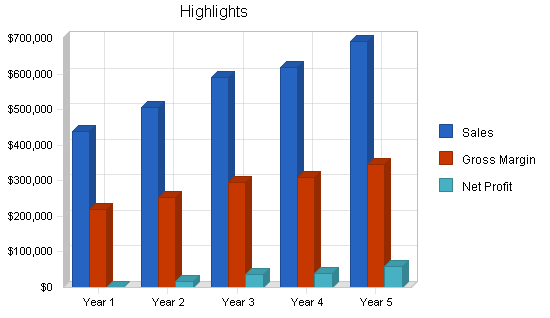

Financial Projections:

clair de lune expects to produce $439,500 in the first year of operation, with aggressive growth projections of 15% in year two and 17% in year three, fueled by expanded product lines and aggressive marketing. The store is projected to become profitable during the second year of operation.

1.1 Objectives

- To create a shopping environment where women (and men) feel comfortable, pampered and stimulated by the wide array of choices that are available to fill their needs.

- To utilize superior customer service to create positive word-of-mouth recommendations and repeat sales

- To give every customer one-to-one attention.

- To have 50% of all customers return within six (6) months of their first purchase.

- To be in the consideration set for all planned Intimate Apparel Enthusiast (IAE) purchases in southern Kansas City and Johnson County by end of year two.

- To make clair de lune the number one destination for bridal lingerie purchases by the end of year one.

- To have first year gross sales of $425,000.

- To grow the business by 15% in year two.

1.2 Mission

clair de lune is a specialty lingerie boutique offering labels, styles and sizes that are currently unavailable in Kansas City, thereby filling a void that exists between Victoria’s Secret and department store selections.

Our mission is to give the discriminating lingerie shopper what she is looking for, whether it be fit, comfort or style, in an atmosphere that is comfortable, exciting and satisfying.

We want to create a connection with the Intimate Apparel Enthusiast (IAE) that evokes the feeling that clair de lune is “my lingerie store.”

1.3 Keys to Success

- Offer superior quality products with cutting edge designs that are not available in other outlets in the Kansas City market.

- Secure a great store location that offers high customer traffic for impulse purchases, caters to desirable demographics, includes compatible stores (e.g. bridal, women’s apparel), and is in an easily accessible, known destination.

- Understand clair de lune’s target customer to ensure that the correct product mix is available to meet their needs.

- Offer an assortment of sizes (especially in the larger sizes to meet the needs of the growing plus size market).

- Offer superior, personalized customer service to create favorable word-of-mouth recommendations and influence a high rate of repeat business.

- Continuously monitor inventory levels, and make adjustments as needed.

- Educate and advise customers on proper fitting and the quality/value relationship of some of the higher priced (likely European) brands.

- Offer a variety of price points so that customers do not feel intimidated by the higher priced offerings.

- Change in-store and window displays frequently to increase impulse purchases, creating the belief that there is always something new at clair de lune.

Company Summary

clair de lune is a European influenced lingerie boutique offering quality merchandise and personalized service to Intimate Apparel Enthusiasts (IAEs). It is scheduled to open this September in a 1,300 square foot space in the Hawthorne Plaza shopping center in Overland Park, Kansas.

2.1 Hours of Operation

Exact hours of operation are to be determined. We plan to follow schedules similar to the other women’s apparel retailers in the shopping center. Additionally we will be sensitive to holiday hours and special group opportunities to maximize our exposure and sales potential.

2.2 Company Ownership

clair de lune will be formed as a privately held S corporation in the state of Kansas. The company is owned by Terry Levine, who has over 20 years of marketing and advertising experience, with a specialty in the retail industry. Ms. Levine will work full time as an owner/operator, responsible for running the business, sales and buying. She will be assisted by a 3/4 time store manager and part-time salespeople.

2.3 Location

Location is a critical element to any retail business. The right location is paramount to the success of a lingerie boutique since a large share of sales will likely be derived from impulse purchases and influenced by neighboring store traffic. While it should be possible, and is definitely desirable, to build clair de lune into a destination location for lingerie purchases, a location with high foot traffic will contribute to strong awareness and impulse purchases.

Many locations were considered for clair de lune with the following criteria in mind:

- Desirable demographic composition

- Strong foot traffic

- Complementary retailers

- Open-air mall or neighborhood center vs. strip mall or indoor mall

- Successful retail reputation

- Relatively easy access via primary streets

Fortunately, Kansas City offers many neighborhoods with upscale demographics. This bodes well for a store like clair de lune which is selling the type of lingerie that is a desired luxury rather than a necessity. We are very fortunate that within one of the best neighborhoods in the Kansas City metro area, we have found the perfect location for clair de lune at Hawthorne Plaza.

Located in the heart of Johnson County, Kansas, one of the wealthiest counties in the nation and the third highest county in the country for population growth, Hawthorne Plaza, a 14-year old shopping venue, offers the perfect mix of boutique retailers and customers for clair de lune.

According to demographic research provided by the Kansas City Star, the median household income of persons who have shopped at Hawthorne Plaza in the past 30 days is $83,820. This is higher than any other major shopping center in Kansas City, including Town Center Plaza, which is across the street from Hawthorne, and the prestigious Country Club Plaza, in Kansas City, MO.

Scarborough Research indicates that 65% of persons who have shopped at Hawthorne in the past 30 days are between the ages of 25 and 54, which encompasses the key age groups for the lingerie brands that clair de lune will offer.

Not only does Hawthorne offer ideal demographic composition, but it offers high traffic volume as well. More than 200,000 people live within five miles of Hawthorne. It is situated across the street from another highly trafficked mall, Town Center Plaza, and is within a few blocks of Sprint World Headquarters Campus, which employs approximately 10,000 people. Scarborough Research from ’02/’03 estimates that over 56,000 adults shopped Hawthorne in an average 30-day period.

Hawthorne Plaza features a great mix of specialty stores, many of which are locally owned. Complementary businesses that have the potential of sharing customers with clair de lune include a number of women’s apparel shops: Talbots, Saffees, Vinones, Keil & Co, Under the Palm Tree; a swimwear boutique; a bridal boutique; a perfume shop; a hair salon; and a couple of upscale jewelry stores. Hawthorne offers some popular restaurants that help to maintain high traffic counts.

The open-air mall has a sophisticated profile that offers an appealing backdrop for a European influenced lingerie boutique. Hawthorne Plaza is an established shopping destination in the Kansas City market and is considered a “go to center” for sophisticated shoppers.

2.4 Start-up Summary

Start-up expenses and proposed financing are outlined below.

- clair de lune will open with several months of inventory. The majority of the company’s assets will reside in inventory.

- The major start-up expenses and acquired long-term assets include $100,000 in start-up inventory and $45,100 to build-out the store and prepare it for operations (design, fixtures, lease-hold improvements, signage, Point of Sale (POS) system, packaging, supplies, etc.).

- Start-up requirements include sufficient working capital to help meet the running costs for the first 2-3 months of operations.

- The total start-up requirements are estimated to be $171,750.

- The start-up costs will be financed through a combination of owner investment, line-of-credit (LOC) and long-term borrowing:

- Owner’s investment $21,750 cash

- Ten year SBA loan $150,000

- Short-term $25,000 revolving line-of-credit for inventory replenishment and new purchases

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Logo, Stationery, Business Cards | $1,500 |

| Utilities & Telephone | $2,000 |

| Packaging/Sacks/Boxes | $2,500 |

| Hangers | $300 |

| Business Supplies | $600 |

| Real Estate Attorney | $2,000 |

| CPA | $500 |

| Grand Opening Event | $3,000 |

| Signage | $1,500 |

| POS System | $3,500 |

| Bank Card Machine & Supplies | $400 |

| Build-out | $15,000 |

| Business & Inventory Insurance | $2,500 |

| Travel-Market Buying Trips | $2,250 |

| Other | $0 |

| Total Start-up Expenses | $38,550 |

| Start-up Assets | |

| Cash Required | $18,200 |

| Start-up Inventory | $100,000 |

| Other Current Assets | $0 |

| Long-term Assets | $15,000 |

| Total Assets | $133,200 |

| Total Requirements | $171,750 |

| Start-up Funding | |

| Start-up Expenses to Fund | $38,550 |

| Start-up Assets to Fund | $133,200 |

| Total Funding Required | $171,750 |

| Assets | |

| Non-cash Assets from Start-up | $115,000 |

| Cash Requirements from Start-up | $18,200 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $18,200 |

| Total Assets | $133,200 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $150,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $150,000 |

| Capital | |

| Planned Investment | |

| Investment Cash–Terry Levine | $21,750 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $21,750 |

| Loss at Start-up (Start-up Expenses) | ($38,550) |

| Total Capital | ($16,800) |

| Total Capital and Liabilities | $133,200 |

| Total Funding | $171,750 |

Products

The right mix of products has previously been identified as one of the keys to success for clair de lune. The importance of delivering products that meet the needs and desires of our customers can not be underestimated.

clair de lune will carry quality European and U.S. labeled products that are unique to the Kansas City market. Part of the excitement of shopping at clair de lune will be that our customers will find merchandise that they will not find anywhere else in Kansas City. Our customers may be familiar with some of the brands from shopping on the coasts, on the Internet or seeing them in fashion magazines, but they will not see many, if any, in other local retail outlets.

The quality of the products will be evident in the fabric, structure and design. clair de lune’s knowledgeable staff will educate our customers on unfamiliar brands that offer design elements and fit to which they have not previously been exposed. The depth of brands will enable clair de lune to show our customers what will work best for them in terms of size, style, fit, design, fabric and price.

clair de lune will carry a wide range of prices from moderate to upscale. We want to be in reach of the Victoria’s Secret shopper who spends an average of $30 on a bra. But we also want the opportunity to upsell her to a higher quality line by demonstrating the brand/price/value relationship.

The QuickBooks inventory management software will allow us to track what is selling on a daily basis, and identify hot performers as well as “dogs.” We will also solicit customer feedback and invite suggestions for new offerings.

We have taken two precautions to establish the right product mix up front.

- We have engaged the services of Susan Nethero, owner of Intimacy in Atlanta, GA to serve as buying consultant for the initial inventory order. Susan has been in the retail lingerie business for 12 years, and operates an extremely successful 2,700 sq. ft. store which won an award as Intima Magazine’s Top Lingerie Store in the U.S. in 2004. She has expanded her current store location once, and is acquiring a second store in the fall.

- We will hold a Shoppers Focus Group to gain feedback on product offerings, price points, brand awareness and buying patterns of Kansas City women. The focus group will consist of 10 women representing different age groups and lifestyles.

3.1 Merchandise Assortment

Bras & Panties:

The mainstay of our inventory will be bras and panties. In order for any woman to feel that clair de lune is “her lingerie store,” we must be able to meet her needs for basics, as well as special occasion lingerie. According to Women’s Wear Daily, bras and panties represented the majority of all intimate apparel sales at 57% of the total dollar volume, and we expect that it will lead the volume for clair de lune as well.

Panties have become a particularly hot item over the past couple of years, with a strong consumer demand for fashion coordinates. Women are stocking up on multiple pairs of panties to match each bra or camisole, knowing that styles are rapidly changing. According to NPD Group, panty sales increased 7.8% from 2002 to 2003.

The biggest growth is the boy leg and boy brief silhouette. The styling appeals to the junior market in colorful prints and appliques as well as the misses market with a lacier model sometimes referred to as a Tanga panty. Most manufacturers are anticipating another strong season for thongs.

clair de lune will have displays that feature a complete array of panty silhouettes including classic briefs, bikinis, hi-cut briefs, boy-shorts, g-strings, v-strings and more. This will allow customers to mix and match panties with any item, depending on the style they prefer.

Industry resources typically estimate that 7 out of 10 women wear the wrong bra. clair de lune will be known for expertise in bra fitting as well as carrying a large range of styles and sizes. We will stock AA-J cup sizes and band width to at least 48 and possibly higher. We will special order other sizes as needed. Prices will range from $35 to $150, with the greatest depth in the $45-$80 range.

Daywear:

Daywear sales were up 27% in 2003 according to Women’s Wear Daily. The lines continue to blur between innerwear and ready-to-wear with many women choosing to wear their lingerie outside of the home. Daywear is an important impulse purchase as well as gift-giving item. clair de lune will be well stocked in beautiful camisoles, lacy shells and sleeveless and sleeved tops to inspire special purchases.

Nightwear/At-Homewear:

The appetite for comfortable, cocooning clothes has continued to increase post-September 11. Add to this the increased interest in wellness and exercise that has spurred yoga wear to crossover to street-wear and at-homewear, and the advances in softer, multifunctional microfibers that feel great against the skin, and you have a great formula for increased sales in this category.

According to the NPD Group, the youth market drove the growth of sleepwear and at-homewear in 2002 and 2003. In the 13-17 and 18-34 age groups, sales rose by double digits, while sales were down by less than 10% for consumers 35 to 54 and 55 or older. The styles in loungewear are less unkempt, and more flattering. They have cleaner lines and are more put together, and very acceptable to wear for casual activities outside of the home.

clair de lune will offer nightshirts, pajamas, loungewear and robes in mostly lightweight fabrics. Initially, we will not buy very deeply in this category until we get a better read on what our customers desire. There are more outlets for these types of products in Kansas City, so we may choose to minimize our offerings in this category, other than during the holiday gift buying season in 4th quarter.

Bridal:

We expect bridal to be a big category for clair de lune since the opportunity for personal service works especially well for this category. We will establish a strong referral network with the bridal store that is a few doors down as well as other bridal stores in Kansas City.

Shapewear and Maternity:

clair de lune will have minimal offerings in this category, but plans to expand as demand dictates.

Hosiery:

We recognize that hosiery can be a great driver for repeat visits, and plan to open with at least one line in year one, and expand this category in year two. Since hosiery has unique display requirements and lower per unit revenue, we will start slowly in this category and develop this area based on customer demand.

3.2 Product Sourcing & Buying

Our merchandise will be purchased from the top manufacturers in the world, through their regional representatives or direct from the manufacturer.

Inventory will be tracked and monitored through the QuickBooks POS system. Basic designs that are kept in-stock by suppliers will be re-ordered on a continual basis, as needed. Seasonal designs will be ordered several months in advance.

As previously mentioned, a key to opening our store with a desirable mix of inventory will be utilizing Susan Nethero, owner of Intimacy in Atlanta, as a buying consultant. We will utilize Susan’s vast knowledge of the industry and her supplier relationships to determine the ideal brands, styles, colors, sizes and quantities for our target market. SU.S.an will also advise us in negotiating the most favorable terms with vendors.

We will carefully monitor what sells and what doesn’t, listen to customer feedback, and keep a careful eye on ever-changing fashion trends to optimize future orders.

We will attend at least two industry shows per year, to stay current on new designers and trends. We have already attended Intima America and Lingerie Americas, both in New York, in March, 2004, which featured a wide array of international and U.S. product lines. The shows were invaluable in giving us some ideas of what product lines to initially carry at clair de lune, and in establishing vendor relationships. In addition to exposing us to the wide array of available lines, both shows provided us with educational seminars that either reinforced many of our plans or provided new thinking to our business strategies.

3.3 Inventory Management & Technology

We will use the QuickBooks Pro Point of Sale system for cash register, inventory, and customer information tracking. The software was developed for a retail environment and has the capacity to handle up to 40,000 SKUs. It is much more affordable than the Retail Pro system, which is the top-of-the line system for multi-store retailers. We believe that QuickBooks should meet our initial inventory management needs; however we will be continuously monitoring this system and how it serves our needs to determine if an upgrade will be necessary in the future.

Market Analysis Summary

There is little reason to doubt that the Kansas City market is a reflection of the national market when it comes to a growing interest among women for intimate apparel. This coupled with the continued economic strength of the Johnson County, KS and south Kansas City geographic portion of the market lends further credence to the great potential for clair de lune.

This portion of the plan will explore the key target audiences we have identified as best prospects for the products and services clair de lune will provide.

4.1 Market Segmentation

clair de lune will target specific market segments:

- Women 25-59 with household income of $75K+

- Women 18-24

- Brides

Market Potential for Target Segment 1:

Within a five (5) mile radius of our store location, 51.4% of the households have an income of $75K+. This translates into 39,956 households that fall within our primary target income bracket. This number is projected to grow to 54,560 by 2008.

Since one of our goals is to build clair de lune into a destination location for lingerie purchases, it is also pertinent to look at households with $75K+ income in a 15 mile radius of our location. There are 130,986 households that meet this criteria, and that number is projected to grow to 183,630 by 2008.

There are 49,281 women aged 25-59 that live within five miles of our location. That number is projected to grow to 53,671 by 2008.

Within a 15 mile radius, there are 256,303 women aged 25-59 with a growth projection of 270,040 by 2008.

While we do not have statistics that quantify the number of women 25-59 with household income of $75K+, we can estimate that number. Within a 15 mile radius, 32.2% of households have an income of $75K+. If we apply a 32.2% factor against 256,303 women aged 25-59, that gives us 82,529 potential customers in Segment 1.

Market Potential for Target Segment 2:

There are 7,140 women 18-24 that live within five miles of our location. That number is projected to grow to 8,578 by 2008.

Since 18-24 year olds are much more likely to be impulse purchasers, we are limiting our market potential number to a five mile radius for this age group.

We have not put a household income qualifier on this segment, since the age group includes students and young singles that are only supporting themselves rather than an entire household. Many in this age group are Victoria’s Secret shoppers, and Scarborough Research data shows us that two-thirds of their customers have a household income under $75K. However, we believe it is realistic to assume that many women in this target segment still reside in those $75K+ households referenced above. They take advantage of available disposable income to purchase lingerie.

Market Potential for Target Segment 3:

The Kansas City Star tells us that approximately 15,000 women get married in Kansas City each year. If we conservatively estimate that an average of three persons (including the bride) will be purchasing bridal lingerie for the bride, that gives us a market potential of 45,000 women in this category.

Overall Potential:

Expenditures on women’s apparel within a five (5) mile radius in 2003 was $113,444,950. We can assume that approximately 14% of that total was intimate apparel, based on national averages. We can then estimate that there were $1,588,293 expenditures on intimate apparel within a five mile radius. clair de lune would only need to capture 2.8% of that potential market to meet our sales forecasts for 2004. And that is only looking at expenditures within that five mile radius.

Source: ESRI BIS forecasts for 2003 and 2008

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Women 25-59, HHI $75K+ | 5% | 82,529 | 86,953 | 91,614 | 96,525 | 86,953 | 1.31% |

| Women 18-24 | 20% | 7,140 | 8,568 | 10,282 | 12,338 | 8,578 | 4.69% |

| Bridal | 0% | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | 0.00% |

| Total | 1.07% | 134,669 | 140,521 | 146,896 | 153,863 | 140,531 | 1.07% |

4.2 Target Market Segment Strategy

Women have varying attitudes towards the role of undergarments in their lives. This is evidenced by the different personalities that are projected through the contents of their underwear drawers. For example, there’s the “low involvement” segment, who buy just enough lingerie to get them through the week. For them, underwear is a functional necessity, and they really don’t care if it’s all white or all black, as long as they have a clean pair of panties to wear.

The fact that a woman spends a fortune on designer suits does not necessarily translate into designer labels on her bras.

clair de lune wants to capture the attention of the Intimate Apparel Enthusiast (IAE). According to a segmentation study done by the Cambridge Group, the IAE is aged 18-34, wears matching bras and panties, and loves to shop for underwear, especially on impulse. Although IAEs are only 18 percent of the market, they account for 25 percent of the sales. Their entire underwear collection looks like most women’s “special occasion” section of their lingerie drawer.

Many of these local IAEs are currently Victoria’s Secret customers because that is the only specialty retailer in Kansas City that offers the variety they are looking for. According to Scarborough Research (March 2002-Feb 2003) over 200,000 persons in Kansas City have shopped at a Victoria’s Secret in the past 90 days. Of those Victoria’s Secret shoppers, over one-third (33.8%) are aged 18-24, and 82.1% are aged 18-44.

What this means for clair de lune is that approximately one (1) out of every seven (7) women in Kansas City over the age of 18 has enough “involvement” with their lingerie to want to shop at a specialty store versus a department store or mass merchandiser.

Although the young IAE is buying a lot of undergarments, she is not necessarily the most profitable customer. Mediamark Research (MRI) from Fall of 2003 shows that adults who spend over $100 per year on lingerie tend to be in the 25-59 age group. Adults 25-59 account for 65.5% of all Adults 18+ in the U.S., whereas Adults spending over $100 per year on lingerie account for 80.7% of all Adults 18+.

Expenditures by Age of Lingerie Purchasers

Nightwear Bra Panties Night/Bras/Panties/Shape

|

|

U.S. 18+ |

<$50 |

$50-99 |

$100+ |

<$50 |

$50-99 |

$100+ |

<$50 |

$50-99 |

<$50 |

$50-99 |

$100+ |

|

18-24 |

13.1 |

10.8 |

14.5 |

10.4 |

12.8 |

10.1 |

10.2 |

11.5 |

14.0 |

12.0 |

12.6 |

10.1 |

|

25-29 |

8.5 |

8.3 |

10.0 |

11.1 |

7.8 |

9.5 |

9.3 |

8.6 |

9.2 |

8.3 |

9.0 |

10.2 |

|

30-34 |

10.0 |

9.9 |

9.9 |

16.9 |

9.6 |

10.8 |

13.2 |

10.3 |

10.3 |

9.9 |

10.6 |

13.2 |

|

35-39 |

9.9 |

12.7 |

9.2 |

11.0 |

10.5 |

10.0 |

12.4 |

10.7 |

11.4 |

10.7 |

10.2 |

12.0 |

|

40-44 |

11.23 |

13.1 |

11.9 |

6.7 |

10.6 |

11.9 |

17.7 |

11.3 |

15.1 |

11.5 |

12.9 |

16.2 |

|

45-49 |

10.0 |

8.9 |

10.2 |

10.9 |

10.5 |

13.6 |

11.1 |

10.5 |

12.4 |

10.4 |

12.3 |

11.4 |

|

50-54 |

8.9 |

10.1 |

13.2 |

13.2 |

9.8 |

11.5 |

8.7 |

10.1 |

10.1 |

9.8 |

11.0 |

9.2 |

|

55-59 |

6.9 |

8.7 |

8.1 |

9.1 |

8.6 |

7.4 |

7.7 |

8.0 |

7.0 |

8.0 |

7.6 |

8.5 |

|

60-64 |

5.4 |

5.1 |

5.4 |

6.4 |

5.7 |

5.1 |

4.0 |

5.4 |

3.8 |

5.4 |

4.7 |

4.0 |

|

65-69 |

4.3 |

4.1 |

2.2 |

2.8 |

4.4 |

3.8 |

2.5 |

4.4 |

2.1 |

4.3 |

3.3 |

2.4 |

|

70-74 |

3.9 |

3.0 |

2.1 |

1.5 |

3.6 |

2.8 |

1.8 |

2.9 |

2.4 |

3.3 |

2.8 |

1.5 |

|

75+ |

7.9 |

5.4 |

3.4 |

0.0 |

6.2 |

3.6 |

1.5 |

6.4 |

2.1 |

6.3 |

3.1 |

1.4 |

Source: MRI Fall 2003

Income is another key factor in amount spent per year on lingerie. It also influences the types of brands that a consumer purchases. clair de lune is most interested in consumers who are spending at least $100+ per year on lingerie. These consumers tend to have a household income of $75K+.

Expenditures by Household Income of Lingerie Purchasers

Night/Bras/Panties/Shape

|

HH Income |

U.S. 18+ |

<$50 |

$50-99 |

$100+ |

|

<$25K |

22.3 |

20.0 |

12.9 |

7.7 |

|

$25-35K |

11.4 |

11.2 |

7.6 |

6.1 |

|

$35-45K |

10.7 |

10.4 |

9.7 |

11.1 |

|

$45-60K |

13.7 |

14.6 |

15.3 |

12.6 |

|

$60-75K |

11.4 |

11.4 |

11.3 |

9.2 |

|

$75-100K |

12.9 |

14.0 |

19.0 |

20.6 |

|

$100-150K |

11.1 |

11.9 |

14.8 |

21.2 |

|

$150-200K |

3.6 |

3.7 |

5.7 |

7.4 |

|

$200K |

2.9 |

2.8 |

3.7 |

4.2 |

Source: MRI Fall 2003

Characteristics of our target customers:

- Women 25-59 with household income $75K+

- Of this segment, women over 35 are more lifestyle and status conscious; they favor European brands with high design and quality, shop less often, but favor premium brands.

- Young women 18-24 shop more often and are likely to be current Victoria’s Secret customers

- We can offer this segment better customer service, higher quality merchandise and more selection that they are used to receiving at Victoria’s Secret.

- Teens (13-17) often have media created tendencies; they are avid readers of fashion magazines.

- With ever-increasing disposable income, purchase decisions are influenced by those publications and peers. While not with in our core target demographic, they are also influenced by mothers and older sisters and may follow their purchase paths.

4.3 Industry Analysis

Mass merchandisers lead the women’s innerwear market in share, as they do in a variety of consumer products. Mass merchandisers like Target not only offer the convenience of one-stop shopping for a variety of needs, but they are increasing their selection of designer labels at lower prices. Brands sold at mass merchandisers include:

- Hanes

- Vassarette

- Fruit of the Loom

- Bestform

- Jockey

Department stores hold second place in terms of market share, offering a wider variety of merchandise, more high-end products, more hard to find sizes, and, if you’re lucky, some customer service. Brands sold at department stores include many of the above, plus:

Mid-Tier: (Kohl’s, JC Penney)

- Vanity Fair

- Warners

- Playtex

Major: (Dillard’s, Jones)

- Bali

- Olga

- DKNY

- Tommy Hilfiger

Better Dept: (Saks, Nordstrom’s)

- Wacoal

- Chantelle

- Donna Karan

- On Gossamer

Victoria’s Secret is the leading specialty chain and garners approximately a 20% share of the U.S. bra market, according to NPD Group.

None of these stores carry the international brands and up and coming labels that will be offered at clair de lune.

The rest of the women’s intimate apparel sales are primarily through non-chain specialty stores, other national chains (e.g. Gap) and Internet/direct mail (catalog sales).

4.3.1 Competition and Buying Patterns

In Kansas City, the choices of outlets for women to purchase intimate apparel is more limited than many other markets in the U.S. THERE ARE NO INDEPENDENT LINGERIE BOUTIQUES TO SPEAK OF IN KANSAS CITY.

The only store that can be classified as a lingerie boutique in Kansas City, is a 200 sq. ft. shop in the downtown area called Birdies. It opened in late 2003 and carries approximately 200 SKUs and three to four brands that are primarily trendy and youth oriented with low to moderate pricing. The store does very little promotion, and is in a low traffic area (hard to find), with little retail surrounding it. We don’t consider Birdies to be direct competition in its current state, but it does have some awareness among younger shoppers.

There are nine (9) Victoria’s Secret stores in Kansas City with a 10th location opening in May ’04 in north Kansas City. If you are an Intimate Apparel Enthusiast (IAE) in Kansas City, chances are that you shop at Victoria’s Secret since your other retail options are so limited. According to Scarborough Research, 15% of all women in Kansas City have shopped at a Victoria’s Secret in the past 90 days. Considering that this number takes into account women over 65 years old and all economic brackets, that number is significant.

The fact that there is a Victoria’s Secret in Town Center Plaza across the street from clair de lune is considered a positive. Customers who are lingerie shopping and do not find what they want at Victoria’s Secret can easily cross the street to visit clair de lune. Although Town Center and Hawthorne are technically different retail venues, traffic patterns suggest that consumers treat them as one destination. The challenge will be to attract the younger customers. According to Scarborough Research, over one third of Victoria’s Secret shoppers in Kansas City are 18-24, and 56% are 18-34. The demographics of Town Center Plaza skew younger than Hawthorne Plaza, so we will need to encourage Moms to bring their daughters into clair de lune to shop.

Other chain specialty lingerie retailers in Kansas City include BodyGap and Inner Self. BodyGap appeals to similar demographics as Victoria’s Secret, and has a location across the street at Town Center Plaza. We believe that this is a positive for the same reasons as stated above for Victoria’s Secret. Inner Self has one location on the Country Club Plaza, which is approximately 15 miles away. Inner Self targets the 30 to 45 year old, size 12 woman, who is looking for comfort, not fashion. It is not a store for IAEs, and is not considered to pose a geographic or demographic competitive threat.

Of the various channels described above, clair de lune will most likely share customers with the Department Stores and Specialty Chains as those are the only true retail options currently available in Kansas City with the types of products that appeal to the IAE. However, both of these channels fall dramatically short in terms of customer service and depth of quality product.

Tom Wyatt, President of Warnaco–“The department store is confusing. It’s hard to find a product, there’s no service and it’s very sterile. Until a decade ago, the department store dominated the bra industry. But it has ceased to be at all inspirational. It’s no longer a place where a woman shops and feels special.”

According to Warnaco focus groups, women HATE the underwear shopping experience at department stores. Bras and underwear are jammed onto racks that are packed too close together; the layout is determined by brand rather than purpose; and customer service is non-existent, which is a crucial component to bra shopping, hence about 80 percent of women wear the wrong size.

CLAIR DE LUNE HAS A TRUE VOID TO FILL.

4.3.2 Trends

The U.S. Intimate Apparel industry appears to be healthy. Women’s Wear Daily reported that for the 12 months ending October 2003, total volume in dollars was up 4.3 percent, and total volume units were up 6 percent. The largest percentage increases came from the daywear category with sales up 27.1 percent and units up 27.5 percent.

Women’s Wear Daily reports that department stores and chain specialty stores are losing market share. We assume that much of that erosion is a result of the increasing confidence in Internet shopping and where available, specialty retailers. IAEs recognize that a specialty boutique such as clair de lune will offer excellent customer service, product knowledge, personal fitting service, custom order options and wonderful product.

Innovations in textiles and manufacturing have caught consumer’s attention. Seamless undergarments that permit a greater range of motion and a smoother silhouette as well as new generations of microfibers that keep a body warmer, cooler or drier have encouraged consumers to seek out garments and fabrics that meet and exceed their demands.

The hottest trends at the intimate apparel shows in New York in March 2004 were:

- Increased interest in and availability of plus-size undergarments

- Innerwear that crosses over to outerwear

- Multiple silhouettes in panty styles, with popular junior styles such as boy briefs showing up more in mature lines

Strategy and Implementation Summary

Specific details regarding our strategic and tactical plans will be covered in greater detail in the following sections. However, to create an overview of the opportunity that exists for clair de lune, we offer the following SWOT (Strengths/Weaknesses/Opportunities/Threats) Analysis:

Strengths:

- Quality and selection of products

- Differentiation

- Excellent customer service

- Commitment of owner

- Location

Weaknesses:

- Owner’s inexperience as a lingerie retailer

- A target audience with limited exposure to many higher end, quality lingerie brands

Opportunities:

- Void in Kansas City market for lingerie boutiques

- Attractive retail environment in Kansas City, and especially around the store location

- Educate Kansas City consumers on quality international brands of lingerie

- Establish relationships with complementary retailers (e.g. bridal shops) to share customers

- Increased consumer interest in intimate apparel

Threats:

- Slow recovery from recent economic downturn

- Mis-calculating customer’s tastes and needs, resulting in too many mark downs

- Talk of Victoria’s Secret adding lines from international designers in the near future

5.1 Marketing Strategy

Marketing Objective:

Generate awareness through various marketing communications tactics to generate customer trial visits in support of the business goals and objectives for clair de lune.

Strategies:

- Utilize print advertising to generate awareness among the target audience and to emphasize key shopping periods.

- Ongoing use of direct marketing to keep clair de lune top-of-mind among a portion of the target audience at all times.

- Develop and implement on-going in-store promotions, guerrilla marketing tactics and cross-retail marketing to generate on-going awareness, trial and repeat visits to clair de lune.

- Employ strategic placement on the Internet.

Tactics:

Print advertising: Employ key print advertising vehicles to build awareness among the target market:

- Advertise in Kansas City Star’s “STAR” Sunday magazine on an on-going basis to generate awareness as well as advertise call-to-action messages during key shopping periods, e.g. Christmas holidays, wedding/bridal season.

- Advertise in the twice annual KC Weddings magazine to create awareness among the all-important wedding/bridal audience.

- KC Weddings is distributed throughout the Greater Kansas City regional area, with bridal retailers offering free copies, and other bookstores and retailers offering it for purchase. The circulation is 26,000 annually.

- Periodic advertising in other publications focusing on specific audiences within the target segments to generate awareness and highlight key shopping periods, e.g. Jewish Chronicle and Johnson County Sun.

On-going use of direct marketing:

- Direct mail will target a portion of the trade area (defined as a 15 mile radius) on a monthly basis. From 500 to 1,000 post-card mailings will be sent out on a monthly basis. Messages will run the gamut from “Now Open” to introduction of product lines to special shopping events. In the case of special shopping events, larger quantities will be mailed (see below). Our rationale for limited quantity mailings on a monthly basis is to keep the clair de lune name a “new news” message among a portion of the target audience at all times. This will generate awareness, which will lead to trial visits and word-of-mouth interest.

- Special Shopping Event mailings will be generated to reach a higher percentage of the target audience in the trade area. These events will include the all important 4th quarter holiday shopping season and mark down events. For these events, we anticipate mailing to as many as 1,500 to 2,000 customers and prospects minimum.

- As clair de lune generates its trackable customer data base, we will utilize direct mail to target specific interests, whether that be based on particular products, brands or seasonal purchases. A “preferred customer” mailing list will also be utilized to inform those important friends in advance of special shopping events.

- We intend to implement a birthday program and quarterly trunk shows to also be driven by direct mail.

Low or no-cost “guerrilla” marketing will be a key strategy in the first 12-24 months that clair de lune is open for business.

- Cross-promotion/marketing with complementary stores in Hawthorne – We will create incentives for the nearby women’s apparel and specialty stores to refer their customers to clair de lune. Whether that be by honoring a similar sale incentive (percentage off retail) or limited time discounts to employees, we will find ways to make it worth the effort to send their customers to our shop.

- Emphasis on Bridal Shops – Recognizing the important role that lingerie plays in completing a bridal wardrobe, clair de lune will cross-market with area bridal shops to provide those customers with the total positive experience. Our staff will be available to provide advice, special fittings, and group pricing for wedding parties.

- Generate awareness – Whether it’s classy introduction cards under windshield wipers, participation in bridal and fashion shows, or telling our story to women’s groups and organizations, the staff of clair de lune will look for those no-cost opportunities to generate awareness within our target audience.

- Drive increased customer traffic with a customer referral program targeting our preferred customer base.

Employ strategic placement among key websites on the Internet.

- Purchase ad space on the popular Knot.com wedding advisory website.

- Negotiate with key product vendors for a regional listing as a key retailer for the brand.

- Negotiate with Kansas City Star for ad space on its website for occasional exposure.

- By year-end have our own website plan written for implementation during year two.

The following is a month-by-month overview of our marketing plans execution:

|

Star Magazine |

KC Weddings |

Direct Mail |

|

| Sep |

1x |

|

1,000 |

| Oct |

1x |

|

1,000 |

| Nov |

1x |

|

1,000 |

|

Dec |

2x |

1x |

|

| Jan |

1x |

|

1,500 |

| Feb |

1x |

|

2,000 |

| Mar |

1x |

|

500 |

| Apr |

1,000 |

||

| May |

1x |

|

500 |

| Jun |

1x |

1x |

500 |

| Jul |

500 |

||

| Aug |

1x |

|

1,500 |

5.2 Sales Strategy

- Offer personalized customer service by well-trained, well compensated and appreciated employees. Develop customer relationships and loyalty that creates a desire for return visits.

- Utilize the Quickbooks POS system to record customers’ contact and purchase information, enabling us to follow up with direct mail and/or phone calls to communicate special events and the arrival of new products of interest.

- Offer a 14-day exchange policy to give customers an option to return undesired selections without losing revenue from the sale.

- Establish two major markdown events per year and promote the events to customers and prospects. These events will be used to move old inventory and create a special reason to visit clair de lune. Except for during the markdown events, merchandise will be sold at full price to maintain the integrity of the quality products we are offering. We do not want to train our customers to wait for a sale.

- Network with bridal shops throughout Kansas City to promote gift registry and the personalized attention that clair de lune offers brides and their wedding parties.

- Employees will receive added incentive to help meet/exceed customer service and sales goals.

5.2.1 Sales Forecast

clair de lune’s projected average transaction is $70. This figure was derived using a couple of different sources.

- The average transaction on figleaves.com, a hugely successful online lingerie website, with a customer base of 250,000 is $63. We can assume that customers buying on figleaves.com have a specific purchase objective in mind, and are not “just shopping.” The in-store experience at clair de lune will facilitate additional impulse purchases with successful merchandising techniques, which will raise the average transaction above an online purchase.

- The average transaction during the start-up phase of a similar lingerie boutique in Connecticut was $75. While you may expect a higher average transaction in Connecticut due to the wealth of the community and the higher awareness and acceptance of upscale brands, their start-up was over 15 years ago, and the cost of goods has increased significantly in that time.

We feel that an initial average transaction projection of $70 is conservative, and will work to increase that number to $80 by year two (2).

For the first year, our sales projections are based on 20 transactions per day times the number of selling days in the month. These numbers have been seasonally adjusted based on U.S. Department of Commerce monthly sales of women’s clothing specialty stores (3-year average, 2000-2002). The monthly indices are as follows:

|

Women’s Specialty Store |

Index |

|

| Jan |

5.9 |

71 |

| Feb |

6.7 |

81 |

| Mar |

8.6 |

104 |

| Apr |

8.7 |

105 |

| May |

8.8 |

106 |

| Jun |

8.0 |

96 |

| Jul |

7.4 |

89 |

| Aug |

8.3 |

100 |

| Sep |

7.9 |

95 |

| Oct |

8.3 |

100 |

| Nov |

8.9 |

107 |

| Dec |

12.5 |

151 |

In the sales projections table, we have adjusted our sales projections for February to a 110 index to account for a Valentine’s Day spike.

We are projecting a rate of growth of 15% in year two and 18% in year three. This will come from garnering a larger market share based on increased awareness, positive word-of-mouth recommendations, and customers adopting clair de lune as their exclusive lingerie outlet, as well as increased offerings in high demand areas such as maternity and hard-to-find sizes.

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | |||||

| Lingerie | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Other | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Lingerie cost | $219,779 | $252,746 | $295,735 | $308,774 | $345,827 |

| Other | $0 | $0 | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $219,779 | $252,746 | $295,735 | $308,774 | $345,827 |

5.3 Competitive Edge

clair de lune will establish itself as the best place to shop for lingerie in Kansas City through its product offering, the scope and level of services it provides and outstanding customer service.

PRODUCTS: clair de lune will provide a high level of quality and value to the consumer by offering a wide range of styles and sizes, with little or no crossover of brands with other retailers in Kansas City. Some brands under consideration include:

- Andres Sarda

- Borner

- Cagi

- Calida

- Cosabella

- Huit

- Le Caprice de Marie

- LZ

- NK

- Nina Von C

- Oscalito

- Selmark

- Simone Perele

SERVICES: clair de lune will create customer loyalty by offering one-to-one attention to all of their shopping needs. The following is an initial list of services that will be offered:

- Professional bra fitting

- Signature gift wrapping to reinforce the store image and make the recipient feel special

- Gift registry & wish list for wedding, birthday and anniversary. This allows spouses and friends to know just what the recipient would like and simplifies the shopping experience.

- Bridal showers–By special arrangement, clair de lune will offer space and catering for bridal showers with incentives to purchase merchandise.

- Custom/special orders

- Record of customers’ size needs and purchase history

EMPLOYEES: clair de lune’s employees will enjoy a fun, friendly, fair and challenging work environment which rewards hard work and dedication to the business and its customers. It is our desire that employees are long-term, ensuring an expertise that will support the customer experience. clair de lune will seek out employees who not only desire to train for success, but have the personality and drive to be the best in customer service, while representing the best lingerie retailer. clair de lune will provide product and customer service training to assure every employee not only benefits from, but contributes to our #1 goal of outstanding customer service.

5.4 Milestones

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Complete business plan | 2/1/2004 | 4/30/2004 | $100 | Levine | Marketing |

| Secure financing | 5/3/2004 | 6/18/2004 | $0 | Levine | Marketing |

| Logo & packaging design | 5/3/2004 | 6/4/2004 | $500 | Levine | Web |

| Secure store location & lease | 5/3/2004 | 5/28/2004 | $6,000 | Levine | Web |

| Hire designer & confirm build-out plan | 5/7/2004 | 5/28/2004 | $0 | Levine | Department |

| Apply for business licenses, registration, etc. | 5/31/2004 | 6/4/2004 | $300 | Levine | Department |

| Purchase QuickBooks hardware & software | 5/31/2004 | 6/2/2004 | $3,500 | Levine | Department |

| Hire staff | 5/31/2004 | 8/20/2004 | $0 | Levine | Department |

| Remodel store | 6/7/2004 | 9/3/2004 | $15,000 | Levine | Department |

| Order store fixtures | 6/7/2004 | 6/18/2004 | $15,000 | Levine | Department |

| Place inventory orders | 6/12/2004 | 6/20/2004 | $100,000 | Levine | Department |

| Secure insurance | 7/5/2004 | 7/9/2004 | $2,500 | Levine | Department |

| Order Bankcard Supplies & Machine | 7/5/2004 | 7/9/2004 | $400 | Levine | Department |

| Order POS Supplies | 7/5/2004 | 7/9/2004 | $400 | Levine | Department |

| Order packaging | 7/12/2004 | 7/12/2004 | $2,500 | Levine | Web |

| Design and place opening advertising | 7/12/2004 | 7/30/2004 | $3,000 | Levine | Department |

| Contact utility companies | 7/12/2004 | 7/16/2004 | $2,000 | Levine | Department |

| Order business supplies & forms | 8/2/2004 | 8/6/2004 | $600 | Levine | Web |

| Plan opening event | 8/2/2004 | 9/2/2004 | $3,000 | Levine | Department |

| Bra fitting training | 8/16/2004 | 8/20/2004 | $0 | Levine | Department |

| Store opening | 9/7/2004 | 9/7/2004 | $0 | Levine | Department |

| Opening event | 9/10/2004 | 9/10/2004 | $0 | Levine | Department |

| Totals | $154,800 | ||||

Management Summary

Management of clair de lune is made up of the owner, Terry Levine, and a manager who still needs to be hired. The owner will focus on sales, inventory and marketing. The manager will also focus on sales and handle the many administrative functions that are necessary to run a lingerie boutique.

Terry Levine is the owner/operator. Her experience in retail advertising will be a tremendous asset in establishing clair de lune. Terry has more than 20 years of advertising agency experience as a media strategist and media director involved with many well known retail, consumer and package goods clients including Wal-Mart, Thrifty Car Rental, Farmland Foods, NetZero, Commerce Bank, Rentway, the Buckle, Mission Mall, and Blockbuster Video and Music among others. These clients all benefited from Terry’s leadership role as a retail strategist and visionary.

As a seasoned media specialist, Terry honed her expertise as a numbers “expert,” negotiator and relationship builder with vendors and clients alike; skills that will again prove very beneficial in her role as a retailer.

In addition to her extensive association with diverse retail entities, Terry is a seasoned traveler. Travelling throughout Europe, particularly France and Italy, and her zeal for retail, helped focus her attention on boutique shopping, and especially lingerie boutiques. She recognized that these European retailers provided focus on product and a level of customer service and product knowledge rarely seen in the U.S. and especially not in Kansas City. It was this seed of a dream, planted several years ago, that is now developing into these plans for clair de lune.

6.1 Personnel Plan

The personnel plan is included in the following table. It calls for Terry Levine, owner/operator to work full time and draw a salary of $52,700 the first year of operation. There will be one manager who will work at least 30 hours per week, and draw a salary of $21.50 per hour. This would be equivalent to a full time salary of $45,000. There will be two part-time salespeople who will each work 18 hours per week at a salary of $10.00 per hour. We feel that we are offering generous salaries to our employees so we can attract and retain high quality personnel. It is imperative that our salespeople demonstrate a level of maturity, knowledge and comfort with our customers that will put them at ease and make them want to come back frequently.

All personnel, except the owner, will be eligible for bonuses when monthly sales goals are achieved.

Scheduling will allow for two people to be working during all hours that clair de lune is open. More will be scheduled to meet the demand of the day or season.

At this time, medical benefits will not be offered to employees. The status of medical benefits will be re-assessed after the first year of operation.

Outside consultants will be used to help with the following functions:

- Buying

- In-store and window displays

- Accounting

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Terry Levine–CEO | $52,705 | $55,340 | $58,107 | $61,013 | $64,063 |

| Manager | $31,220 | $35,000 | $40,000 | $42,000 | $44,100 |

| Salespeople | $16,720 | $27,556 | $28,934 | $30,380 | $31,900 |

| Total People | 4 | 5 | 5 | 5 | 5 |

| Total Payroll | $100,645 | $117,896 | $127,041 | $133,393 | $140,063 |

Financial Plan

- A 10-year SBA loan will be secured to cover start-up expenses and the first 2-3 months of salary, rent, taxes, insurance and credit card fees.

- A line-of-credit up to $25,000 will be used to cover any monthly cash-flow shortage and greater than anticipated inventory requirements.

- Sales growth is expected to be aggressive with projections of sales increases of 15% in year two and 17% in year three.

- Profits will be reinvested to reduce debt, expand product lines and increase personnel, as needed.

- clair de lune is a retail store, and will not be selling on credit. clair de lune will accept cash, checks and all major credit cards.

- Marketing and advertising will be no greater than 6% of sales.

7.1 Important Assumptions

| General Assumptions | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% |

| Long-term Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 |

7.2 Break-even Analysis

| Break-even Analysis | |

| Monthly Revenue Break-even | $34,528 |

| Assumptions: | |

| Average Percent Variable Cost | 50% |

| Estimated Monthly Fixed Cost | $17,264 |

7.3 Projected Profit and Loss

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Direct Cost of Sales | $219,779 | $252,746 | $295,735 | $308,774 | $345,827 |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $219,779 | $252,746 | $295,735 | $308,774 | $345,827 |

| Gross Margin | $219,779 | $252,746 | $295,735 | $308,774 | $345,827 |

| Gross Margin % | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% |

| Expenses | |||||

| Payroll | $100,645 | $117,896 | $127,041 | $133,393 | $140,063 |

| Marketing and Advertising | $26,495 | $30,000 | $34,000 | $36,000 | $38,000 |

| Depreciation | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Start-up inventory amortization | $0 | $0 | $0 | $0 | $0 |

| Rent | $36,000 | $36,000 | $36,000 | $36,000 | $36,000 |

| Packaging | $2,400 | $2,400 | $2,400 | $2,400 | $2,400 |

| Cell Phone | $600 | $600 | $600 | $600 | $600 |

| Travel | $4,800 | $2,400 | $2,400 | $2,400 | $2,400 |

| Utilities | $7,200 | $7,416 | $7,638 | $7,868 | $8,104 |

| Payroll Taxes | $0 | $0 | $0 | $0 | $0 |

| Merchandiser | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 |

| Buying Consultant | $9,600 | $0 | $0 | $0 | $0 |

| Web Design | $1,420 | $1,000 | $1,000 | $1,000 | $1,000 |

| Insurance | $2,496 | $2,621 | $2,752 | $2,890 | $3,034 |

| Credit Card Fees | $10,110 | $11,626 | $13,604 | $14,204 | $15,908 |

| Accountant | $600 | $600 | $600 | $600 | $600 |

| Total Operating Expenses | $207,166 | $217,360 | $232,835 | $242,155 | $252,909 |

| Profit Before Interest and Taxes | $12,613 | $35,386 | $62,900 | $66,619 | $92,918 |

| EBITDA | $15,613 | $38,386 | $65,900 | $69,619 | $95,918 |

| Interest Expense | $13,024 | $12,134 | $11,126 | $10,009 | $8,787 |

| Taxes Incurred | $0 | $6,976 | $15,532 | $16,983 | $25,239 |

| Net Profit | ($410) | $16,277 | $36,241 | $39,627 | $58,891 |

| Net Profit/Sales | -0.09% | 3.22% | 6.13% | 6.42% | 8.51% |

7.4 Projected Cash Flow

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Subtotal Cash from Operations | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $439,558 | $505,492 | $591,469 | $617,547 | $691,653 |

| Expenditures | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Expenditures from Operations | |||||

| Cash Spending | $100,645 | $117,896 | $127,041 | $133,393 | $140,063 |

| Bill Payments | $225,880 | $372,142 | $424,501 | $441,651 | $489,058 |

| Subtotal Spent on Operations | $326,525 | $490,038 | $551,542 | $575,044 | $629,121 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $9,908 | $10,540 | $11,855 | $12,968 | $14,185 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $336,433 | $500,578 | $563,397 | $588,012 | $643,306 |

| Net Cash Flow | $103,125 | $4,914 | $28,072 | $29,536 | $48,347 |

| Cash Balance | $121,325 | $126,239 | $154,311 | $183,846 | $232,194 |

7.5 Projected Balance Sheet

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Current Assets | |||||

| Cash | $121,325 | $126,239 | $154,311 | $183,846 | $232,194 |

| Inventory | $20,790 | $23,908 | $27,975 | $29,208 | $32,713 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $142,115 | $150,147 | $182,286 | $213,055 | $264,907 |

| Long-term Assets | |||||

| Long-term Assets | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Accumulated Depreciation | $3,000 | $6,000 | $9,000 | $12,000 | $15,000 |

| Total Long-term Assets | $12,000 | $9,000 | $6,000 | $3,000 | $0 |

| Total Assets | $154,115 | $159,147 | $188,286 | $216,055 | $264,907 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $31,234 | $30,529 | $35,281 | $36,391 | $40,537 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $31,234 | $30,529 | $35,281 | $36,391 | $40,537 |

| Long-term Liabilities | $140,092 | $129,552 | $117,697 | $104,729 | $90,544 |

| Total Liabilities | $171,326 | $160,081 | $152,978 | $141,120 | $131,081 |

| Paid-in Capital | $21,750 | $21,750 | $21,750 | $21,750 | $21,750 |

| Retained Earnings | ($38,550) | ($38,960) | ($22,684) | $13,558 | $53,185 |

| Earnings | ($410) | $16,277 | $36,241 | $39,627 | $58,891 |

| Total Capital | ($17,210) | ($934) | $35,308 | $74,935 | $133,826 |

| Total Liabilities and Capital | $154,115 | $159,147 | $188,286 | $216,055 | $264,907 |

| Net Worth | ($17,210) | ($934) | $35,308 | $74,935 | $133,826 |

7.6 Business Ratios

The following table outlines some of the more important ratios from the Women’s Accessory and Specialty Store industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 5632.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Sales Growth | 0.00% | 15.00% | 17.01% | 4.41% | 12.00% | 2.95% |

| Percent of Total Assets | ||||||

| Inventory | 13.49% | 15.02% | 14.86% | 13.52% | 12.35% | 63.14% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 16.69% |

| Total Current Assets | 92.21% | 94.34% | 96.81% | 98.61% | 100.00% | 86.54% |

| Long-term Assets | 7.79% | 5.66% | 3.19% | 1.39% | 0.00% | 13.46% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 20.27% | 19.18% | 18.74% | 16.84% | 15.30% | 28.54% |

| Long-term Liabilities | 90.90% | 81.40% | 62.51% | 48.47% | 34.18% | 10.62% |

| Total Liabilities | 111.17% | 100.59% | 81.25% | 65.32% | 49.48% | 39.16% |

| Net Worth | -11.17% | -0.59% | 18.75% | 34.68% | 50.52% | 60.84% |

| Percent of Sales | ||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 44.19% |

| Selling, General & Administrative Expenses | 53.53% | 49.23% | 46.13% | 45.85% | 43.61% | 21.68% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 2.27% |

| Profit Before Interest and Taxes | 2.87% | 7.00% | 10.63% | 10.79% | 13.43% | 3.56% |

| Main Ratios | ||||||

| Current | 4.55 | 4.92 | 5.17 | 5.85 | 6.53 | 2.90 |

| Quick | 3.88 | 4.14 | 4.37 | 5.05 | 5.73 | 0.53 |

| Total Debt to Total Assets | 111.17% | 100.59% | 81.25% | 65.32% | 49.48% | 50.96% |

| Pre-tax Return on Net Worth | 2.38% | -2489.95% | 146.64% | 75.55% | 62.87% | 9.06% |

| Pre-tax Return on Assets | -0.27% | 14.61% | 27.50% | 26.20% | 31.76% | 18.48% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Net Profit Margin | -0.09% | 3.22% | 6.13% | 6.42% | 8.51% | n.a |

| Return on Equity | 0.00% | 0.00% | 102.64% | 52.88% | 44.01% | n.a |

| Activity Ratios | ||||||

| Inventory Turnover | 6.73 | 11.31 | 11.40 | 10.80 | 11.17 | n.a |

| Accounts Payable Turnover | 8.23 | 12.17 | 12.17 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 28 | 30 | 28 | n.a |

| Total Asset Turnover | 2.85 | 3.18 | 3.14 | 2.86 | 2.61 | n.a |

| Debt Ratios | ||||||

| Debt to Net Worth | 0.00 | 0.00 | 4.33 | 1.88 | 0.98 | n.a |

| Current Liab. to Liab. | 0.18 | 0.19 | 0.23 | 0.26 | 0.31 | n.a |

| Liquidity Ratios | ||||||

| Net Working Capital | $110,882 | $119,618 | $147,005 | $176,664 | $224,370 | n.a |

| Interest Coverage | 0.97 | 2.92 | 5.65 | 6.66 | 10.57 | n.a |

| Additional Ratios | ||||||

| Assets to Sales | 0.35 | 0.31 | 0.32 | 0.35 | 0.38 | n.a |

| Current Debt/Total Assets | 20% | 19% | 19% | 17% | 15% | n.a |

| Acid Test | 3.88 | 4.14 | 4.37 | 5.05 | 5.73 | n.a |

| Sales/Net Worth | 0.00 | 0.00 | 16.75 | 8.24 | 5.17 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Lingerie | 0% | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Lingerie cost | $13,965 | $18,200 | $18,725 | $27,482 | $12,922 | $18,480 | $19,656 | $19,110 | $19,292 | $17,472 | $15,575 | $18,900 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $13,965 | $18,200 | $18,725 | $27,482 | $12,922 | $18,480 | $19,656 | $19,110 | $19,292 | $17,472 | $15,575 | $18,900 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Terry Levine–CEO | 0% | $2,292 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 | $4,583 |

| Manager | 0% | $3,010 | $2,520 | $2,520 | $3,010 | $2,520 | $2,520 | $2,520 | $2,520 | $2,520 | $2,520 | $2,520 | $2,520 |

| Salespeople | 0% | $720 | $1,440 | $1,440 | $1,600 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 | $1,440 |

| Total People | 3 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | |

| Total Payroll | $6,022 | $8,543 | $8,543 | $9,193 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | |

| Long-term Interest Rate | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | 9.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 | |

| Direct Cost of Sales | $13,965 | $18,200 | $18,725 | $27,482 | $12,922 | $18,480 | $19,656 | $19,110 | $19,292 | $17,472 | $15,575 | $18,900 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $13,965 | $18,200 | $18,725 | $27,482 | $12,922 | $18,480 | $19,656 | $19,110 | $19,292 | $17,472 | $15,575 | $18,900 | |

| Gross Margin | $13,965 | $18,200 | $18,725 | $27,482 | $12,922 | $18,480 | $19,656 | $19,110 | $19,292 | $17,472 | $15,575 | $18,900 | |

| Gross Margin % | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | |

| Expenses | |||||||||||||

| Payroll | $6,022 | $8,543 | $8,543 | $9,193 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | |

| Marketing and Advertising | $3,025 | $2,025 | $2,025 | $5,000 | $2,315 | $2,600 | $1,735 | $580 | $1,735 | $2,850 | $290 | $2,315 | |

| Depreciation | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Start-up inventory amortization | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Packaging | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Cell Phone | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | |

| Travel | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Utilities | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Merchandiser | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Buying Consultant | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | $800 | |

| Web Design | $0 | $0 | $0 | $0 | $1,000 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | |

| Insurance | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | $208 | |

| Credit Card Fees | 15% | $642 | $837 | $861 | $1,264 | $594 | $850 | $904 | $879 | $887 | $804 | $716 | $869 |

| Accountant | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | |

| Total Operating Expenses | $15,397 | $17,113 | $17,137 | $21,165 | $18,160 | $17,761 | $16,950 | $15,770 | $16,933 | $17,965 | $15,317 | $17,495 | |

| Profit Before Interest and Taxes | ($1,432) | $1,087 | $1,588 | $6,317 | ($5,238) | $719 | $2,706 | $3,340 | $2,359 | ($493) | $258 | $1,405 | |

| EBITDA | ($1,182) | $1,337 | $1,838 | $6,567 | ($4,988) | $969 | $2,956 | $3,590 | $2,609 | ($243) | $508 | $1,655 | |

| Interest Expense | $1,119 | $1,113 | $1,107 | $1,101 | $1,095 | $1,089 | $1,082 | $1,076 | $1,070 | $1,064 | $1,057 | $1,051 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($2,551) | ($26) | $481 | $5,216 | ($6,333) | ($370) | $1,623 | $2,264 | $1,289 | ($1,556) | ($800) | $354 | |

| Net Profit/Sales | -9.14% | -0.07% | 1.28% | 9.49% | -24.51% | -1.00% | 4.13% | 5.92% | 3.34% | -4.45% | -2.57% | 0.94% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 | |

| Subtotal Cash from Operations | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $27,930 | $36,400 | $37,450 | $54,964 | $25,844 | $36,960 | $39,312 | $38,220 | $38,584 | $34,944 | $31,150 | $37,800 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $6,022 | $8,543 | $8,543 | $9,193 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | $8,543 | |

| Bill Payments | $341 | $10,217 | $9,434 | $9,851 | $21,060 | $11,165 | $31,511 | $30,068 | $26,634 | $28,603 | $25,551 | $21,445 | |

| Subtotal Spent on Operations | $6,363 | $18,760 | $17,977 | $19,044 | $29,603 | $19,708 | $40,054 | $38,611 | $35,177 | $37,146 | $34,094 | $29,988 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $792 | $798 | $804 | $810 | $816 | $822 | $829 | $835 | $841 | $847 | $854 | $860 | |