Barton Interiors

Executive Summary

Barton Interiors is a proposed venture that will offer comprehensive interior design services for homes and offices in the Boulder, Colorado area. Barton Interiors also will provide access to products to complement the design consulting services including furniture, both new and antique, decorator fabric, and home and office accessories. This venture offers the personalized services the target market desires and can afford in a way that is unique from concept to implementation.

Recent market research indicates a specific and growing need in the area for the interior design consulting services and products Barton Interiors offers the market it will serve. The market strategy will be based on a cost effective approach to reach this clearly defined target market. Although the population of Boulder is under 100,000, the market has a significant quantity of relatively wealthy households that are conscious of the appearance and feel of their home and offices.

The approach to promote Barton Interiors with be through establishing relationships with key people in the community and then through referral activities once a significant client base is established. Barton Interiors will focus on developing solid and loyal client relationships offering design solutions based on the client’s taste, budget, use, and goals for the space. The additional selection, accessibility of product, design services, and value-based pricing will differentiate Barton Interiors from the other options in the area.

Total revenues in the first year are projected to exceed $46,000 with a loss. The venture will show increasing profits in year two and three, with revenues projected to increase to almost $80,000. This interior design business plan outlines the concept and implementation and details regarding the first three years of this venture.

Objectives

- Realize an average of $3,870 of sales each business month for the first year, $5,720 for the second, and $6,600 for the third year.

- Generate a minimum of 45% of revenues from product sales versus consulting billing.

- Establish a commercial revenue client base accounting for 10% of total revenues.

Mission

Barton Interiors is an interior design service for discerning, quality-conscious clients that seek assistance in their design choices for their primary residences, vacation homes, and businesses. This experience offers personal attention through the design process and also provides design resources and products to its clients through special purchases of furniture, fabric, and accessories. The total experience is provided in a way to inform, inspire, and assist people through the process of transforming their home or business environment to become a unique and personalized expression of themselves and add to their enjoyment of that interior space.

Keys to Success

The primary keys to success for Barton Interiors will be based on the following factors:

- Provide the highest quality interior design consulting experience possible.

- Sell specially selected products to these clients to further meet their interior design needs.

- Communicate with our client base through the website and personalized communication techniques.

- Retain clients to generate repeat purchases and initiate referrals.

Products and Services

Barton Interiors focuses on providing interior design consulting. This is complemented by specially purchased furniture, art pieces, decorator fabric, and accessories for the home and office. The sales process will begin with interior design consulting services, and then progress on to offer specially selected components to complement the design theme.

Products available through Barton Interiors include:

- Furniture available through special purchase arrangements with Thomasville, Drexel Heritage, and Henredon and local craftsman.

- A selection of decorator fabrics from Waverly, P Kaufmann, Fabricut, Ralph Lauren, Regal, Robert Allen, Latimer Alexander, Covington, and Portfolio.

- A line of drapery hardware called “Oval Office Iron” purchased through Dept. of the Interior Decorator Fabrics in Eugene, Oregon found at www.fabric-online.com.

- Accessory and art pieces available through wholesale shows.

- Hunter Douglas window treatment products including a variety of hard window coverings.

- Interior shutters made of wood and a plastic/resin product called “polywood.”

- Antiques acquired for specific client needs through an arrangement with a local antique buyer and through direct purchases through other sources.

Product and Service Description

Our primary points of differentiation offer these qualities:

- A unique client experience from a trained and professional interior designer that is qualified and capable of meeting the needs of discerning clients with high expectations.

- Access to a wide and unique selection of new and antique furniture, accessories, and special-order decorator fabrics.

- Personal assistance from a complementary product offering, including hard-covering window treatment, hardware, and home accessories that fit the look and objectives of each project.

Competitive Comparison

Our competition is primarily from other interior designers. Looking at a broader picture, there is also competition from the “do-it-yourself” resource providers that have retail stores and websites that include the following:

- Bed, Bath and Beyond moved into the market in the year 2000 at an excellent location.

- Discount stores including Target, Wal-Mart and Home Depot have expanded their fabric, bedding, pillow, and ready-made drapery selections often representing lines including Waverly.

- Norwalk continues to make purchasing “blank” furniture and making a designer fabric selection an attractive option to recovering furniture.

- Catalog sales continue to be a strong force with a list including Pottery Barn, Calico Corners, Ballard Design, and Eddie Bauer expanding purchasing selection.

- The list of competitors for home accessory competition includes Pier 1 and local competitors that provide an entire list of other furniture, accessory and gift stores.

- Web sales of furniture, fabric and other interior design-oriented products has expanded dramatically and in many cases is easily available.

Sales Literature

A simple and professional looking brochure will be available to provide to referral sources, leave at seminars, and on a select basis, use for direct mail purposes.

Company Summary

Barton Interiors is a start-up business that will offer comprehensive interior design services for home and office. This business will assist those that want to have guidance and council in developing a basic design concept of their project, to the person that desires someone to take it from concept to complete implementation. Barton Interiors will offer the ability for clients to purchase new and antique furniture, art work, decorator fabric, and home accessories. The website www.bartoninteriors.com will be used as another way to communicate the services available and provide a portfolio of the work accomplished. The business will begin as a home-based business and is expected to remain in this structure through at least the first three years.

Company Ownership

Barton Interiors, located in Boulder, Colorado is registered in the State of Colorado as a sole proprietorship owned and operated by Jill Barton dba Barton Interiors.

Company Locations and Facilities

Barton Interiors is operated from a home office located in Boulder, Colorado. A room is dedicated to support a work area, a client contact work center, and display samples of design concepts, products, and past work.

Market Analysis Summary

Barton Interiors has a defined target market client that will be the basis of building this business. This client is identical for both the residence and office spaces, but the target market is identical based on her different roles for each of those spaces.

Effective marketing combined with an optimal product offering is critical to the Barton Interiors’ success and future profitability. The owner possesses solid information about the market and knows a great deal about the common attributes of those that are expected to be prized and loyal clients. This information will be leveraged to better understand who Barton Interiors will serve, their specific needs, and how to better communicate with them.

Market Segmentation

The profile of the Barton Interior client consists of the following geographic, demographic, psychographic, and behavior factors:

Geographics

- The geographic market is the affluent sector within the Boulder, Colorado area with a population of 94,673. (Based on the 2000 Census data.)

- A 20-mile geographic area is in need of the products and services offered and do not intend to pursue the Denver market at this time.

- The total target market population is estimated at 24,000 based on the following demographics.

Demographics

- Female, married and have attended college.

- Have children, but they are not necessarily at home.

- A combined household annual income greater than $100,000.

- Age range of 35 to 55 years, with a median age of 42.

- Owns their home, townhouse and/or condominium valued at over $425,000.

- They and/or their spouse work in a professional setting and may have interior design requirements for their office space as well as their homes.

- Belong to one or more business, service, and/or athletic organization including:

- Boulder Country Club.

- Junior League of Boulder.

- American Business Women’s Association.

- American Auxiliary of University Women.

- Doctor’s Wives Auxiliary.

The following is known regarding the profile of the typical resident of Boulder:

- 67% have lived in the area for seven years or more.

- 23% are between the ages of 35 and 44.

- 40% have completed some college.

- 24% are managers, professionals and/or owners of a business.

- 53% are married.

- 65% have no children living at home.

- 56% own their residence.

Psychographics

- The appearance of her home is a priority.

- Entertaining and showing her home is important.

- She perceives herself as creative, tasteful and able, but seeks validation and support regarding her decorating ideas and choices.

- She reads one or more of the following magazines:

- Martha Stewart Living.

- Country Living.

- Home.

- House Beautiful.

- Country Home.

- Metropolitan Home.

- Traditional Homes.

- Victoria.

- Elle Decor.

- If she does seek out television as an information source for home decorating that is most likely to be “Martha Stewart” and, on a lesser basis, “Interior Motives.”

Behaviors

- She takes pride in having an active role in decorating their home.

- Her home is a form of communicating “who she is” to others.

- Comparison positioning and stature within social groups are made on an ongoing basis, but rarely discussed.

Barton Interiors is providing its clients the opportunity to create a home environment to express who they are. They seek design assistance and have the resources to accomplish their goals. They desire their home to be personal, unique, and tasteful as it communicates a message about what is important to them. Barton Interiors will seek to fulfill the following benefits that are important to our clients.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Country Club Women | 12% | 34,400 | 38,528 | 43,151 | 48,329 | 54,128 | 12.00% |

| Boomers in Transition | 9% | 12,000 | 13,080 | 14,257 | 15,540 | 16,939 | 9.00% |

| Professional Youngsters | 8% | 8,000 | 8,640 | 9,331 | 10,077 | 10,883 | 8.00% |

| Home Builders | 5% | 8,000 | 8,400 | 8,820 | 9,261 | 9,724 | 5.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 10.09% | 62,400 | 68,648 | 75,559 | 83,207 | 91,674 | 10.09% |

Target Market Segment Strategy

Our marketing strategy will create awareness, interest, and appeal from our target market for what Barton Interiors offers its clients. The target markets are separated into four segments; “Country Club Women,” “Boomers in Transition,” “Professional Youngsters,” and “Home Builders.” The primary marketing opportunity is selling to these well defined and accessible target market segments that focuses on investing discretionary income in these areas:

Country Club Women – The most dominant segment of the four is comprised of women in the age range of 35 to 50. They are married, have a household income greater than $100,000, own at least one home or condominium, and are socially active at and away from home. They are members of the Boulder Country Club, Junior League of Boulder, AAUW, and/or the Doctor’s Wives Auxiliary. They have discretionary income, and their home and how it looks is a priority. The appearance of where they live communicates who they are and what is important to them. This group represents the largest collection of “Martha Stewart Wanna Be’s,” with their profile echoing readers of Martha Stewart Living magazine, based on the current demographics described in the 2001 Martha Stewart Living Media Kit.

Boomers in Transition – This group, typically ranging in age from 50 to 65, is going through a positive and planned life transition. They are changing homes (either building or moving) or remodeling due to empty nest syndrome, retirement plans, general downsizing desires, or to just get closer to the golf course. Their surprisingly high level of discretionary income is first spent on travel, with decorating their home a close second. This is what makes this segment so attractive. The woman of the couple is the decision maker, and often does not always include the husband in the selection or purchase process.

Professional Youngsters – Couples between the ages of 25 and 35 establishing their first “adult” household fall into this group. They both work, earn in excess of $80,000 annually, and now want to invest in their home. They seek to enjoy their home and communicate a “successful” image and message to their contemporaries. They buy big when they have received a promotion, a bonus, or an inheritance.

Home Builders – People in the home building process, typically ranging in age from 40 to 55, are prime candidates for Barton Interiors. This applies to both primary residences and vacations and secondary homes. Although only expected to occur two to fives times each year for the business, this event will be the single largest dollar transaction amount.

Market Trends

The home textile market, considered to include sheets, towels, draperies, carpets, blankets, and upholstery, accounts for 37% of all textile output. The trade publication “Home Textiles Today” estimates the size of the U.S. home textiles market at the wholesale level, excluding carpets, to be between $6.5 billion to $7 billion annually. The industry is expected to realize a steady increase over the next few years.

The industry is driven by the number of “household formations” which is expected to continue through the first years of the new millennium. This is primarily due to the solid growth in the number of single-parent and non-family households. This growth also comes from baby boomers needing bigger houses to accommodate growing and extended families and, as people get older, they are buying homes rather than renting to realize tax and equity building benefits. Favorable mortgage rates will also enable others to invest in their existing home.

The “do-it-yourself” (DIY) market continues to grow and closely parallels the professional home-improvement market. DIY market growth is attributed to an increased presence of products, the personal satisfaction experienced, and the cost savings clients realize. A portion of the do-it-yourself market is the “buy-it-yourself” (BIY) market. Consumers are buying the product and arranging for someone else to do the fabrication and/or installation. This is more expensive then the do-it-yourself approach, but less costly than buying finished products from other sources. It also provides similar feelings of creativity, pride, and individuality associated with direct creative involvement. This sense of “participation” in home decorating is an important factor for many of these committed clients.

Regardless of this data, the following trends and issues impact the success and challenges of Barton Interiors.

- National economic health: The industry performs better when the country experiences “good times” regardless of its direct impact on the local economy. Sales decrease when the stock market falls and when NATO takes military action. An upbeat State of the Union address by the President correlates with an increase in sales.

- New home construction activity: More closely related to what is taking place in our local economy, new home construction has a significant impact on sales across all product lines.

- Shifts in design trends: Major changes in design trends increase sales. The Boulder market lags behind metropolitan design trends by six to 12 months. This offers a buying advantage for the store, offering a preview of what is coming and how we should adjust our in-stock inventory.

Market Growth

American Demographics projects the number of U.S. households will grow by 16% to 115 million by the year 2010. Almost half of the households comprised of people from 35 to 44 years old are married couples with children under the age of 18. Based on this research, households in the 45 to 65 age range will grow to 34 million by the year 2000. These households will increase another 32 percent to 45 million in 2010 as baby boomers add to this peak-earning and spending age group. These families will either build new homes or move into existing dwellings. With approximately 46.2% of the nation’s 93.3 million dwellings built before 1960, many of these homeowners are also expected to update.

One important factor is that married couples in the 35 to 65 age range represent a growth segment and enjoy larger incomes than other family structures. They enjoy the choice to spend their disposable income on life’s amenities. They may demonstrate “cocooning” by making their home a more comfortable and attractive haven. They choose to spend resources here rather than on vacations and other discretionary options. This group represents a larger subsegment of the target market.

These factors contribute to an increased need for home decorator fabrics for window treatment, upholstery, pillows, bedding, and other fabric accessory needs. This demand is expected to be complemented by the growth in the Boulder market. The majority of homeowners spend a large percentage of their disposable income on home goods within two years after buying a new house. Therefore, positive trends in new housing activity represents growth and opportunity for home textiles.

Recent slow downs in the local economy have resulted in falling below sales projections and these factors will affect market growth. Adding additional revenues through the website will hopefully add a more stable factor in to the revenue stream.

The publication, American Demographics, projects the number of U.S. households will grow by 16% between 1995 and the year 2010, an increase from 98.5 million to 115 million. Of the households comprised of people from 35 to 44 years old, almost half are married couples with children under the age of 18. Based on research by American Demographics, households in the 45 to 65 age range should grow to 34 million by the year 2000. These households will increase another 32 percent to 45 million in 2010 as baby boomers add to this peak-earning and spending age group. With approximately 46.2% of the nation’s 93.3 million dwellings built before 1960, many of these homeowners are also expected to update. These factors contribute to an increased need for home decorator fabrics for window treatment, upholstering, pillows, bedding, and other fabric accessory needs. This demand is expected to be complemented by the growth in the Boulder market. The majority of homeowners spend a large percentage of their disposable income on home goods within two years after buying a new house. Therefore, positive trends in new housing activity represents growth and opportunity for home textiles.

One important factor is that married couples in the 35 to 65 age range represent a growth segment and enjoy larger incomes than other family structures. They enjoy the choice to spend their disposable income on life’s amenities. They may demonstrate “cocooning” by making their home a more comfortable and attractive haven. They choose to spend resources here rather than on vacations and other discretionary options. This group represents a larger sub-segment of the target market.

Market Needs

Barton Interiors will provide its clients the opportunity to create a home environment to express who they are. They have the choice to actively participate in the design, look, and feel of their home. They desire their home to be personal, unique, and tasteful as well as communicate a message about what is important to them. Barton Interiors seek to fulfill the following benefits that we know are important to our clients.

Service Business Analysis

The industry continues to be competitive with a “commodity” concern with “designers” of all skill and background levels available throughout the market.

- Potential Competitors: There are many other interior designers in the Boulder area and these competitors range from those that provide simple-focused services, such as draperies only, to a more full-service interior design approach similar to Barton Interiors.

- Power of Suppliers: Moderately high in most anyone that has a business licence can have access to wholesale purchase of furniture, fabrics and accessories.

- Power of Buyers: Very low as buyers work within the financial terms and product availability offered through the suppliers that specify the terms and conditions.

- Substitute Products: High as many people refer to themselves as interior designers regardless of background, training, or certification. Substitute products are also high in the area of window treatment as hardcovering solutions have become available and increasingly affordable. This includes blinds, shutters, and other “manufactured” treatments. Substitute products are not as prevalent in the area of antiques and art pieces.

- Rivalry: Moderately low with the “territorial” structure that the industry experiences and moderately low exit barriers. The easy entry is accompanied with an easy exit and people get out when it is not working.

With the slow, but steady, growth of the past few years, the industry is now experiencing a “cautious optimism” regarding the future. Growth and expansion activities for most areas of the interior design industry appear to be carefully considered. Many in the industry continues to decide what to do and buy as the economy has experienced a slowdown and increased uncertainty from the more economically confident 1990’s.

Distributing a Service

Our primary method of distribution will be on a direct sales basis for each individual client.

Competition and Buying Patterns

Competition in the area is strong, with designers ranging from the home-based, no formal training individuals to the more formalized store front, American Association of Interior Designers (ASID) certified designers that have close relationships with prestigious architects. In most cases, clients make the provider decision on the basis of three criteria in this order with these percent influences indicated after each:

- Referrals and relationship with other professionals, particularly architects (55%).

- Personality and “expected relationship” with the designer (25% ).

- Past work (15%).

- ASID certification (5%).

Understanding the influence of these factors on the prospective client will be key in the marketing strategy.

Main Competitors

Current local competition includes the following:

- Interior Designers: There are 37 interior designers listed in the Boulder Yellow Pages (Year 2000-2001 issue) that offer fabric as a part of their services. Interior designers make profit off mark-up of fabric in addition to their hourly services charges. Their costs per yard are typically higher since they do not benefit from retail or volume discounts. Therefore, their costs to their client is often two to four times higher than the price per yard from Barton Interiors.

- House of Fabrics: Nationwide recognition and buying power of numerous types of dated fabric with strong product availability. This store has experienced financial difficulty in recent years and has closed several locations throughout the country.

- Warehouse Fabrics: Locally owned, offering low-cost products with a wide selection of discontinued fabrics and only a limited number of “current” fabrics. This warehouse concept offers marginal client service with what many “upper end” clients consider to be an “undesirable” shopping environment.

- JoAnn’s: Nationwide chain with strong buying power. They have a broad fabric selection for clothing with a limited number of in-store decorator fabrics available. Their primary target markets are the clothing seamstress, with an increasing emphasis on craft items. Low prices are fabric main point of competitive differentiation.

- Website Providers: Fabric sales over the Web are limited at this time, and this will be a source of competition for the future to watch. Currently, there is no measurable impact on our market through competitive websites.

Catalog Competitors

An increasing level of competition is anticipated from catalog sales. Recent trends, such as those demonstrated in the well established but evolving Pottery Barn catalog, indicates increased interest in offering decorator fabric, window designs, and other home decorating products through this increasingly popular channel of distribution. Catalog sources do not offer clients the option to see, touch, and have the fabric in their homes. Price is the most significant competitive factor this product source presents. The most aggressive catalog competitor is Calico Corners followed by Pottery Barn and other home-accessory-based providers.

Discounters

Channels of distribution continue to shift in favor of discounters, who account for a significant portion of the growth in the industry. As consumers experience lower levels of disposable income, discounters leverage frequent store promotions to entice frugal, value-oriented consumers. One of the biggest criticism of discounters is their failure to offer a quality service experience and their failure to present inviting displays to promote sales. These discounters, along with specialty store chains, present one of the most severe competitive threats for individually-owned specialty stores. This is partially due to extensive promotional efforts, price advantages, and established relationships with their vendors. One example of these discounters is the “home improvement” chains, such as Home Base. This aggressive retailer has adopted a strategy to include complete decorator departments in their metropolitan stores. Currently existing in the Los Angeles market, this strategy is anticipated to be introduced into the Seattle area and other select metropolitan markets within the year. Although the Boulder Home Base store sells basic curtain rod hardware and other hard cover window treatment, there are no known plans at this time for the Boulder Home Base store to implement this in the foreseeable future. This will be an important issue to monitor for competitive purposes.

Business Participants

Industry participants in the area of interior design comes from six general categories; interior designers, traditional furniture stores, traditional fabric retail stores, catalog and Web-based sales, click and mortar discounters, and individually owned stores. Most of these players have some type of an online presence. The following provides an overview of the type of participants that are most active and most successful in this arena.

Interior Designers

This large group makes up a substantial quantity of higher-end fabric purchases. For example, there are 37 interior designers listed in the Boulder Yellow Pages (Year 2001-2002 issue) that offer fabric as a part of their services. Interior designers make profit off mark-up of fabric in addition to their hourly services charges. Their costs per yard are typically higher since they do not benefit from retail or volume discounts. Therefore, their costs to the client is often two to four times higher than the price per yard from Barton Interiors. It is unusual to find an independent interior designer that has a website.

Traditional Fabric Retail Stores

The traditional retail stores are corporate stores (not franchises) that have multiple locations in select metropolitan markets. Example of these stores include:

- JoAnn’s www.joanns.com – Nationwide chain with strong buying power. They have a broad fabric selection for clothing with a limited number of in-store decorator fabrics available. Their primary target markets are the clothing seamstress, with an increasing emphasis on craft items. JoAnn’s purchased the House of Fabric chain and has a link set up from the previous URL www.houseoffabrics.com.

- Calico Corners www.calicocorners.com – This national chain was a franchise through the 1980s (no longer selling licenses) and has been purchasing those stores throughout the country. Calico Corners stores number about 90 and are in most larger cities, with a concentration in the Northeast.

Catalog and Web-based Competitors

Virtually every catalog and major retail store in the industry now has a website. The most aggressive and direct catalog competitor is Calico Corners at www.calicocorners.com which complements their 80+ retail store network. An increasing level of competition is anticipated from these catalog and Web-based sales. Recent trends, such as those demonstrated in the well established, but evolving, Pottery Barn catalog at www.potterybarn.com and Ballard Design at www.ballarddesigns.com indicates increased interest in offering decorator fabric for window design and upholstery through this increasingly popular channel of distribution.

Click and Mortar Discounters

Channels of distribution continue to shift in favor of discounters, who account for a significant portion of the growth in the industry and who have been extremely active on the Web. As consumers experience lower levels of disposable income, discounters leverage frequent store promotions to entice frugal, value-oriented consumers. One of the biggest criticism of discounters is their failure to offer a quality service experience and their failure to present inviting displays to promote sales. One example of these discounters is the “home improvement” chains, such as Home Base at www.homebase.com. This aggressive retailer has adopted a strategy to include complete decorator departments in their metropolitan stores. Currently existing in the Los Angeles market, this strategy is anticipated to be introduced into the Seattle area and other select metropolitan markets within the year. Although the Boulder Home Base store sells basic curtain rod hardware and other hard cover window treatment, there are no known plans at this time for the Boulder Home Base store to implement this in the foreseeable future. Bed, Bath & Beyond at www.bedbathandbeyond.com has an even larger assortment of hardware with a selection of pre-made solutions for window treatments, bedding and pillows. Both of these retailers have stores in our market and with selection activity on the Web, this will be important to monitor for competitive purposes.

Individually Owned Stores

Some form of locally owned stores exist in virtually every market with a population of over 50,000. Typically, the low end begins with those that carry a limited selection of decorator fabric, often with a focus on clothing fabric and crafts. At a slightly more sophisticated level, stores may offer low-cost products with a wide selection of discontinued fabrics and only a limited number of “current” fabrics. “Full service” individually owned stores, like Barton Interiors, are less prevalent. An increasing number of these stores at all level do have websites, including this local competitor example: www.econosales.com.

Strategy and Implementation Summary

The primary sales and marketing strategy for Barton Interiors includes these factors:

- A premier interior design consulting experience that provides impressive client service throughout.

- The sale of other complementary products that adds value for the client’s total experience.

- Providing a experience that will result in repeat business for home and/or office needs and client referrals.

This strategy will be implemented through the tactics and programs described in this section.

SWOT Analysis

The following SWOT analysis captures the key strengths and weaknesses relating to the market analysis summary and describes the opportunities and threats facing Barton Interiors.

Strengths

- The proven ability to establish excellent personalized client service.

- Strong relationships with suppliers that offer flexibility and respond to special product requirements.

- Good referral relationships with architects, complementary vendors, and local realtors.

- Client loyalty developed through a solid reputation among repeat, high-dollar purchase clients.

Weaknesses

- The owner is still climbing the “retail experience learning curve.”

- Not established in a market where a variety of interior design options exist.

- Challenges of the seasonality of the business.

Opportunities

- A significant portion of our target market is desperately looking for the services Barton Interiors will offer.

- Strategic alliances offering sources for referrals and joint marketing activities to extend our reach.

- Promising activity from new home construction activity.

- Changes in design trends can initiate home updating and, therefore, generate sales.

Threats

- Continued price pressure due to competition or the weakening market reducing contribution margins.

- Dramatic changes in design, including fabric colors and styles can present challenges to keep paced with what is desired by what is expected to be a leading-edge client base.

- Expansion of products and services offered by other sources including national discount stores into the local market including Target, Wal-Mart, and Home Depot.

- Catalog resources, including Calico Corners and Pottery Barn, with aggressively priced trend-setting fabric products including drapery, bedding and slipcovers.

This analysis indicates solid potential success, but the weaknesses and threats must be recognized throughout the life of the venture.

Strategy Pyramid

The following three strategies summarize our implementation process for the upcoming year. They address in-store retail revenue, expansion to non-fabric revenue sources, and Web-based sales activities.

STRATEGY #1 – Generating Referrals

Tactic #1A – Build a client base through leveraging existing contacts from former clients of the architecture firm.

Tactic #1B – Build a referral network through professional contacts. Offer special order fabric that will arrive in reasonable time frame and enable to provide something very unique for each customer.

Program #1A – Press release in the local paper announcing the business is open.

Program #1B – Offer seminars through organizations to promote the concept of using an interior designer and using Barton Interiors.

STRATEGY #2 – Product Sales

Tactic #2A – Promotion of products available through Barton Interiors.

Program #2A – Seminars and demonstration promotions.

Program #2B – Cross selling activities with home and office consulting.

Tactic #2B – Promotion of art and antiques.

Program #2C – Demonstrate the unique qualities they offer to promote these higher dollar transactions.

Program #2D – Display this through the online and notebook portfolio.

STRATEGY #3 – Generate Awareness Through the Website

Tactic #3A – Better facilitate and communicate Barton Interiors services and product through the website.

Program #3A – Design of www.bartoninteriors.com.

Program #3B – Integration of completed client work.

Tactic #3B – Monthly assessment of performance of email inquiries.

Program #3C – Establish goals of the program (Refer to Web Strategy Plan done in Web Strategy Pro).

Program #3D – Evaluate the client work initiated through the site.

Value Proposition

Barton Interiors offers the highest interior design experience for the home and office conveniently available for those in the Boulder area. The concept is unique through the selection of antiques, home accessories, and complementary products along with the interior design consulting experience.

Competitive Edge

Barton Interiors will be differentiated from other interior designers by the value it offers in quality, sought-after products not found through other designers or store choices, and through the excellent service and support it offers. Client follow-through will be impeccable. This competitive edge leverages the same proven factors that indicated higher success rates for interior design services.

Marketing Strategy

The marketing strategy is based on establishing Barton Interiors as the resource of choice for people in need of interior design ideas and products. The more involved “do-it-yourself” and the “buy-it-yourself” clients will find the consulting and guidance helpful. On the other end of the spectrum, the “just-get-it-done” client will find Barton will successfully accomplish exactly that. All clients will find Barton Interiors to be a resources to decorate their homes and offices in a way that is inspiring, inviting, and motivating.

Our marketing strategy is based on superior performance in the following areas:

- Unique consulting services.

- Product choices specifically chosen for each individual client project.

- Overall quality of the experience and the result.

- Excellent client service and support regardless.

This marketing strategy will create awareness, interest, and appeal from our target market for what Barton Interiors offers our clients. This will be executed in a manner that will entice them to come back for repeat purchases and encourage them to refer friends and professional contacts.

Pricing Strategy

Product pricing is based on offering high value to our clients compared to others in the market. Value is determined based on the best design services, providing a “picture” of what the space will look like before the work begins, convenience, and timeliness in accomplishing the goal.

Promotion Strategy

The promotion strategy will focus on generating referrals. Other potential sources of promotion include:

- Newspaper Advertisements: Select advertisements in the Boulder Herald.

- Television Advertisements: Select “Martha Stewart” and “Interior Motives” local television shows.

- Quarterly Postcard: A direct mail postcard distributed to the client mailing list.

- Website: Traffic from www.bartoninteriors.com.

Distribution Strategy

The primary source of distribution is through the tradition retail distribution channel. On a secondary basis, it will be through the website via email inquiries and phone sales, or directly from the site itself.

Marketing Programs

The single objective is to position Barton Interiors as the premier source for home decorator fabrics in the Boulder area, commanding a majority of the market share within three years. The marketing strategy will seek to first create client awareness regarding the products and services offered, develop that client base, establish connections with targeted markets and work toward building client loyalty and referrals.

Barton Interiors’ four main marketing strategies are:

- Increased awareness and image.

- Leveraging existing client base.

- Cross selling.

- New home construction promotion.

The strategies will be implements through the following marketing tactics and programs.

Strategy #1

INCREASED AWARENESS and IMAGE – Informing those not yet aware of what Barton Interiors offers.

- Advertising

- Martha Stewart.

- Interior Motives.

- Referral Generation

- Realtor “open house” promotions.

- Complementary vendor referrals.

- Imperial Floors.

- Upholstery resources.

- “Design Time” Interior Design.

- 27th Street Fabrics.

- Organization Relationships

- Co-sponsorship of fund raising activities.

- Participating in social and service events.

Strategy #2

LEVERAGING EXISTING CLIENT BASE – Our best sales in the future will come from our current client base.

- Client Service and Relationships

- Exceptional client service in the store.

- Follow up contact.

- Personal shopper support.

- Additional Experiences

- Classes.

- Demonstrations.

Strategy #3

CROSS SELLING – Increasing the average dollar amount per transaction.

- Internal

- Additional sales of furniture, art pieces, and fabric and home accessories.

- Look for office/commercial assignments.

- Prospecting

- Ongoing work including more involvement in the implementation phase.

- Future assignments based on additional work initiated by family changes and transitions.

Strategy #4

NEW HOME CONSTRUCTION PROMOTION – Connecting with people involved in the building process.

- Connecting with “Suppliers”

- Realtors gift certificate program.

- Builders design support services.

- Loan Officers gift certificate program.

- Connecting with “Clients”

- Subscription and use of “newcomers” report.

- Chamber of Commerce new members update.

Positioning Statement

For the person that seeks to create a personalized and unique impression of her home, Barton Interiors is the source for client-oriented design services. Clients will be impressed with, and return for, the services they receive and the outcome they have enjoyed. Unlike other interior designers or stores, such as JoAnn’s, Warehouse Fabric, or catalog options, Barton Interiors is a pleasant and tasteful resource that encourages everyone in the process of decorating their home. Unlike using the services of other interior decorators, Barton Interiors allows the individual to participate in their design choices to the extent they choose, and realize greater value for the dollars they invest.

Sales Strategy

The key to our sales strategy is referrals from pleased clients that are proud of the result Barton Interiors provided them and pleased to tell their friends–people much like them. Keeping in contact with past clients to acquire repeat business and to remind them of this referral opportunity will be key. Sales activities will depend on creating awareness about the services Barton Interiors offers and then build on each and every client as they make the decision to refer to others.

Web Plan Summary

The website of www.bartoninteriors.com will be used for information only purposes at this time. Contact information will be presented with a complete portfolio of work accomplished. Additional information will be provided regarding the product-based resources Barton Interiors incorporates into the work done for clients.

Sales Forecast

The sales forecast is broken down into three main revenue streams; residential consulting revenue, commercial consulting revenue, and product sales. The goal is to have these two revenue streams be equal by the second year, with product sales slower to secure during year one. The revenue forecast for the upcoming year is based on a modest 12% growth rate. The economic unpredictability adds to the difficulty of making these projections.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Residential Consulting | $22,700 | $31,200 | $46,000 |

| Commercial Consulting | $3,960 | $6,240 | $7,200 |

| Product Sales | $19,800 | $31,200 | $46,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $46,460 | $68,640 | $99,200 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Residential Consulting | $3,405 | $4,680 | $6,900 |

| Commercial Consulting | $594 | $936 | $1,080 |

| Product Sales | $10,890 | $17,160 | $25,300 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $14,889 | $22,776 | $33,280 |

Sales Programs

In brief, our marketing mix is comprised of these approaches to pricing, distribution, advertising and promotion, and client service.

Pricing – Residential consulting will bill at an average of $90 per hour and commercial consulting at $100 per hour.

Distribution – All services and products will be distributed directly through the personal contact.

Advertising and Promotion – The most successful advertising is anticipated to be through the Boulder Herald and through ads on local broadcasts of the “Martha Stewart” and “Interior Motives” television shows.

Client Service – Excellent, personalized, fun, one-of-a-kind client service is essential. This is perhaps the only attribute that cannot be duplicated by any competitor.

The first goal is to recognize individualized needs of each client. If they are a repeat client, they benefit from the knowledge regarding their lifestyle and taste that was gained from the previous experience.

Strategic Alliances

Barton Interiors does have some dynamic alliances. Based on initial research and contacts, several architect firms are willing to refer clients to Barton Interiors, including Jill’s existing employer, Gibson & Sawyer, LLC. Other alliances include a retail store called “Providance” which focuses on gallery-type pieces for the home and office and is expected to refer clients. There is also a positive relationship with “Interior Fabricators” and this business is expected to be a referral resource. Strategic online alliances do not exist at this time. This will be an area of concentrated development for the future and is reflected in our milestone chart.

Milestones

The milestone chart below accompanied by the graphic outlines key activities that will be critical to Barton Interiors’ success in the coming year.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Year Buying Program | 1/2/2002 | 1/30/2002 | $560 | Jill | Products |

| Membership Strategy | 2/2/2002 | 2/15/2002 | $225 | Jill | Promotions |

| Seminar Schedule & Prep. | 3/1/2002 | 4/1/2002 | $45 | Jill | Marketing |

| Seminars | 4/1/2002 | 5/30/2002 | $540 | Jill | Marketing |

| Client Review/Analysis | 6/1/2002 | 6/15/2002 | $250 | Jill | Marketing |

| Furniture Market (High Point, N.C.) | 11/10/2002 | 11/20/2002 | $1,800 | Jill | Products |

| Year End Evaluation | 12/20/2002 | 12/31/2002 | $250 | Jill & CPA | Management |

| Totals | $3,670 | ||||

Management Summary

Jill Barton is the founder and owner of Barton Interiors. Jill received a Bachelor of Arts degree from the University of Oregon in 1990 through the College of Architecture and Interior Design and is ASID certified. After working for three years at a prestigious interior design firm in Portland, Oregon, she moved to Boulder in 1993 and began working with Gibson & Sawyer, LLC, a well-established architecture firm focusing on the commercial sector. Jill worked with the architects in the interior design needs for their projects. During this time, she has developed relationships with a number of community, professional, and supplier contacts throughout the Boulder and Greater Denver area. Jill plans to leave the firm on favorable terms at the end of the year.

With her new role at Barton Interiors, Jill will oversee all aspects of the design process and all business operations. Jill’s responsibilities include all aspects of establishing the business, marketing, buying, bookkeeping and financial dealings.

Organizational Structure

The organization structure is simplistic. Jill manages all employees and professional contacts, and will be interfacing with more than 12 account executives/vendors. Jill will determine resources requirements and monitor expenses for all aspects of the firm.

Personnel Plan

Jill will act as a sole proprietor without employees at this point. Contract labor may required for upholstery and fabrication purposes, but that will be included in the cost of good for each client’s project. Jill’s salary will begin at a modest $1,200 per month, increase quarterly, and then is projected at $2,400 per month for year two and $3,000 for year three.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Jill Barton | $19,800 | $28,800 | $36,000 |

| Other | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $19,800 | $28,800 | $36,000 |

Financial Plan

The initial funding of $25,000 will be invested by the owner. The goal is to fund the growth of the business from its earnings. The financial plan contains these essential factors:

- A growth rate in sales of 47% for the year 2002 and 15% for 2003.

- An average sales per month that increases each year, averaging $3,870 in the first year, $5,720 the second, and $6,600 in the third year.

- Continue to fund the growth of the business from the revenues it generates.

<p size="4" Financial difficulties and risks

- Slow sales resulting in less-than-projected cash flow.

- Unexpected and excessive cost increases compared to the planned expenses.

- Overly aggressive and debilitating actions by competing designers.

- A parallel entry by a new competitor further diminishing revenue generation potential.

Worst case risks might include

- Determining the business cannot support itself on an ongoing basis.

- Dealing with the financial, business, and personal devastation of the venture’s failure. Survivable but painful.

Break-even Analysis

The break-even analysis below is expressed as a per-client unit. This is based on average hourly billing, product sales, and costs per transaction.

| Break-even Analysis | |

| Monthly Revenue Break-even | $4,067 |

| Assumptions: | |

| Average Percent Variable Cost | 32% |

| Estimated Monthly Fixed Cost | $2,763 |

Important Assumptions

The following captured critical assumptions will determine the potential for future success.

- A healthy economy that supports a moderate level of growth in the market.

- The ability to support a gross margin percentage in excess of 65%.

- Keeping operating costs low, particularly in the areas of product purchases ongoing monthly expenses.

- Receiving an initial payment for each project of 50% of estimated time and product purchases and collecting the balance of these revenues within 45 days of completing each project.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 9.50% | 9.50% | 9.50% |

| Long-term Interest Rate | 8.50% | 8.50% | 8.50% |

| Tax Rate | 28.17% | 28.00% | 28.17% |

| Other | 0 | 0 | 0 |

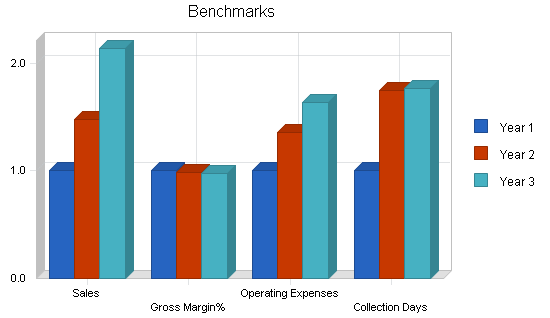

Key Financial Indicators

The key financial indicators focus on cash flow. There is virtually no inventory but late payments for completed jobs will be a concern. Timely billing and collection will be critical. All expenses are tracked on a monthly basis, recorded in the accounting software, and will be compared to our business plan budget.

Start-up Summary

The following details the initial start-up expenses for Barton Interiors. Most equipment costs are office related. Sample and display costs include books, samples and resources necessary to promote furniture, fabric and other home accessory products.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $500 |

| Stationery etc. | $850 |

| Brochures | $420 |

| Consultants | $450 |

| Insurance | $150 |

| Samples and Reference Books | $3,250 |

| Research and development | $800 |

| Expensed equipment | $4,250 |

| Other | $550 |

| Total Start-up Expenses | $11,220 |

| Start-up Assets | |

| Cash Required | $9,780 |

| Other Current Assets | $1,000 |

| Long-term Assets | $3,000 |

| Total Assets | $13,780 |

| Total Requirements | $25,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $11,220 |

| Start-up Assets to Fund | $13,780 |

| Total Funding Required | $25,000 |

| Assets | |

| Non-cash Assets from Start-up | $4,000 |

| Cash Requirements from Start-up | $9,780 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $9,780 |

| Total Assets | $13,780 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Jill Barton | $25,000 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $25,000 |

| Loss at Start-up (Start-up Expenses) | ($11,220) |

| Total Capital | $13,780 |

| Total Capital and Liabilities | $13,780 |

| Total Funding | $25,000 |

Projected Profit and Loss

The following represents the projected profit and loss for Barton Interiors based on sales and expense projections for 2002 through 2004.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $46,460 | $68,640 | $99,200 |

| Direct Cost of Sales | $14,889 | $22,776 | $33,280 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $14,889 | $22,776 | $33,280 |

| Gross Margin | $31,571 | $45,864 | $65,920 |

| Gross Margin % | 67.95% | 66.82% | 66.45% |

| Expenses | |||

| Payroll | $19,800 | $28,800 | $36,000 |

| Sales and Marketing and Other Expenses | $11,560 | $13,430 | $15,100 |

| Depreciation | $300 | $750 | $800 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $540 | $660 | $800 |

| Insurance | $960 | $1,200 | $1,600 |

| Rent | $0 | $0 | $0 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $33,160 | $44,840 | $54,300 |

| Profit Before Interest and Taxes | ($1,589) | $1,024 | $11,620 |

| EBITDA | ($1,289) | $1,774 | $12,420 |

| Interest Expense | $0 | $76 | $238 |

| Taxes Incurred | $0 | $265 | $3,206 |

| Net Profit | ($1,589) | $683 | $8,176 |

| Net Profit/Sales | -3.42% | 0.99% | 8.24% |

Projected Cash Flow

The cash flow projections are outlined below. These cash flow projects are based on our basic assumptions and expense and revenue projections.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $32,522 | $48,048 | $69,440 |

| Cash from Receivables | $9,578 | $18,511 | $26,892 |

| Subtotal Cash from Operations | $42,100 | $66,559 | $96,332 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $1,600 | $1,800 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $210 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $42,310 | $68,159 | $98,132 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $19,800 | $28,800 | $36,000 |

| Bill Payments | $24,693 | $38,506 | $52,924 |

| Subtotal Spent on Operations | $44,493 | $67,306 | $88,924 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $44,493 | $67,306 | $88,924 |

| Net Cash Flow | ($2,183) | $852 | $9,209 |

| Cash Balance | $7,597 | $8,449 | $17,658 |

Projected Balance Sheet

Barton Interiors’ balance sheet is outlined below.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $7,597 | $8,449 | $17,658 |

| Accounts Receivable | $4,360 | $6,441 | $9,308 |

| Other Current Assets | $790 | $790 | $790 |

| Total Current Assets | $12,747 | $15,680 | $27,757 |

| Long-term Assets | |||

| Long-term Assets | $3,000 | $3,000 | $3,000 |

| Accumulated Depreciation | $300 | $1,050 | $1,850 |

| Total Long-term Assets | $2,700 | $1,950 | $1,150 |

| Total Assets | $15,447 | $17,630 | $28,907 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,256 | $3,157 | $4,457 |

| Current Borrowing | $0 | $1,600 | $3,400 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $3,256 | $4,757 | $7,857 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $3,256 | $4,757 | $7,857 |

| Paid-in Capital | $25,000 | $25,000 | $25,000 |

| Retained Earnings | ($11,220) | ($12,809) | ($12,126) |

| Earnings | ($1,589) | $683 | $8,176 |

| Total Capital | $12,191 | $12,874 | $21,050 |

| Total Liabilities and Capital | $15,447 | $17,630 | $28,907 |

| Net Worth | $12,191 | $12,874 | $21,050 |

Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7389, Business Services–Interior Design Services, are shown for comparison. If we fail in any of these areas, we will need to re-evaluate our business model:

- Gross margins at, or above, 65%.

- Month-to-month and annual increases to meet the expected growth requirements.

- Self-fund growth not dependant on the credit line to meet cash requirements.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 47.74% | 44.52% | 12.40% |

| Percent of Total Assets | ||||

| Accounts Receivable | 28.22% | 36.53% | 32.20% | 26.10% |

| Other Current Assets | 5.11% | 4.48% | 2.73% | 44.70% |

| Total Current Assets | 82.52% | 88.94% | 96.02% | 74.50% |

| Long-term Assets | 17.48% | 11.06% | 3.98% | 25.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 21.08% | 26.98% | 27.18% | 44.30% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 16.00% |

| Total Liabilities | 21.08% | 26.98% | 27.18% | 60.30% |

| Net Worth | 78.92% | 73.02% | 72.82% | 39.70% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 67.95% | 66.82% | 66.45% | 0.00% |

| Selling, General & Administrative Expenses | 73.96% | 65.72% | 38.61% | 80.80% |

| Advertising Expenses | 16.36% | 12.24% | 11.36% | 1.30% |

| Profit Before Interest and Taxes | -3.42% | 1.49% | 11.71% | 2.20% |

| Main Ratios | ||||

| Current | 3.92 | 3.30 | 3.53 | 1.75 |

| Quick | 3.92 | 3.30 | 3.53 | 1.38 |

| Total Debt to Total Assets | 21.08% | 26.98% | 27.18% | 60.30% |

| Pre-tax Return on Net Worth | -13.03% | 7.36% | 54.07% | 3.80% |

| Pre-tax Return on Assets | -10.29% | 5.38% | 39.38% | 9.70% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -3.42% | 0.99% | 8.24% | n.a |

| Return on Equity | -13.03% | 5.30% | 38.84% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.20 | 3.20 | 3.20 | n.a |

| Collection Days | 55 | 96 | 97 | n.a |

| Accounts Payable Turnover | 8.58 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 26 | n.a |

| Total Asset Turnover | 3.01 | 3.89 | 3.43 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.27 | 0.37 | 0.37 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $9,491 | $10,924 | $19,900 | n.a |

| Interest Coverage | 0.00 | 13.47 | 48.93 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.33 | 0.26 | 0.29 | n.a |

| Current Debt/Total Assets | 21% | 27% | 27% | n.a |

| Acid Test | 2.58 | 1.94 | 2.35 | n.a |

| Sales/Net Worth | 3.81 | 5.33 | 4.71 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Residential Consulting | 0% | $800 | $900 | $1,000 | $1,200 | $1,400 | $1,600 | $1,800 | $2,000 | $2,400 | $2,800 | $3,200 | $3,600 |

| Commercial Consulting | 0% | $0 | $0 | $0 | $240 | $280 | $320 | $360 | $400 | $440 | $560 | $640 | $720 |

| Product Sales | 0% | $400 | $600 | $800 | $1,000 | $1,200 | $1,400 | $1,600 | $1,800 | $2,000 | $2,400 | $3,000 | $3,600 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $1,200 | $1,500 | $1,800 | $2,440 | $2,880 | $3,320 | $3,760 | $4,200 | $4,840 | $5,760 | $6,840 | $7,920 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Residential Consulting | $120 | $135 | $150 | $180 | $210 | $240 | $270 | $300 | $360 | $420 | $480 | $540 | |

| Commercial Consulting | $0 | $0 | $0 | $36 | $42 | $48 | $54 | $60 | $66 | $84 | $96 | $108 | |

| Product Sales | $220 | $330 | $440 | $550 | $660 | $770 | $880 | $990 | $1,100 | $1,320 | $1,650 | $1,980 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $340 | $465 | $590 | $766 | $912 | $1,058 | $1,204 | $1,350 | $1,526 | $1,824 | $2,226 | $2,628 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | 9.50% | |

| Long-term Interest Rate | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | 8.50% | |

| Tax Rate | 30.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | 28.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $1,200 | $1,500 | $1,800 | $2,440 | $2,880 | $3,320 | $3,760 | $4,200 | $4,840 | $5,760 | $6,840 | $7,920 | |

| Direct Cost of Sales | $340 | $465 | $590 | $766 | $912 | $1,058 | $1,204 | $1,350 | $1,526 | $1,824 | $2,226 | $2,628 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $340 | $465 | $590 | $766 | $912 | $1,058 | $1,204 | $1,350 | $1,526 | $1,824 | $2,226 | $2,628 | |

| Gross Margin | $860 | $1,035 | $1,210 | $1,674 | $1,968 | $2,262 | $2,556 | $2,850 | $3,314 | $3,936 | $4,614 | $5,292 | |

| Gross Margin % | 71.67% | 69.00% | 67.22% | 68.61% | 68.33% | 68.13% | 67.98% | 67.86% | 68.47% | 68.33% | 67.46% | 66.82% | |

| Expenses | |||||||||||||

| Payroll | $1,200 | $1,200 | $1,200 | $1,500 | $1,500 | $1,500 | $1,800 | $1,800 | $1,800 | $2,100 | $2,100 | $2,100 | |

| Sales and Marketing and Other Expenses | $2,165 | $615 | $615 | $885 | $625 | $625 | $685 | $685 | $935 | $685 | $2,425 | $615 | |

| Depreciation | $25 | $25 | $25 | $25 | $25 | $25 | $25 | $25 | $25 | $25 | $25 | $25 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $45 | $45 | $45 | $45 | $45 | $45 | $45 | $45 | $45 | $45 | $45 | $45 | |

| Insurance | $80 | $80 | $80 | $80 | $80 | $80 | $80 | $80 | $80 | $80 | $80 | $80 | |

| Rent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $3,515 | $1,965 | $1,965 | $2,535 | $2,275 | $2,275 | $2,635 | $2,635 | $2,885 | $2,935 | $4,675 | $2,865 | |

| Profit Before Interest and Taxes | ($2,655) | ($930) | ($755) | ($861) | ($307) | ($13) | ($79) | $215 | $429 | $1,001 | ($61) | $2,427 | |

| EBITDA | ($2,630) | ($905) | ($730) | ($836) | ($282) | $12 | ($54) | $240 | $454 | $1,026 | ($36) | $2,452 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($2,655) | ($930) | ($755) | ($861) | ($307) | ($13) | ($79) | $215 | $429 | $1,001 | ($61) | $2,427 | |

| Net Profit/Sales | -221.25% | -62.00% | -41.94% | -35.29% | -10.66% | -0.39% | -2.10% | 5.12% | 8.86% | 17.38% | -0.89% | 30.64% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $840 | $1,050 | $1,260 | $1,708 | $2,016 | $2,324 | $2,632 | $2,940 | $3,388 | $4,032 | $4,788 | $5,544 | |

| Cash from Receivables | $0 | $12 | $363 | $453 | $546 | $736 | $868 | $1,000 | $1,132 | $1,266 | $1,461 | $1,739 | |

| Subtotal Cash from Operations | $840 | $1,062 | $1,623 | $2,161 | $2,562 | $3,060 | $3,500 | $3,940 | $4,520 | $5,298 | $6,249 | $7,283 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $210 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $840 | $1,062 | $1,623 | $2,371 | $2,562 | $3,060 | $3,500 | $3,940 | $4,520 | $5,298 | $6,249 | $7,283 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $1,200 | $1,200 | $1,200 | $1,500 | $1,500 | $1,500 | $1,800 | $1,800 | $1,800 | $2,100 | $2,100 | $2,100 | |

| Bill Payments | $88 | $2,583 | $1,209 | $1,345 | $1,772 | $1,667 | $1,815 | $2,019 | $2,174 | $2,588 | $2,705 | $4,729 | |

| Subtotal Spent on Operations | $1,288 | $3,783 | $2,409 | $2,845 | $3,272 | $3,167 | $3,615 | $3,819 | $3,974 | $4,688 | $4,805 | $6,829 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $1,288 | $3,783 | $2,409 | $2,845 | $3,272 | $3,167 | $3,615 | $3,819 | $3,974 | $4,688 | $4,805 | $6,829 | |

| Net Cash Flow | ($448) | ($2,721) | ($786) | ($474) | ($710) | ($106) | ($114) | $122 | $546 | $611 | $1,444 | $454 | |

| Cash Balance | $9,332 | $6,612 | $5,826 | $5,352 | $4,642 | $4,536 | $4,421 | $4,543 | $5,089 | $5,700 | $7,143 | $7,597 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $9,780 | $9,332 | $6,612 | $5,826 | $5,352 | $4,642 | $4,536 | $4,421 | $4,543 | $5,089 | $5,700 | $7,143 | $7,597 |

| Accounts Receivable | $0 | $360 | $798 | $975 | $1,254 | $1,572 | $1,831 | $2,091 | $2,350 | $2,670 | $3,132 | $3,722 | $4,360 |

| Other Current Assets | $1,000 | $1,000 | $1,000 | $1,000 | $790 | $790 | $790 | $790 | $790 | $790 | $790 | $790 | $790 |

| Total Current Assets | $10,780 | $10,692 | $8,410 | $7,801 | $7,396 | $7,004 | $7,157 | $7,302 | $7,683 | $8,549 | $9,621 | $11,656 | $12,747 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Accumulated Depreciation | $0 | $25 | $50 | $75 | $100 | $125 | $150 | $175 | $200 | $225 | $250 | $275 | $300 |

| Total Long-term Assets | $3,000 | $2,975 | $2,950 | $2,925 | $2,900 | $2,875 | $2,850 | $2,825 | $2,800 | $2,775 | $2,750 | $2,725 | $2,700 |

| Total Assets | $13,780 | $13,667 | $11,360 | $10,726 | $10,296 | $9,879 | $10,007 | $10,127 | $10,483 | $11,324 | $12,371 | $14,381 | $15,447 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $2,542 | $1,165 | $1,286 | $1,717 | $1,607 | $1,748 | $1,947 | $2,088 | $2,500 | $2,546 | $4,617 | $3,256 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $2,542 | $1,165 | $1,286 | $1,717 | $1,607 | $1,748 | $1,947 | $2,088 | $2,500 | $2,546 | $4,617 | $3,256 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $2,542 | $1,165 | $1,286 | $1,717 | $1,607 | $1,748 | $1,947 | $2,088 | $2,500 | $2,546 | $4,617 | $3,256 |

| Paid-in Capital | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 |

| Retained Earnings | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) | ($11,220) |

| Earnings | $0 | ($2,655) | ($3,585) | ($4,340) | ($5,201) | ($5,508) | ($5,521) | ($5,600) | ($5,385) | ($4,956) | ($3,955) | ($4,016) | ($1,589) |

| Total Capital | $13,780 | $11,125 | $10,195 | $9,440 | $8,579 | $8,272 | $8,259 | $8,180 | $8,395 | $8,824 | $9,825 | $9,764 | $12,191 |

| Total Liabilities and Capital | $13,780 | $13,667 | $11,360 | $10,726 | $10,296 | $9,879 | $10,007 | $10,127 | $10,483 | $11,324 | $12,371 | $14,381 | $15,447 |

| Net Worth | $13,780 | $11,125 | $10,195 | $9,440 | $8,579 | $8,272 | $8,259 | $8,180 | $8,395 | $8,824 | $9,825 | $9,764 | $12,191 |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Jill Barton | 0% | $1,200 | $1,200 | $1,200 | $1,500 | $1,500 | $1,500 | $1,800 | $1,800 | $1,800 | $2,100 | $2,100 | $2,100 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total Payroll | $1,200 | $1,200 | $1,200 | $1,500 | $1,500 | $1,500 | $1,800 | $1,800 | $1,800 | $2,100 | $2,100 | $2,100 | |