D.A.P. Exports

Executive Summary

D.A.P. Exports is a business that exports automobile parts and auto lubricants to Jamaica and other countries including Venezuela, Columbia and Ecuador. Many of the company’s shipments combine American-made products with foreign parts with some re-packaging and labeling.

Auto part sales is currently a $100 million industry in Latin America and the Caribbean. In these countries, a majority of the automobiles were manufactured in the 1980’s. Finding replacement parts for these autos has become a difficult process as auto makers focus on cars produced in the last ten years.

D.A.P. Exports has established an extensive network of customer contacts in the region. James Dunn, owner of D.A.P Exports, has twenty years of experience selling consumer products in Latin America and the Caribbean. James has been a salesperson for Axiom Food Products, Klymor Manufacturing, and Dudley Food Products.

During those years, James used taxi services in Latin America and the Caribbean. It was during one of those trips that he became aware of the demand for auto parts and auto lubricants. James also discovered the best distribution system for auto products in the region, through the local taxi companies.

D.A.P. Exports will contract with the region’s taxi companies to provide auto parts and auto lubricants at wholesale prices. The taxi companies will either use the parts to repair their own vehicles or they will sell the parts to consumers. D.A.P Exports will also sell auto parts to auto part stores in the region.

1.1 Objectives

D.A.P. Exports’ objectives are as follows:

- Achieve handsome sales revenues during first year of operation.

- Achieve a customer base of 100 taxi companies in the region.

- Increase sales modestly during the second year of operation.

1.2 Mission

The mission of D.A.P. Exports is to be the auto parts provider of choice with the region’s taxi companies.

Company Summary

D.A.P. Exports is a business that exports automobile parts and auto lubricants to Jamaica and other countries including Venezuela, Columbia and Ecuador. Many of the company’s shipments combine American-made products with foreign parts with some re-packaging and labeling.

The company will be organized as a limited liability partnership.

D.A.P. Exports has an 8,000 square foot facility in Monroe, Florida. The facility is located near the South Florida transportation hub critical to our important markets. it will keep costs in control as well as enabling fast and economical access to our key markets for company-related business.

2.1 Company Ownership

D.A.P. Exports is an LLC partnership owned by James Dunn and a silent partner (name withheld).

2.2 Start-up Summary

The start-up expense for D.A.P. Exports is focused primarily on inventory and repackaging equipment. James Dunn will personally invest in the company. The silent partner will invest additional funds. In addition, Dunn will also secure a long-term loan.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $10,000 |

| Stationery etc. | $1,000 |

| Brochures | $2,000 |

| Insurance | $2,000 |

| Rent | $2,000 |

| Expensed Equipment | $50,000 |

| Total Start-up Expenses | $67,000 |

| Start-up Assets | |

| Cash Required | $83,000 |

| Start-up Inventory | $100,000 |

| Other Current Assets | $0 |

| Long-term Assets | $0 |

| Total Assets | $183,000 |

| Total Requirements | $250,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $67,000 |

| Start-up Assets to Fund | $183,000 |

| Total Funding Required | $250,000 |

| Assets | |

| Non-cash Assets from Start-up | $100,000 |

| Cash Requirements from Start-up | $83,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $83,000 |

| Total Assets | $183,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $100,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $100,000 |

| Capital | |

| Planned Investment | |

| James Dunn | $50,000 |

| Silent Partner | $100,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $150,000 |

| Loss at Start-up (Start-up Expenses) | ($67,000) |

| Total Capital | $83,000 |

| Total Capital and Liabilities | $183,000 |

| Total Funding | $250,000 |

Products

D.A.P. Exports’ products are the following:

- Transmission parts

- Engine parts

- Electrical parts

- Engine lubricants

Market Analysis Summary

Auto part sales is a $100 million dollar industry in Latin America and the Caribbean. In these countries, a majority of the automobiles were manufactured in the 1980s. Finding replacement parts for these autos has become a difficult process as auto makers focus on cars produced in the last ten years.

Typically, old cars are used as a source of parts once they can no longer be repaired. The major obstacle to accessing the market is the sparse number of auto part stores in the region where the prices for auto parts are high. Most of these auto stores focus on the upscale customer and don’t carry a wide range of parts for the older autos.

D.A.P. Exports will sell parts to auto stores but we will also pursue a new distribution network as well. The largest buyers of auto parts in the region are taxi companies. D.A.P. Exports has established an extensive network of contacts with these companies, and we will sell directly to them.

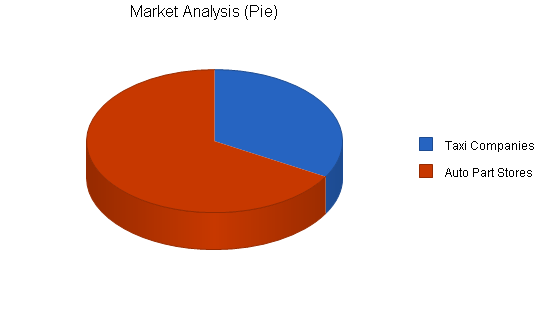

4.1 Market Segmentation

D.A.P. Exports will focus on the following target customers:

- Taxi companies

- Auto part stores

It is expected that individuals will also purchase from D.A.P., but the repeat business, lower price sensitivity and larger volume per order mean that stores and taxi services will be more attractive customers for D.A.P.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Taxi Companies | 10% | 2,000 | 2,200 | 2,420 | 2,662 | 2,928 | 10.00% |

| Auto Part Stores | 8% | 4,000 | 4,320 | 4,666 | 5,039 | 5,442 | 8.00% |

| Total | 8.68% | 6,000 | 6,520 | 7,086 | 7,701 | 8,370 | 8.68% |

4.2 Industry Analysis

Currently, the markets are too small to attract many competitors. The auto parts shops in the region are not expanding to meet the demand for parts for older cars. They are instead focusing on the newer cars that are being imported into the countries by wealthy individuals.

Utilizing the taxi services as a distribution network as well as primary customers is an excellent strategy to capture market share of a segment that is currently being ignored by bigger players.

4.3 Target Market Segment Strategy

It is estimated that there are over 25,000 vehicles in the region that are used by taxi services. And that number is growing.

The taxi firms are excellent target customers for D.A.P. Export products. First, they represent the largest buying block in our target countries. In addition there is no established channel for them to purchase parts for their cars at this time.

By buying direct from D.A.P. Export, they reduce the cost of parts and they get exactly what they need quickly.

Although many of the taxi drivers are independent or work for small companies, the informal network within this group is extensive. There is a lot of downtime in this business, where drivers are waiting for fares. They will chat to friends/colleagues about their cars and their work. We will benefit from this through word-of-mouth recommendations.

4.4 Competition and Buying Patterns

Without much competition, the key to maintaining the customer base is the right parts, at a reasonable price, delivered quickly. As D.A.P. Exports meets customer’s demand for parts in a timely manner, sales will grow. The company will be able to strengthen the business relationships that will be critical when competition does emerge.

Strategy and Implementation Summary

D.A.P. Exports will offer a 15% discount on all purchases of $1,000 or more. We will also have two salespeople based in Latin America and the Caribbean. Our focus will be to establish our future on a strong relationship with the region’s taxi services.

James has established export contacts in Latin America and the Caribbean, that will make the process of developing an export channel for car parts much easier. In these countries, much business in done by a handshake and word of mouth, rather than formal contracts. His experience and contacts will be invaluable in this environment.

5.1 Competitive Edge

The products that D.A.P is selling are made for older cars, and the trend in this country is towards newer cars, therefore domestic demand for these parts is falling. For this reason, James will be able to negotiate excellent prices on the products that he will sell. He will also order in bulk which will further increase his negotiating leverage.

The other competitive edge of D.A.P. Exports is that we can assemble a product package that is exactly what a specific customer wants. When the taxi service buys directly from D.A.P. Exports, they will receive the highest quality product at the lowest price. Previously, because of the lack of an organized, established channel, car owners had to spend time shopping around for parts. Therefore their cars would be off the road for longer periods of time–every day costing them more lost revenue.

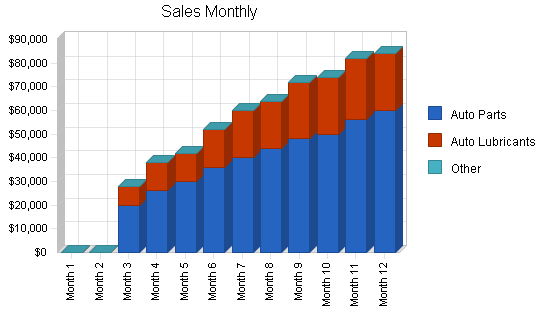

5.2 Sales Forecast

The following is the sales forecast for three years.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Auto Parts | $410,000 | $480,000 | $550,000 |

| Auto Lubricants | $186,000 | $230,000 | $274,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $596,000 | $710,000 | $824,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Auto Parts | $200,000 | $240,000 | $275,000 |

| Auto Lubricants | $93,000 | $115,000 | $137,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $293,000 | $355,000 | $412,000 |

5.3 Milestones

The accompanying chart and table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Facility Set-up | 5/1/2002 | 5/20/2002 | $20,000 | James Dunn | Marketing |

| Inventory Set-up | 5/1/2002 | 5/20/2002 | $100,000 | James Dunn | Department |

| Marketing Campaign | 5/1/2002 | 6/15/2002 | $20,000 | James Dunn | Department |

| Totals | $140,000 | ||||

5.4 Marketing Strategy

During the months of May and June the regional salespeople will deliver presentations to taxi firms and auto parts stores in the region. D.A.P. Export will offer a 15% discount on all purchases over $1,000.

The key to the marketing strategy is continuous follow-up with customers so we can anticipate the parts inventory that will be needed in the future.

Management Summary

James Dunn, owner of D.A.P Exports, will manage the business. He has twenty years of experience selling consumer products in Latin America and the Caribbean, so has extensive knowledge of this region and culture. In addition he has contacts with people and businesses that can only be gained from years of living or working in a country. James has been a salesperson for Axiom Food Products, Klymor Manufacturing, and Dudley Food Products, and during this time travelled to the Caribbean and Latin America at least three times a year.

James has excellent management skills. In his last position he managed a sales staff of five people, and each year the team beat its sales quota by more than 10%. He was successful in motivating the best performance of each staff member.

James has also had experience in running a small business in the past. He and his wife have successfully run a small catering business in their hometown for the past four years. James wife will continue to run this business while he focuses on launching D.A.P. Exports.

6.1 Personnel Plan

D.A.P. Exports’ personnel are as follows:

- James Dunn

- Facility staff (4)

- Sales staff (2)

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| James Dunn | $36,000 | $39,000 | $42,000 |

| 4 Facility Staff | $86,400 | $94,000 | $102,000 |

| 2 Sales Staff | $72,000 | $80,000 | $88,000 |

| Total People | 7 | 7 | 7 |

| Total Payroll | $194,400 | $213,000 | $232,000 |

Financial Plan

The following is the financial plan for D.A.P. Exports.

7.1 Break-even Analysis

The monthly break-even point, based on average monthly running costs and estimated variable costs of sales is shown in the table and chart below.

| Break-even Analysis | |

| Monthly Revenue Break-even | $42,743 |

| Assumptions: | |

| Average Percent Variable Cost | 49% |

| Estimated Monthly Fixed Cost | $21,730 |

7.2 Projected Profit and Loss

The following table and charts highlight the projected profit and loss for three years.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $596,000 | $710,000 | $824,000 |

| Direct Cost of Sales | $293,000 | $355,000 | $412,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $293,000 | $355,000 | $412,000 |

| Gross Margin | $303,000 | $355,000 | $412,000 |

| Gross Margin % | 50.84% | 50.00% | 50.00% |

| Expenses | |||

| Payroll | $194,400 | $213,000 | $232,000 |

| Sales and Marketing and Other Expenses | $6,000 | $10,000 | $15,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $7,200 | $8,000 | $9,000 |

| Insurance | $0 | $0 | $0 |

| Rent | $24,000 | $24,000 | $24,000 |

| Payroll Taxes | $29,160 | $31,950 | $34,800 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $260,760 | $286,950 | $314,800 |

| Profit Before Interest and Taxes | $42,240 | $68,050 | $97,200 |

| EBITDA | $42,240 | $68,050 | $97,200 |

| Interest Expense | $10,000 | $10,000 | $10,000 |

| Taxes Incurred | $9,672 | $17,415 | $26,160 |

| Net Profit | $22,568 | $40,635 | $61,040 |

| Net Profit/Sales | 3.79% | 5.72% | 7.41% |

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $149,000 | $177,500 | $206,000 |

| Cash from Receivables | $324,550 | $509,078 | $594,578 |

| Subtotal Cash from Operations | $473,550 | $686,578 | $800,578 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $473,550 | $686,578 | $800,578 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $194,400 | $213,000 | $232,000 |

| Bill Payments | $265,680 | $487,380 | $533,881 |

| Subtotal Spent on Operations | $460,080 | $700,380 | $765,881 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $460,080 | $700,380 | $765,881 |

| Net Cash Flow | $13,470 | ($13,802) | $34,697 |

| Cash Balance | $96,470 | $82,668 | $117,365 |

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $96,470 | $82,668 | $117,365 |

| Accounts Receivable | $122,450 | $145,872 | $169,293 |

| Inventory | $46,200 | $55,976 | $64,964 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $265,120 | $284,516 | $351,622 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $265,120 | $284,516 | $351,622 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $59,552 | $38,313 | $44,379 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $59,552 | $38,313 | $44,379 |

| Long-term Liabilities | $100,000 | $100,000 | $100,000 |

| Total Liabilities | $159,552 | $138,313 | $144,379 |

| Paid-in Capital | $150,000 | $150,000 | $150,000 |

| Retained Earnings | ($67,000) | ($44,432) | ($3,797) |

| Earnings | $22,568 | $40,635 | $61,040 |

| Total Capital | $105,568 | $146,203 | $207,243 |

| Total Liabilities and Capital | $265,120 | $284,516 | $351,622 |

| Net Worth | $105,568 | $146,203 | $207,243 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5013, Moter Vehicles Supplies and New Parts, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 19.13% | 16.06% | 12.20% |

| Percent of Total Assets | ||||

| Accounts Receivable | 46.19% | 51.27% | 48.15% | 25.10% |

| Inventory | 17.43% | 19.67% | 18.48% | 46.10% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 15.10% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 86.30% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 13.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 22.46% | 13.47% | 12.62% | 46.60% |

| Long-term Liabilities | 37.72% | 35.15% | 28.44% | 11.50% |

| Total Liabilities | 60.18% | 48.61% | 41.06% | 58.10% |

| Net Worth | 39.82% | 51.39% | 58.94% | 41.90% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 50.84% | 50.00% | 50.00% | 21.70% |

| Selling, General & Administrative Expenses | 47.05% | 44.28% | 42.59% | 13.20% |

| Advertising Expenses | 1.01% | 1.41% | 1.82% | 0.70% |

| Profit Before Interest and Taxes | 7.09% | 9.58% | 11.80% | 1.40% |

| Main Ratios | ||||

| Current | 4.45 | 7.43 | 7.92 | 1.98 |

| Quick | 3.68 | 5.97 | 6.46 | 0.78 |

| Total Debt to Total Assets | 60.18% | 48.61% | 41.06% | 58.10% |

| Pre-tax Return on Net Worth | 30.54% | 39.71% | 42.08% | 3.80% |

| Pre-tax Return on Assets | 12.16% | 20.40% | 24.80% | 9.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 3.79% | 5.72% | 7.41% | n.a |

| Return on Equity | 21.38% | 27.79% | 29.45% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.65 | 3.65 | 3.65 | n.a |

| Collection Days | 56 | 92 | 93 | n.a |

| Inventory Turnover | 5.31 | 6.95 | 6.81 | n.a |

| Accounts Payable Turnover | 5.46 | 12.17 | 12.17 | n.a |

| Payment Days | 28 | 38 | 28 | n.a |

| Total Asset Turnover | 2.25 | 2.50 | 2.34 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 1.51 | 0.95 | 0.70 | n.a |

| Current Liab. to Liab. | 0.37 | 0.28 | 0.31 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $205,568 | $246,203 | $307,243 | n.a |

| Interest Coverage | 4.22 | 6.81 | 9.72 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.44 | 0.40 | 0.43 | n.a |

| Current Debt/Total Assets | 22% | 13% | 13% | n.a |

| Acid Test | 1.62 | 2.16 | 2.64 | n.a |

| Sales/Net Worth | 5.65 | 4.86 | 3.98 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Auto Parts | 0% | $0 | $0 | $20,000 | $26,000 | $30,000 | $36,000 | $40,000 | $44,000 | $48,000 | $50,000 | $56,000 | $60,000 |

| Auto Lubricants | 0% | $0 | $0 | $8,000 | $12,000 | $12,000 | $16,000 | $20,000 | $20,000 | $24,000 | $24,000 | $26,000 | $24,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $0 | $0 | $28,000 | $38,000 | $42,000 | $52,000 | $60,000 | $64,000 | $72,000 | $74,000 | $82,000 | $84,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Auto Parts | $0 | $0 | $10,000 | $13,000 | $15,000 | $18,000 | $20,000 | $22,000 | $24,000 | $25,000 | $23,000 | $30,000 | |

| Auto Lubricants | $0 | $0 | $4,000 | $6,000 | $6,000 | $8,000 | $10,000 | $10,000 | $12,000 | $12,000 | $13,000 | $12,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $36,000 | $42,000 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| James Dunn | 0% | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| 4 Facility Staff | 0% | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 |

| 2 Sales Staff | 0% | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| Total People | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | |

| Total Payroll | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $28,000 | $38,000 | $42,000 | $52,000 | $60,000 | $64,000 | $72,000 | $74,000 | $82,000 | $84,000 | |

| Direct Cost of Sales | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $36,000 | $42,000 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $36,000 | $42,000 | |

| Gross Margin | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $46,000 | $42,000 | |

| Gross Margin % | 0.00% | 0.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 56.10% | 50.00% | |

| Expenses | |||||||||||||

| Payroll | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | |

| Sales and Marketing and Other Expenses | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Payroll Taxes | 15% | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 | $2,430 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | $21,730 | |

| Profit Before Interest and Taxes | ($21,730) | ($21,730) | ($7,730) | ($2,730) | ($730) | $4,270 | $8,270 | $10,270 | $14,270 | $15,270 | $24,270 | $20,270 | |

| EBITDA | ($21,730) | ($21,730) | ($7,730) | ($2,730) | ($730) | $4,270 | $8,270 | $10,270 | $14,270 | $15,270 | $24,270 | $20,270 | |

| Interest Expense | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | $833 | |

| Taxes Incurred | ($6,769) | ($6,769) | ($2,569) | ($1,069) | ($469) | $1,031 | $2,231 | $2,831 | $4,031 | $4,331 | $7,031 | $5,831 | |

| Net Profit | ($15,794) | ($15,794) | ($5,994) | ($2,494) | ($1,094) | $2,406 | $5,206 | $6,606 | $9,406 | $10,106 | $16,406 | $13,606 | |

| Net Profit/Sales | 0.00% | 0.00% | -21.41% | -6.56% | -2.61% | 4.63% | 8.68% | 10.32% | 13.06% | 13.66% | 20.01% | 16.20% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $7,000 | $9,500 | $10,500 | $13,000 | $15,000 | $16,000 | $18,000 | $18,500 | $20,500 | $21,000 | |

| Cash from Receivables | $0 | $0 | $0 | $700 | $21,250 | $28,600 | $31,750 | $39,200 | $45,100 | $48,200 | $54,050 | $55,700 | |

| Subtotal Cash from Operations | $0 | $0 | $7,000 | $10,200 | $31,750 | $41,600 | $46,750 | $55,200 | $63,100 | $66,700 | $74,550 | $76,700 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $7,000 | $10,200 | $31,750 | $41,600 | $46,750 | $55,200 | $63,100 | $66,700 | $74,550 | $76,700 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | |

| Bill Payments | ($406) | ($798) | ($266) | $3,844 | $5,314 | $6,231 | $16,894 | $43,008 | $43,641 | $50,728 | $48,778 | $48,711 | |

| Subtotal Spent on Operations | $15,794 | $15,402 | $15,934 | $20,044 | $21,514 | $22,431 | $33,094 | $59,208 | $59,841 | $66,928 | $64,978 | $64,911 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $15,794 | $15,402 | $15,934 | $20,044 | $21,514 | $22,431 | $33,094 | $59,208 | $59,841 | $66,928 | $64,978 | $64,911 | |

| Net Cash Flow | ($15,794) | ($15,402) | ($8,934) | ($9,844) | $10,236 | $19,169 | $13,656 | ($4,008) | $3,259 | ($228) | $9,572 | $11,789 | |

| Cash Balance | $67,206 | $51,803 | $42,869 | $33,025 | $43,260 | $62,429 | $76,085 | $72,077 | $75,336 | $75,109 | $84,681 | $96,470 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $83,000 | $67,206 | $51,803 | $42,869 | $33,025 | $43,260 | $62,429 | $76,085 | $72,077 | $75,336 | $75,109 | $84,681 | $96,470 |

| Accounts Receivable | $0 | $0 | $0 | $21,000 | $48,800 | $59,050 | $69,450 | $82,700 | $91,500 | $100,400 | $107,700 | $115,150 | $122,450 |

| Inventory | $100,000 | $100,000 | $100,000 | $86,000 | $67,000 | $46,000 | $28,600 | $33,000 | $35,200 | $39,600 | $40,700 | $39,600 | $46,200 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $183,000 | $167,206 | $151,803 | $149,869 | $148,825 | $148,310 | $160,479 | $191,785 | $198,777 | $215,336 | $223,509 | $239,431 | $265,120 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $183,000 | $167,206 | $151,803 | $149,869 | $148,825 | $148,310 | $160,479 | $191,785 | $198,777 | $215,336 | $223,509 | $239,431 | $265,120 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $0 | $392 | $4,452 | $5,902 | $6,482 | $16,245 | $42,345 | $42,732 | $49,885 | $47,952 | $47,469 | $59,552 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $0 | $392 | $4,452 | $5,902 | $6,482 | $16,245 | $42,345 | $42,732 | $49,885 | $47,952 | $47,469 | $59,552 |

| Long-term Liabilities | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

| Total Liabilities | $100,000 | $100,000 | $100,392 | $104,452 | $105,902 | $106,482 | $116,245 | $142,345 | $142,732 | $149,885 | $147,952 | $147,469 | $159,552 |

| Paid-in Capital | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 |

| Retained Earnings | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) | ($67,000) |

| Earnings | $0 | ($15,794) | ($31,589) | ($37,583) | ($40,077) | ($41,172) | ($38,766) | ($33,560) | ($26,955) | ($17,549) | ($7,443) | $8,962 | $22,568 |

| Total Capital | $83,000 | $67,206 | $51,411 | $45,417 | $42,923 | $41,828 | $44,234 | $49,440 | $56,045 | $65,451 | $75,557 | $91,962 | $105,568 |

| Total Liabilities and Capital | $183,000 | $167,206 | $151,803 | $149,869 | $148,825 | $148,310 | $160,479 | $191,785 | $198,777 | $215,336 | $223,509 | $239,431 | $265,120 |

| Net Worth | $83,000 | $67,206 | $51,411 | $45,417 | $42,923 | $41,828 | $44,234 | $49,440 | $56,045 | $65,451 | $75,557 | $91,962 | $105,568 |