Guildford Dry Cleaning Service

Executive Summary

Guildford Dry Cleaning Service is a sole trader, start-up enterprise, to be established in Guildford, Surrey. The company will provide dry cleaning, laundry, and garment alterations, offered with regular home pick-up and delivery services.

The company will have a production facility, but will not need a retail shop front because of our pick-up and delivery service. However, we will need delivery vans, and customer service trained drivers.

Customers can choose payment either at the time of each delivery, or by monthly credit card billing. The Service will send statements to each contract customer, itemising service fees and the charge for the service to their credit cards for payment, at the end of each month.

The business provides a new door-to-door dry cleaning, laundry, and alteration service in Guildford that surely will attract customer attention. Working customers may find this service is convenient for them and want to try it. If they are satisfied with the service quality they are likely to become repeat customers. When the patronage happens continuously, they become loyal customers of the service. These customers will recommend Guildford Dry Cleaning Service to their friends and coworkers. As more and more customers use this service, Guildford Dry Cleaning Service’s image is enhanced and we will gain more and more market share.

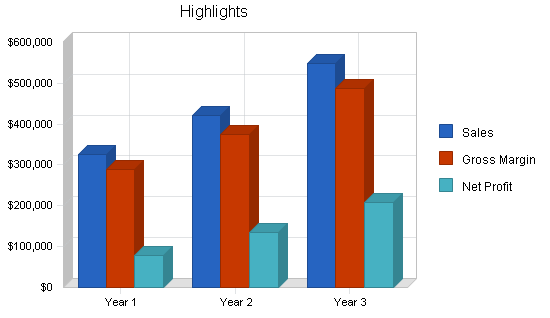

Sales forecast gradually increase over Years 1-3 and comprise total sales of £324,700. We project solid Net profits in the first year. Third year Sales and Net Profits increase significantly.

1.1 Mission

We will offer dry cleaning, laundry, and clothing alteration services with free home pickup and delivery. Our high quality and convenience will save time for working customers.

1.2 Keys to Success

-

The business is entering the first year of operation therefore a comprehensive marketing strategy will be the key to success of the business.

-

It is important to remember that the target customers have money and want to be provided with a high quality service; therefore they will only use this service if they are entirely satisfied.

-

Furthermore, the hours of operation must be convenient and service completion must be timely in order that customers are not harried after a long day working.

1.3 Objectives

In providing laundry and garment alteration services for customers in Guildford area, Guildford Dry Cleaning Service aims to:

-

Attain a 30% market share by the end of the first year

-

Have first year total sales in excess of £324,000

-

Producing net profits of over £75,000.

Company Summary

Guildford Dry Cleaning Service is a sole trader, start-up enterprise, to be established in Guildford, Surrey. The company will provide dry cleaning, laundry, and garment alterations, offered with regular home pick-up and delivery services.

The company will have a production facility, but will not need a retail shop front because of our pick-up and delivery service. However, we will need delivery vans, and customer service trained drivers.

Initially, the production facility will be rented. Cleaning equipment will be leased with accompanying maintenance contracts.

Start-up financing will be through owner investment and bank loans, with a line of credit established for operations eventualities.

2.1 Company Ownership

The proposed legal form of business is sole trader. This is a small business and need not publicly disclose its finances. The business can immediately start without the complicated procedures associated with partnerships, limited liability companies, or co-operatives. The owner/founder will be the director and will initially handle the bookkeeping responsibilities.

2.2 Start-up Summary

Capital resource plan

Loan: Lending plan has to be completed and submitted to the bank six months before starting the business. Loan will be needed two months in advance.

Leasing equipment: Buying new machines costs approximately £30,000 as opposed to leasing which costs £10,000 per year including maintenance. Evaluating the leasing solution shows NPV higher than that of buying machines. Moreover, the business is new and has less experience in maintenance and repair of machine breakdown, therefore the optimal solution is leasing machines. The following machines will be leased:

- 1 Washer – 17kg capacity, high spin, microprocessor control, electric heat

- 1 Tumble dryer – 18kg capacity, stainless steel drum and gas heated

- 1 Dry cleaning machine – 11kg

- 1 Roller Iron 1000 x 300 mm, variable speed and vacuum exhauster

- 1 Ironing table with steaming vacuum board, integral 7 litre boiler, iron, water pump and light

Capital plan: The owner will invest £32,000 in the business. Additional capital for the business will be borrowed from a bank.

- Buying a new van, and office/facilities equipment (computer, printer, fax, telephone instrument, tables, chairs, shelving, work tables, racks, etc…) and initial leasing of laundry machines: £19,500

- Buying another new van in April: £7,000

Annual interest of 6.48% has to be paid on the long-term loans secured with fixed assets.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | £150 |

| Stationery etc. | £1,200 |

| Brochures | £2,250 |

| Recruitment and Training | £400 |

| Insurance | £570 |

| Rent | £600 |

| Utilities | £500 |

| Leased Equipment | £834 |

| Research and Development | £0 |

| Expensed Equipment | £5,000 |

| Other | £2,790 |

| Total Start-up Expenses | £14,294 |

| Start-up Assets | |

| Cash Required | £10,000 |

| Start-up Inventory | £500 |

| Other Current Assets | £0 |

| Long-term Assets | £14,000 |

| Total Assets | £24,500 |

| Total Requirements | £38,794 |

| Start-up Funding | |

| Start-up Expenses to Fund | £14,294 |

| Start-up Assets to Fund | £24,500 |

| Total Funding Required | £38,794 |

| Assets | |

| Non-cash Assets from Start-up | £14,500 |

| Cash Requirements from Start-up | £10,000 |

| Additional Cash Raised | £12,706 |

| Cash Balance on Starting Date | £22,706 |

| Total Assets | £37,206 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | £0 |

| Long-term Liabilities | £19,500 |

| Accounts Payable (Outstanding Bills) | £0 |

| Other Current Liabilities (interest-free) | £0 |

| Total Liabilities | £19,500 |

| Capital | |

| Planned Investment | |

| Investor 1 | £32,000 |

| Investor 2 | £0 |

| Other | £0 |

| Additional Investment Requirement | £0 |

| Total Planned Investment | £32,000 |

| Loss at Start-up (Start-up Expenses) | (£14,294) |

| Total Capital | £17,706 |

| Total Capital and Liabilities | £37,206 |

| Total Funding | £51,500 |

Services

Guildford Dry Cleaning Service is going to provide the following services for customers with free home pick-up and delivery in the Guildford area:

- Dry cleaning

- Laundry for personal clothes and large items such as blankets, duvets, curtains, etc.

- Alteration service

Operations plan

There are two ways for customers to take part in the service. Customers can sign contracts with Guildford Dry Cleaning Service to get regularly scheduled service, or they can also order over the telephone or e-mail to Guildford Dry Cleaning Service.

Customers can choose payment either at the time of each delivery, or by monthly credit card billing. The Service will send statements to each contract customer, itemising service fees and the charge for the service to their credit cards for payment, at the end of each month.

No retail shop will be rented in order to reduce the operation cost. An operations facility for installing machines and equipment, washing and cleaning activities, and storing not yet cleaned and cleaned products is needed. The operations facility will require about 200 square metres divided into four main sections as follows:

- Machine installation and cleaning activities

- Sorting and storage of dirty garments received

- Storing cleaned garments after finishing prior to delivery

- Garment alteration workroom

The whole operation process will be controlled and monitored by a laundry expert employee, and generally managed by the business owner.

Market Analysis Summary

There are a number of reasons for choosing the dry cleaning, laundry, and alteration service industry:

-

Payment for the service is by cash, cheque, or credit card.

-

No capital stagnancy, receive payment every month, easy to get instant profit.

-

Capital requirement for purchasing commercial laundry equipment is minimal, therefore the risk of this business is low.

-

This service only requires a few staff.

-

Supplies needed service for customers’ frequent demand (laundry – clean clothes).

-

Customers use this service as there are few or no alternatives (dry cleaning, carpet cleaning…).

-

The demand for using service is increasing due to changing life styles, incomes, and the increase in clothing expenditure.

Source: “10 Reasons Why The Dry Cleaning Business Continues To Grow”, http://www.mindspring.com/~jimgirone/cleanpage/howto.html

4.1 Market Segmentation

Table 1: Labour market

|

Labour market |

Percentage (%) |

|

Proportion of males employed full-time 2001/2002 |

92.8 |

|

Proportion of males employed part-time 2001/2002 |

7.2 |

|

Proportion of females employed full-time 2001/2002 |

61.3 |

|

Proportion of females employed part-time 2001/2002 |

38.7 |

Table 2: Guildford economic change

|

Economic change |

Percentage (%) |

|

Change in GDP per head (1995 – 1998) |

39.6 |

|

Change in average gross weekly earning (1999 – 2002) |

21.2 |

|

Change in total employment (1991 – 2001) |

36.9 |

Sources: Local knowledge, Local futures

http://www.guildford.gov.uk/NR/rdonlyres/1F571647-185A-4470-9D3F-06B31BB5D10A/0/GuildfordAuditReportfinal.PDF

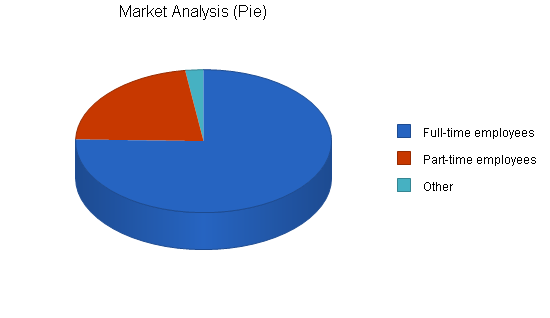

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Full-time employees | 5% | 49,400 | 51,870 | 54,464 | 57,187 | 60,046 | 5.00% |

| Part-time employees | 10% | 14,625 | 16,088 | 17,697 | 19,467 | 21,414 | 10.00% |

| Other | 2% | 1,500 | 1,530 | 1,561 | 1,592 | 1,624 | 2.01% |

| Total | 6.12% | 65,525 | 69,488 | 73,722 | 78,246 | 83,084 | 6.12% |

4.2 Target Market Segment Strategy

Table 1 in the previous topic shows the percentages of males and females working full time from the period 2001 – 2002 which are a lot higher than that of those working part time. Employment, income, and GDP trends show an increase over the past several years.

These tables show that more and more people have money (standard of living increased) but have less time to do their housework (laundry) in Guildford. They are often tired after working all day and tend to spend money to hire someone else to do the housework for them. Moreover, the demand on clothes of these working people (particularly professionals) usually increases proportionately with their income. Buying more clothes, especially expensive clothes, makes them pay more attention to the care and cleaning of those clothes. With careful research, this business focuses on working and professional class customers as a target segment market.

4.3 Service Business Analysis

There are two competitors in dry cleaning, laundry and alteration services in Guildford: Trend Cleaners and Woodbridge Hill Cleaners and Launderers. They are both small-scale services but have quite a lot of customers (this information is collected by self research and observation). However, these shops do not provide door-to-door service free of charge for customers. Hereunder are the strengths, weaknesses, opportunities and threats pertaining to this business:

4.3.1 Competition and Buying Patterns

Strengths:

- We offer a new service for dry cleaning, and laundry, providing another choice for customers.

- We provide quick and convenient service in order to save customer’s time.

Weaknesses:

- Strong competition from already established competitors in Guildford.

- Starting at no market share at all.

- Less experience than competitors.

Opportunities:

- Expenditure in clothing is increasing, including expensive clothes; therefore the demand of taking care of clothes also increases.

- There are more and more women – who traditionally do the laundry and cleaning work in the family – going to work outside the home. The target market of this business is working-class and professional-class customers.

- Average income of Guildford citizens is increasing.

- People tend to spend more time on leisure activities rather than doing the house work.

- Participation within a steadily growing service. The forecast of the dry cleaning and laundry service goes steadily up through 2010.

- There is a high likelihood of repeat business.

- The ability to decrease the fixed costs as the sales volume increases.

Threats:

- If the business is successful, there will be new competitors who supply the same kind of service.

- New technology changes may bring out new family washing machines for dry cleaning.

Strategy and Implementation Summary

Evaluation

The following areas will be monitored to evaluate the business performance:

- Monthly and annual sales

- Monthly and annual profit

- Repeat business

- Customer satisfaction

The business success will depend on quality and convenience of the service, customer opinions, and competitor response.

Optimism

The business provides a new door-to-door dry cleaning, laundry, and alteration service in Guildford that surely will attract customer attention. Working customers may find this service is convenient for them and want to try it. If they are satisfied with the service quality they will likely become repeat customers. When the patronage happens continuously, they become loyal customers of the service. These customers will recommend Guildford Dry Cleaning Service to their friends and coworkers. As more and more customers use this service, Guildford Dry Cleaning Service’s image is enhanced and we will gain more and more market share.

If we attain monthly and annual sales at least as forecasted, total costs and expenses, including any unanticipated charges, will not exceed our estimates and therefore the monthly and annual profit will be satisfactorily achieved.

Difficulties and Risks

Guildford Dry Cleaning is a start-up and as such has less experience and begins with no market share at all. Assertive, effective initial marketing efforts will be necessary to gain a customer base. If existing competitors see us as a major threat and they resort to overtly aggressive and debilitating actions it will be very difficult for us to become an established player in the marketplace. Risks caused by competitors are possible, therefore the business has to monitor and evaluate its performance frequently, and collect customer evaluations and suggestions in order to continually improve.

Worst Case Risks

The worst case scenario would be that the business cannot support itself on an ongoing basis. The costs of doing business may be under-estimated, or sales and profit may be less than expected, making the business difficult to finance. Moreover, in case of social economic recession, political changes, or inflation, the business may perform even worse than has been forecasted.

5.1 Competitive Edge

As the UK’s economy grows rapidly and quality of life is increased, people tend to spend more time and money in leisure activities rather than doing their house work. They prefer that someone else does the cleaning work for them. Guildford has a population of 129,701 served by three dry cleaning and laundry shops. These existing shops wait for customers to bring their garments in and pick them up later. Customers have to drive cars to town, find parking places, carry their clothes or large items such as curtains, blankets, etc. to the shop, and to queue for being serviced. Then they must repeat this boring process when they come to collect their items. Moreover, these shops are only open from 9am – 6pm, and closed on Sunday, which are almost the same working hours of offices; most inconvenient for customers especially those with full-time jobs.

By understanding and addressing this need, our new dry cleaning, laundry and alteration service will be established, providing door-to-door service free of delivery charge. We make our customers’ lives simpler by saving them time, and eliminating waiting in queues, parking problems, forgetting to collect clothes, missing meals, and going home late.

5.2 Marketing Strategy

Place: Trading directly with customers, conveniently in the customers’ houses in Guildford. We are choosing to not rent a shop in high street in the town centre, thereby reducing costs. Guildford Dry Cleaning Service will receive clothes from and return them to customers’ houses. Requests for urgent situation pick ups and deliveries will be accommodated, and a nominal fee charged.

Product: Free home pick up and delivery service, coming to customers’ house between 6 – 9 pm twice per week. We provide convenience and high quality dry cleaning, laundry, and alteration services.

Price: Normally, new businesses set their initial prices lower than their competitors. In our situation however, the business has higher costs for our delivery service and promotions to increase customers’ awareness and establish our brand name. We will set our prices to match those of our competitors. The pricing scheme is based on a per-service price. Moreover, the business targets working and professional customers who often pay less attention to price than the quality and convenience of service. Kelvin Clancy (in Kotler, 2003) shows that only between 15 and 35 percent of buyers are price sensitive. People with higher incomes are willing to pay more for features, customer service, quality, and convenience.

Promotion:

- Advertise our new service in the Surrey Advertiser, the Internet, public areas such as buses and train stations, shopping centres and supermarkets etc., and drop advertising material into families’ mailboxes.

- Offer 10% discount as an incentive for customers who sign one-year contracts.

- Issue coupons with lower price for loyal customers.

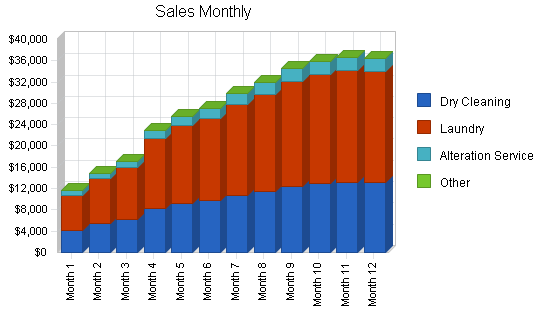

5.3 Sales Forecast

Sales forecast gradually increase over the year 2006 and comprise total sales of £324,700. However, in the last three months, October, November and December the sales almost remains the same due to the demand of this service at the end of years doesn’t increase, and even has a minor decrease.

As forecasted, turnover of total market continues to rise and the price of dry cleaning and laundry services also increases from 5-10% http://www.keynote.co.uk/GlobalFrame.htm. However, to avoid being too optimistic, this sale estimation is calculated based on the turnover of competitors in the year 2002.

(Source: http://www.startinbusiness.co.uk/listings/bi9zopps/sale/details/flz201_laundry.htm).

Turnover projections of £324,700 for the year were generated in the following areas:

| Description | Forecast 2006 | Percentage |

| Dry Cleaning |

£116,892 |

36% |

| Other Laundry | £185,079 | 57% |

| Alteration Services | £22,729 | 7% |

| Total | £324,700 | 100% |

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Dry Cleaning | £116,892 | £151,960 | £197,548 |

| Laundry | £185,079 | £240,603 | £312,784 |

| Alteration Service | £22,729 | £29,547 | £38,412 |

| Other | £0 | £0 | £0 |

| Total Sales | £324,700 | £422,110 | £548,744 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Dry Cleaning | £14,027 | £18,235 | £23,706 |

| Laundry | £14,806 | £19,248 | £25,023 |

| Alteration Service | £6,819 | £8,864 | £11,524 |

| Other | £0 | £0 | £0 |

| Subtotal Direct Cost of Sales | £35,652 | £46,348 | £60,252 |

Management Summary

The owner of the business will be director and accountant working full time.

A laundry expert will be employed and will be in charge of the operation and the quality of garment cleaning. Workers will report to the laundry expert who reports to the owner.

6.1 Personnel Plan

Through the consultation of British Cleaning Council, the term of reference of a laundry expert and workers are prepared. Employment information will be advertised in the newspaper. The laundry expert and two part-time workers who have experience in laundry work will be employed.

The laundry expert will be in charge of the operation and the quality of garment cleaning. Workers will be responsible for cleaning and classifying work and have the duty to report daily work to the laundry expert. The expert has to report their working results and problems to the director.

Two part-time drivers for picking up and delivering clothes work from 17.30 to 21.30, Monday through Saturday.

The staff should be able to carry out working conditions and requirements:

- Understand and apply dry cleaning and washing processes

- Meet set standards by following instructions

- Work in hot, humid surroundings

- Perform the same work continuously

- Overtime may be required during peak seasons such as spring and autumn.

Number of staff and salary in the period of January to March 2006:

|

Description |

No of people |

Salary per hour (£) |

Working hours/week |

|

|

Owner |

Full-time |

1 |

20 |

48 |

|

Laundry expert |

Full-time |

1 |

10 |

48 |

|

Workers |

Part-time |

2 |

7 |

48 |

|

Drivers |

Part-time |

2 |

5 |

24 |

|

Total |

6 |

42 |

168 |

From April to December 2004, the business has more customers and becomes busier, thus new staff (a worker and a driver) are employed.

The business prefers to hire extra part-time workers and drivers sharing the total needed working hours. In case one of them becomes sick or busy, other staff can replace them; therefore, the working process will not be effected.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Director/Accountant | £46,080 | £47,462 | £48,886 |

| Laundry expert | £23,040 | £23,731 | £24,443 |

| Worker-1 | £10,080 | £10,382 | £10,693 |

| Worker-2 | £10,080 | £10,382 | £10,693 |

| Worker-3 | £8,064 | £8,306 | £8,555 |

| Driver-1 | £3,360 | £3,461 | £3,565 |

| Driver-2 | £3,360 | £3,461 | £3,565 |

| Driver-3 | £2,880 | £2,966 | £3,055 |

| Other | £0 | £0 | £0 |

| Total People | 8 | 8 | 8 |

| Total Payroll | £106,944 | £110,151 | £113,455 |

Financial Plan

The following topics describe the cash flow statement, profit and loss account, and balance sheet have been built using forecasted information which is as accurate and realistic as possible. These financial statements show that the business runs quite well and achieves expected results.

7.1 Important Assumptions

Sales increase gradually over the 12 months showing the positive trend of sales. Guildford Dry Cleaning is steadily gaining market share.

Gross profit and net profit rise proportionately to sales revenue.

Return on capital employed: Pendlebury (2002) indicates this ratio is useful to measure the efficiency which the long term capital has been employed. The business’ return on capital employed (ROCE) increases over the 12 months showing the effect of using capital to grow business, especially in the last months of the year.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 6.48% | 6.48% | 6.48% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The following table and chart show our Break-even Analysis.

| Break-even Analysis | |

| Monthly Revenue Break-even | £16,281 |

| Assumptions: | |

| Average Percent Variable Cost | 11% |

| Estimated Monthly Fixed Cost | £14,493 |

7.3 Projected Profit and Loss

In general, the business might meet some difficulties in the beginning months but after that the business grows as expected and produces a small profit at the end of the year. It is not necessary for the business to gain high profit in the first year, breaking even is acceptable.

Here under are the estimated fixed costs and variable costs for the year 2006. These costs have been divided into two periods:

- Jan – Mar

- Apr – Dec: One more van (£7,000) will be purchased and new staff recruited; therefore interest, maintenance, petrol, salary and national insurance are increased

|

Fixed costs Per Month |

Jan – Mar |

Apr – Dec |

|

Interest rate |

1,264 |

1,604 |

|

Machine leasing |

834 |

834 |

|

Building renting |

600 |

600 |

|

Maintenance |

50 |

100 |

|

Petrol |

150 |

300 |

|

Salary per month |

7,584 |

9,408 |

|

National Insurance |

421 |

620 |

|

Total |

10,903 |

13,466 |

|

Variable costs Per Month |

Jan – Mar |

Apr – Dec |

|

Tea/Coffee break |

100 |

100 |

|

Office cleaning |

100 |

100 |

|

Recruitment cost |

45 |

400 |

|

Advertisement |

150 |

200 |

|

Telephone |

300 |

500 |

|

Electricity |

500 |

500 |

|

Miscellaneous |

300 |

300 |

|

Total |

1,495 |

2,100 |

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | £324,700 | £422,110 | £548,744 |

| Direct Cost of Sales | £35,652 | £46,348 | £60,252 |

| Other Costs of Sales | £0 | £0 | £0 |

| Total Cost of Sales | £35,652 | £46,348 | £60,252 |

| Gross Margin | £289,048 | £375,762 | £488,492 |

| Gross Margin % | 89.02% | 89.02% | 89.02% |

| Expenses | |||

| Payroll | £106,944 | £110,151 | £113,455 |

| Sales and Marketing and Other Expenses | £2,250 | £2,700 | £3,000 |

| Depreciation | £4,236 | £4,700 | £4,700 |

| Rent | £7,200 | £7,200 | £7,200 |

| Utilities | £11,400 | £12,000 | £13,000 |

| Inserted Row | £0 | £0 | £0 |

| Petrol | £3,150 | £3,500 | £4,000 |

| Equipment Lease | £10,008 | £12,000 | £15,000 |

| Maintenance | £1,050 | £1,200 | £1,500 |

| Office Cleaning | £1,200 | £1,500 | £1,500 |

| Insurance | £6,840 | £6,840 | £6,840 |

| Payroll Taxes (National Insurance, etc.) | £16,042 | £16,523 | £17,018 |

| Other | £3,600 | £4,000 | £4,000 |

| Total Operating Expenses | £173,920 | £182,314 | £191,213 |

| Profit Before Interest and Taxes | £115,128 | £193,449 | £297,279 |

| EBITDA | £119,364 | £198,149 | £301,979 |

| Interest Expense | £1,469 | £1,297 | £976 |

| Taxes Incurred | £34,098 | £57,645 | £88,891 |

| Net Profit | £79,562 | £134,506 | £207,412 |

| Net Profit/Sales | 24.50% | 31.87% | 37.80% |

7.4 Projected Cash Flow

Cash flow increases gradually over the year creating the positive net present value. To exist and develop in the competitive market are getting more and more difficult. Obtaining loyal customers and recruiting new customers in term of long run business are extremely difficult therefore the service aims to achieve low profit create and enhance the service’s image which are the advantage competition in the market.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | £324,700 | £422,110 | £548,744 |

| Subtotal Cash from Operations | £324,700 | £422,110 | £548,744 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | £0 | £0 | £0 |

| New Current Borrowing | £0 | £0 | £0 |

| New Other Liabilities (interest-free) | £0 | £0 | £0 |

| New Long-term Liabilities | £7,000 | £0 | £0 |

| Sales of Other Current Assets | £0 | £0 | £0 |

| Sales of Long-term Assets | £0 | £0 | £0 |

| New Investment Received | £0 | £0 | £0 |

| Subtotal Cash Received | £331,700 | £422,110 | £548,744 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | £106,944 | £110,151 | £113,455 |

| Bill Payments | £123,286 | £173,837 | £220,566 |

| Subtotal Spent on Operations | £230,230 | £283,988 | £334,021 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | £0 | £0 | £0 |

| Principal Repayment of Current Borrowing | £0 | £0 | £0 |

| Other Liabilities Principal Repayment | £0 | £0 | £0 |

| Long-term Liabilities Principal Repayment | £4,084 | £4,792 | £5,112 |

| Purchase Other Current Assets | £0 | £0 | £0 |

| Purchase Long-term Assets | £7,000 | £0 | £0 |

| Dividends | £0 | £0 | £0 |

| Subtotal Cash Spent | £241,314 | £288,780 | £339,133 |

| Net Cash Flow | £90,386 | £133,330 | £209,611 |

| Cash Balance | £113,092 | £246,421 | £456,032 |

7.5 Projected Balance Sheet

The table below shows the balance sheet annual figures for the first three years of operation. First year monthly figures are presented in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | £113,092 | £246,421 | £456,032 |

| Inventory | £4,008 | £5,210 | £6,773 |

| Other Current Assets | £0 | £0 | £0 |

| Total Current Assets | £117,099 | £251,631 | £462,805 |

| Long-term Assets | |||

| Long-term Assets | £21,000 | £21,000 | £21,000 |

| Accumulated Depreciation | £4,236 | £8,936 | £13,636 |

| Total Long-term Assets | £16,764 | £12,064 | £7,364 |

| Total Assets | £133,863 | £263,695 | £470,169 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | £14,180 | £14,298 | £18,472 |

| Current Borrowing | £0 | £0 | £0 |

| Other Current Liabilities | £0 | £0 | £0 |

| Subtotal Current Liabilities | £14,180 | £14,298 | £18,472 |

| Long-term Liabilities | £22,416 | £17,624 | £12,512 |

| Total Liabilities | £36,596 | £31,922 | £30,984 |

| Paid-in Capital | £32,000 | £32,000 | £32,000 |

| Retained Earnings | (£14,294) | £65,268 | £199,774 |

| Earnings | £79,562 | £134,506 | £207,412 |

| Total Capital | £97,268 | £231,774 | £439,185 |

| Total Liabilities and Capital | £133,863 | £263,695 | £470,169 |

| Net Worth | £97,268 | £231,774 | £439,185 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios for commercial dry cleaning and laundry establishments are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 30.00% | 30.00% | 0.41% |

| Percent of Total Assets | ||||

| Inventory | 2.99% | 1.98% | 1.44% | 3.56% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 39.13% |

| Total Current Assets | 87.48% | 95.43% | 98.43% | 57.85% |

| Long-term Assets | 12.52% | 4.57% | 1.57% | 42.15% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 10.59% | 5.42% | 3.93% | 26.66% |

| Long-term Liabilities | 16.75% | 6.68% | 2.66% | 20.51% |

| Total Liabilities | 27.34% | 12.11% | 6.59% | 47.17% |

| Net Worth | 72.66% | 87.89% | 93.41% | 52.83% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 89.02% | 89.02% | 89.02% | 100.00% |

| Selling, General & Administrative Expenses | 55.72% | 51.42% | 46.64% | 78.43% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.78% |

| Profit Before Interest and Taxes | 35.46% | 45.83% | 54.17% | 3.01% |

| Main Ratios | ||||

| Current | 8.26 | 17.60 | 25.05 | 1.57 |

| Quick | 7.98 | 17.24 | 24.69 | 1.30 |

| Total Debt to Total Assets | 27.34% | 12.11% | 6.59% | 57.48% |

| Pre-tax Return on Net Worth | 116.85% | 82.90% | 67.47% | 5.38% |

| Pre-tax Return on Assets | 84.91% | 72.87% | 63.02% | 12.65% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 24.50% | 31.87% | 37.80% | n.a |

| Return on Equity | 81.80% | 58.03% | 47.23% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 12.00 | 10.06 | 10.06 | n.a |

| Accounts Payable Turnover | 9.69 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 27 | n.a |

| Total Asset Turnover | 2.43 | 1.60 | 1.17 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.38 | 0.14 | 0.07 | n.a |

| Current Liab. to Liab. | 0.39 | 0.45 | 0.60 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | £102,920 | £237,334 | £444,333 | n.a |

| Interest Coverage | 78.38 | 149.12 | 304.46 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.41 | 0.62 | 0.86 | n.a |

| Current Debt/Total Assets | 11% | 5% | 4% | n.a |

| Acid Test | 7.98 | 17.24 | 24.69 | n.a |

| Sales/Net Worth | 3.34 | 1.82 | 1.25 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Dry Cleaning | £4,176 | £5,364 | £6,156 | £8,280 | £9,216 | £9,720 | £10,728 | £11,520 | £12,456 | £12,924 | £13,212 | £13,140 | |

| Laundry | £6,612 | £8,493 | £9,747 | £13,110 | £14,592 | £15,390 | £16,986 | £18,240 | £19,722 | £20,463 | £20,919 | £20,805 | |

| Alteration Service | £812 | £1,043 | £1,197 | £1,610 | £1,792 | £1,890 | £2,086 | £2,240 | £2,422 | £2,513 | £2,569 | £2,555 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Total Sales | £11,600 | £14,900 | £17,100 | £23,000 | £25,600 | £27,000 | £29,800 | £32,000 | £34,600 | £35,900 | £36,700 | £36,500 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Dry Cleaning | £501 | £644 | £739 | £994 | £1,106 | £1,166 | £1,287 | £1,382 | £1,495 | £1,551 | £1,585 | £1,577 | |

| Laundry | £529 | £679 | £780 | £1,049 | £1,167 | £1,231 | £1,359 | £1,459 | £1,578 | £1,637 | £1,674 | £1,664 | |

| Alteration Service | £244 | £313 | £359 | £483 | £538 | £567 | £626 | £672 | £727 | £754 | £771 | £767 | |

| Other | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Direct Cost of Sales | £1,274 | £1,636 | £1,878 | £2,525 | £2,811 | £2,965 | £3,272 | £3,514 | £3,799 | £3,942 | £4,030 | £4,008 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Director/Accountant | 0% | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 | £3,840 |

| Laundry expert | 0% | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 | £1,920 |

| Worker-1 | 0% | £672 | £672 | £672 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 |

| Worker-2 | 0% | £672 | £672 | £672 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 |

| Worker-3 | 0% | £0 | £0 | £0 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 | £896 |

| Driver-1 | 0% | £160 | £160 | £160 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 |

| Driver-2 | 0% | £160 | £160 | £160 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 |

| Driver-3 | 0% | £0 | £0 | £0 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 | £320 |

| Other | 0% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total People | 6 | 6 | 6 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | |

| Total Payroll | £7,424 | £7,424 | £7,424 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | 6.48% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | £11,600 | £14,900 | £17,100 | £23,000 | £25,600 | £27,000 | £29,800 | £32,000 | £34,600 | £35,900 | £36,700 | £36,500 | |

| Direct Cost of Sales | £1,274 | £1,636 | £1,878 | £2,525 | £2,811 | £2,965 | £3,272 | £3,514 | £3,799 | £3,942 | £4,030 | £4,008 | |

| Other Costs of Sales | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Total Cost of Sales | £1,274 | £1,636 | £1,878 | £2,525 | £2,811 | £2,965 | £3,272 | £3,514 | £3,799 | £3,942 | £4,030 | £4,008 | |

| Gross Margin | £10,326 | £13,264 | £15,222 | £20,475 | £22,789 | £24,035 | £26,528 | £28,486 | £30,801 | £31,958 | £32,670 | £32,492 | |

| Gross Margin % | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | 89.02% | |

| Expenses | |||||||||||||

| Payroll | £7,424 | £7,424 | £7,424 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | |

| Sales and Marketing and Other Expenses | £150 | £150 | £150 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | |

| Depreciation | £275 | £275 | £275 | £275 | £392 | £392 | £392 | £392 | £392 | £392 | £392 | £392 | |

| Rent | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | |

| Utilities | £800 | £800 | £800 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | |

| Inserted Row | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Petrol | £150 | £150 | £150 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | |

| Equipment Lease | £834 | £834 | £834 | £834 | £834 | £834 | £834 | £834 | £834 | £834 | £834 | £834 | |

| Maintenance | £50 | £50 | £50 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | |

| Office Cleaning | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | £100 | |

| Insurance | £570 | £570 | £570 | £570 | £570 | £570 | £570 | £570 | £570 | £570 | £570 | £570 | |

| Payroll Taxes (National Insurance, etc.) | 15% | £1,114 | £1,114 | £1,114 | £1,411 | £1,411 | £1,411 | £1,411 | £1,411 | £1,411 | £1,411 | £1,411 | £1,411 |

| Other | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | |

| Total Operating Expenses | £12,367 | £12,367 | £12,367 | £15,098 | £15,215 | £15,215 | £15,215 | £15,215 | £15,215 | £15,215 | £15,215 | £15,215 | |

| Profit Before Interest and Taxes | (£2,040) | £897 | £2,856 | £5,376 | £7,574 | £8,820 | £11,313 | £13,271 | £15,586 | £16,743 | £17,455 | £17,277 | |

| EBITDA | (£1,765) | £1,172 | £3,131 | £5,651 | £7,966 | £9,212 | £11,705 | £13,663 | £15,978 | £17,135 | £17,847 | £17,669 | |

| Interest Expense | £104 | £102 | £101 | £137 | £135 | £133 | £131 | £129 | £127 | £125 | £123 | £121 | |

| Taxes Incurred | (£643) | £239 | £827 | £1,572 | £2,232 | £2,606 | £3,354 | £3,943 | £4,638 | £4,985 | £5,200 | £5,147 | |

| Net Profit | (£1,501) | £557 | £1,929 | £3,668 | £5,207 | £6,081 | £7,827 | £9,199 | £10,821 | £11,633 | £12,132 | £12,009 | |

| Net Profit/Sales | -12.94% | 3.74% | 11.28% | 15.95% | 20.34% | 22.52% | 26.27% | 28.75% | 31.27% | 32.40% | 33.06% | 32.90% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | £11,600 | £14,900 | £17,100 | £23,000 | £25,600 | £27,000 | £29,800 | £32,000 | £34,600 | £35,900 | £36,700 | £36,500 | |

| Subtotal Cash from Operations | £11,600 | £14,900 | £17,100 | £23,000 | £25,600 | £27,000 | £29,800 | £32,000 | £34,600 | £35,900 | £36,700 | £36,500 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| New Current Borrowing | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Other Liabilities (interest-free) | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Long-term Liabilities | £0 | £0 | £0 | £7,000 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Sales of Other Current Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Sales of Long-term Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| New Investment Received | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Cash Received | £11,600 | £14,900 | £17,100 | £30,000 | £25,600 | £27,000 | £29,800 | £32,000 | £34,600 | £35,900 | £36,700 | £36,500 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | £7,424 | £7,424 | £7,424 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | £9,408 | |

| Bill Payments | £206 | £6,203 | £7,030 | £7,800 | £10,317 | £10,891 | £11,313 | £12,506 | £13,276 | £14,276 | £14,618 | £14,849 | |

| Subtotal Spent on Operations | £7,630 | £13,627 | £14,454 | £17,208 | £19,725 | £20,299 | £20,721 | £21,914 | £22,684 | £23,684 | £24,026 | £24,257 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Principal Repayment of Current Borrowing | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Other Liabilities Principal Repayment | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Long-term Liabilities Principal Repayment | £276 | £278 | £280 | £282 | £364 | £366 | £368 | £370 | £372 | £374 | £376 | £378 | |

| Purchase Other Current Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Purchase Long-term Assets | £0 | £0 | £0 | £7,000 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Dividends | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | |

| Subtotal Cash Spent | £7,906 | £13,905 | £14,734 | £24,490 | £20,089 | £20,665 | £21,089 | £22,284 | £23,056 | £24,058 | £24,402 | £24,635 | |

| Net Cash Flow | £3,694 | £995 | £2,366 | £5,510 | £5,511 | £6,335 | £8,711 | £9,716 | £11,544 | £11,842 | £12,298 | £11,865 | |

| Cash Balance | £26,400 | £27,395 | £29,761 | £35,270 | £40,782 | £47,116 | £55,827 | £65,544 | £77,087 | £88,929 | £101,227 | £113,092 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | £22,706 | £26,400 | £27,395 | £29,761 | £35,270 | £40,782 | £47,116 | £55,827 | £65,544 | £77,087 | £88,929 | £101,227 | £113,092 |

| Inventory | £500 | £1,274 | £1,636 | £1,878 | £2,525 | £2,811 | £2,965 | £3,272 | £3,514 | £3,799 | £3,942 | £4,030 | £4,008 |

| Other Current Assets | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Current Assets | £23,206 | £27,674 | £29,031 | £31,638 | £37,796 | £43,593 | £50,081 | £59,099 | £69,057 | £80,886 | £92,871 | £105,257 | £117,099 |

| Long-term Assets | |||||||||||||

| Long-term Assets | £14,000 | £14,000 | £14,000 | £14,000 | £21,000 | £21,000 | £21,000 | £21,000 | £21,000 | £21,000 | £21,000 | £21,000 | £21,000 |

| Accumulated Depreciation | £0 | £275 | £550 | £825 | £1,100 | £1,492 | £1,884 | £2,276 | £2,668 | £3,060 | £3,452 | £3,844 | £4,236 |

| Total Long-term Assets | £14,000 | £13,725 | £13,450 | £13,175 | £19,900 | £19,508 | £19,116 | £18,724 | £18,332 | £17,940 | £17,548 | £17,156 | £16,764 |

| Total Assets | £37,206 | £41,399 | £42,481 | £44,813 | £57,696 | £63,101 | £69,197 | £77,823 | £87,389 | £98,826 | £110,419 | £122,413 | £133,863 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | £0 | £5,970 | £6,773 | £7,457 | £9,954 | £10,516 | £10,897 | £12,064 | £12,801 | £13,789 | £14,123 | £14,360 | £14,180 |

| Current Borrowing | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Current Liabilities | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Subtotal Current Liabilities | £0 | £5,970 | £6,773 | £7,457 | £9,954 | £10,516 | £10,897 | £12,064 | £12,801 | £13,789 | £14,123 | £14,360 | £14,180 |

| Long-term Liabilities | £19,500 | £19,224 | £18,946 | £18,666 | £25,384 | £25,020 | £24,654 | £24,286 | £23,916 | £23,544 | £23,170 | £22,794 | £22,416 |

| Total Liabilities | £19,500 | £25,194 | £25,719 | £26,123 | £35,338 | £35,536 | £35,551 | £36,350 | £36,717 | £37,333 | £37,293 | £37,154 | £36,596 |

| Paid-in Capital | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 | £32,000 |

| Retained Earnings | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) | (£14,294) |

| Earnings | £0 | (£1,501) | (£944) | £984 | £4,652 | £9,859 | £15,940 | £23,767 | £32,966 | £43,787 | £55,420 | £67,552 | £79,562 |

| Total Capital | £17,706 | £16,205 | £16,762 | £18,690 | £22,358 | £27,565 | £33,646 | £41,473 | £50,672 | £61,493 | £73,126 | £85,258 | £97,268 |

| Total Liabilities and Capital | £37,206 | £41,399 | £42,481 | £44,813 | £57,696 | £63,101 | £69,197 | £77,823 | £87,389 | £98,826 | £110,419 | £122,413 | £133,863 |

| Net Worth | £17,706 | £16,205 | £16,762 | £18,690 | £22,358 | £27,565 | £33,646 | £41,473 | £50,672 | £61,493 | £73,126 | £85,258 | £97,268 |

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Full-time employees | 5% | 49,400 | 51,870 | 54,464 | 57,187 | 60,046 | 5.00% |

| Part-time employees | 10% | 14,625 | 16,088 | 17,697 | 19,467 | 21,414 | 10.00% |

| Other | 2% | 1,500 | 1,530 | 1,561 | 1,592 | 1,624 | 2.01% |

| Total | 6.12% | 65,525 | 69,488 | 73,722 | 78,246 | 83,084 | 6.12% |