Kaolin Calefactors

Executive Summary

Kaolin Calefactors (KC) is an Oregon company that designs and manufactures production and custom dishware. The designs can be anything that the customer would like, however, Sue Glazer’s genre is modern or popular art. The typical customer is either someone purchasing a handmade gift for a friend/relative, or someone who is interested in owning unusual everyday dishware.

Kaolin Calefactors is a unique business opportunity that will allow Sue Glazer to combine her love for ceramics and parlay this affinity into a money making venture.

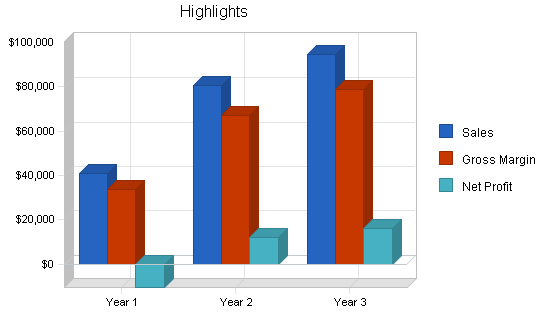

Kaolin Calefactors will leverage their competitive advantage of a customer-centric business model to rapidly gain market share in the custom dishware niche. Profitability will be reached by month nine and revenues for year three are projected to reach $78,000.

1.1 Objectives

The objectives for the first three years of operation include:

- To create a company whose goal is to exceed customer’s expectations.

- To increase the number of custom clients by 20% per year.

- To develop a sustainable start-up business that leverages a hobby into a business.

1.2 Mission

Kaolin Calefactors’ mission is to design and construct the finest dishware pottery. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed the expectations of our customers.

1.3 Keys to Success

The key to success is innovative design and a customer-centric approach.

Company Summary

Kaolin Calefactors is a Eugene, OR based start-up company that hand makes production and custom ceramic dishware. KC sells their products in local crafts stores, craft fairs, and via their website.

2.1 Company Ownership

Kaolin Calefactors is a sole proprietorship founded and owned by Sue Glazer.

2.2 Start-up Summary

Kaolin Calefactors will incur the following start-up costs:

- Computer system with a CD-RW, printer, Microsoft Office and QuickBooks Pro.

- Commercial kiln.

- Electric potters wheel.

- Storage containers for the clay and glazes.

- Assorted tools for trimming, edging and glazing.

- Shelves and large tables for storage and work spaces.

- Website development.

Please note that the following items which are considered assets to be used for more than a year will labeled long-term assets and will be depreciated using G.A.A.P. approved straight-line depreciation method.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $500 |

| Website development | $0 |

| Brochures | $150 |

| Other | $0 |

| Total Start-up Expenses | $650 |

| Start-up Assets | |

| Cash Required | $11,750 |

| Other Current Assets | $0 |

| Long-term Assets | $5,600 |

| Total Assets | $17,350 |

| Total Requirements | $18,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $650 |

| Start-up Assets to Fund | $17,350 |

| Total Funding Required | $18,000 |

| Assets | |

| Non-cash Assets from Start-up | $5,600 |

| Cash Requirements from Start-up | $11,750 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $11,750 |

| Total Assets | $17,350 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Sue | $18,000 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $18,000 |

| Loss at Start-up (Start-up Expenses) | ($650) |

| Total Capital | $17,350 |

| Total Capital and Liabilities | $17,350 |

| Total Funding | $18,000 |

Products

Kaolin Calefactors makes production and custom dishware. KC manufactures a line of 12 production styles of dishware as well as the option of custom designs. Custom designs can be either based on a design KC has done in the past or can be a creation of the customer.

Please note that the use of the term production is not the traditional usage. While Sue does have some production designs, all this means is that she makes them for inventory regardless if there is an order for them. Production in this case does not take on the typical association of “mass production.”

The pieces of dishware that are offered are serving platters, dinner plates, bowls, coffee cups, and saucers. Other pieces can be created at the request of the customer. The dishware comes in several different shapes as well as different glazing options. Kaolin Calefactors products are expensive. KC is not trying to compete on price. KC will be making high quality, handmade pieces, that can be glazed in any way the customer wants. The price/positioning strategy will be the upper end of the market.

Market Analysis Summary

The market can be broken down into two groups, those that are buying the products for a gift, and those that are buying it for themselves. 80% of the consumer market for pottery is adult females.

4.1 Market Segmentation

The market can be segmented into two different groups:

- People that are purchasing the pottery for other people. This segment is looking for a gift for someone and want something that is unique, and stands out relative to most other dishware. This segment often will be purchasing from the production line of dishware

- People that are buying pottery for themselves. Some people have a very specific idea/style in mind and are more likely to opt for a custom design. Custom work is more expensive and typically more unique, it is intuitive to expect that the more unique design, the more likely that the person is buying the product for themselves.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Gift purchasers | 8% | 21,455 | 23,171 | 25,025 | 27,027 | 29,189 | 8.00% |

| End consumers | 9% | 19,886 | 21,676 | 23,627 | 25,753 | 28,071 | 9.00% |

| Total | 8.48% | 41,341 | 44,847 | 48,652 | 52,780 | 57,260 | 8.48% |

4.2 Target Market Segment Strategy

These two groups will be targeted by developing visibility for Kaolin Calefactors in areas that people interested in fine, handmade dishware can be found, including participating in local craft fairs. Local craft fairs are a gathering of different crafts people that set up booths displaying all of their creations. People that are looking for unique, handmade designs, will often come to the craft fairs to view a wide selection of products.

Kaolin Calefactors will also have a website that will extensively detail all of the different production designs that are available. In addition to the production items, Sue’s portfolio of past and present designs will be available online to offer suggestions for custom designs.

Lastly, all of the products, particularly useful in the retail sale of the KC products in craft stores, comes with a little card that details information about Kaolin Calefactors, Sue, and the website. The website is advertised heavily in this flyer, encouraging people to visit the site and gain insight into the infinite number of custom designs available.

4.3 Industry Analysis

The craft industry is composed of wood workers, ceramics, doll painters, and jewelers. The majority of craftspeople attend weekend craft shows while at the same time maintaining a full-time job. This aspect of having a full-time job and creating crafts for sale is interesting in the sense that people are trying to combine their hobby into a minor money making venture.

The minority of craftsmen turn their hobby into a full-time job, like Sue.

While most craftsmen generally work at home, potters as a subset typically rent out space. Potters typically have more equipment and require more space for the different phases of the pottery, like the drying phase, the post-kiln phase, and then the post-glazing phase.

4.3.1 Competition and Buying Patterns

The competition consists of different sources.

- Commercial dishware manufacturers. This competitor mass manufactures a wide range of dishware. These companies appeal to someone that is looking for general dishware. These competitors serve people that are more interested in function instead of aesthetics.

- Assorted craftspeople. This group of competitors is serving the segment of people that are purchasing the ceramics for gifts.

- Other potters. This group is the most direct competitor in terms of business activities, but not necessarily the most vigorous. The reason they are not the most vigorous competitors is because most potters that sell their products make cups and vases. Therefore, while they are direct competitors, not many are making competing dishware.

Strategy and Implementation Summary

The strategy for building customers will be based on communicating Kaolin Calefactors’ customer-centric approach to the customer. Kaolin Calefactors encourages a cooperative relationship with their customers in the design and manufacture of the dishware.

5.1 Competitive Edge

Kaolin Calefactors’ competitive edge is their customer-centric approach to business. This is most prevalent in the custom designs where Sue works hand-in-hand with the customer to allow them to create their perfect design. This cooperative relationship with the customer begins at the design stage and continues throughout the work process.

This customer-centric approach is quite intuitive and effective for several reasons. It is intuitive for Sue because while it is obviously important for the business to make money, Sue believes that if she treats customers properly the profits will happen as a by product. This approach is effective because it is far cheaper to maintain a happy customer than it is to attract new ones.

5.2 Sales Strategy

The sales strategy will be based on communicating that owning your own production, or custom, dishware is a source of pride and appreciation by you as well as your guests. Dishware is something that you use, typically two times a day. It is something that you are always looking at. It is also something that can add to the presentation of the food. Lastly, if properly cared for, the dishware is a long-term investment because it is quite durable and the designs can be timeless.

The other element that will be emphasized when trying to turn a prospective customer into a sale is the cooperative process that involves the customer in the creation of their dishware.

5.2.1 Sales Forecast

The first month of business will be used to set up the work studio as well as line up retail sales outlets, schedule upcoming craft fairs, and the design of the website. There will be a bit of business occurring in month two with a steady increase by month five.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Gift purchasers | $21,436 | $42,457 | $49,854 |

| End consumers | $19,292 | $38,211 | $44,869 |

| Total Sales | $40,728 | $80,668 | $94,723 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Gift purchasers | $3,644 | $7,218 | $8,475 |

| End consumers | $3,280 | $6,496 | $7,628 |

| Subtotal Direct Cost of Sales | $6,924 | $13,714 | $16,103 |

5.3 Milestones

Kaolin Calefactors will have several milestones:

- Business plan completion. This will be done as a roadmap for the organization. This will be an indispensable tool for the ongoing performance and improvement of the company.

- Office/work space set up.

- Establishment of retail sales outlets.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Office/work space set up | 1/1/2001 | 2/1/2001 | $0 | ABC | Department |

| Establishment of retail sales outlets | 1/1/2001 | 3/1/2001 | $0 | ABC | Department |

| Totals | $0 | ||||

Management Summary

Sue Glazer has a Bachelor of Arts from Washington and Jefferson. After taking a variety of classes her freshman year, including a ceramics class, she fell in love with pottery. Recognizing that ceramics was her love in life, she continued schooling at Carnegie Mellon University, pursuing her Masters in Art.

After this two-year program, she began looking for jobs that would allow her to practice her love of pottery. Through contact with one of her professors from W&J, she learned a professorship was open at W&J in the art department, and she spent four years teaching ceramics. After the four years she decided to move out to the Pacific Northwest.

6.1 Personnel Plan

Kaolin Calefactors is a sole proprietorship with Sue as the only employee. She will be responsible for everything, strategic relationships, administrative details, and of course, the creation of the art.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Sue | $30,000 | $35,000 | $40,000 |

| Other | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 |

| Total Payroll | $30,000 | $35,000 | $40,000 |

Financial Plan

The following sections will outline important financial information.

Please note under the Ratios table there is a bit of a discrepancy under the gross margin category as well as the selling/general and administrative expense category. The explanation for these differences are that the costs associated with doing business have been placed into different categories relative to the industry average. This is why one figure is higher than the industry average and another is lower.

7.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The Break-even Analysis indicates that approximately $4,400 will be needed in monthly revenue to reach the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $4,449 |

| Assumptions: | |

| Average Percent Variable Cost | 17% |

| Estimated Monthly Fixed Cost | $3,693 |

7.3 Projected Profit and Loss

The following table will indicate projected profit and loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $40,728 | $80,668 | $94,723 |

| Direct Cost of Sales | $6,924 | $13,714 | $16,103 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $6,924 | $13,714 | $16,103 |

| Gross Margin | $33,805 | $66,955 | $78,620 |

| Gross Margin % | 83.00% | 83.00% | 83.00% |

| Expenses | |||

| Payroll | $30,000 | $35,000 | $40,000 |

| Sales and Marketing and Other Expenses | $2,100 | $1,900 | $1,700 |

| Depreciation | $1,116 | $1,116 | $1,116 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities/ DSL/ web hosting | $1,800 | $1,800 | $1,800 |

| Insurance | $600 | $600 | $600 |

| Rent | $4,200 | $4,200 | $4,200 |

| Payroll Taxes | $4,500 | $5,250 | $6,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $44,316 | $49,866 | $55,416 |

| Profit Before Interest and Taxes | ($10,511) | $17,089 | $23,204 |

| EBITDA | ($9,395) | $18,205 | $24,320 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $5,127 | $6,961 |

| Net Profit | ($10,511) | $11,962 | $16,243 |

| Net Profit/Sales | -25.81% | 14.83% | 17.15% |

7.4 Projected Cash Flow

The following chart and table will indicate projected cash flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $40,728 | $80,668 | $94,723 |

| Subtotal Cash from Operations | $40,728 | $80,668 | $94,723 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $40,728 | $80,668 | $94,723 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $30,000 | $35,000 | $40,000 |

| Bill Payments | $18,222 | $31,814 | $36,972 |

| Subtotal Spent on Operations | $48,222 | $66,814 | $76,972 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $48,222 | $66,814 | $76,972 |

| Net Cash Flow | ($7,493) | $13,854 | $17,751 |

| Cash Balance | $4,257 | $18,111 | $35,862 |

7.5 Projected Balance Sheet

The following table will indicate the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $4,257 | $18,111 | $35,862 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $4,257 | $18,111 | $35,862 |

| Long-term Assets | |||

| Long-term Assets | $5,600 | $5,600 | $5,600 |

| Accumulated Depreciation | $1,116 | $2,232 | $3,348 |

| Total Long-term Assets | $4,484 | $3,368 | $2,252 |

| Total Assets | $8,741 | $21,479 | $38,114 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $1,902 | $2,679 | $3,071 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,902 | $2,679 | $3,071 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $1,902 | $2,679 | $3,071 |

| Paid-in Capital | $18,000 | $18,000 | $18,000 |

| Retained Earnings | ($650) | ($11,161) | $801 |

| Earnings | ($10,511) | $11,962 | $16,243 |

| Total Capital | $6,839 | $18,801 | $35,043 |

| Total Liabilities and Capital | $8,741 | $21,479 | $38,114 |

| Net Worth | $6,839 | $18,801 | $35,043 |

7.6 Business Ratios

The following Ratios table compares standard ratios based on the Standard Industry Code #3269, Pottery Products, to the planned numbers for Kaolin Calefactors.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 98.06% | 17.42% | 5.10% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 39.20% |

| Total Current Assets | 48.70% | 84.32% | 94.09% | 76.70% |

| Long-term Assets | 51.30% | 15.68% | 5.91% | 23.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 21.76% | 12.47% | 8.06% | 34.10% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 19.80% |

| Total Liabilities | 21.76% | 12.47% | 8.06% | 53.90% |

| Net Worth | 78.24% | 87.53% | 91.94% | 46.10% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 83.00% | 83.00% | 83.00% | 38.40% |

| Selling, General & Administrative Expenses | 108.81% | 68.17% | 65.85% | 21.60% |

| Advertising Expenses | 2.21% | 1.12% | 0.95% | 1.20% |

| Profit Before Interest and Taxes | -25.81% | 21.18% | 24.50% | 2.80% |

| Main Ratios | ||||

| Current | 2.24 | 6.76 | 11.68 | 1.77 |

| Quick | 2.24 | 6.76 | 11.68 | 1.01 |

| Total Debt to Total Assets | 21.76% | 12.47% | 8.06% | 53.90% |

| Pre-tax Return on Net Worth | -153.71% | 90.89% | 66.21% | 3.40% |

| Pre-tax Return on Assets | -120.26% | 79.56% | 60.88% | 7.40% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -25.81% | 14.83% | 17.15% | n.a |

| Return on Equity | -153.71% | 63.63% | 46.35% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 10.58 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 26 | 28 | n.a |

| Total Asset Turnover | 4.66 | 3.76 | 2.49 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.28 | 0.14 | 0.09 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $2,355 | $15,433 | $32,791 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.21 | 0.27 | 0.40 | n.a |

| Current Debt/Total Assets | 22% | 12% | 8% | n.a |

| Acid Test | 2.24 | 6.76 | 11.68 | n.a |

| Sales/Net Worth | 5.96 | 4.29 | 2.70 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Gift purchasers | 0% | $500 | $650 | $1,025 | $1,400 | $1,600 | $1,758 | $2,014 | $2,245 | $2,378 | $2,578 | $2,601 | $2,687 |

| End consumers | 0% | $450 | $585 | $923 | $1,260 | $1,440 | $1,582 | $1,813 | $2,021 | $2,140 | $2,320 | $2,341 | $2,418 |

| Total Sales | $950 | $1,235 | $1,948 | $2,660 | $3,040 | $3,340 | $3,827 | $4,266 | $4,518 | $4,898 | $4,942 | $5,105 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Gift purchasers | $85 | $111 | $174 | $238 | $272 | $299 | $342 | $382 | $404 | $438 | $442 | $457 | |

| End consumers | $77 | $99 | $157 | $214 | $245 | $269 | $308 | $343 | $364 | $394 | $398 | $411 | |

| Subtotal Direct Cost of Sales | $162 | $210 | $331 | $452 | $517 | $568 | $651 | $725 | $768 | $833 | $840 | $868 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sue | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| Total Payroll | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $950 | $1,235 | $1,948 | $2,660 | $3,040 | $3,340 | $3,827 | $4,266 | $4,518 | $4,898 | $4,942 | $5,105 | |

| Direct Cost of Sales | $162 | $210 | $331 | $452 | $517 | $568 | $651 | $725 | $768 | $833 | $840 | $868 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $162 | $210 | $331 | $452 | $517 | $568 | $651 | $725 | $768 | $833 | $840 | $868 | |

| Gross Margin | $789 | $1,025 | $1,616 | $2,208 | $2,523 | $2,772 | $3,176 | $3,540 | $3,750 | $4,066 | $4,102 | $4,237 | |

| Gross Margin % | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | 83.00% | |

| Expenses | |||||||||||||

| Payroll | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Sales and Marketing and Other Expenses | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | |

| Depreciation | $93 | $93 | $93 | $93 | $93 | $93 | $93 | $93 | $93 | $93 | $93 | $93 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities/ DSL/ web hosting | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Insurance | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | |

| Rent | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | $350 | |

| Payroll Taxes | 15% | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | $3,693 | |

| Profit Before Interest and Taxes | ($2,905) | ($2,668) | ($2,077) | ($1,485) | ($1,170) | ($921) | ($517) | ($153) | $57 | $373 | $409 | $544 | |

| EBITDA | ($2,812) | ($2,575) | ($1,984) | ($1,392) | ($1,077) | ($828) | ($424) | ($60) | $150 | $466 | $502 | $637 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($2,905) | ($2,668) | ($2,077) | ($1,485) | ($1,170) | ($921) | ($517) | ($153) | $57 | $373 | $409 | $544 | |

| Net Profit/Sales | -305.74% | -216.03% | -106.63% | -55.83% | -38.48% | -27.56% | -13.51% | -3.58% | 1.26% | 7.60% | 8.27% | 10.66% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $950 | $1,235 | $1,948 | $2,660 | $3,040 | $3,340 | $3,827 | $4,266 | $4,518 | $4,898 | $4,942 | $5,105 | |

| Subtotal Cash from Operations | $950 | $1,235 | $1,948 | $2,660 | $3,040 | $3,340 | $3,827 | $4,266 | $4,518 | $4,898 | $4,942 | $5,105 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $950 | $1,235 | $1,948 | $2,660 | $3,040 | $3,340 | $3,827 | $4,266 | $4,518 | $4,898 | $4,942 | $5,105 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | |

| Bill Payments | $42 | $1,263 | $1,314 | $1,435 | $1,554 | $1,619 | $1,671 | $1,753 | $1,827 | $1,870 | $1,933 | $1,941 | |

| Subtotal Spent on Operations | $2,542 | $3,763 | $3,814 | $3,935 | $4,054 | $4,119 | $4,171 | $4,253 | $4,327 | $4,370 | $4,433 | $4,441 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,542 | $3,763 | $3,814 | $3,935 | $4,054 | $4,119 | $4,171 | $4,253 | $4,327 | $4,370 | $4,433 | $4,441 | |

| Net Cash Flow | ($1,592) | ($2,528) | ($1,866) | ($1,275) | ($1,014) | ($778) | ($344) | $12 | $192 | $528 | $509 | $664 | |

| Cash Balance | $10,158 | $7,630 | $5,763 | $4,488 | $3,474 | $2,696 | $2,352 | $2,364 | $2,556 | $3,084 | $3,593 | $4,257 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $11,750 | $10,158 | $7,630 | $5,763 | $4,488 | $3,474 | $2,696 | $2,352 | $2,364 | $2,556 | $3,084 | $3,593 | $4,257 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $11,750 | $10,158 | $7,630 | $5,763 | $4,488 | $3,474 | $2,696 | $2,352 | $2,364 | $2,556 | $3,084 | $3,593 | $4,257 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 | $5,600 |

| Accumulated Depreciation | $0 | $93 | $186 | $279 | $372 | $465 | $558 | $651 | $744 | $837 | $930 | $1,023 | $1,116 |

| Total Long-term Assets | $5,600 | $5,507 | $5,414 | $5,321 | $5,228 | $5,135 | $5,042 | $4,949 | $4,856 | $4,763 | $4,670 | $4,577 | $4,484 |

| Total Assets | $17,350 | $15,665 | $13,044 | $11,084 | $9,716 | $8,609 | $7,738 | $7,301 | $7,220 | $7,319 | $7,754 | $8,170 | $8,741 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,219 | $1,266 | $1,383 | $1,500 | $1,563 | $1,612 | $1,692 | $1,764 | $1,806 | $1,868 | $1,875 | $1,902 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,219 | $1,266 | $1,383 | $1,500 | $1,563 | $1,612 | $1,692 | $1,764 | $1,806 | $1,868 | $1,875 | $1,902 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $1,219 | $1,266 | $1,383 | $1,500 | $1,563 | $1,612 | $1,692 | $1,764 | $1,806 | $1,868 | $1,875 | $1,902 |

| Paid-in Capital | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 | $18,000 |

| Retained Earnings | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) |

| Earnings | $0 | ($2,905) | ($5,572) | ($7,649) | ($9,134) | ($10,304) | ($11,225) | ($11,742) | ($11,894) | ($11,837) | ($11,465) | ($11,056) | ($10,511) |

| Total Capital | $17,350 | $14,446 | $11,778 | $9,701 | $8,216 | $7,046 | $6,125 | $5,608 | $5,456 | $5,513 | $5,885 | $6,294 | $6,839 |

| Total Liabilities and Capital | $17,350 | $15,665 | $13,044 | $11,084 | $9,716 | $8,609 | $7,738 | $7,301 | $7,220 | $7,319 | $7,754 | $8,170 | $8,741 |

| Net Worth | $17,350 | $14,446 | $11,778 | $9,701 | $8,216 | $7,046 | $6,125 | $5,608 | $5,456 | $5,513 | $5,885 | $6,294 | $6,839 |