Gentle Touch Creations

Executive Summary

Gentle Touch Creations is a start-up business specializing in hand-made herbal products created by Joanne Lovejoy, the company founder. These products include herbal therapy packs, soaps, Saint-John’s-wort oil, balsam eye packs, salves, moisturizers, herbal bath bags, and bath powder. All Gentle Touch Creations are made from herbs that are either garden grown or gathered in local fields or wooded areas when they are at their peak of maturity and the concentration of active ingredients is highest.

Herbal products have grown in popularity with consumers over the past ten years. Herbal products industry exceeded $4.3 billion dollar in sales last year. Where once a customer would have to go to a speciality shop to purchase herbal products, now those same product are available at the local supermarket. The demand has created a cottage industry of supplying herbal products to companies who then market the product under their own brand name.

Gentle Touch Creations will sell its product line to herbal product companies that sell baskets with specific themes (such as balsam salve and eye packs).

Joanne Lovejoy has seven years of experience in the herbal product industry. She has worked as a Product Manager for both Jerry’s Herbal Products and Safe Soap. She has maintained her contacts in the industry and has already signed contracts with Forest Meadows Products and WindWalker Products to supply herbal therapy packs, salves, balsam eye pack, and Saint-John’s-wort oil.

1.1 Mission

The mission of Gentle Touch Creations is to create herbal products that heal, sooth and cleanse our customers.

1.2 Objectives

The objectives for Gentle Touch Creations are as follows:

- Achieve sales goal of $120,000 during first year of operation.

- Achieve a regular customer base of 10 companies.

- Increase sales by 15% during the second year of operation.

Company Summary

Gentle Touch Creations is a provider of herbal products including herbal therapy packs, soaps, Saint-John’s-wort oil, balsam eye packs, salves, moisturizers, herbal bath bags, and bath powder. Gentle Touch Creations sells its product line to herbal product companies that sell baskets with specific herbal themes.

The company will be organized as a Sole Proprietorship.

2.1 Company Ownership

Gentle Touch Creations is owned by Joanne Lovejoy.

2.2 Start-up Summary

The start-up expense for the Gentle Touch Creations is focused primarily on production and extraction equipment. Joanne Lovejoy will invest $50,000. In addition, she will secure a $50,000 SBA loan.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $600 |

| Stationery etc. | $100 |

| Insurance | $300 |

| Rent | $600 |

| Expensed Equipment | $40,000 |

| Total Start-up Expenses | $41,600 |

| Start-up Assets | |

| Cash Required | $33,400 |

| Start-up Inventory | $5,000 |

| Other Current Assets | $5,000 |

| Long-term Assets | $15,000 |

| Total Assets | $58,400 |

| Total Requirements | $100,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $41,600 |

| Start-up Assets to Fund | $58,400 |

| Total Funding Required | $100,000 |

| Assets | |

| Non-cash Assets from Start-up | $25,000 |

| Cash Requirements from Start-up | $33,400 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $33,400 |

| Total Assets | $58,400 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $50,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $50,000 |

| Capital | |

| Planned Investment | |

| Joanne Lovejoy | $50,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $50,000 |

| Loss at Start-up (Start-up Expenses) | ($41,600) |

| Total Capital | $8,400 |

| Total Capital and Liabilities | $58,400 |

| Total Funding | $100,000 |

2.3 Company Locations and Facilities

Gentle Touch Creations is located in a 2,000 square foot manufacturing space in the Sneed Industrial Park in northwest Tracy.

Products

The product line of Gentle Touch Creations is as follows:

- Herbal Therapy Packs for back and neck pain and relief of muscle aches, filled with wheat berries and flax seed and 10 herbs. These are made of natural cotton or patterned flannel and can be heated in the microwave oven or cooled in the freezer for optimum benefit.

- Saint-John’s-wort oil for use as an anti-inflammatory or for burns, in a roll-on applicator.

- Balsam eye packs in eye-pleasing patterns that help relieve sinus discomfort and eyestrain.

- Salves with Comfrey for healing cuts, Goldenseal, Balsam and other herbs for use on split skin caused by the drying effects of heat, cold or water.

- Moisturizer for face and hands with various scented oils.

- Soaps created with such herbs as powdered balsam and rose petals marbleized throughout each cake, gently scented.

- Herbal bath bags of lavender, peppermint, oatmeal and herbs.

- Bath powder made from arrowroot, cornstarch, rose petals and other herbs.

Market Analysis Summary

Herbal products have grown in popularity with consumers over the past ten years. The herbal products industry exceeded $4.3 billion in sales last year. Where once a customer would have to go to a speciality shop to purchase herbal products, now those same products are available at the local supermarket. The demand has created a cottage industry of supplying herbal products to companies who then market these products under their own brand name.

Currently, the industry can be divided into two segments:

- Herbal Health Products

- Herbal Beauty Products.

4.1 Market Segmentation

Gentle Touch Creations will focus on two target companies:

- Herbal Heath Products: The Northeast is home to a number of small-to-medium size herbal heath product companies such as Comfort Zone and HealthSmart in Burlington, GHK Natural Products and Wise Herb in Madison, and Sliver Dream and Simple LIfe in Montgomery. All of these companies buy raw or finished product from third-party vendors. These companies generated sales in excess of $40 million last year. Their products are sold in health and natural food stores on the East Coast and Midwest.

- Herbal Beauty Products: The Northeast is also home to a number of small-to-medium size herbal beauty product companies such as Glow and Nature’s Way in Tracy, Garden Dream and Rising Sun Products in Madison, and Carpe Diem Natural Products and Simple LIfe in Montgomery. All of these companies buy raw or finished product from third-party vendors. These companies generated sales in excess of $60 million last year. Most of their product are sold in health and natural food stores only on the East Coast.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Herbal Heath Products | 1% | 20,000 | 20,200 | 20,402 | 20,606 | 20,812 | 1.00% |

| Herbal Beauty Products | 2% | 4,000 | 4,080 | 4,162 | 4,245 | 4,330 | 2.00% |

| Total | 1.17% | 24,000 | 24,280 | 24,564 | 24,851 | 25,142 | 1.17% |

4.2 Target Market Segment Strategy

Herbal health products dominate sales but herbal beauty products have been growing in popularity each year.

There are 10,000 herbal health product companies that are competing for market share among consumers. Most of these companies are regionally focused but 15% of these companies distribute their products nationally. This is compared to only 2,000 herbal beauty product companies. Most of these companies also only compete regionally though there are a handful (4%) that dominate the national market. As sales grow in herbal beauty product, more new companies will enter the marketplace.

Gentle Touch Products will focus on the small companies serving the East Coast regional market. Many of these smaller companies aggressively seek out new products that they can add to their product line. The cost of manufacturing all these items themselves is prohibitive so they contract with third party vendors to supply product.

4.3 Service Business Analysis

As the herbal market has grown into a multi-billion dollar industry, so has the opportunity for small firms and farms to supply product to larger herbal companies that then repackage and market the product under their own brand. The size of these suppliers can range to a one-person operation to a small farm that can have 20 or more employees.

As the larger and second tier companies face off to win greater market share, they are constantly looking for additional product items that will improve their advantage in the marketplace. Routinely, a product like an herbal therapy pack, is an attractive cost efficient addition to a product line.

4.3.1 Competition and Buying Patterns

Quality and timeliness are the essential factors in being successful as a supplier to an herbal product company. This is especially true when the product is re-packaged as part of a gift basket. A delay in delivery will impact the company’s ability to meet delivery deadlines.

Quality is also an important factor because word of mouth is one of the strongest marketing tools with herbal products. The local success of an herbal product many times leads to a larger company procuring the product for their line.

Joanne Lovejoy has sold her herbal products at craft fairs in the region for the past five years. The popularity and customer satisfaction of these products was an important selling point when WindWalker Products first approached Joanne about her herbal therapy packs.

Strategy and Implementation Summary

Gentle Touch Creations will focus first on building a client base with herbal health product companies. Joanne Lovejoy will be responsible for marketing the company’s services to potential customers.

Currently, the company has been successful in acquiring 2 contracts with the following companies:

- Forest Meadows Products

- WindWalker Products.

5.1 Competitive Edge

The competitive advantage of Gentle Touch Creations is the consistent quality of the herbs that are at the core of each product. The products have been tested locally for years developing and establishing the customer satisfaction level demanded by Gentle Touch Creations.

5.2 Sales Strategy

Joanne Lovejoy has seven years of experience in the herbal product industry. She has worked as a Product Manager for both Jerry’s Herbal Products and Safe Soap. She has maintained her contacts in the industry and has already signed contracts with Forest Meadows Products and WindWalker Products to supply herbal therapy packs, salves, balsam eye packs, and Saint-John’s-wort oil.

Joanne Lovejoy will build on these successes and market her product line to herbal product companies through face-to-face selling.

5.2.1 Sales Forecast

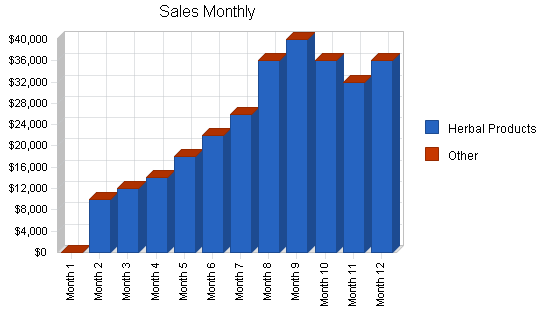

Gentle Touch Creations anticipates that sales will start quickly. The first billing will be sent out in mid-May.

The following sales forecast table and chart are for three years. Monthly figures for the first year are in the appendix.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Herbal Products | $282,000 | $340,000 | $420,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $282,000 | $340,000 | $420,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Herbal Products | $141,000 | $170,000 | $200,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $141,000 | $170,000 | $200,000 |

5.3 Marketing Strategy

Joanne Lovejoy will market the company’s product line at regional craft fairs. She will coordinate her fair participation with presentation meetings with herbal company representatives. In addition she will regularly send free samples to her potential clients so that they can experience the quality of her products first hand. The key to her marketing though will be face-to-face sales.

Joanne will also launch the Gentle Touch Creations website. The site will be designed to promote her products, list a calendar of her craft fair appearances, and, initially, offer a selection or her most popular products for direct web-sales. She will rely on the experts at 1st-at-the-Top.com Internet and E-commerce consultants for the design, hosting, and search engine placement of the website.

5.4 Milestones

The accompanying table shows specific milestones, with responsibilities assigned, dates, and (in most cases) budgets. Joanne is focusing, in this plan, on a few key milestones that should be accomplished.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Setup Production Facility | 3/1/2002 | 5/1/2002 | $40,000 | Joanne Lovejoy | Owner |

| Establish Inventory | 4/1/2002 | 5/5/2002 | $5,000 | Joanne Lovejoy | Owner |

| Confirm Craft Fair Dates | 5/1/2002 | 6/21/2002 | $1,000 | Joanne Lovejoy | Owner |

| Develop Website | 4/1/2002 | 7/1/2002 | $2,000 | 1st-at-the-Top.com | Web |

| Totals | $48,000 | ||||

Personnel Plan

Joanne Lovejoy has seven years of experience in the herbal product industry. She has worked as a Product Manager for both Jerry’s Herbal Products and Safe Soap. She has experience managing a staff and getting their best performance.

Over the past three years, Joanne has built her business from a part-time craft activity to its current production level. Her current staff should be sufficient for the first two years of operation. It is possible that there will be additional hiring during the third year of operation.

Financial Plan

The following topics cover the financial plan for Gentle Touch Products. The tables show annual figures. Monthly numbers for the first year are in the appendix.

7.1 Break-even Analysis

The monthly break-even point is approximately $17,000.

| Break-even Analysis | |

| Monthly Revenue Break-even | $17,188 |

| Assumptions: | |

| Average Percent Variable Cost | 50% |

| Estimated Monthly Fixed Cost | $8,594 |

7.2 Projected Profit and Loss

The following table and charts highlight the projected profit and loss for three years.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $282,000 | $340,000 | $420,000 |

| Direct Cost of Sales | $141,000 | $170,000 | $200,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $141,000 | $170,000 | $200,000 |

| Gross Margin | $141,000 | $170,000 | $220,000 |

| Gross Margin % | 50.00% | 50.00% | 52.38% |

| Expenses | |||

| Payroll | $70,800 | $76,000 | $105,000 |

| Sales and Marketing and Other Expenses | $4,260 | $7,200 | $8,500 |

| Depreciation | $4,800 | $4,800 | $4,800 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $4,800 | $5,300 | $6,000 |

| Insurance | $650 | $780 | $900 |

| Rent | $7,200 | $7,800 | $8,500 |

| Payroll Taxes | $10,620 | $11,400 | $15,750 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $103,130 | $113,280 | $149,450 |

| Profit Before Interest and Taxes | $37,870 | $56,720 | $70,550 |

| EBITDA | $42,670 | $61,520 | $75,350 |

| Interest Expense | $5,158 | $4,340 | $3,050 |

| Taxes Incurred | $9,814 | $15,714 | $20,250 |

| Net Profit | $22,899 | $36,666 | $47,250 |

| Net Profit/Sales | 8.12% | 10.78% | 11.25% |

7.3 Projected Cash Flow

The following table and chart highlights the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $70,500 | $85,000 | $105,000 |

| Cash from Receivables | $161,300 | $244,675 | $300,759 |

| Subtotal Cash from Operations | $231,800 | $329,675 | $405,759 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $12,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $243,800 | $329,675 | $405,759 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $70,800 | $76,000 | $105,000 |

| Bill Payments | $173,564 | $232,719 | $263,829 |

| Subtotal Spent on Operations | $244,364 | $308,719 | $368,829 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $3,000 | $6,000 | $3,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $8,400 | $8,400 | $8,400 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $255,764 | $323,119 | $380,229 |

| Net Cash Flow | ($11,964) | $6,556 | $25,530 |

| Cash Balance | $21,436 | $27,993 | $53,522 |

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $21,436 | $27,993 | $53,522 |

| Accounts Receivable | $50,200 | $60,525 | $74,766 |

| Inventory | $19,800 | $23,872 | $28,085 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $96,436 | $117,390 | $161,373 |

| Long-term Assets | |||

| Long-term Assets | $15,000 | $15,000 | $15,000 |

| Accumulated Depreciation | $4,800 | $9,600 | $14,400 |

| Total Long-term Assets | $10,200 | $5,400 | $600 |

| Total Assets | $106,636 | $122,790 | $161,973 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $24,738 | $18,625 | $21,959 |

| Current Borrowing | $9,000 | $3,000 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $33,738 | $21,625 | $21,959 |

| Long-term Liabilities | $41,600 | $33,200 | $24,800 |

| Total Liabilities | $75,338 | $54,825 | $46,759 |

| Paid-in Capital | $50,000 | $50,000 | $50,000 |

| Retained Earnings | ($41,600) | ($18,701) | $17,965 |

| Earnings | $22,899 | $36,666 | $47,250 |

| Total Capital | $31,299 | $67,965 | $115,215 |

| Total Liabilities and Capital | $106,636 | $122,790 | $161,973 |

| Net Worth | $31,299 | $67,965 | $115,215 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5122, Drug, Proprietaries, and Sundries, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 20.57% | 23.53% | 16.90% |

| Percent of Total Assets | ||||

| Accounts Receivable | 47.08% | 49.29% | 46.16% | 28.90% |

| Inventory | 18.57% | 19.44% | 17.34% | 31.30% |

| Other Current Assets | 4.69% | 4.07% | 3.09% | 28.80% |

| Total Current Assets | 90.43% | 95.60% | 99.63% | 89.00% |

| Long-term Assets | 9.57% | 4.40% | 0.37% | 11.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 31.64% | 17.61% | 13.56% | 49.00% |

| Long-term Liabilities | 39.01% | 27.04% | 15.31% | 12.60% |

| Total Liabilities | 70.65% | 44.65% | 28.87% | 61.60% |

| Net Worth | 29.35% | 55.35% | 71.13% | 38.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 50.00% | 50.00% | 52.38% | 25.20% |

| Selling, General & Administrative Expenses | 41.73% | 39.09% | 41.11% | 15.50% |

| Advertising Expenses | 0.85% | 0.88% | 0.95% | 1.00% |

| Profit Before Interest and Taxes | 13.43% | 16.68% | 16.80% | 1.80% |

| Main Ratios | ||||

| Current | 2.86 | 5.43 | 7.35 | 1.67 |

| Quick | 2.27 | 4.32 | 6.07 | 0.86 |

| Total Debt to Total Assets | 70.65% | 44.65% | 28.87% | 61.60% |

| Pre-tax Return on Net Worth | 104.52% | 77.07% | 58.59% | 5.70% |

| Pre-tax Return on Assets | 30.68% | 42.66% | 41.67% | 14.90% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 8.12% | 10.78% | 11.25% | n.a |

| Return on Equity | 73.16% | 53.95% | 41.01% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.21 | 4.21 | 4.21 | n.a |

| Collection Days | 56 | 79 | 78 | n.a |

| Inventory Turnover | 10.57 | 7.79 | 7.70 | n.a |

| Accounts Payable Turnover | 8.02 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 35 | 28 | n.a |

| Total Asset Turnover | 2.64 | 2.77 | 2.59 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 2.41 | 0.81 | 0.41 | n.a |

| Current Liab. to Liab. | 0.45 | 0.39 | 0.47 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $62,699 | $95,765 | $139,415 | n.a |

| Interest Coverage | 7.34 | 13.07 | 23.13 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.38 | 0.36 | 0.39 | n.a |

| Current Debt/Total Assets | 32% | 18% | 14% | n.a |

| Acid Test | 0.78 | 1.53 | 2.67 | n.a |

| Sales/Net Worth | 9.01 | 5.00 | 3.65 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Herbal Products | 0% | $0 | $10,000 | $12,000 | $14,000 | $18,000 | $22,000 | $26,000 | $36,000 | $40,000 | $36,000 | $32,000 | $36,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $0 | $10,000 | $12,000 | $14,000 | $18,000 | $22,000 | $26,000 | $36,000 | $40,000 | $36,000 | $32,000 | $36,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Herbal Products | $0 | $5,000 | $6,000 | $7,000 | $9,000 | $11,000 | $13,000 | $18,000 | $20,000 | $18,000 | $16,000 | $18,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $0 | $5,000 | $6,000 | $7,000 | $9,000 | $11,000 | $13,000 | $18,000 | $20,000 | $18,000 | $16,000 | $18,000 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Joanne Lovejoy | 0% | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| 2 Production Staff | 0% | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 |

| P/T Production Staff | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Total Payroll | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $10,000 | $12,000 | $14,000 | $18,000 | $22,000 | $26,000 | $36,000 | $40,000 | $36,000 | $32,000 | $36,000 | |

| Direct Cost of Sales | $0 | $5,000 | $6,000 | $7,000 | $9,000 | $11,000 | $13,000 | $18,000 | $20,000 | $18,000 | $16,000 | $18,000 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $5,000 | $6,000 | $7,000 | $9,000 | $11,000 | $13,000 | $18,000 | $20,000 | $18,000 | $16,000 | $18,000 | |

| Gross Margin | $0 | $5,000 | $6,000 | $7,000 | $9,000 | $11,000 | $13,000 | $18,000 | $20,000 | $18,000 | $16,000 | $18,000 | |

| Gross Margin % | 0.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | |

| Expenses | |||||||||||||

| Payroll | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | |

| Sales and Marketing and Other Expenses | $380 | $380 | $380 | $380 | $380 | $380 | $380 | $230 | $230 | $380 | $380 | $380 | |

| Depreciation | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Insurance | $650 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | $600 | |

| Payroll Taxes | 15% | $885 | $885 | $885 | $885 | $885 | $885 | $885 | $885 | $885 | $885 | $885 | $885 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $9,215 | $8,565 | $8,565 | $8,565 | $8,565 | $8,565 | $8,565 | $8,415 | $8,415 | $8,565 | $8,565 | $8,565 | |

| Profit Before Interest and Taxes | ($9,215) | ($3,565) | ($2,565) | ($1,565) | $435 | $2,435 | $4,435 | $9,585 | $11,585 | $9,435 | $7,435 | $9,435 | |

| EBITDA | ($8,815) | ($3,165) | ($2,165) | ($1,165) | $835 | $2,835 | $4,835 | $9,985 | $11,985 | $9,835 | $7,835 | $9,835 | |

| Interest Expense | $411 | $405 | $399 | $393 | $388 | $482 | $472 | $462 | $452 | $442 | $432 | $422 | |

| Taxes Incurred | ($2,888) | ($1,191) | ($889) | ($588) | $14 | $586 | $1,189 | $2,737 | $3,340 | $2,698 | $2,101 | $2,704 | |

| Net Profit | ($6,738) | ($2,779) | ($2,075) | ($1,371) | $33 | $1,367 | $2,774 | $6,386 | $7,793 | $6,295 | $4,902 | $6,309 | |

| Net Profit/Sales | 0.00% | -27.79% | -17.29% | -9.79% | 0.18% | 6.22% | 10.67% | 17.74% | 19.48% | 17.49% | 15.32% | 17.53% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $2,500 | $3,000 | $3,500 | $4,500 | $5,500 | $6,500 | $9,000 | $10,000 | $9,000 | $8,000 | $9,000 | |

| Cash from Receivables | $0 | $0 | $250 | $7,550 | $9,050 | $10,600 | $13,600 | $16,600 | $19,750 | $27,100 | $29,900 | $26,900 | |

| Subtotal Cash from Operations | $0 | $2,500 | $3,250 | $11,050 | $13,550 | $16,100 | $20,100 | $25,600 | $29,750 | $36,100 | $37,900 | $35,900 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $12,000 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $2,500 | $3,250 | $11,050 | $13,550 | $28,100 | $20,100 | $25,600 | $29,750 | $36,100 | $37,900 | $35,900 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | $5,900 | |

| Bill Payments | $15 | $656 | $7,042 | $8,918 | $10,294 | $13,956 | $16,619 | $19,449 | $28,790 | $27,877 | $21,118 | $18,831 | |

| Subtotal Spent on Operations | $5,915 | $6,556 | $12,942 | $14,818 | $16,194 | $19,856 | $22,519 | $25,349 | $34,690 | $33,777 | $27,018 | $24,731 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $6,615 | $7,256 | $13,642 | $15,518 | $16,894 | $20,556 | $23,719 | $26,549 | $35,890 | $34,977 | $28,218 | $25,931 | |

| Net Cash Flow | ($6,615) | ($4,756) | ($10,392) | ($4,468) | ($3,344) | $7,544 | ($3,619) | ($949) | ($6,140) | $1,123 | $9,682 | $9,969 | |

| Cash Balance | $26,785 | $22,029 | $11,637 | $7,169 | $3,825 | $11,369 | $7,750 | $6,802 | $662 | $1,785 | $11,467 | $21,436 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $33,400 | $26,785 | $22,029 | $11,637 | $7,169 | $3,825 | $11,369 | $7,750 | $6,802 | $662 | $1,785 | $11,467 | $21,436 |

| Accounts Receivable | $0 | $0 | $7,500 | $16,250 | $19,200 | $23,650 | $29,550 | $35,450 | $45,850 | $56,100 | $56,000 | $50,100 | $50,200 |

| Inventory | $5,000 | $5,000 | $5,500 | $6,600 | $7,700 | $9,900 | $12,100 | $14,300 | $19,800 | $22,000 | $19,800 | $17,600 | $19,800 |

| Other Current Assets | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $43,400 | $36,785 | $40,029 | $39,487 | $39,069 | $42,375 | $58,019 | $62,500 | $77,452 | $83,762 | $82,585 | $84,167 | $96,436 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Accumulated Depreciation | $0 | $400 | $800 | $1,200 | $1,600 | $2,000 | $2,400 | $2,800 | $3,200 | $3,600 | $4,000 | $4,400 | $4,800 |

| Total Long-term Assets | $15,000 | $14,600 | $14,200 | $13,800 | $13,400 | $13,000 | $12,600 | $12,200 | $11,800 | $11,400 | $11,000 | $10,600 | $10,200 |

| Total Assets | $58,400 | $51,385 | $54,229 | $53,287 | $52,469 | $55,375 | $70,619 | $74,700 | $89,252 | $95,162 | $93,585 | $94,767 | $106,636 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $423 | $6,746 | $8,579 | $9,832 | $13,405 | $15,982 | $18,488 | $27,853 | $27,170 | $20,498 | $17,978 | $24,738 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $12,000 | $11,500 | $11,000 | $10,500 | $10,000 | $9,500 | $9,000 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $423 | $6,746 | $8,579 | $9,832 | $13,405 | $27,982 | $29,988 | $38,853 | $37,670 | $30,498 | $27,478 | $33,738 |

| Long-term Liabilities | $50,000 | $49,300 | $48,600 | $47,900 | $47,200 | $46,500 | $45,800 | $45,100 | $44,400 | $43,700 | $43,000 | $42,300 | $41,600 |

| Total Liabilities | $50,000 | $49,723 | $55,346 | $56,479 | $57,032 | $59,905 | $73,782 | $75,088 | $83,253 | $81,370 | $73,498 | $69,778 | $75,338 |

| Paid-in Capital | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Retained Earnings | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) | ($41,600) |

| Earnings | $0 | ($6,738) | ($9,517) | ($11,592) | ($12,963) | ($12,930) | ($11,562) | ($8,788) | ($2,402) | $5,392 | $11,687 | $16,589 | $22,899 |

| Total Capital | $8,400 | $1,662 | ($1,117) | ($3,192) | ($4,563) | ($4,530) | ($3,162) | ($388) | $5,998 | $13,792 | $20,087 | $24,989 | $31,299 |

| Total Liabilities and Capital | $58,400 | $51,385 | $54,229 | $53,287 | $52,469 | $55,375 | $70,619 | $74,700 | $89,252 | $95,162 | $93,585 | $94,767 | $106,636 |

| Net Worth | $8,400 | $1,662 | ($1,117) | ($3,192) | ($4,563) | ($4,530) | ($3,162) | ($388) | $5,998 | $13,792 | $20,087 | $24,989 | $31,299 |