Accurate Chiropractic

Executive Summary

Accurate Chiropractic, LLC is a clinic that specializes in providing natural healthcare to members of the community who are injured as a result of motor vehicle and work related accidents, or suffer from chronic pain. Its owner is Dr. Angelo M. Rubano, Jr., D.C.

Dr. Rubano has a proven track record of success in his profession, having recently sold a practice in New Jersey for $124,000, which he purchased 3 years ago at a cost of $20,000. He has been in private practice as a business owner since graduating from Life Chiropractic College 11 years ago. His leadership ability has proven effective in both the civic and professional arenas, where he has served on various executive boards of successful and growing organizations. Through these organizations he has developed expertise in coordinating large scale events and networking. In addition, he is an accomplished public speaker, an attribute which has served him well as both an expert medical witness and lecturer on various health related topics.

His guiding business philosophy is to be creative rather than competitive. Realizing that nearly 80% of the population has never used or thought about Chiropractic Care, he understands there are more than enough potential patients to go around. Ultimately his plan for growth will incorporate other doctors in the area who can benefit from the corporate approach Accurate Chiropractic has for providing health and safety consultation to the service and construction corporate market. With this in mind Dr. Rubano’s approach is to see himself primarily as a marketer of chiropractic services. Accurate Chiropractic, LLC will reach the untapped market of Chiropractic patients by connecting emotionally with our target market through a systematic series of direct mail advertising. We will serve the injured directly, as well as indirectly through corporate clientele. We will be a contributor to the community through outreach events aimed at childrens’ and workers’ safety.

1.1 Mission

Our mission is to educate and adjust as many families as possible to optimal health through natural Chiropractic Care in an environment that encourages personal growth and development and recognizes the basic human need to feel in control and be respected.

1.2 Keys to Success

- Implementing and maintaining an organized, consistent means of lead generation, lead tracking, and follow-up to turn leads into prospects

- Utilizing a repeatable system for turning prospects into patients.

- Hiring and keeping reliable office staff who grasp the company mission and share the same concern for people.1

1 see Addendum, Personnel Plan

1.3 Objectives

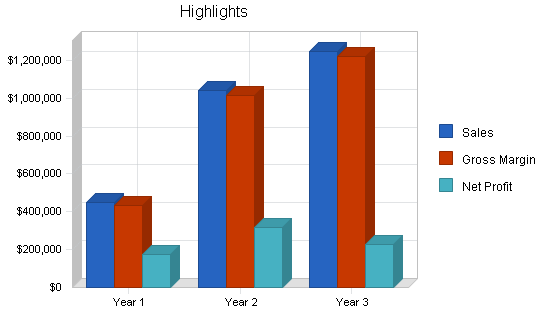

-

Collections of $420,000 in the first year

- Hold Gross Margin to minimum of 55%

- 300 total cases by the end of year 1

- Case Average of $3,500 by end of year 2

Company Summary

Accurate Chiropractic, LLC is a new company that provides patient-centered care, rehabilitation, and education to the following markets:

- Residents of our community injured in motor vehicle crashes and their families

- Chronic and acute back and neck pain sufferers and their families

- Members of the area’s work force that are injured on the job

As the business grows, we will bring on more providers to more readily facilitate our patients’ steps to wellness and fitness, and we will sell nutritional goods. Aside from treating injured workers, our goal will be to expand into the work related injury market and develop alliances with self insured companies on a consultant basis.

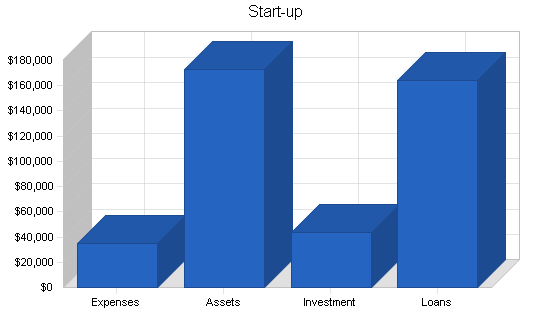

2.1 Start-up Summary

Our start-up costs are $207,575, which includes of concept research and development, business and marketing software, educational brochures, stationary, legal and accounting cost, office furniture and computers, initial month’s rent/security deposit, and initial advertising cost, including production of printed reports.

Long-term assets include a key of diagnostic equipment (Surface EMG with dynamic range of motion valued at $8,000), X-ray equipment, and chiropractic tables.

Much of this will be financed by direct owner investment. The projected loan to aid in the purchase of equipment and working capital is shown as a long term liability. The assumptions are shown in the following table and chart.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $2,500 |

| Stationery etc. | $1,000 |

| Brochures | $200 |

| Consultants | $0 |

| Insurance | $1,000 |

| Rent | $5,675 |

| Licensing | $6,000 |

| Research and Development | $6,000 |

| 800 Line Set Up Fees | $200 |

| Computers and Software | $8,000 |

| Print Advertising and Report Production | $1,000 |

| Office Furniture | $3,000 |

| Total Start-up Expenses | $34,575 |

| Start-up Assets | |

| Cash Required | $69,000 |

| Other Current Assets | $0 |

| Long-term Assets | $104,000 |

| Total Assets | $173,000 |

| Total Requirements | $207,575 |

| Start-up Funding | |

| Start-up Expenses to Fund | $34,575 |

| Start-up Assets to Fund | $173,000 |

| Total Funding Required | $207,575 |

| Assets | |

| Non-cash Assets from Start-up | $104,000 |

| Cash Requirements from Start-up | $69,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $69,000 |

| Total Assets | $173,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $164,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $164,000 |

| Capital | |

| Planned Investment | |

| Start Up Cost Funded by Owner | $33,575 |

| Additional Owner Capitol Investment | $10,000 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $43,575 |

| Loss at Start-up (Start-up Expenses) | ($34,575) |

| Total Capital | $9,000 |

| Total Capital and Liabilities | $173,000 |

| Total Funding | $207,575 |

2.2 Company Ownership

The company is set up as a Florida Limited Liability Corporation for the purpose of providing some shielding of liability to its members without the intricacies of an S-Corporation. The principal and founding member is Angelo M. Rubano, Jr. D.C.

Dr. Angelo M. Rubano, Jr. is a 1993 graduate of Life Chiropractic College in Marietta, Ga. After receiving his license to practice chiropractic medicine from the State of New Jersey in March of 19941 he immediately went into private practice as a junior partner of Adams Chiropractic Center in Wall, N.J. where he continued until 1999. During that time, he also was co-owner of The Pain Relief Center in Edison, N.J. In May of 2000 Dr. Rubano gave up his partnership with Adams Chiropractic and purchased The Pain Relief Center for $20,000, renaming the clinic Accurate Health and Wellness LLC. After producing increased revenues over the past three years, Dr. Rubano sold this practice for $124,000. Dr. Rubano received his license to practice chiropractic medicine in the State of Florida in May of 2003 and became certified by the state as a workers’ compensation provider in September of 2003.1

In addition to providing care to those injured in work and motor vehicle related accidents Dr. Rubano has also been called upon to function as the physician for college and professional sports teams, Fortune 500 companies, and the president and founder of one of the largest ministries in the Northeast United States.2 He has been utilized as a consultant and as a witness in personal injury cases because of his expertise in the area of Low Speed Rear Impact Collisions. Dr. Rubano served as president of Letip of Middlesex County3 for 2 years (maximum allowable term) and on the board of directors of the organization for 5 years. He was named an Elder of Faith Fellowship Ministries World Outreach Center, a 12,000 member church in Sayerville, New Jersey in 1998. He will continue in this role at the church’s Faith International Training School and Faith Fellowship World Outreach Ministries Church in Fort Myers, Florida. In this capacity he has helped the church organize its outreach ministry through home bible studies, and large gatherings such as the Great Big Event, in which he personally performed health screenings of 75 members of the Fort Myers community.

___________________________________________________

1 see Addendum, Credentials;

2 see Addendum, Testimonials;

3 Letip is an international organization that functions to help small businesses grow through the exchange of business tips. The central offices are located in California, and there are local chapters throughout the country.

Products and Services

Accurate Chiropractic, LLC offers a high level professional service that helps take injured and ill people of all ages from varying states of pain and inactivity to comfort and wholeness. We provide a drugless approach to healthcare by giving patients the tools they need, physically, mentally, and emotionally, to return to an active and healthy lifestyle. To the corporate client, we provide analysis of factors that increase the risk of on-the-job injuries and the tools to reduce those risks. Considering that low back pain is responsible for half of workers’ compensation costs, and that past research has demonstrated time and again that Chiropractic Care compared to other typical medical treatment is more successful and more cost effective for these conditions, it is obvious that this is a much needed service that will create a high demand when approached the right way.1,2

We will also sell products that support our services, including home exercise devices, pillows, TENS units, and weight loss programs. (A TENS — transcutaneous electric nerve stimulation –unit is a small, battery-powered, portable muscle stimulation machine that can be used at home to help control pain.)

___________________________________________________

1 Mootz, R.D., Franklin,G.M., Stoner,W.H. Strategies for preventing chronic disability in injured workers. Topical Clinical Chiropractic, 1999; 6(2):13-25

2 Florida Department of Labor and Employment Security, Division of Workers’ Compensation, Claims and Medical Billing Data, 1994-1999

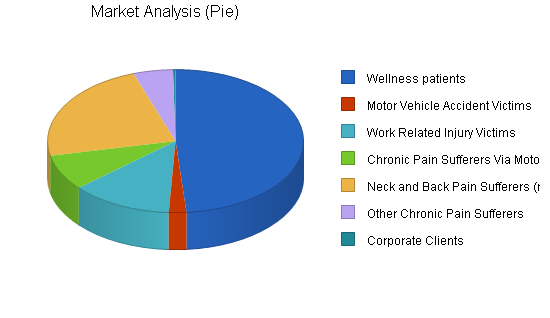

Market Analysis Summary

Accurate Chiropractic, LLC will focus on people injured in motor vehicle traffic accidents and work related incidents, as well as those with chronic and acute back and neck pain and their families. These are groups which respond well to conservative treatment and have often been dismissed by the medical community as malingerers or difficult to treat cases.

Our most important group of potential customers (those injured in accidents) come in all ages. They range in income and social status from the “Actualizers” (the very wealthy who are actually living the American Dream) to “Strugglers” (those that are barely getting by). Whether young or old, these people want to get back to an active lifestyle so they can to return to work, recreation, and family as quickly as possible and they are covered by the health, accident, or workers’ compensation insurance to pay for it or have the legal backing to win it in court.

4.1 Market Segmentation

- Recent Motor Vehicle Accident Victims: our most important segment includes those individuals injured within a 6 month time period of visiting our office. Insurance claims are easier to handle at this stage making for more lucrative reimbursement rates. In addition, early intervention aids more rapid recovery, which leads to greater word of mouth referral.

- Work Related Injury Victims: this is a yet untapped market in our field. Recent legislation in the state of Florida (Effective October 1, 2003) makes it possible for Chiropractors to not only treat injured workers but to also function as case managers. In this capacity we are able to direct the entire care of the injured worker. With case averages ranging from $6,323-$7,465 this is a very lucrative market. (Case averages referenced from Florida division of Financial services website: www.fldfs.com/WCAPPS/Claims_Research/Stats_Results.asp year 2001 statistics.)

- Victims of Chronic Pain Resultant from Past Motor Vehicle Accident: the segment of the population that has attempted other forms of treatment without the results they were expecting. They are candidates for not only a natural approach to treatment but also “back end” sales of therapeutic devices such as TENS units, heat and cold packs, and home exercise devices.

- Neck and Back Pain sufferers with onset unrelated to Motor Vehicle Accidents: This accounts for a large percentage of the population, nearly 30% of our population experiences one or the other (we have adjusted our numbers to account for the fact that a large portion of these will have experienced their problem as a result of a motor vehicle accident).

- Other Pain Sufferers: refers to the segment of the market that experiences pain syndromes like Fibromyalgia, Chronic Fatigue Syndrome, Migraine and Tension Headaches, Carpal Tunnel Syndrome, middle back pain, etc. This is a segment of the population we will attract thanks in part to our affiliation with several managed care and major medical programs. These are cases that most M.D.s are not equipped to properly service because their training in musculoskeletal disorders is limited, and the prescription drug route has yet to develop a legitimate answer for these problems.

- Corporate Clients: This segment of the market is primarily overlooked by Doctors of Chiropractic. But, based on the fact that musculoskeletal injuries are a significant contributor to rising workers’ compensation insurance costs, it is an area that is ripe for the Chiropractic Industry. Not only can we provide the care for their workers, but we can also provide the education and follow-up necessary to prevent injuries from occuring in the first place. The rapid development of SouthWest Florida in general, and Fort Myers in particular, has attracted many new businesses. Presently there are over 529 businesses in Lee County with 50 or more employees.1 By law, these companies are required to have safety programs in place. We can help provide them with the framework for their program to succeed.

- Wellness Patients: Through education and awareness programs,it is our goal to help the community understand the role their nervous and skeletal system plays in their overall well-being. This is the area for the largest growth potential. Whereas the other conditions are tied mainly to population growth, this area is tied to our ability to educate patientswho have healedon theimportance ofcontinuing care on a wellness and preventative basis.

___________________________________________________

1 Lee County Demographic Profile 2003, Lee County Economic Development Office (in conjunction with Horizon Council Team Lee County and The Lee County Industrial Development Authority)

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Wellness patients | 6% | 78,697 | 83,419 | 88,424 | 93,729 | 99,353 | 6.00% |

| Motor Vehicle Accident Victims | 6% | 3,553 | 3,766 | 3,992 | 4,232 | 4,486 | 6.00% |

| Work Related Injury Victims | 1% | 20,603 | 20,809 | 21,017 | 21,227 | 21,439 | 1.00% |

| Chronic Pain Sufferers Via Motor Vehicle Accidents | 6% | 13,141 | 13,929 | 14,765 | 15,651 | 16,590 | 6.00% |

| Neck and Back Pain Sufferers (non MVA) | 6% | 37,182 | 39,413 | 41,778 | 44,285 | 46,942 | 6.00% |

| Other Chronic Pain Sufferers | 6% | 8,062 | 8,546 | 9,059 | 9,603 | 10,179 | 6.00% |

| Corporate Clients | 3% | 529 | 542 | 558 | 575 | 592 | 2.85% |

| Total | 5.39% | 161,767 | 170,424 | 179,593 | 189,302 | 199,581 | 5.39% |

4.2 Service Business Analysis

Chiropractic Medicine in Lee County, Florida consists of several hundred chiropractic offices. In the city of Fort Myers and neighboring Fort Myers Beach, there are some 73 offices listed.1

Chiropractic entities range from small operations which do not take or accept insurance plans to multi-discipline offices with medical doctors and physical therapist on staff. While practicing in New Jersey, I was part of the Provider Panels for several of the largest Health Insurance Providers, including several that are among the most heavily utilized in Florida, including Aetna, United HealthCare, and Blue Cross/Blue Shield. While I stand a good chance of being accepted into these organizations, due in part to my relationship with a key representative within the Lee County Government Office (letters of recommendation from large employers count a great deal to image conscious insurance companies), this segment only affects a small percentage of my overall plan for success. Since automobile accident cases do not follow the managed care paradigm, there is easy access to our services without need of referral or membership in a managed care organization. Within the area of workers’ compensation, although managed care does play a role to a certain extent, our plan to market to “self insured” companies (see Marketing Plan) will give our clinic ample exposure and access to thousands of injured workers without the stipulations of managed care, nor their propensity to slash medical fees.

___________________________________________________

1 Yellow Book 2003-2004, Ft. Myers/Cape Coral Edition, Chiropractic Section, pages 182-185.

4.2.1 Competition and Buying Patterns

The key element in the purchase decisions in the healthcare of accident victims is the patient’s perceptions of the doctor’s competence and empathy with his or her situation. More so than in illness care, there is a certain psychosocial component that goes along with being injured in an accident and the potential of being unable to provide for yourself or for your family for any length of time. The doctor who can demonstrate to the patient that he has a good sense of what the patient is experiencing is more likely to connect with and gain the trust of that patient. This relationship is fostered by establishing a game plan for that patient’s care and consistently following that game plan so that there are no sudden changes or surprises.

Auto accident patients frequently are referred by personal injury attorneys and medical doctors; therefore, it is essential to build relationships with attorneys in the area that specialize in personal injury litigation as well as medical physicians. Maintaining these relationships requires prompt reporting, open lines of communication, and the utilization of a team of specialists in other fields of diagnostic imaging and medicine.

Patients rarely compare providers. Typically if they are referred by an outside source such as an attorney, physician, or other patient they follow the word of mouth referral. It is rare for someone to go price shopping from one chiropractor to the next, although some will “shop” for a second opinion.

The most important element by far is what it takes to keep a patient and have that patient refer their friends and family. It is well worth the effort to go the extra mile and return the patient’s (or attorney’s, or doctor’s) phone call personally or provide a free cervical pillow to the accident victim, especially in light of the potential revenue each of these cases brings.

In the area of workers’ compensation, the principles of patient’s perception are similar, with the added element that the patient’s employer also needs to feel confident in the type of care provided. It is essential to understand the investment each company has in their employees, beyond just their ability to perform a specific job. A clear focus on constant communication with the company’s safety manager and an emphasis on rehabilitation to return the injured worker back to the job as quickly as possible are essential components.

In this area, ancillary services such as follow-up education for injury prevention, post-job-offer screenings, and updating the employer groups in changes to workers compensation law are ideally part of the package companies are looking for when considering a doctor to oversee the care and rehabilitation of their injured labor force.

4.3 Target Market Segment Strategy

We have chosen this target market because it represents a portion of the population whose needs match our offerings. Although for years many have viewed Chiropractors as “bone doctors,” we are actually specialist in helping correct problems related to the muscles, tendons, ligaments, and nerves, who use bones as mechanical levers to assist the body’s natural healing properties. Most injuries due to vehicular and work related accidents involve the soft tissues of the body, namely the muscles, ligaments, and nerves. In addition to the facts mentioned above, it makes complete economical sense to target this market, because it is still the most financially rewarding, with case average amounts being 30-50% higher than cases covered by traditional insurance plans. Perhaps most importantly, this area needs this type of service. As of the 2000 Census this section of Lee County (a 7 mile ring around our projected office location), one of the fastest growing counties in the country, had over 75,000 people in the 15-54 years of age category, a segment of the population that is projected to grow 6% by the year 2005. Accident rates for this segment of the population are close to 30% higher than the general population.

According to a compilation of data obtained from NHTSA (The National Highway Traffic Safety Authority), The Crashworthiness Data System, The Fatal Accident Sampling System, as well as the General Estimates System, the national average with regard to incidence (that is the number of a given event occuring within a population in a given time period) is 770 out of 100,000. That is, 770 out of every 100,000 people will be involved in an accident each year. In a growing area with as many young drivers as in Fort Myers, Fl., that number is much higher. In fact, according to data for the year 2001 obtained from the Florida Department of Highway Safety and Motor Vehicles, the incidence for motor vehicle crashes across all age groups (age 15-85+) in the state of Florida is closer to 2,270 out of 100,000.1 This is nearly 3 times the national average. Based on information provided by Scan/US Inc. That translates into over 3,500 motor vehicle accidents for the residents living within a 7 mile ring around our office location.2

Another key factor in analyzing our market is calculating injury prevalence. Prevalence is the number of people who suffer with a given problem at one time. Assuming a 25% chronicity for a period of 25 years at the national average rate of incidence (770/100,000), 6.7% of the population would be affected. Assuming a 50% chronicity, 9.6% of the population would be affected.3 That translates into 10,803-15,479 people within a 7 mile radius of our office suffering from chronic neck, back, and other pain syndromes resultant from motor vehicle accidents alone. Keeping in mind that the incidence rate in Florida is 3 times the national average this is a very conservative estimation.

Much like the victims of motor vehicle accidents, a large percentage of those injured at work experience problems with the soft tissues in and around the spine. According to data provided by the U.S. Department of Labor, as of the year 2001, 20% of all work related injuries in the U.S. affect the soft tissues of the neck, back, and extremities.5 In Lee County alone there were 20,603 reported cases of neck, back, trunk, and extremity injuries that required medical attention.6 These are people who would benefit from Chiropractic care and up to now have not had the opportunity to receive it on a broad scale. As previously stated, recent legislative changes make that possible.7

___________________________________________________

1 2001 Florida Traffic Crash Facts www.hsmv.state.fl.us

2 2000/2005 Scan/US Estimates for Site located at 26.5214, 81.8977 www.scanus.com

3 Foreman SM, Croft A.C.: Whiplash Injuries The Cervical Acceleration/Deceleration Syndrome (3rd Edition). Baltimore, Lippincott Williams Wilkins Co., 2001

4 U.S. Census Bureau Statistics for 2000 Census with Population Reported by Age and Sex.

5 U.S. Department of Labor, Bureau of Labor Statistics Injuries, Illnesses, and Fatalities www.bls.gov/iif/home.htm

6 Florida Division of Financial Services workers’ compensation Claims Statistical Query (made 10/1/2003) www.fldfs.com/WCAPPS/Claims_Research/Stats_Results.asp

7 2003 Florida workers’ compensation Reform

Strategy and Implementation Summary

Accurate Chiropractic, LLC will focus, geographically on the southwestern Lee County region of Florida, particularly in the town of Fort Myers.

The target customers are those members of our community who have been injured in motor vehicle and work related accidents either recently or in the past. We will reach these people directly through emotional based direct response marketing and indirectly through our contacts with local personal injury attorneys, medical physicians, and corporate clients.

5.1 Competitive Edge

We start with a competitive edge in that our location is ideal.Within a 7 mile ring around our officethere are projected to be 165,958 people by the year 2005 (156,517 as of the 2000 census).1 There is no other competitor in this areathat we know of that can make the same claimand shares our vision for care of the injured. Our positioning in this area is hard to match; the combination of land development and road improvement in the area make for hazardous driving conditions andgreater potential for injured workers.We must be aware that wewill only produce results if we maintain our mainstrategic focus and direct our marketing, business development, and fulfillment in the area of injury and chronic pain care.

Our name, Accurate Chiropractic, LLC, also provides us a competitive edge. First the name itself, Accurate has the connotation we are looking to get across to our patients that our care is the right care for them. Second it puts us at or nearthe front of the yellow pages and managed care providerdirectories.

___________________________________________________

1 2005 Scan/US Projections, Scan/US, Inc. (800)272-2687 and www.scanus.com

5.2 Marketing Strategy

Marketing in a chiropractic practice hinges on the ability to properly communicate to the general public that natural care is a viable and effective alternative to traditional medicine.In accident/injury care,marketing must be done directly to the end consumer (patients),and indirectly through legal and medical professionals, as well as corporate safety managers.

We will develop a database of injured people who are seeking or have an interest inalternatives to traditional medicalcare. It starts withdirectresponse advertising geared at eliciting an emotional response. We will place small advertisements in local daily, weekly, and monthly publications unlike any listings from other doctors in our area.We will not attempt to sell our services by stating we are the best, wecare, we have a friendly staff, etc.- everyone else is doing just that.1Rather, we will sell a concept that strikes an emotional cord with the injured and causes them to call a toll freevoice recorded message (people are more likely to call knowing they will not be pressured by a live person)for a free report on various topics.2 Each topic, be it auto accident, back pain, orneck painwill have its own (800) number to allow us to track the effectiveness of our advertising (wehave already purchased this tool from a companythat provides the service and transcription of information calledPATlive).We will simply ask the prospective patient to leave their name andaddress only (the software automatically records their phone number) and give them the option of being directly connected to a caring professional.3 The database will be managed by our clerical staff, who will enter data received by fax from PATlive’s transcription service directly into ourcontact management software and follow-up with our system of mailing reports and newsletters.

The purpose of the free reports will be to show our prospects that we “really do” understand not only their condition, but their situation as well (i.e. its affect on their work, family life, etc.), and will lead them to the next level of a free “condition specific” evaluation. All free offers will have a one month expiration date with follow up reports and progressively enticing offersbeing sent the 2nd and 3rd weeks. Any prospect that does not schedule within the first month will automatically begin receiving our newsletter the next month.

Internal marketing is just as important to the well being of a chiropractic practice.Each patient will receive a monthly newsletter and be”rewarded” for providing referrals of family and friends.Rewards will be items such as free movie tickets and gift certificates to local restaurants. Biweekly half hour health seminars held in the office will be used to educate our patients on subjects that are essential to maintaining their improved state of health.These two means of communication with our existing client base will also provide a means of “back end” sales with direct response advertisements for exercise, nutritional, and therapeutic devices.Asa means of offsetting the cost of producing and mailing the newsletters, we will seek out corporate partnerships from our suppliers. In this relationship we will include an advertisement of their specific product(s) in our newsletter in exchange for their financial backing.As our mailing list grows, we will have more bargaining power with these corporate entities.(Although privacy laws prevent us from sharing our patients’ personal information with these companies, it does not forbid usfrom mailing to them directly.)

As part of a grass roots effort to become entrenched in the community Dr. Rubano has already begun efforts to form a LeTip Chapter in Fort Myers. LeTip is a professional organization of men and women dedicated to the highest standards of competence and service.Its purpose is the exchange of business tips. Unlike the local Chambers of Commerce, there are no conflicts of interest allowed in LeTip.Dr. Rubano was president of the Middlesex County New Jersey Chapter for 2 years and served on the executive board for 5 years. Business Tips from that chapter resulted in a yearlyaverage of $35,000 worth of businessfor Dr. Rubano’s New Jersey practice during his 6 year membership with the organization.Dr. Rubano will also join the local Chamber of Commerce, with perhaps a different mindset than most other practitioners.Rather than attempting to get individual patients through the variouschamber functions, he will usemembership in this organizationas the avenue to further corporate relationships.

In order to put Dr.Rubano in the public eye as the expert in the area for accident and chronic pain care, we will secure speaking engagements with local high schools and civic groupsand arrange meetings with local personal injury attorneys and physicians (see section 5.4). In addition, once annually we will coordinate our area’s “Kids Day America”tm in which we coordinate the efforts of the localpolice, fire department, EPA, and other area businessesin aBig Event designed to increase awareness of children’s safety, following the guidelines set forth by FuturePerfect.4 The police will do fingerprinting, the fire marshall will have activitiesrelating to fire safety, while we will check every child that participates for the presence of spinal misalignments and educate their parents on child safety measures for automobile travel.We have already secured the licensing as the official event coordinator for the Fort Myers area event to be held in May 2004. Since this event began 10 years ago,practitioners in the state of Florida have held some of the most successful events, with anywhere between 500 to4,000 children being screened by theChiropractor.

It is important that we position ourselves as the most efficient and cooperative chiropractic office in town by not only speaking about service, but demonstrating it. We will do this by being open on “off hours” and “off days.” Historically chiropractic offices have been closed on Tuesdays, Thursdays, and Saturdays, as well as early mornings andlunch hours. We willmake it a point to provideopportunities for patients to be seen during these days and times. Patient phone calls will be returned within 2 hours and a 24-hour emergency line will be provided for all patients.Understanding that communication is essential to how physicians and attorneys handle their clients, we will see to it that everyphysician and attorneywho refers a patient will get a phone call from the doctorwithin 1 hour and a report within 48 hours, with regular status reports to follow on a weekly basis. This high level of communication for patients and professionalswill be accomplished during “off” hours by using a locator service which will automatically send a message to the doctor’s beeper or cell phone that a message has been recorded.

As we expand further into the corporate market, we will seek to function as consultants to midsize companies (50 or more employees).Our strategy will be basically the same, with just a slight variation.Direct response advertisements will be aimed at CFOs and safety managers instead of accident victims.Free reports will be geared to peaking the corporate clients’ interest in us as the expert at reducing insurance cost, improving employer-employee relationships, and creating a safer work environment to help them keep more dollars in their pockets. Communicationin this area is paramount.We will send daily Fax summariesin a clear, concise format to the companies’ safety managers, detailinginjury and return to work status of their employees. Patients will be seen the same day as the injury,with an immediatestatus report to follow within 1 hour of his/her visit. Newsletters specifically geared to the corporate client’s interestwill be sent monthly with legislative updates and tips for safety and injury prevention.Our Health and Safety Awareness Campaign outreach program to Hispanic workers through our affiliation with Faith Fellowship World Outreach Ministries5 will facilitate our relationship with both the growing Hispanic community and demonstrate our commitment to servicing the area labor force.6

___________________________________________________

1 See Addendum- Sample Advertisement

2 See Addendum- Sample Free Report

3 See Addendum- Sample PATlive Report

4 See Addendum- KidsDay Americatm Brochure

5Faith Fellowship World Outreach Ministries is a multicultural church. Founded in 2000 as an offshoot of Faith Fellowship Ministries World Outreach Center in Sayerville, N.J. the church has put on such civic programs as The Great Big Event (community outreach program which provided medical screenings, fingerprinting, financial seminars for the elderly, etc.) and First Time Home Buyers Seminars.

6 See Addendum- Letter of Collaboration from FFWOM

5.3 Sales Strategy

Sales in our business are part service and part education. We must service the patient by listening intently and identifying their chief area(s) of concern, and then provide visible evidence, when it exists, to show them what the cause of their problem is and the benefits of correcting that problem. We will never sell a patient on a visit by visit basis, but rather on a per case basis demonstrating the value of following a proven program that works for their complaint.

We must never be afraid to tell the patient everything they need, but also keep in mind people do not always buy what they need but what they emotionally desire. We must cause them to emotionally desire better health. When a patient balks at our care plan we must refocus them on the benefits of the end result and in the end be willing to walk away from someone who is not willing to invest in their own health. Our fees are non-negotiable.

The same holds true when working at the corporate level. When selling a company on our ability to service their workforce, we must make it clear that cheap care is not the same as cost-effective care. It is important to demonstrate how providing the right type of care for each situation while costing them money in the short term will actually save them money by reducing lost work time, the cost of training new or replacement employees, and insurance costs.

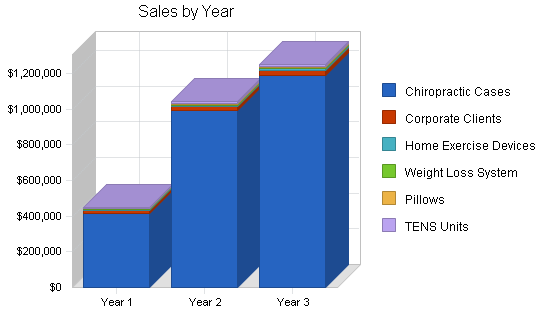

5.3.1 Sales Forecast

The following table and chart give a run down of forecasted sales. We expect sales to increase steadily as our marketing program and contact management system (see Marketing Strategy Summary, section 5.3) are put into place. The cost of Chiropractic Service is representative of what we believe to be a reasonable assumption of how much we need to spend in advertising, both internal and external, to obtain new patients. The unit cost of one new patient is $50. Revenue created from each new patient is assumed to be $3000 per case, which is averaged out to $250 per month per case. This figure is a conservative estimate, based on the figures we have reviewed regarding Medical Treatment amounts for victims of Motor Vehicle and Work Related Accidents (reference section 2.3, Market Segmentation). While in the real world these numbers will vary based on the frequency of any one given patient’s treatment (some higher, some lower), averaging makes it easier to calculate.

Revenue generated by our Corporate Client base will be based on an up-front contingency fee, set at $1500, and a commission of 20% of clients’ workers’ compensation insurance savings. The contingency fee will include the production of a safety manual if needed, as well as quarterly Safety Seminars, our monthly newsletter, ergonomic and injury assessment, and access to our 24 hour industry hot-line. The only direct costs associated with chiropractic care are the cleaning of patient areas and laundry, and the chiropractors’ time, which is accounted for by owner’s salary in the Personnel Table.

Sales for TENS units and Weight Loss Systems were projected with an assumption of a 10% compliance for new patients each month. Pillows and Home Exercise devices were projected with a 25% compliance rate. The per unit cost of TENS units is $29, selling for $150. The per unit cost of exercise devices is $23 selling for $50. Pillows cost $14 each, and are sold at $30 a piece, while the Weight Loss Systems costs $27 and retails for $80.

Please note that for ease of understanding year by year growth projections are made with a January 2004 start date. We are, however, prepared to begin immediately providing adequate funding is secured.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Chiropractic Cases | $412,475 | $990,000 | $1,188,000 |

| Corporate Clients | $18,000 | $21,600 | $25,920 |

| Home Exercise Devices | $5,700 | $8,640 | $10,800 |

| Weight Loss System | $3,760 | $5,760 | $6,912 |

| Pillows | $3,480 | $5,616 | $6,739 |

| TENS Units | $5,640 | $8,640 | $10,368 |

| Total Sales | $449,055 | $1,040,256 | $1,248,739 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Chiropractic Cases | $4,125 | $9,900 | $11,880 |

| Corporate Clients | $3,600 | $4,320 | $5,184 |

| Home Exercise Devices | $2,622 | $3,974 | $4,968 |

| Weight Loss System | $1,269 | $1,944 | $2,333 |

| Pillows | $1,624 | $2,617 | $3,140 |

| TENS Units | $1,363 | $2,091 | $2,509 |

| Subtotal Direct Cost of Sales | $14,603 | $24,846 | $30,014 |

5.4 Milestones

The accompanying table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

What the table doesn’t show is the commitment behind it. Our business plan includes complete provisions for plan-vs.-actual analysis, and we will hold monthly follow-up meetings to discuss the variance and course corrections.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| “Whiplash: the Epidemic” Presentations to Attorneys | 12/20/2003 | 1/20/2003 | $50 | Dr. Rubano | Marketing |

| Complete Business Plan | 10/10/2003 | 11/11/2003 | $350 | Dr. Rubano | Administrative |

| Establish Bank Account For Business | 11/1/2003 | 11/11/2003 | $0 | Dr. Rubano | Administrative |

| Purchase Business Card sand Letterhead/Envelopes | 11/3/2003 | 11/17/2003 | $450 | Sonia Rubano | Marketing |

| Print 500 copies of MVA Free Report | 11/17/2003 | 11/17/2003 | $200 | Sonia Rubano | Marketing |

| Compose Sales Letters For MVA victims, Low Back Pain, Neck Pain | 9/10/2003 | 11/20/2003 | $0 | Dr. Rubano | Marketing |

| Print Copy of Office Policy and Procedural Manual | 11/20/2003 | 11/23/2003 | $20 | Sonia Rubano | Administrative |

| Mail Intoductory Letter to 25 Area PI Attorneys | 11/20/2003 | 11/23/2003 | $25 | Dr. Rubano | Marketing |

| Mail Introductory Letter to 25 Area Physicians | 11/20/2003 | 11/23/2003 | $25 | Dr. Rubano | Marketing |

| Letters to 4 Area High School Vice Principals Re Driver safety | 11/23/2003 | 11/25/2003 | $4 | Sonia Rubano | Marketing |

| Follow-up Phone Calls to Area Attorneys | 11/23/2003 | 11/26/2003 | $0 | Dr. Rubano | Marketing |

| Followup Phone Calls to Area Physicians | 11/23/2003 | 11/26/2003 | $0 | Dr. Rubano | Marketing |

| Secure Start Up Funding | 10/31/2003 | 11/30/2003 | $0 | Dr. Rubano | Administrative |

| Followup Calls To Vice Principals | 11/27/2003 | 11/30/2003 | $0 | Dr. Rubano | Marketing |

| Type and Print Sales Letters | 9/20/2003 | 12/2/2003 | $150 | Sonia Rubano | Marketing |

| Team Meeting | 12/1/2003 | 12/5/2003 | $0 | Dr. Rubano | Administrative |

| Team Meeting | 12/15/2003 | 12/19/2003 | $0 | Dr. Rubano | Administrative |

| Compose Corporate Client Sales Letter | 11/30/2003 | 12/20/2003 | $0 | Dr. Rubano | Marketing |

| Direct Response Ad for MVA Victims Multiple Publications | 12/20/2003 | 12/20/2003 | $400 | Sonia Rubano | Marketing |

| Type and Print Corporate Sales Letter | 12/20/2003 | 12/23/2003 | $0 | Sonia Rubano | Marketing |

| Team Meeting | 12/22/2003 | 12/24/2003 | $0 | Dr. Rubano | Administrative |

| Organize LeTip Chapter | 10/10/2003 | 12/30/2003 | $0 | Dr. Rubano | Administrative |

| Team Meeting | 12/29/2003 | 12/30/2003 | $0 | Dr. Rubano | Administrative |

| Money Mailer Direct Response Saturation Mailer | 12/27/2003 | 1/4/2004 | $500 | Sonia Rubano | Marketing |

| Team Meeting | 1/2/2004 | 1/4/2004 | $0 | Dr. Rubano | Administrative |

| Opening Day in Office | 1/5/2004 | 1/5/2004 | $750 | Dr. Rubano | Administrative |

| Half Hour to Health Seminar | 1/6/2004 | 1/6/2004 | $50 | Dr. Rubano | Marketing |

| Team Meeting | 1/9/2004 | 1/12/2004 | $0 | Dr. Rubano | Administrative |

| Team Meeting | 1/16/2004 | 1/19/2004 | $0 | Dr. Rubano | Administrative |

| Half Hour To Health Seminar | 1/20/2004 | 1/20/2004 | $50 | Dr. Rubano | Marketing |

| Followup Mailing and Phone Call to Initial 25 Attorney and Physicians | 1/21/2004 | 1/24/2004 | $0 | Dr. Rubano | Marketing |

| Mail to 25 Additional Attorneys and Physicians | 1/21/2004 | 1/24/2004 | $50 | Sonia Rubano | Marketing |

| Prepare and Mail Monthly Newsletter to Patients and Prospects | 1/11/2004 | 1/25/2004 | $250 | Sonia Rubano | Marketing |

| Team Meeting | 1/23/2004 | 1/26/2004 | $0 | Dr. Rubano | Administrative |

| Followup Phone Calls with Additional Attorneys and Physicians | 1/24/2004 | 1/27/2004 | $0 | Dr. Rubano | Marketing |

| Inaugaral Letip Meeting | 1/15/2004 | 1/29/2004 | $0 | Dr. Rubano | Marketing |

| Multiple Direct Response Ads | 1/6/2004 | 1/31/2004 | $320 | Sonia Rubano | Marketing |

| Contact MADD Organization for Help with Teen Driver Safety Awareness | 1/27/2004 | 2/1/2004 | $0 | Dr. Rubano | Marketing |

| Team Meeting | 1/30/2004 | 2/2/2004 | $0 | Dr. Rubano | Administrative |

| Half Hour to Health Seminar | 2/3/2004 | 2/3/2004 | $50 | Dr. Rubano | Marketing |

| Team Meeting | 2/6/2004 | 2/9/2004 | $0 | Dr. Rubano | Administrative |

| Role Out Corporate Program with Direct Response Post Cards to CFO’s | 1/27/2004 | 2/14/2004 | $350 | Sonia Rubano | Marketing |

| Team Meeting | 2/13/2004 | 2/16/2004 | $0 | Dr. Rubano | Administrative |

| Half Hour to Health Seminar | 2/17/2004 | 2/17/2004 | $50 | Dr. Rubano | Marketing |

| Team Meeting | 2/20/2004 | 2/23/2004 | $0 | Dr. Rubano | Administrative |

| Prepare and Mail Monthly Newsletter | 2/11/2004 | 2/25/2004 | $250 | Sonia Rubano | Marketing |

| Letip Meeting | 2/5/2004 | 2/26/2004 | $30 | Dr. Rubano | Marketing |

| Presentation to Corporate Client | 2/5/2004 | 2/26/2004 | $100 | Dr. Rubano | Marketing |

| Whiplash The Epidemic Presentation to Attorney | 2/20/2004 | 2/27/2004 | $50 | Dr. Rubano | Marketing |

| Multiple Direct Response Ads | 2/1/2004 | 2/28/2004 | $320 | Sonia Rubano | Marketing |

| Team Meeting | 2/27/2004 | 3/2/2004 | $0 | Dr. Rubano | Administrative |

| Half Hour To Health Seminar | 3/2/2004 | 3/2/2004 | $50 | Dr. Rubano | Marketing |

| Team Meeting | 3/4/2004 | 3/7/2004 | $0 | Dr. Rubano | Administrative |

| Presentations to Area High Schools | 1/10/2004 | 3/10/2004 | $300 | Dr. Rubano | Marketing |

| Followup with Any Upcoming Speaking Engagements | 3/5/2004 | 3/10/2004 | $0 | Sonia Rubano | Marketing |

| Direct Response Post Card to Corporate Clients | 2/27/2004 | 3/14/2004 | $300 | Sonia Rubano | Marketing |

| Team Meeting | 3/11/2004 | 3/14/2004 | $0 | Dr. Rubano | Administrative |

| Half Hour to Health Seminar | 3/16/2004 | 3/16/2004 | $50 | Dr. Rubano | Marketing |

| Followup Phone call and mailing to previously contacted Physicians and Attorneys | 3/17/2004 | 3/20/2004 | $0 | Dr. Rubano | Marketing |

| Mail Introductory Letter to 25 Attorneys and Physicians | 3/17/2004 | 3/20/2004 | $50 | Sonia Rubano | Marketing |

| Team Meeting | 3/18/2004 | 3/21/2004 | $0 | Dr. Rubano | Marketing |

| Followup Calls to Attorneys and Physicians | 3/20/2004 | 3/23/2004 | $0 | Dr. Rubano | Marketing |

| LeTip Meeting | 3/4/2004 | 3/25/2004 | $44 | Dr. Rubano | Marketing |

| Prepare and Mail Monthly Newsletter | 3/11/2004 | 3/25/2004 | $250 | Sonia Rubano | Marketing |

| Presentation to Corporate Clients | 3/5/2004 | 3/26/2004 | $100 | Dr. Rubano | Marketing |

| Whiplash the Epidemic Presentation | 3/20/2004 | 3/27/2004 | $50 | Dr. Rubano | Marketing |

| Team Meeting | 3/25/2004 | 3/28/2004 | $0 | Dr. Rubano | Administrative |

| Multiple Direct Response Ads | 3/1/2004 | 3/31/2004 | $400 | Sonia Rubano | Marketing |

| Review Business Plan and Adjust Action Steps as Needed | 3/28/2004 | 3/31/2004 | $0 | Dr. Rubano | Administrative |

| Direct Response Mailing to Corporate Clients | 3/27/2004 | 4/14/2004 | $300 | Sonia Rubano | Marketing |

| Begin Action Steps For Kids Day America Program (see Kids Day Manual) | 2/28/2004 | 5/15/2004 | $850 | Dr. Rubano | Marketing |

| Totals | $7,588 | ||||

Web Plan Summary

Although we do not anticipate the website being a big player in our marketing and sales game plan initially, we do understand the importance a web presence has in portraying a certain image to the public. The Accurate Chiropractic, LLC website will offer basic information on the benefits of chiropractic care for various injuries and conditions, as well as listing our address, contact information, and hours. We will list a series of FAQs (Frequently Asked Questions), and include a link to a mapping site with online directions to the office.

In the future, we may consider adding an interactive format that allows patients to check their account balance and activity, pay bills, and schedule appointments online. It is our goal to keep up with changes in technology so long as they are cost effective; therefore, we will review our web plan quarterly and make changes in accordance with our growth and cash flow analysis.

To further show off its expertise, the Accurate Chiropractic, LLC website should create a resources area, offering articles, research and copies of our monthly newsletters to interested parties. A calendar of upcoming seminars and Dr. Rubano’s schedule of continuing education will also be an excellent way of showing our commitment to keeping up with the latest in natural healthcare advances.

The key to the website strategy will be combining a very well designed front end, with a back end capable of recording leads. The web address, which is already under construction, is www.accuratechiro.com.

6.1 Website Marketing Strategy

Initially, our website will not play a large part in our overall marketing strategy. As previously stated, the Accurate Chiropractic, LLC site will be provided as a convenience for our active clientele and for information purposes on a word of mouth basis. It should be well designed to add to our professional image. Eventually, we may decide to buy targeted key word searches; however, this would be subject to price and cost effectiveness.

6.2 Development Requirements

The Accurate Chiropractic website will be initially developed with few technical resources. A simple hosting provider, AllSoft Computer Associates, will host the site and provide the technical back end.

Accurate Chiropractic will work with a contracted user interface designer to develop the site. The user interface designer will use our existing graphic art to come up with the website logo, and the website graphics.

The maintenance of the site will be done by AllSoft. As the website rolls out future development such as newsletters and downloadable articles, we may need to contract with a technical resource to build the trackable download and the newsletter capabilities.

Management Summary

The initial management depends on the founder himself. In addition to Dr. Rubano, we have back up consulting services provided by Sam Fisher, our CPA and Mary Snell, our corporate attorney. We also have a consulting agreement with Altadonna Communications, who provides support with regard to our marketing program.

7.1 Personnel Plan

The following table summarizes our personnel expenditures for the first three years, with compensation increasing from less than $110K the first year to about $755K in the third. We believe this plan is a compromise between fairness and expedience, and reflects our mindset toward expansion to service a growing market. Year 1 salaries reflect 2 months for the front desk position; initially this role will be included in the insurance staff position. The Chiropractic Assistant position will be added at the start of the fourth quarter to aid in the increased patient flow.

Year 2 salaries reflect a full year for Associate Doctor #1 and a 1/2 year for Associate Doctor #2. Performance bonuses will be calculated at the end of each year based on net profits. Employee benefits such as health insurance are addressed in the Profit and Loss Table (section 8.3). The detailed monthly personnel plan for the first year is included in the appendices.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Angelo M. Rubano, Jr. D.C. | $63,500 | $200,000 | $300,000 |

| Associate Dr. #1 | $0 | $65,000 | $130,000 |

| Associate Dr. #2 | $0 | $37,500 | $110,000 |

| Insurance Staff | $26,316 | $28,396 | $30,476 |

| Insurance Staff #2 | $0 | $14,448 | $28,396 |

| Front Desk Staff | $6,450 | $25,800 | $28,400 |

| Front Desk Staff #2 | $0 | $12,900 | $25,800 |

| Chiropractic Assistant #1 | $12,900 | $33,540 | $36,120 |

| Chiropractic Assistant #2 | $0 | $30,960 | $33,540 |

| Chiropractic Assistant #3 | $0 | $0 | $30,960 |

| Total People | 4 | 9 | 10 |

| Total Payroll | $109,166 | $448,544 | $753,692 |

Financial Plan

- We want to finance growth mainly through cash flow. We recognize that this means we will have to grow more slowly than we might like.

- The most important factor in our situation is maintaining or growing our case average (i.e., the amount of revenue per case per year). This is the area that will account for exponential growth. While the goal of our external sales and marketing plan is to bring new patients to the practice, the focus of our internal program will be to increase the value of the service provided.

- We are also assuming start-up capital of $43,575 (provided by the owner), and an initial long-term loan from a reputable funding source of another $164,000.

8.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. The monthly assumptions are included in the appendices. From the beginning, we recognize that collection days are critical. Interest rates, tax rates, and personnel burden are based on worst case scenario assumptions.

Three of the more important underlying assumptions are:

- We assume that there are no unforeseen changes in automobile insurance provisions regarding personal injury protection coverage.

- We assume that motor vehicle accidents and injuries will continue at a rate commensurate with that of the last 10-year period.

- We assume that work place injuries continue at a rate commensurate with that of the last 10 years as well.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

8.2 Break-even Analysis

- Fixed costs are calculated as day-to-day running expenses and are averaged out over the course of 12 months to develop the one month figure.

- Fixed costs include owner’s salary, rent, payroll, utilities, commonly used supplies and forms, necessary insurance, legal and technical support, professional memberships, continuing education, and employee benefits.

- Variable Cost includes our costs for inventory sold, and direct costs per patient of chiropractic care.

| Break-even Analysis | |

| Monthly Revenue Break-even | $14,694 |

| Assumptions: | |

| Average Percent Variable Cost | 3% |

| Estimated Monthly Fixed Cost | $14,216 |

8.3 Projected Profit and Loss

Our projected profit and loss is shown in the following table, with sales increasing from just under $450K the first year to more than $1.2 million the third. Due in part to the nature of our business (service oriented, without the need of expensive production cost or inventory), we expect modest profits for the first year. Although our location is somewhat subject to seasonal shifts, particularly in the senior citizen population, or main target group is year round residents; therefore, we can expect linear growth as opposed to cyclical growth. In other words, our year two earnings are based on growth from the average sales of month 12 in year one, rather than the twelve month average of year one. We anticipate this growth will level out somewhat near the end of year 3, as we reach maximum capacity in terms of case load for our present staff size. Prior to that point, we will review our business plan and determine if space additions are necessary and viable for our present office location, or if we should consider developing an office in a neighboring town.

Marketing/Promotion expenses are estimated at $300 per client for the first year, decreasing over the next two years as word of mouth and corporate affiliations generate sales without extra advertising.

Depreciation of long-term assets is as follows: X-ray equipment over a thirty year period, chiropractic tables over a twenty year period, and computerized diagnostic equipment over a seven year period.

As with the break-even, we are projecting very conservatively regarding fixed cost, cost of sales, and gross margin. Our fixed cost and cost of sales should be slightly lower in reality, and gross margin higher, than in this projection. In determining insurance, printing, and advertising expenses, we purposely projected higher than average costs. We prefer to project conservatively so that we ensure adequate cash flow.

The detailed monthly projections are included in the appendices.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $449,055 | $1,040,256 | $1,248,739 |

| Direct Cost of Sales | $14,603 | $24,846 | $30,014 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $14,603 | $24,846 | $30,014 |

| Gross Margin | $434,452 | $1,015,410 | $1,218,725 |

| Gross Margin % | 96.75% | 97.61% | 97.60% |

| Expenses | |||

| Payroll | $109,166 | $448,544 | $753,692 |

| Marketing/Promotion | $20,000 | $20,000 | $20,000 |

| Depreciation | $4,248 | $4,634 | $4,634 |

| Rent | $15,100 | $22,335 | $25,455 |

| Utilities | $5,500 | $9,000 | $11,500 |

| Insurance | $925 | $2,965 | $3,575 |

| Payroll Taxes | $0 | $0 | $0 |

| Office Supplies | $4,763 | $11,353 | $14,205 |

| Legal Fees | $0 | $2,500 | $2,500 |

| Accounting Fees | $1,100 | $2,500 | $2,500 |

| Computer Technical Support | $660 | $792 | $872 |

| XRay Film and Processor Maintenance | $1,925 | $3,890 | $5,980 |

| Professional Organization Membership | $770 | $966 | $1,110 |

| Employee Benefits Package | $6,435 | $21,060 | $42,120 |

| Total Operating Expenses | $170,592 | $550,539 | $888,143 |

| Profit Before Interest and Taxes | $263,860 | $464,871 | $330,582 |

| EBITDA | $268,108 | $469,505 | $335,216 |

| Interest Expense | $14,910 | $12,275 | $9,525 |

| Taxes Incurred | $74,685 | $135,779 | $96,317 |

| Net Profit | $174,265 | $316,817 | $224,740 |

| Net Profit/Sales | 38.81% | 30.46% | 18.00% |

8.4 Projected Cash Flow

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly cash balance. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendices.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $112,264 | $260,064 | $312,185 |

| Cash from Receivables | $234,790 | $645,903 | $889,198 |

| Subtotal Cash from Operations | $347,054 | $905,967 | $1,201,383 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $347,054 | $905,967 | $1,201,383 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $109,166 | $448,544 | $753,692 |

| Bill Payments | $139,334 | $270,089 | $266,050 |

| Subtotal Spent on Operations | $248,500 | $718,633 | $1,019,742 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $27,504 | $27,500 | $27,500 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $276,004 | $746,133 | $1,047,242 |

| Net Cash Flow | $71,050 | $159,834 | $154,141 |

| Cash Balance | $140,050 | $299,884 | $454,024 |

8.5 Projected Balance Sheet

The balance sheet in the following table shows managed but sufficient growth of net worth, and a healthy financial position.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $140,050 | $299,884 | $454,024 |

| Accounts Receivable | $102,001 | $236,290 | $283,646 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $242,051 | $536,173 | $737,670 |

| Long-term Assets | |||

| Long-term Assets | $104,000 | $104,000 | $104,000 |

| Accumulated Depreciation | $4,248 | $8,882 | $13,516 |

| Total Long-term Assets | $99,752 | $95,118 | $90,484 |

| Total Assets | $341,803 | $631,292 | $828,155 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $22,042 | $22,213 | $21,836 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $22,042 | $22,213 | $21,836 |

| Long-term Liabilities | $136,496 | $108,996 | $81,496 |

| Total Liabilities | $158,538 | $131,209 | $103,332 |

| Paid-in Capital | $43,575 | $43,575 | $43,575 |

| Retained Earnings | ($34,575) | $139,690 | $456,507 |

| Earnings | $174,265 | $316,817 | $224,740 |

| Total Capital | $183,265 | $500,082 | $724,823 |

| Total Liabilities and Capital | $341,803 | $631,292 | $828,155 |

| Net Worth | $183,265 | $500,082 | $724,823 |

8.6 Business Ratios

The following table shows the projected businesses ratios. We expect to maintain healthy ratios for profitability, risk, and return.

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8041, [Offices and Clinics of Chiropractors], are shown for comparison.

The following table outlines some of the more important ratios from the chiropractic industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 8041.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 131.65% | 20.04% | 5.93% |

| Percent of Total Assets | ||||

| Accounts Receivable | 29.84% | 37.43% | 34.25% | 21.14% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 45.36% |

| Total Current Assets | 70.82% | 84.93% | 89.07% | 71.11% |

| Long-term Assets | 29.18% | 15.07% | 10.93% | 28.89% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 6.45% | 3.52% | 2.64% | 29.10% |

| Long-term Liabilities | 39.93% | 17.27% | 9.84% | 19.50% |

| Total Liabilities | 46.38% | 20.78% | 12.48% | 48.60% |

| Net Worth | 53.62% | 79.22% | 87.52% | 51.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 96.75% | 97.61% | 97.60% | 100.00% |

| Selling, General & Administrative Expenses | 58.41% | 58.00% | 52.82% | 75.10% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.61% |

| Profit Before Interest and Taxes | 58.76% | 44.69% | 26.47% | 3.98% |

| Main Ratios | ||||

| Current | 10.98 | 24.14 | 33.78 | 1.86 |

| Quick | 10.98 | 24.14 | 33.78 | 1.38 |

| Total Debt to Total Assets | 46.38% | 20.78% | 12.48% | 10.80% |

| Pre-tax Return on Net Worth | 135.84% | 90.50% | 44.29% | 60.83% |

| Pre-tax Return on Assets | 72.83% | 71.69% | 38.77% | 27.59% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 38.81% | 30.46% | 18.00% | n.a |

| Return on Equity | 95.09% | 63.35% | 31.01% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.30 | 3.30 | 3.30 | n.a |

| Collection Days | 55 | 79 | 101 | n.a |

| Accounts Payable Turnover | 7.32 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 30 | n.a |

| Total Asset Turnover | 1.31 | 1.65 | 1.51 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.87 | 0.26 | 0.14 | n.a |

| Current Liab. to Liab. | 0.14 | 0.17 | 0.21 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $220,009 | $513,960 | $715,834 | n.a |

| Interest Coverage | 17.70 | 37.87 | 34.71 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.76 | 0.61 | 0.66 | n.a |

| Current Debt/Total Assets | 6% | 4% | 3% | n.a |

| Acid Test | 6.35 | 13.50 | 20.79 | n.a |

| Sales/Net Worth | 2.45 | 2.08 | 1.72 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Chiropractic Cases | 0% | $0 | $6,250 | $12,500 | $18,725 | $25,000 | $31,250 | $37,500 | $43,750 | $50,000 | $56,250 | $62,500 | $68,750 |

| Corporate Clients | 0% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Home Exercise Devices | 0% | $300 | $350 | $400 | $400 | $450 | $500 | $500 | $500 | $550 | $550 | $600 | $600 |

| Weight Loss System | 0% | $240 | $240 | $240 | $240 | $320 | $320 | $320 | $320 | $320 | $400 | $400 | $400 |

| Pillows | 0% | $180 | $210 | $240 | $240 | $270 | $270 | $300 | $330 | $330 | $360 | $360 | $390 |

| TENS Units | 0% | $360 | $360 | $360 | $360 | $360 | $480 | $480 | $480 | $600 | $600 | $600 | $600 |

| Total Sales | $2,580 | $8,910 | $15,240 | $21,465 | $27,900 | $34,320 | $40,600 | $46,880 | $53,300 | $59,660 | $65,960 | $72,240 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Chiropractic Cases | $0 | $63 | $125 | $187 | $250 | $313 | $375 | $438 | $500 | $563 | $625 | $688 | |

| Corporate Clients | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Home Exercise Devices | $138 | $161 | $184 | $184 | $207 | $230 | $230 | $230 | $253 | $253 | $276 | $276 | |

| Weight Loss System | $81 | $81 | $81 | $81 | $108 | $108 | $108 | $108 | $108 | $135 | $135 | $135 | |

| Pillows | $84 | $98 | $112 | $112 | $126 | $126 | $140 | $154 | $154 | $168 | $168 | $182 | |

| TENS Units | $87 | $87 | $87 | $87 | $87 | $116 | $116 | $116 | $145 | $145 | $145 | $145 | |

| Subtotal Direct Cost of Sales | $690 | $790 | $889 | $951 | $1,078 | $1,193 | $1,269 | $1,346 | $1,460 | $1,564 | $1,649 | $1,726 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Angelo M. Rubano, Jr. D.C. | 0% | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $5,000 | $6,000 | $6,000 | $7,500 | $7,500 | $7,500 |

| Associate Dr. #1 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Associate Dr. #2 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Insurance Staff | 0% | $2,150 | $2,150 | $2,150 | $2,150 | $2,150 | $2,150 | $2,236 | $2,236 | $2,236 | $2,236 | $2,236 | $2,236 |

| Insurance Staff #2 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Front Desk Staff | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,150 | $2,150 | $2,150 |

| Front Desk Staff #2 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Chiropractic Assistant #1 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,580 | $2,580 | $2,580 | $2,580 | $2,580 |

| Chiropractic Assistant #2 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Chiropractic Assistant #3 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 4 | 4 | 4 | |

| Total Payroll | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $7,236 | $10,816 | $10,816 | $14,466 | $14,466 | $14,466 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $2,580 | $8,910 | $15,240 | $21,465 | $27,900 | $34,320 | $40,600 | $46,880 | $53,300 | $59,660 | $65,960 | $72,240 | |

| Direct Cost of Sales | $690 | $790 | $889 | $951 | $1,078 | $1,193 | $1,269 | $1,346 | $1,460 | $1,564 | $1,649 | $1,726 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $690 | $790 | $889 | $951 | $1,078 | $1,193 | $1,269 | $1,346 | $1,460 | $1,564 | $1,649 | $1,726 | |

| Gross Margin | $1,890 | $8,121 | $14,351 | $20,514 | $26,822 | $33,128 | $39,331 | $45,535 | $51,840 | $58,097 | $64,311 | $70,515 | |

| Gross Margin % | 73.26% | 91.14% | 94.17% | 95.57% | 96.14% | 96.53% | 96.87% | 97.13% | 97.26% | 97.38% | 97.50% | 97.61% | |

| Expenses | |||||||||||||

| Payroll | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $7,236 | $10,816 | $10,816 | $14,466 | $14,466 | $14,466 | |

| Marketing/Promotion | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | |

| Depreciation | $0 | $386 | $386 | $386 | $386 | $386 | $386 | $386 | $386 | $386 | $386 | $386 | |

| Rent | $0 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | $1,373 | |

| Utilities | $0 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $154 | $154 | $154 | $154 | $154 | $154 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Office Supplies | $0 | $433 | $433 | $433 | $433 | $433 | $433 | $433 | $433 | $433 | $433 | $433 | |

| Legal Fees | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Accounting Fees | $0 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | |

| Computer Technical Support | $0 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | $60 | |

| XRay Film and Processor Maintenance | $0 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | |

| Professional Organization Membership | 15% | $0 | $70 | $70 | $70 | $70 | $70 | $70 | $70 | $70 | $70 | $70 | $70 |

| Employee Benefits Package | $0 | $585 | $585 | $585 | $585 | $585 | $585 | $585 | $585 | $585 | $585 | $585 | |

| Total Operating Expenses | $7,817 | $11,499 | $11,499 | $11,499 | $11,499 | $11,499 | $12,739 | $16,319 | $16,319 | $19,969 | $19,969 | $19,969 | |

| Profit Before Interest and Taxes | ($5,927) | ($3,378) | $2,852 | $9,015 | $15,323 | $21,629 | $26,592 | $29,216 | $35,521 | $38,128 | $44,342 | $50,546 | |

| EBITDA | ($5,927) | ($2,992) | $3,239 | $9,401 | $15,710 | $22,015 | $26,978 | $29,602 | $35,907 | $38,514 | $44,728 | $50,932 | |

| Interest Expense | $1,348 | $1,328 | $1,309 | $1,290 | $1,271 | $1,252 | $1,233 | $1,214 | $1,195 | $1,176 | $1,157 | $1,137 | |

| Taxes Incurred | ($2,182) | ($1,412) | $463 | $2,317 | $4,216 | $6,113 | $7,608 | $8,401 | $10,298 | $11,086 | $12,956 | $14,822 | |

| Net Profit | ($5,092) | ($3,295) | $1,080 | $5,407 | $9,837 | $14,264 | $17,752 | $19,601 | $24,029 | $25,866 | $30,230 | $34,586 | |

| Net Profit/Sales | -197.36% | -36.98% | 7.09% | 25.19% | 35.26% | 41.56% | 43.72% | 41.81% | 45.08% | 43.36% | 45.83% | 47.88% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $645 | $2,228 | $3,810 | $5,366 | $6,975 | $8,580 | $10,150 | $11,720 | $13,325 | $14,915 | $16,490 | $18,060 | |

| Cash from Receivables | $0 | $65 | $2,093 | $6,841 | $11,586 | $16,260 | $21,086 | $25,897 | $30,607 | $35,321 | $40,134 | $44,903 | |

| Subtotal Cash from Operations | $645 | $2,292 | $5,903 | $12,207 | $18,561 | $24,840 | $31,236 | $37,617 | $43,932 | $50,236 | $56,624 | $62,963 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $645 | $2,292 | $5,903 | $12,207 | $18,561 | $24,840 | $31,236 | $37,617 | $43,932 | $50,236 | $56,624 | $62,963 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $6,150 | $7,236 | $10,816 | $10,816 | $14,466 | $14,466 | $14,466 | |

| Bill Payments | $51 | $1,660 | $5,734 | $7,687 | $9,588 | $11,594 | $13,577 | $15,255 | $16,143 | $18,098 | $19,006 | $20,942 | |

| Subtotal Spent on Operations | $6,201 | $7,810 | $11,884 | $13,837 | $15,738 | $17,744 | $20,813 | $26,071 | $26,959 | $32,564 | $33,472 | $35,408 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | $2,292 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $8,493 | $10,102 | $14,176 | $16,129 | $18,030 | $20,036 | $23,105 | $28,363 | $29,251 | $34,856 | $35,764 | $37,700 | |

| Net Cash Flow | ($7,848) | ($7,810) | ($8,272) | ($3,922) | $530 | $4,804 | $8,131 | $9,254 | $14,681 | $15,379 | $20,860 | $25,263 | |

| Cash Balance | $61,152 | $53,342 | $45,070 | $41,148 | $41,678 | $46,482 | $54,613 | $63,867 | $78,548 | $93,927 | $114,787 | $140,050 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $69,000 | $61,152 | $53,342 | $45,070 | $41,148 | $41,678 | $46,482 | $54,613 | $63,867 | $78,548 | $93,927 | $114,787 | $140,050 |

| Accounts Receivable | $0 | $1,935 | $8,553 | $17,890 | $27,148 | $36,487 | $45,968 | $55,332 | $64,595 | $73,963 | $83,388 | $92,724 | $102,001 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $69,000 | $63,087 | $61,895 | $62,960 | $68,296 | $78,165 | $92,450 | $109,945 | $128,462 | $152,511 | $177,315 | $207,511 | $242,051 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 | $104,000 |

| Accumulated Depreciation | $0 | $0 | $386 | $772 | $1,158 | $1,545 | $1,931 | $2,317 | $2,703 | $3,089 | $3,475 | $3,862 | $4,248 |

| Total Long-term Assets | $104,000 | $104,000 | $103,614 | $103,228 | $102,842 | $102,455 | $102,069 | $101,683 | $101,297 | $100,911 | $100,525 | $100,138 | $99,752 |

| Total Assets | $173,000 | $167,087 | $165,509 | $166,187 | $171,137 | $180,621 | $194,519 | $211,628 | $229,759 | $253,422 | $277,839 | $307,649 | $341,803 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,471 | $5,479 | $7,370 | $9,204 | $11,143 | $13,069 | $14,719 | $15,541 | $17,467 | $18,310 | $20,182 | $22,042 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,471 | $5,479 | $7,370 | $9,204 | $11,143 | $13,069 | $14,719 | $15,541 | $17,467 | $18,310 | $20,182 | $22,042 |

| Long-term Liabilities | $164,000 | $161,708 | $159,416 | $157,124 | $154,832 | $152,540 | $150,248 | $147,956 | $145,664 | $143,372 | $141,080 | $138,788 | $136,496 |