Web Applications, Inc.

Executive Summary

Web Applications is a start-up company that is designed to offer Web-based business management applications. Web Applications has developed an Internet-based application called Online Office Manager, for which a patent is pending. Online Office Manager allows businesses and individuals to keep in touch even when working in different locations. Online Office Manager provides applications which replace the physical office. With Online Office Manager, your office moves with you at all times, and you have 24-hour access to it. Users can get Online Office Manager by subscribing to our server on the Internet.

As with any start-up company, Web Applications recognizes its risks. We are a new company and as such, we will need to meet market acceptance. To that end, the company is working to determine trends in the industry, the needs of the customer, and how best to address the needs of the customer.

We expect to compete as a thriving company in the computer applications software industry. The software market has long been one of the computer industry’s fastest growing segments. Revenues for the worldwide software market reached $122 billion two years ago, up 15% from the year before that, according to estimates by International Data Corporation (IDC), a market research firm in Framingham, Massachusetts. Revenues continued to show robust growth last year. IDC projects that revenues will grow at a compound annual rate of approximately 12% for the next several years, surpassing $220 billion three years from now.

The company is seeking a moderate start-up investment. The company’s revenue projections for year one are for a 10-fold growth. Web Applications expects to achieve profitability within six months of beginning operations.

1.1 Mission

At Web Applications, our mission is to provide an online office system that links workers in different locations to their mother company.

Company Summary

Web Applications, Inc. was established in 1998 to provide a Web-based business application with features that give users the ability to remain in touch with operations at all times from anywhere in the world. The company was formed by Mr. Lester Andrews and is a Georgia incorporated S-Corporation.

2.1 Start-up Summary

Start-up costs, expenses and funding sources are laid out in the tables and chart below.

| Start-up Funding | |

| Start-up Expenses to Fund | $60,100 |

| Start-up Assets to Fund | $57,500 |

| Total Funding Required | $117,600 |

| Assets | |

| Non-cash Assets from Start-up | $5,000 |

| Cash Requirements from Start-up | $52,500 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $52,500 |

| Total Assets | $57,500 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $1,000 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $1,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $15,000 |

| Investor 2 | $101,600 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $116,600 |

| Loss at Start-up (Start-up Expenses) | ($60,100) |

| Total Capital | $56,500 |

| Total Capital and Liabilities | $57,500 |

| Total Funding | $117,600 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $500 |

| Stationery etc. | $300 |

| Sales Campaign | $5,000 |

| Dynamic Communications fees | $4,200 |

| Phone Lines | $800 |

| Rent | $800 |

| Hardware | $23,500 |

| Software | $25,000 |

| Total Start-up Expenses | $60,100 |

| Start-up Assets | |

| Cash Required | $52,500 |

| Other Current Assets | $5,000 |

| Long-term Assets | $0 |

| Total Assets | $57,500 |

| Total Requirements | $117,600 |

2.2 Financial Risks and Contingencies

The company recognizes that it is subject to both market and industry risks. We believe our risks are as follows, and we are addressing each as indicated.

- Start-up company. We face all the risks associated with being a start-up company. We feel that we can overcome these with our experience in the industry and by quickly establishing desired relationships.

- Security. Security is a major issue, but all features provide security options; documents and directories can be password-protected and have specific, user-only access rights.

Services

Web Applications has developed an Internet-based application called Online Office Manager, for which a patent is pending. Online Office Manager allows businesses and individuals to keep in touch effectively even with a distance factor. Online Office Manager provides applications which replace the physical office. With Online Office Manager, your office moves with you at all times and you have 24-hour access to it. Users can get Online Office Manager by subscribing to our server on the Internet. There is no need to buy any software or upgraded versions of the software.

3.1 Service Description

Main Features

- Communication and productivity. This feature will allow you to see who is online within an organization. Our communication feature will enable the user to initiate and conduct a chat session, and will give them the means to initiate NetMeeting. Users can send and receive files directly through the Internet. Documents can also be stored in one central location.

- Email. Users will be able to send and receive emails and faxes in a personal mailbox. Within the email tool, users can create and use different folders to hold their private email. They will also have quick access to folders in an organization, and the ability to create and maintain an address book.

- Messaging. Users will be able to send text messages to others online. This feature will receive and log messages giving a “while you were out” type application.

- Schedules. Scheduling meetings can be done en-mass, i.e. users select a group of users and request a meeting. They can also specify which users must be present for the meeting to occur, and which are optional. When confirmations are received for all those required, a message is placed on everyone’s calendar. The user will also be able to set up scheduled reminders that fire off at a certain time. The system can maintain a database of resources. For the individual users, they can store their own personal schedule.

- Document Management. Users can store different documents on the system. Checked-in documents are saved in a manner which will allow for easy retrieval at a later time. Document searching can be done using a keyword, and the document can be viewed in a number of different formats without having to install any software.

Secondary Features

- Online bill payments. This service will be name branded from services like Checkfree. It will allow users to electronically pay bills all in one location.

- Threaded bulletin board. This allows users to leave messages and multiple individuals to respond, leave their own message, and track the history.

- Package tracking. Users can view the status of packages that are being shipped with FedEx, UPS, etc.

- Travel planner. Will allow users to make travel arrangements and get discounts. Users can create travel profiles and itineraries online.

- Credit check services. This will allow users to check credit ratings of potential business partners or vendors.

- Conduct surveys. Users can create a survey and distribute it on the system. Responses can be given and returned to the system where they will be tabulated and maintained.

Online Office Manager comes in three packages and customers can choose the one with the applications that best suit their needs.

3.2 Future Services

In the future, we will implement Phase 2 of our plan. Our research and development (R&D) will yield innovation with input from customers and the marketplace. Given below is a detailed look at the future applications that will be a part of the Phase 2 program. The biggest and most complex application of Phase 2 will be the telephone/fax service.

Telephone/Fax services.

A full-blown phone messaging service will be provided, and users can get a number on our phone network from which they can get messages. The existence of messages will be indicated in the user mailbox and the user can play them over the computer (sound card and speakers are required). The same number can also be used to receive faxes. Faxes will be received and stored in one central location, then placed in the user mailbox. The user can then retrieve them in an image, forward them to a real fax machine, or forward them to an email address. The user will also be able to fax documents over the Internet through our system. They can drag and drop a document on the fax button, give a phone number, and the document will be routed to our system and automatically faxed to the desired number (long distance charges will be added to the bill). The service will allow two people to connect over the Internet using microphone and speakers as a Web-phone (this will provide great savings on long distance phone calls).

Other Future Applications

- Work flow–Enables sales representatives in the field to initiate customer orders with auto routing approval and notification management.

- Company activities planner–Increase access to information about company activities.

- Online purchasing system–For order entry, inventory tracking, and office supplies and equipment.

- Time sheet reporting–Enables employees to fill out daily time sheets online and route them into responsible department using project name or unique ID.

- Knowledge-based application–Provides a discussion database for sharing knowledge and information that is valuable within the company.

- Vacation request–Individuals can request vacation time and managers can approve or reject the request online.

- While you were out application–Will enable messages to be taken and sent to user’s mailbox.

- Account tracking application–For sales persons, this feature will provide a process for tracking customer information and competitive opportunities.

- Job postings–Enables people to browse various categories and sub-categories of ads and submit resumes.

Market Analysis Summary

We expect to compete as a thriving company in the computer applications software industry. Applications software are computer programs designed to accomplish user tasks, such as word processing, graphic design, desktop publishing, inventory control, and more. The software industry consists of three general market segments: application solutions, application tools, and systems software. The software market has long been one of the computer industry’s fastest growing segments. Revenues for the worldwide software market reached $122 billion in 1997, up about 15% from 1996 according to estimates by IDC. Revenues continued to show robust growth in 1998. IDC projects that revenues will grow at a compound annual rate of approximately 12% for the next several years, surpassing $220 billion by 2002.

- Applications software includes programs that perform specific industry or business functions. The worldwide market for applications software increased to $56 billion in 1997, a 17% rise over 1996, and is expected to grow 15% annually through 2001, to approximately $98 billion.

- Application tools include data access and retrieval, data management, data manipulation, and program design and development software. The worldwide application tool software market grew 13% in 1997, to $31 billion. It should continue to increase 12% to 13% annually, approaching $50 billion by 2002.

- System-level software comprises operating systems, operating systems enhancements, and data center management. The worldwide market for system-level software increased 13% in 1997, to $35.1 billion. This figure should exceed $53 billion by 2001, based on an 11% compound annual growth rate (CAGR).

Applications software can be either developed by outside vendors and sold in packaged form, or custom-made by users themselves. Many computer users don’t have the time or desire to write their own computer programs or to hire a software developer; they can choose from thousands of quality packaged programs ready for use with little or no modification. The proliferation of computers has increased the number of people who use computers relative to those who can program them, increasing the packaged software’s importance. Custom software is tailored to the needs of a specific individual or organization.

4.1 A Brief Look at the Internet

In just five years, the Internet has undergone a major metamorphosis. From an obscure network used by a limited number of academics and researchers, the Internet has been transformed into a global Web of more than 100 million interconnected computers encompassing users from all walks of life. Described below are the various segments of the Internet:

- Hardware: networking equipment. This sector provides the primary infrastructure on which the Internet is built. Two prominent types of network equipment are routers and remote access concentrators. Cisco Systems Inc. with sales of approximately $9.9 billion and a market share of 67%, dominated the routers market in 1998. Ascend Communications, Inc. (1998 sales of $1.48 billion) and Cisco share leadership of the remote access concentrator market, with shares of approximately 28% and 27%, respectively.

- Software. Two of the main types of Internet software are browsers and security programs. Microsoft Corporation and Netscape Communications Corporation dominate the key software component of the World Wide Web. The security segments are needed to ensure the safety of networks and transactions. Security Dynamics Technology Inc. (1998 sales of $41 million) has taken the lead in providing authentication and encryption products.

- Services. Internet service providers (ISPs) offer a way for people to enter the Internet. According to IDC, America Online has approximately 43% share of the total subscribers in the ISP segment, followed by Microsoft’s MSN, and AT&T’s WorldNet.

- Destinations. Destinations are websites that people can go to for information, entertainment, or commerce.

4.2 Brief Look at the Computer Industry

In the first six months of 1997, a total of 37 million personal computers (PC) were shipped worldwide. That figure rose to 40 million during the same time period in 1998 and, according to IDC, this figure is expected to rise by 16% in 1999. PC growth in 1997 and 1998 was boosted by the introduction of the sub-$1,000 PC. This price point is due in large part to the sharp drop in prices of the major components that go into the PC. Another way PC makers have addressed lower price points is through cost-reduction efforts made possible by new manufacturing and distribution strategies. Two important initiatives are underway:

- Build to order (BTO). Under BTO, PC’s are assembled by the manufacturer.

- Channel assembly. Under channel assembly, distributors or resellers build and configure the machines.

In both cases, the building or configuring occurs when an order is received. By using these methods, indirect PC vendors hope to keep inventories lower and, through the cost savings achieved, offer more competitive prices to customers. Compaq, Dell, IBM, and Hewlett Packard dominate the computer industry.

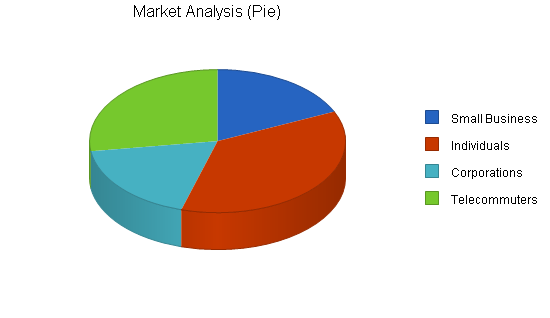

4.3 Market Segmentation

A review of all of our markets is given below:

- Small businesses. According to trends, the Internet will no longer be just a marketing vehicle; it will become the backbone of a company’s business infrastructure. Companies use the Internet to set up home pages that describe their products and lines of business. This gives them an excellent medium to raise their profile, advertise products, and recruit employees.

- Individuals. As of year-end 1998, almost 100 million users accessed the Internet regularly, up from 69 million at the end of 1997, according to IDC. A key factor in the recent growth of the Internet is the popularity of the sub-$1,000 PC. Computers sold at or below $1,000 have appealed to first-time PC users and lower-income families. In the United States, less than one-third of the population is connected, leaving plenty of room for growth. When consumers are asked why they purchased a PC, the most common answer is to connect to the Internet. Individual investors have been attracted in growing numbers to the ease and convenience provided by online investing websites such as E*Trade and eSchwab.

- Corporations. Half of the total number of large U.S. and European organizations have developed corporate Intranets, which use the infrastructure and standards of the Internet for internal company networks that link employees. Corporations have discovered that the technologies employed by the Internet, particularly the infrastructure and standards of the World Wide Web, are an inexpensive and powerful alternative to other forms of internal corporate communication.

- Telecommuters. Telecommuting seems to be on a steady growth curve, with approximately 11 million telecommuters in the U.S. today, according to the latest survey from FIND/SVP, a research and consulting firm. Telecommuting will continue to grow because there are frequent references to productivity gains in the range of 15-25% for telecommuters.

Customer Buying Criteria

Customers are expected to use our services based on traditional factors:

- Price. Pricing is one of our competitive advantages. We offer prices that are lower than those of any of our competitors.

- Service. Customers not only expect the best service but value for money, which is what we give them in our product.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Small Business | 10% | 500,000 | 550,000 | 605,000 | 665,500 | 732,050 | 10.00% |

| Individuals | 35% | 1,000,000 | 1,350,000 | 1,822,500 | 2,460,375 | 3,321,506 | 35.00% |

| Corporations | 10% | 500,000 | 550,000 | 605,000 | 665,500 | 732,050 | 10.00% |

| Telecommuters | 25% | 750,000 | 937,500 | 1,171,875 | 1,464,844 | 1,831,055 | 25.00% |

| Total | 24.55% | 2,750,000 | 3,387,500 | 4,204,375 | 5,256,219 | 6,616,661 | 24.55% |

4.4 The Y2K Issue

One of the more pressing issues facing the computer industry is the Year 2000 problem, also referred to as “Y2K” and “the millennium bug.” Unless addressed properly, this problem will cause many computers worldwide to stop functioning properly. Y2K arises from the fact that until the mid-1980s or so, programmers used two-digit numbers to represent years. For example, “97” was used to represent the year 1997. While this design saved computer storage space, which was expensive and in limited supply, it also produced the situation in which all dates input in these computers refer to the twentieth century. The Gartner Group, a Connecticut-based information technology (IT) consulting firm, estimates the worldwide repair bills in the $300 billion – $600 billion range, but this includes only the cost of fixing programs written in Cobol. Software Productivity Research, a Massachusetts based software-consulting firm, has made a broader estimate that includes repairs, damages, and litigation. This group estimates that the total cost from 1994 to 2005 will top $3.6 trillion.

Our products will not be affected by the Y2K problem.

4.5 Service Business Analysis

Competition

There is one major company with whom we will be competing and that is HotOffice Technology. Its product, HotOffice, is a low-end business planner that focuses on the basic business structure. Other companies compete in the industry, but they only specialize on one of the many features we offer.

HotOffice Technology

HotOffice Technologies, Inc. is a Web-based Intranet Service provider for small business, especially those with collaboration needs, multiple offices, mobile workers, telecommuters, and virtual offices. HotOffice offers small businesses an affordable, secure Intranet solution at a fraction of the cost of purchasing and maintaining a traditional Intranet or Extranet. This subscription service provides a large, powerful suite of collaboration and communication tools in one simple, easy-to-use interface accessible anytime, anywhere. From any PC with Internet access, HotOffice provides instant connection via the Web to email, calendar, documents, bulletin boards, online conference rooms, business centers, and more.

Strengths

Large penetration to the main channels. At the time of this writing, they have the first entry to market. We plan on taking a significant part of that market share within a few months by providing additional features that will be more attractive for users.

Weaknesses

- Low-end products. Their products are only aimed at business users. We offer a product for personal users as well, and our product with its advanced features will surpass that of HotOffice.

- No programming facilities. Their products have no capabilities for programming.

- Other companies.

- These companies form a large group of firms that offer one form of the many applications that we offer. They either specialize in selling hard drive space or email functions.

Barriers to Entry

Web Applications will benefit from several significant barriers to entry which include:

- Development Team. We have a development team that is up to date with the latest industry applications. With this team, we feel confident that we will be a dominant player in the industry and continue to produce and enhance our product with time.

- Diversification. Anyone coming into the market will find it difficult to duplicate what we have because of our diversification. We offer a product with multi-dimensional applications.

- Market penetration. Once we are in the market and established, it will be difficult for someone to break into a market where someone is already operating successfully.

Strategy and Implementation Summary

We intend to become the leader and most creative provider of Web-based business management applications on the market. We aim to create a user-friendly application that will be an integral component in any personal or business environment. We will do this by developing an innovative and progressive development and management team. We will also accomplish our goal by using customer input to further develop our products and services.

We will leverage this new product in the computer software industry to dominate the growing Web-based applications market, especially the small businesses. We have a premium, value-added product with three different packages from which the user can choose the one that best suits their needs. These strategic product lines will enable domination of the target market. The products all share the core applications but differ in range of services.

As a company, we feel that there are a number of opportunities we can capitalize on and they include:

Small Businesses

- Better communication. Businesses will be able to set up meetings without incurring travel costs. Our products break down the walls that are created by the distance separating team or group members.

- Alternative for office network. With our product and its applications, there will be no need for businesses to set up office networks or purchase additional hardware.

- Cost effective. It is cost effective in that only a monthly fee is required, as opposed to huge amounts of money for set up costs and servers.

Corporate

- Setting up on main branch office. We will help companies to set up the system and ease the transition with no delay in ordering equipment and daily operations.

- Control sales team activities. Our product will give those in the sales department the ability to get quick approvals and close deals faster.

- No laptop needed. All user information will be placed online and kept in various departments. This will eliminate the need to carry laptops when traveling, thus reducing the chance of laptop theft, which is high in airports.

Individuals

- Eliminate need for multiple software packages. All applications needed are in one place and more can be added per user request, thus eliminating the need of purchasing individual software packages.

- Portable personal information manager (PIM). Even as you travel, your own PIM on the server will be at work taking messages and putting them in the desired folders. The PIM becomes a personal secretary keeping you informed of special events.

- No laptop needed. All user information will be placed online and kept in various departments. This will eliminate the need to carry laptops when traveling, thus reducing the chance of laptop theft, which is high in airports.

We will outsource all sales operations to a company to be named.

5.1 Sales Forecast

We are confident that our Online Office Manager will be eagerly embraced by mobile computer using businesses and e-commerce businesses. We are forecasting a 10-fold revenue increase over the years covered in this plan, as shown in the table and charts below.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Online Office Manager | $200,000 | $1,500,000 | $2,200,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $200,000 | $1,500,000 | $2,200,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Online Office Manager | $100,000 | $300,000 | $400,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $100,000 | $300,000 | $400,000 |

5.2 Marketing Strategy

We will outsource all marketing operations to Dynamic Communication Solutions because we feel that they have stability and marketing channels that will be effective for our product.

The message associated with our product is value-added applications. Dynamic Communication Solutions has identified a brief promotional plan that is diverse and will include a range of marketing communications including the few listed below.

- Internet.

- Public relations.

- Trade shows.

- Industry conferences and seminars.

- Print advertising. Dynamic Communication Solutions will follow a print advertising program in publications such as Creative Loafing, Belleview Business Chronicle, and the Buckhead Local Paper. Shown below is a breakdown of the various publications.

| Circulation | Target Audience | Space | Cost | Est. Sales | |

| Creative Loafing | 750,000 | Individuals | .5 page | $5,000 | $200,000 |

| Belleview Business Chronicle | 1 million | Businesses | .5 page | $10,000 | $250,000 |

| Buckhead Local Paper | 750,000 | Businesses | .5 page | $10,000 | $250,000 |

5.3 Pricing Strategy

We plan to set our pricing based on competitors’ pricing. Prices will also be based on market prices for similar off-the-shelf products. The automatic upgrade and product enhancement features do not affect the price of any of the services. The figure below shows our tentative pricing schedule, these are monthly rates. We will work in conjunction with Dynamic Communication Solutions to come up with a working pricing schedule. Users will have three payment options:

- Monthly.

- Six-month payment.

- Yearly.

| Gold | Silver | Bronze |

| $29.95 | $25.95 | $12.95 |

5.4 Value Proposition

Web Applications offers the following value propositions for customers.

- Collaboration. Users can work on the same document at the same time from different locations. Both will be able to edit the document and work on the cosmetics simultaneously. This collaboration ability eliminates the need to send the same document back and forth, saving time for both users.

- Communication. Applications allow all users to keep in touch in real time and make any necessary business decisions there and then without holding down the other party involved. Communication can be through several different applications that are offered. This allows for rapid decision-making, helping managers and sales teams make and close deals with greater ease. This will also help speed up the approval process when placing orders.

- Document management. This product allows documents to be stored, viewed, and searched at any given time. Users can create and arrange folders in a manner that will make it easy to retrieve documents. Basically, they have the ability to create their own filing system online.

- Information sharing. With features such as online chat, information can be shared quickly and easily. In the event that sensitive information is being shared, users do not have to worry because security measures have been taken to safeguard all information from outsiders.

- Personal virtual office. With each personal office space, users will have the ability to keep track of all daily tasks. Users have access to their office at anytime, from anywhere.

5.5 Strategic Alliances

The company plans to form strategic alliances with Dynamic Communication Solutions, For Sale By Internet, and a sales company to be announced. The company may develop research alliances to further refine the product and adapt it to new markets in different industries. Below is an explanation of key relationships:

- Dynamic Communication Solutions. This is a company with over ten years of experience in marketing and marketing management. We will outsource all marketing operations to Dynamic Communication Solutions because we feel that they have stability and marketing channels that will be effective for our product. This relationship will eliminate the need to develop our own marketing team.

- For Sale By Internet. This company develops and manages company websites on a contract basis. The company is located in Kirkland, Washington and boasts a Webmaster with over seven years experience in the field. We will benefit from this relationship by having an experienced company handle all design and website management. Also, this will allow us to focus on developing applications for other industries.

- Sales. We will outsource all sales operations to a company to be named later.

Management Summary

Our management philosophy is based on responsibility and mutual respect. At Web Applications, we have an environment that encourages creativity and achievement. Web Applications management is highly experienced and qualified. Its key management team includes Mr. Lester Andrews and Mr. Dwight Austin.

6.1 Management Team

Mr. Lester Andrews – President and CEO

Lester Andrews has over 10 years in the Information System field. In 1987, he attended the DeVry Institute of Technology where he graduated with a degree in Electronics Engineering. He went on to work for Vanstar (formally Computerland) in the networking department handling accounts such as Compaq, Intel, APC, HP, and various others. After leaving Vanstar, he pursed a career that included consulting designing, installing and setting up networks, and network maintenance. Mr. Andrews also worked as a Manager of Information Systems for the Medicare SMART program.

Mr. Dwight Austion – COO/CFO

Mr. Austion graduated from Western Kentucky University with a degree in Sociology and has a vast amount of managerial experience. Between 1994 and 1995, he worked at Turner Broadcasting Systems (TBS) as a project manager. During this time, he was responsible for preparing and delivering presentations for proposals to sell new services. Mr. Austion also managed the daily operations with an annual budget of $320,000. Between 1995 and 1996, Mr. Austion was project manager at Taylor and Mathis/Beacon properties, a Belleview-based real estate company. He had the task of supervising a staff of 20 employees and 10 sub-contractors. He was also in charge of operations, which were run on an annual budget of $450,000. Mr. Austion also worked as project manager for Flower’s Baking Company, where he managed contract services and had an operating budget of $600,000. In December 1997, he took his managerial skills to Hospital Housekeeping Systems where he became operating manager for day staff. He worked closely with the chief operating officer and had an operating budget of $1.2 million.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Lester Andrews | $34,788 | $43,478 | $52,174 |

| Dwight Austion | $34,788 | $43,478 | $52,174 |

| Service Manager | $26,076 | $32,609 | $34,788 |

| Other | $0 | $46,087 | $95,647 |

| Total People | 3 | 5 | 7 |

| Total Payroll | $95,652 | $165,652 | $234,783 |

6.2 Outside Support

For Sale By Internet – Website Developer

For Sale By Internet is led by Webmaster, Mr. Brian Taylor. Having attended the University of Washington between 1983 and 1987, Mr. Taylor graduated with a Bachelor of Science degree in Business Administration & Philosophy in the honors program. Altogether, Mr. Taylor has eight years of experience in the planning, creation, and management of website development. He started his computer career as a Microsoft Contractor at ComputerLand in 1983. As a PC Repair Assistant Manager, he designed and instigated innovative techniques of operation that would further satisfy the customer. As a Software Install Manager for Entex, Mr. Taylor managed the New Software Installation Group that consisted of 12 install technicians. Responsibilities included writing and investigating new databases, and operating parameters to speed up install and delivery time of new PCs. Between July, 1994 and December, 1995, Mr. Taylor was a top salesman for Microrim Software, selling relational databases and accounting software. He then went on to work for CARA testing Microsoft’s IE30 Web browser for JavaScript and VBscript bugs. From October, 1996 to this present day, Mr. Taylor has be a Webmaster for For Sale By Internet. Through this company, Mr. Taylor develops and manages websites on a contract basis.

Dynamic Communication Solutions – Marketing

This is a company with over ten years of experience in marketing and marketing management. We will outsource all marketing operations to Dynamic Communication Solutions because we feel that they have stability and marketing channels that will be effective for our product.

To be announced – Sales

We will outsource all sales operations to a company to be named.

To be announced – Customer service

We will outsource this department to an answering service.

Financial Plan

Funding Requirements and Uses

Based on our projections, we feel an investment in our company is a sound investment. In order to proceed, we are requesting an investment of $101,600 by June, 1999. The funds will be used to purchase equipment and to cover initial operating expenses. The $101,600 will be used to implement Phase 1 of our operations. Once the company is in full operation, we will require an additional capital investment to fund Phase 2 of our operations.

Phase 2

We will be in discussion with developers on the best direction to take and what cost savings we can achieve. The specific details for Phase 2 are still to be determined, but three major areas (server, small PBX, and business development funds) will require approximately $30,000 by January, 2000.

Exit/Payback Strategy

We can provide an exit for this investment within three years by a dividend of excess profits. The increase in profits generated by sales revenue will provide funds to repay the investment.

Conclusion

Based on our projections, we feel an investment to Web Applications is a sound business investment. In order to proceed, we are requesting an investment of $101,600 as soon as possible.

7.1 Break-even Analysis

With average first year fixed monthly costs and an average margin as shown below, Web Applications calculates it will break even at the sales volume presented in the table and chart. The company management plans to reach such level by the end of 2000.

| Break-even Analysis | |

| Monthly Revenue Break-even | $25,333 |

| Assumptions: | |

| Average Percent Variable Cost | 50% |

| Estimated Monthly Fixed Cost | $12,667 |

7.2 Important Assumptions

The following chart contains assumptions important to the success of the company.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.3 Projected Profit and Loss

The projected income statement for Web Applications is shown below. The company is basing its revenue projections on anticipated sales of products.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $200,000 | $1,500,000 | $2,200,000 |

| Direct Cost of Sales | $100,000 | $300,000 | $400,000 |

| Other | $5,000 | $10,000 | $15,000 |

| Total Cost of Sales | $105,000 | $310,000 | $415,000 |

| Gross Margin | $95,000 | $1,190,000 | $1,785,000 |

| Gross Margin % | 47.50% | 79.33% | 81.14% |

| Expenses | |||

| Payroll | $95,652 | $165,652 | $234,783 |

| Sales and Marketing and Other Expenses | $23,400 | $47,000 | $80,000 |

| Depreciation | $0 | $0 | $0 |

| Research and Development | $15,000 | $25,000 | $40,000 |

| Utilities | $600 | $800 | $1,000 |

| Insurance | $600 | $800 | $1,000 |

| Rent | $2,400 | $3,000 | $5,000 |

| Payroll Taxes | $14,348 | $24,848 | $35,217 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $152,000 | $267,100 | $397,000 |

| Profit Before Interest and Taxes | ($57,000) | $922,900 | $1,388,000 |

| EBITDA | ($57,000) | $922,900 | $1,388,000 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $230,725 | $352,783 |

| Net Profit | ($57,000) | $692,175 | $1,035,216 |

| Net Profit/Sales | -28.50% | 46.15% | 47.06% |

7.4 Projected Cash Flow

The cash flow statement can be found in the chart and table below.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $50,000 | $375,000 | $550,000 |

| Cash from Receivables | $120,500 | $933,250 | $1,546,750 |

| Subtotal Cash from Operations | $170,500 | $1,308,250 | $2,096,750 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $36,000 | $0 | $0 |

| Subtotal Cash Received | $206,500 | $1,308,250 | $2,096,750 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $95,652 | $165,652 | $234,783 |

| Bill Payments | $147,562 | $604,177 | $906,344 |

| Subtotal Spent on Operations | $243,214 | $769,829 | $1,141,127 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $10,000 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $253,214 | $769,829 | $1,141,127 |

| Net Cash Flow | ($46,714) | $538,421 | $955,623 |

| Cash Balance | $5,786 | $544,207 | $1,499,830 |

7.5 Projected Balance Sheet

The projected balance sheet is provided below.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $5,786 | $544,207 | $1,499,830 |

| Accounts Receivable | $29,500 | $221,250 | $324,500 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $40,286 | $770,457 | $1,829,330 |

| Long-term Assets | |||

| Long-term Assets | $10,000 | $10,000 | $10,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $10,000 | $10,000 | $10,000 |

| Total Assets | $50,286 | $780,457 | $1,839,330 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $14,786 | $52,781 | $76,438 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $14,786 | $52,781 | $76,438 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $14,786 | $52,781 | $76,438 |

| Paid-in Capital | $152,600 | $152,600 | $152,600 |

| Retained Earnings | ($60,100) | ($117,100) | $575,075 |

| Earnings | ($57,000) | $692,175 | $1,035,216 |

| Total Capital | $35,500 | $727,675 | $1,762,892 |

| Total Liabilities and Capital | $50,286 | $780,457 | $1,839,330 |

| Net Worth | $35,500 | $727,675 | $1,762,892 |

7.6 Business Ratios

The following table outlines some of the more important ratios from the Computer Programming Services industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 7371.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 650.00% | 46.67% | 10.40% |

| Percent of Total Assets | ||||

| Accounts Receivable | 58.66% | 28.35% | 17.64% | 24.10% |

| Other Current Assets | 9.94% | 0.64% | 0.27% | 42.90% |

| Total Current Assets | 80.11% | 98.72% | 99.46% | 71.10% |

| Long-term Assets | 19.89% | 1.28% | 0.54% | 28.90% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 29.40% | 6.76% | 4.16% | 47.80% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 19.10% |

| Total Liabilities | 29.40% | 6.76% | 4.16% | 66.90% |

| Net Worth | 70.60% | 93.24% | 95.84% | 33.10% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 47.50% | 79.33% | 81.14% | 0.00% |

| Selling, General & Administrative Expenses | 76.00% | 33.19% | 33.82% | 82.10% |

| Advertising Expenses | 9.00% | 2.67% | 3.18% | 1.20% |

| Profit Before Interest and Taxes | -28.50% | 61.53% | 63.09% | 2.00% |

| Main Ratios | ||||

| Current | 2.72 | 14.60 | 23.93 | 1.30 |

| Quick | 2.72 | 14.60 | 23.93 | 1.03 |

| Total Debt to Total Assets | 29.40% | 6.76% | 4.16% | 66.90% |

| Pre-tax Return on Net Worth | -160.56% | 126.83% | 78.73% | 3.10% |

| Pre-tax Return on Assets | -113.35% | 118.25% | 75.46% | 9.30% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -28.50% | 46.15% | 47.06% | n.a |

| Return on Equity | -160.56% | 95.12% | 58.72% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 5.08 | 5.08 | 5.08 | n.a |

| Collection Days | 57 | 41 | 60 | n.a |

| Accounts Payable Turnover | 10.91 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 19 | 25 | n.a |

| Total Asset Turnover | 3.98 | 1.92 | 1.20 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.42 | 0.07 | 0.04 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $25,500 | $717,675 | $1,752,892 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.25 | 0.52 | 0.84 | n.a |

| Current Debt/Total Assets | 29% | 7% | 4% | n.a |

| Acid Test | 0.73 | 10.41 | 19.69 | n.a |

| Sales/Net Worth | 5.63 | 2.06 | 1.25 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Online Office Manager | 0% | $5,000 | $10,000 | $10,000 | $15,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $5,000 | $10,000 | $10,000 | $15,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Online Office Manager | $2,500 | $5,000 | $5,000 | $7,500 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $2,500 | $5,000 | $5,000 | $7,500 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Lester Andrews | 0% | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 |

| Dwight Austion | 0% | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 | $2,899 |

| Service Manager | 0% | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 | $2,173 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Total Payroll | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $5,000 | $10,000 | $10,000 | $15,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | |

| Direct Cost of Sales | $2,500 | $5,000 | $5,000 | $7,500 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Other | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $400 | $600 | |

| Total Cost of Sales | $2,900 | $5,400 | $5,400 | $7,900 | $10,400 | $10,400 | $10,400 | $10,400 | $10,400 | $10,400 | $10,400 | $10,600 | |

| Gross Margin | $2,100 | $4,600 | $4,600 | $7,100 | $9,600 | $9,600 | $9,600 | $9,600 | $9,600 | $9,600 | $9,600 | $9,400 | |

| Gross Margin % | 42.00% | 46.00% | 46.00% | 47.33% | 48.00% | 48.00% | 48.00% | 48.00% | 48.00% | 48.00% | 48.00% | 47.00% | |

| Expenses | |||||||||||||

| Payroll | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | |

| Sales and Marketing and Other Expenses | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Research and Development | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | $1,250 | |

| Utilities | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | |

| Insurance | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | $50 | |

| Rent | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Payroll Taxes | 15% | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 | $1,196 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | $12,667 | |

| Profit Before Interest and Taxes | ($10,567) | ($8,067) | ($8,067) | ($5,567) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,267) | |

| EBITDA | ($10,567) | ($8,067) | ($8,067) | ($5,567) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,267) | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($10,567) | ($8,067) | ($8,067) | ($5,567) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,067) | ($3,267) | |

| Net Profit/Sales | -211.33% | -80.67% | -80.67% | -37.11% | -15.33% | -15.33% | -15.33% | -15.33% | -15.33% | -15.33% | -15.33% | -16.33% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $1,250 | $2,500 | $2,500 | $3,750 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Cash from Receivables | $0 | $125 | $3,875 | $7,500 | $7,625 | $11,375 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | |

| Subtotal Cash from Operations | $1,250 | $2,625 | $6,375 | $11,250 | $12,625 | $16,375 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $6,000 | $0 | $30,000 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $1,250 | $2,625 | $6,375 | $11,250 | $12,625 | $22,375 | $20,000 | $50,000 | $20,000 | $20,000 | $20,000 | $20,000 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | $7,971 | |

| Bill Payments | $1,253 | $7,679 | $10,096 | $10,179 | $12,679 | $15,096 | $15,096 | $15,096 | $15,096 | $15,096 | $15,096 | $15,102 | |

| Subtotal Spent on Operations | $9,224 | $15,650 | $18,067 | $18,150 | $20,650 | $23,067 | $23,067 | $23,067 | $23,067 | $23,067 | $23,067 | $23,073 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $10,000 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $9,224 | $15,650 | $18,067 | $18,150 | $20,650 | $23,067 | $23,067 | $33,067 | $23,067 | $23,067 | $23,067 | $23,073 | |

| Net Cash Flow | ($7,974) | ($13,025) | ($11,692) | ($6,900) | ($8,025) | ($692) | ($3,067) | $16,933 | ($3,067) | ($3,067) | ($3,067) | ($3,073) | |

| Cash Balance | $44,526 | $31,501 | $19,809 | $12,909 | $4,884 | $4,193 | $1,126 | $18,059 | $14,993 | $11,926 | $8,859 | $5,786 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $52,500 | $44,526 | $31,501 | $19,809 | $12,909 | $4,884 | $4,193 | $1,126 | $18,059 | $14,993 | $11,926 | $8,859 | $5,786 |

| Accounts Receivable | $0 | $3,750 | $11,125 | $14,750 | $18,500 | $25,875 | $29,500 | $29,500 | $29,500 | $29,500 | $29,500 | $29,500 | $29,500 |

| Other Current Assets | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $57,500 | $53,276 | $47,626 | $39,559 | $36,409 | $35,759 | $38,693 | $35,626 | $52,559 | $49,493 | $46,426 | $43,359 | $40,286 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Assets | $57,500 | $53,276 | $47,626 | $39,559 | $36,409 | $35,759 | $38,693 | $35,626 | $62,559 | $59,493 | $56,426 | $53,359 | $50,286 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $1,000 | $7,342 | $9,759 | $9,759 | $12,176 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,786 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,000 | $7,342 | $9,759 | $9,759 | $12,176 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,786 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $1,000 | $7,342 | $9,759 | $9,759 | $12,176 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,592 | $14,786 |

| Paid-in Capital | $116,600 | $116,600 | $116,600 | $116,600 | $116,600 | $116,600 | $122,600 | $122,600 | $152,600 | $152,600 | $152,600 | $152,600 | $152,600 |

| Retained Earnings | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) | ($60,100) |

| Earnings | $0 | ($10,567) | ($18,633) | ($26,700) | ($32,267) | ($35,333) | ($38,400) | ($41,467) | ($44,533) | ($47,600) | ($50,667) | ($53,733) | ($57,000) |

| Total Capital | $56,500 | $45,933 | $37,867 | $29,800 | $24,233 | $21,167 | $24,100 | $21,033 | $47,967 | $44,900 | $41,833 | $38,767 | $35,500 |

| Total Liabilities and Capital | $57,500 | $53,276 | $47,626 | $39,559 | $36,409 | $35,759 | $38,693 | $35,626 | $62,559 | $59,493 | $56,426 | $53,359 | $50,286 |

| Net Worth | $56,500 | $45,933 | $37,867 | $29,800 | $24,233 | $21,167 | $24,100 | $21,033 | $47,967 | $44,900 | $41,833 | $38,767 | $35,500 |